Pondering the Pundits” is an Open Thread. It is a selection of editorials and opinions from> around the news medium and the internet blogs. The intent is to provide a forum for your reactions and opinions, not just to the opinions presented, but to what ever you find important.

Thanks to ek hornbeck, click on the link and you can access all the past “Pondering the Pundits”.

Follow us on Twitter @StarsHollowGzt

Paul Krugman: Republicans Despise the Working Class, Continued

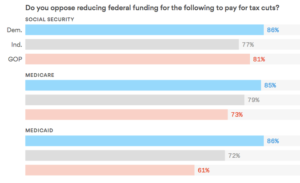

The GOP tax plan is remarkably unpopular. According to the latest NBC poll, only 24% of the public thinks it’s a good idea; 63% believe that it’s mainly for the rich and corporations [editor: it is], while only 7% think it’s aimed at the middle class. Republicans think it will become more popular over time; that’s not what happened with previous tax cuts, and as Drew Altman of Kaiser Family Foundation notes, everyone – even Republicans – hates the idea of cutting major social programs to pay for tax cuts, which is exactly what the GOP plans to do.

How did they manage to produce this political lemon? Josh Barro argues that Republicans have forgotten how to talk about tax cuts. But I think it runs deeper: Republicans have developed a deep disdain for people who just work for a living, and this disdain shines through everything they do. This is true both on substance – the tax bill heavily favors owners over workers – and in the way they talk about it.

Katrina vanden Heuvel: The left helped Jones defeat Moore. It could help more Democrats in 2018.

A week since Doug Jones’s stunning election to the Senate, the political world is still processing the shock of watching crimson Alabama turn blue. For progressives, there was poetic justice in a renowned civil rights lawyer who prosecuted the Ku Klux Klan defeating an open bigot and alleged child molester, helped to victory by highly motivated black women who mobilized voters in their communities. Jones will now occupy an office previously held by Attorney General Jeff Sessions as well as Edmund Pettus, the Confederate general and KKK grand dragon whose name still defaces the Selma bridge where civil rights marchers were beaten bloody in 1965.

Beyond its symbolic power, Jones’s triumph has strategic meaning for Democrats as they look to 2018. Indeed, while the party benefited from President Trump’s plummeting approval rating and Republican nominee Roy Moore’s panoply of scandals, Jones could not have won such a close contest without critical choices made throughout the campaign.

Renato Mariotti: Why hasn’t Trump fired Mueller yet? Because he’s better off not doing it.

Rumors are flying that President Trump will soon fire special counsel Robert S. Mueller III. Over the weekend, Trump transition lawyers alleged wrongdoing on Mueller’s part. Last week, Republican members of Congress grilled Deputy Attorney General Rod J. Rosenstein, challenging Mueller’s legitimacy and objectivity. Conservative commentators have called for Mueller to be investigated, while others have called for him to resign.

Concern that this would undermine the rule of law has gotten so serious that the liberal activist group MoveOn.org has organized a rapid-response plan for protests if Mueller is fired, with the specific timing determined by when in the day the news breaks. On Sunday, though, Trump insisted that he will not fire Mueller but is contemplating firing Rosenstein or Attorney General Jeff Sessions, realizing that firing Mueller would be a “step too far,” according to The Washington Post.

Why would Trump hold off on firing Mueller? Because if his goal is to undermine the investigations into Russian interference in last year’s campaign, keeping Mueller around is probably the best way to do it.

Robert Kuttner: The Tax Cut and the Fake Trump Boom

With the economy producing rising growth rates and falling unemployment, will Donald Trump and the Republican tax bill be able to take political credit for the boom of 2017-2018? Maybe not.

For starters, the boom was already roaring along in 2015 and 2016, before Trump took office, as the post-recession recovery finally kicked in. The year 2015 showed the strongest GDP growth in more than a decade, and 2016 was not far behind.

Unemployment was already down to 4.7 percent when Trump took office and its further drop to 4.1 is entirely the result of policies established before Trump, under one Barack Obama.

Even with these low rates of joblessness, profound structural changes in the labor market fail to translate low unemployment into significant gains in earnings or career prospects. The rise of gig employment, the bashing of trade unions, the elimination of reliable career paths—all of this is intensifying. A slight uptick in median wages doesn’t change that.

The job market is still unreliable for most working people, and most still experience it as lousy. The ratio of employed people to population is unchanged this year, at just 60.1 percent.

The changes in the tax code will do nothing to alter that. And the tax bill will only widen inequality of after-tax income.

Jonathan Feedland: Trump may celebrate his tax giveaway – but politically it could cost him dear

Donald Trump is set to close this most turbulent year with his first big win. Today, barring a last-minute hitch, both houses of the US Congress will send the president a tax reform bill that he will sign with full ceremony. He’ll lavish praise on himself and say he’s making good on his promise to make America great again. Or as he put it via Twitter: “Biggest Tax Cuts and Reform EVER passed. Enjoy, and create many beautiful JOBS!”

The bill he’ll sign today is indeed the most substantial overhaul to the US tax system since Ronald Reagan’s tax cuts of 1986. Still, Trump and his fellow Republicans should pause before they knock back too much pre-Christmas champagne. This could be a victory that comes back to haunt them.

For this bill hands the Democrats just the ammunition they need for their campaign to win back control of Congress in next November’s midterm elections. It’s unpopular – opposed by 55% of US voters, and supported by just 33% of them – and with good reason.

Recent Comments