(10 am. – promoted by ek hornbeck)

They Go or Obama Goes

Robert Scheer,

Truthdig, August 25, 2010

Barack Obama and the Democrats he led to a stunning victory two years ago are going down hard in the face of an economic crisis that he did nothing to create but which he has failed to solve. That is somewhat unfair because the basic blame belongs to his predecessors, Bill Clinton and George W. Bush, who let the bulls of Wall Street run wild in the streets where ordinary folks lived. And there was universal Republican support in Congress for the radical deregulation of the financial industry that produced this debacle.

The core issue for the economy is the continued cost of a housing bubble made possible only after what Clinton Treasury Secretary Lawrence Summers back then trumpeted as necessary “legal certainty” was provided to derivative packages made up of suspect Alt-A and subprime mortgages. It was the Commodity Futures Modernization Act, which Senate Republican Phil Gramm drafted and which Clinton signed into law, that made legal the trafficking in packages of dubious home mortgages. In any decent society the creation of such untenable mortgages and the securitization of risk irrationally associated with it would have been judged a criminal scam. But no such judgment was possible because thanks to Wall Street’s sway under Clinton and Bush the bankers got to rewrite the laws to sanction their treachery.

It is Obama’s continued deference to the sensibilities of the financiers and his relative indifference to the suffering of ordinary people that threaten his legacy, not to mention the nation’s economic well-being. There have been more than 300,000 foreclosure filings every single month that Obama has been president, and as The New York Times editorialized, “Unfortunately, there is no evidence that the Obama administration’s efforts to address the foreclosure problem will make an appreciable dent.”

[snip]

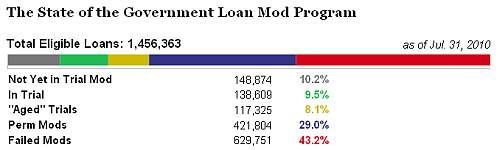

The ugly reality that only 398,198 mortgages have been modified to make the payments more reasonable can be traced to the program being based on the hope that the banks would do the right thing. While Obama continued the Bush practice of showering the banks with bailout money, he did not demand a moratorium on foreclosures or call for increasing the power of bankruptcy courts to force the banks, which created the problem, to now help distressed homeowners.

[snip]

…foreclosures are behind Tuesday’s news that U.S. home sales reached their lowest point in 15 years and that there is unlikely to be an economic recovery without a dramatic turnabout in the housing market. The stock market tanked Tuesday on reports that U.S. home sales had dropped 25.5 percent below the year-ago level.

[snip]

There is no way that Obama can begin to seriously reverse this course without shedding the economic team led by the Clinton-era “experts” like Summers and Treasury Secretary Timothy Geithner who got us into this mess in the first place. They are spooked by one overwhelmingly crippling idea-don’t rattle the financial titans whom we must rely on for investment. But when it comes to keeping people in their homes, it is precisely the big banks that must be rattled into doing the right thing.

Obama gained credibility through sacking Gen. Stanley McChrystal for making untoward remarks. Why not sack Summers and Geithner for untoward policies that have inflicted such misery on the general public?

Read it all at Truthdig…

Also see:

The State of the Government’s Loan Modification Program, at ProPublica

1 comment

Author

or there’ll be changes you can believe in in November, and in 2012, B…