Yes, it an old video but it deserves resurrection from time to time. This is one of those times. When you’re failing and looking to blame someone blame the left, it’s all our fault. This is the fall back that the White House has consistently used since Barack Obama took office. I chuckled at Jon Walker’s article at FDL Action using the Scoobie Doo analogy of the White house tactic of laying the blame on the left for their failed policies from the pathetic health care bill to the Dodd-Frank reform bill and now the economically disastrous debt ceiling deal.

It would seem the White House is basically taking the perspective of a Scooby Doo villain in concluding why their brilliant plans fail. Hanging upside down in a comically oversize net with their rubber monster mask removed they yell, “we would have gotten away with it, too, if it hadn’t been for you meddling progressive bloggers!”

A meeting that took place recently with White House National Economic Council Director Gene Sperling and progressive advocacy groups was described as “tense” by Politico‘s Ben Smith:

Sperling faced a series of questions about the White House’s concessions on the debt ceiling fight and its inability to move in the direction of new taxes or revenues. Progressive consultant Mike Lux, the sources said, summed up the liberal concern, producing what a participant described as an “extremely defensive” response from Sperling.

Sperling, a person involved said, pointed his finger at liberal groups, which he said hadn’t done enough to highlight what he saw as the positive side of the debt package — a message that didn’t go over well with participants.

(emphasis mine)

If this has a familiar ring of “Groundhog’s Day”,, you’d be very correct. John Aravosis of AMERICAblog recalls attending one of those meetings in 2010 with Jared Bernstein, who was Chief Economist and Economic Policy Adviser to VP Biden:

I guess what struck me as most interesting about the meeting were two things. First, when Bernstein noted that, in trying to solve the country’s economic problems, the administration faces “budget constraints and political constraints.” By that, I took Bernstein to mean that the stimulus could only be so large last time, and we can only spend so much more money this time, because we’re facing a huge deficit, so there’s not much money to spend, and because the Hill and public opinion won’t let us spend more.

That struck me as GOP talking points winning the day, and I said so (Professor Kyle wrote about this very notion the other day on the blog). The only reason we’re facing a budget constraint is because we gave in on the political constraint. We permitted Republicans to spin the first stimulus as an abysmal failure, when in fact it created or saved up to 2m jobs. Since Democrats didn’t adequately defend the stimulus, and didn’t sufficiently paint the deficit as the Republicans’ doing, we now are not “politically” permitted to have a larger stimulus because the fiscal constraint has become more important than economic recovery.

And whose fault is that?

Apparently ours.

Bernstein said that the progressive blogs (perhaps he said progressive media in general) haven’t done enough over the past year to tell the positive side of the stimulus.

Jon Walker summed up this blame the left game that the White House is playing as another failure that faults everyone but themselves and their Republican allies:

If people see the the positive tangible effect that a policy has on their lives, they won’t care what anyone has to say about it. Likewise, if a handful of writers sign on to the White House Happy Talk PR campaign, bad policy will never become broadly popular. The administration’s failure to convince either bloggers or the public about the benefits of a particular action is most likely a signal that it is insufficient, ineffective, destructive or incompetent.

Personally, I am more that tired of being told by Obama supporters that we on the left are tea partying, Republicans and racist for criticizing President Obama’s right wing appeasement policies and his failure to follow up on his campaign promises. I’m tired of being told that by criticizing Obama I am emboldening the tea party, so I should STFU and go away. The truth be told they are the tea party Republican allies who are promulgating the right wing policies that will be the destruction of everything that has been gained since Franklin Roosevelt, all because of a well spoken bright shiny object has dazzled them and still does.

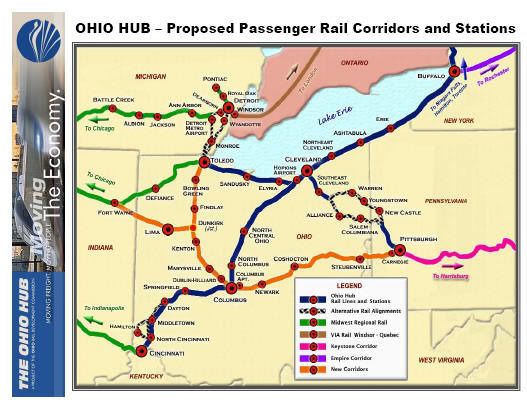

OK, now, thanks to John Kasich, we are not going to get started on that Rapid Rail HSR network before 2015. Indeed, Democrats would probably have to take back one of the two Chambers of the State Legislature to be able to hit the ground running on getting that Rapid Rail HSR network going in 2015.

OK, now, thanks to John Kasich, we are not going to get started on that Rapid Rail HSR network before 2015. Indeed, Democrats would probably have to take back one of the two Chambers of the State Legislature to be able to hit the ground running on getting that Rapid Rail HSR network going in 2015.

Recent Comments