by David Dayen

The House of Representatives officially rejected the bipartisan agreement that passed the Senate with 89 votes for a two-month extension of the payroll tax cut, extended unemployment benefits and a doctor’s fix to prevent a 27% reduction in Medicare reimbursement rates. They did so under a complicated scheme whereby members did not vote on the Senate deal itself, but on whether to move to a conference committee on the package, with the rejection of the Senate deal implicit in the exchange. The final roll call was 229-193, with seven Republicans switching sides and voting with Democrats to reject the conference committee. All Democrats present voted against the bill. [..]

The seven Republican no votes: Charlie Bass (NH), Jeff Flake (AZ), Chris Gibson (NY), Jaime Herrera Beutler (WA), Tim Johnson (IL), Walter Jones (NC), Frank Wolf (VA).

Senate Majority Leader Harry Reid won’t play:

“My House colleagues should be clear on what their vote means today. If Republicans vote down the bipartisan compromise negotiated by Republican and Democratic leaders, and passed by 89 senators including 39 Republicans, their intransigence will mean that in ten days, 160 million middle class Americans will see a tax increase, over two million Americans will begin losing their unemployment benefits, and millions of senior citizens on Medicare could find it harder to receive treatment from physicians. “Senator McConnell and I negotiated a compromise at Speaker Boehner’s request. I will not re-open negotiations until the House follows through and passes this agreement that was negotiated by Republican leaders, and supported by 90 percent of the Senate. “This is a question of whether the House of Representatives will be able to fulfill the basic legislative function of passing an overwhelmingly bipartisan agreement, in order to protect the economic security of millions of middle-class Americans. Democratic and Republican leaders negotiated a compromise and Speaker Boehner should not walk away from it, putting middle-class families at risk of a thousand-dollar tax hike just because a few angry Tea Partiers raised their voices to the Speaker. “I have always sought a year-long extension. I have been trying to forge one for weeks, and I am happy to continue negotiating one once we have made sure middle-class families will not wake up to a tax increase on January 1st. So before we re-open negotiations on a year-long extension, the House of Representatives must protect middle-class families by passing the overwhelmingly bipartisan compromise that Republicans negotiated, and was approved by ninety percent of the Senate.”

A couple of point where I disagree with Barney Frank is that we are doing better than Europe and that the economy is doing better. Maybe for the 1% it is but the middle class is shriveling. The important part of this bill was an extension of the UI which is about expire.

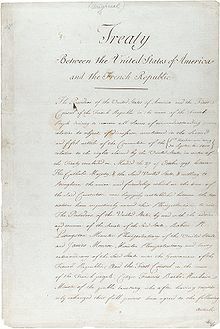

In April 1803, the United States purchased from France the 828,000 square miles that had formerly been French Louisiana. The area was divided into two territories: the northern half was Louisiana Territory, the largely unsettled (though home to many Indians) frontier section that was later explored by Lewis and Clark; and the southern Orleans Territory, which was populated by Europeans.

In April 1803, the United States purchased from France the 828,000 square miles that had formerly been French Louisiana. The area was divided into two territories: the northern half was Louisiana Territory, the largely unsettled (though home to many Indians) frontier section that was later explored by Lewis and Clark; and the southern Orleans Territory, which was populated by Europeans.

Recent Comments