The government may be facing a shutdown by the Senate Democrats and with good reason. It seems the House Republicans, in passing a continuing resolution (CR) to keep the government operational through April 2017, removed two provisions that could result in a filibuster in the Senate. Those provisions would protect the health coverage of retired …

Tag: Jobs

Feb 06 2014

How Will the ACA Impact the Work Force.

On Tuesday, the Congressional Budget Office released it’s latest report on the Affordable Care Act’s impact on the economy. In the report it estimated that the work force would be reduced by 2.3 million workers by 2021 (pdf). Needless to say, the right wing media and Republicans seized on this as proof positive that Obamacare was a “job killer.”

Well not so fast, this is what the report said:

CBO estimates that the ACA will reduce the total number of hours worked, on net, by about 1.5 percent to 2.0 percent during the period from 2017 to 2024, almost entirely because workers will choose to supply less labor-given the new taxes and other incentives they will face and the financial benefits some will receive. Because the largest declines in labor supply will probably occur among lower-wage workers, the reduction in aggregate compensation (wages, salaries, and fringe benefits) and the impact on the overall economy will be proportionally smaller than the reduction in hours worked. [..]

The estimated reduction stems almost entirely from a net decline in the amount of labor that workers choose to supply, rather than from a net drop in businesses’ demand for labor.

In other words, this isn’t about jobs, it’s about whether or not workers will choose to work less in order to hold on to their eligibility for subsidized health care or Medicaid.

The Washington Post‘s fact checker, Glenn Kessler clarified:

First, this is not about jobs offered by employers. It’s about workers – and the choices they make.

The CBO’s estimate is mostly the result of an analysis of the impact of the law on the supply of labor. That means how many people choose to participate in the work force. In other words, the nonpartisan agency is examining whether the law increases or decreases incentives for people to work. [..]

Some might believe that the overall impact of the health law on employment is bad because it would be encouraging people – some 2.3 million – not to work. Indeed, the decline in the workforce participation rate has been of concern to economists, as the baby boom generation leaves the work force, and the health care law appears to exacerbate that trend.

Moreover, the argument could go, this would hurt the nation’s budget because 2.3 million fewer people will pay taxes on their earnings. That’s certainly an intellectually solid argument – though others might counter that universal health care is worth a reduction in overall employment – but it’s not at all the same as saying these jobs would be lost.

On the brighter side, before a House hearing on Wednesday the Director of the CBO Doug Elmendorf made this argument:

“The reason we don’t use the term ‘lost jobs’ is there is a critical difference between people who like to work and can’t find a job – or have a job that’s lost for reasons beyond their control – and people who choose not to work,” he explained. “If someone comes up to you and says, ‘The boss says I’m being laid off because we don’t have enough business to pay,’ any other person feels bad about that and we sympathize for them having lost their job. If someone says, ‘I decided to retire or stay home and spend more time with my family and spend more time doing my hobby,’ they don’t feel bad about it – they feel good about it. And we don’t sympathize. We say congratulations.”

Matt Iglesias at Mother Jones makes a very salient point about the impact on the job force:

Obamacare will reduce employment primarily because it’s a means-tested welfare program, and means-tested programs always reduce employment among the poor.

If, for example, earning $100 in additional income means a $25 reduction in Obamacare subsidies, you’re only getting $75 for your extra work. At the margins, some people will decide that’s not worth it, so they’ll forego working extra hours. That’s the substitution effect. In addition, low-income workers covered by Obamacare will have lower medical bills. This makes them less desperate for additional money, and might also cause them to forego working extra hours. That’s the income effect.

This is not something specific to Obamacare. It’s a shortcoming in all means-tested welfare programs. It’s basically Welfare 101, and in over half a century, no one has really figured out how to get around it. It’s something you just have to accept if you support safety net programs for the poor.

It’s worth noting, however, that health care is an exception to this rule. It doesn’t have to be means tested. If we simply had a rational national health care system, available to everyone regardless of income, then none of this would be an issue. There might still be a small income effect, but it would probably be barely noticeable. Since everyone would be fully covered no matter what, there would no high effective marginal tax rate on the poor and no reason not to work more hours. Someday we’ll get there.

Optimistically, people leaving jobs or working less may be an opportunity for someone else to take their place. On the other side it could increase costs for employers who would then reduce the number of people they hire. This is an educated guessing game that we would not be engaged in if there were single payer or a public option that leveled the playing field.

Jan 10 2014

Jobs Stink

The number of jobs created in the month of December fell far short of the expected 200,000 and unemployment (U-3) fell to 6.7% the lowest it has been since November 2008. I think the word “disappointing” is an understatement:

Stock futures fell after the report was released.

The slowdown in hiring could cause the Federal Reserve to rethink its plans to slow its stimulus efforts. The Fed decided last month to cut back on its monthly bond purchases by $10 billion. It could delay further reductions until it sees evidence that December’s weak numbers were temporary.

Cold weather may have slowed hiring. Construction firms cut 16,000 jobs, the biggest drop in 20 months.

Still, December’s hiring is far below the average gain of 214,000 jobs a month in the preceding four months. But monthly gains averaged 182,000 last year, nearly matching the previous two years.

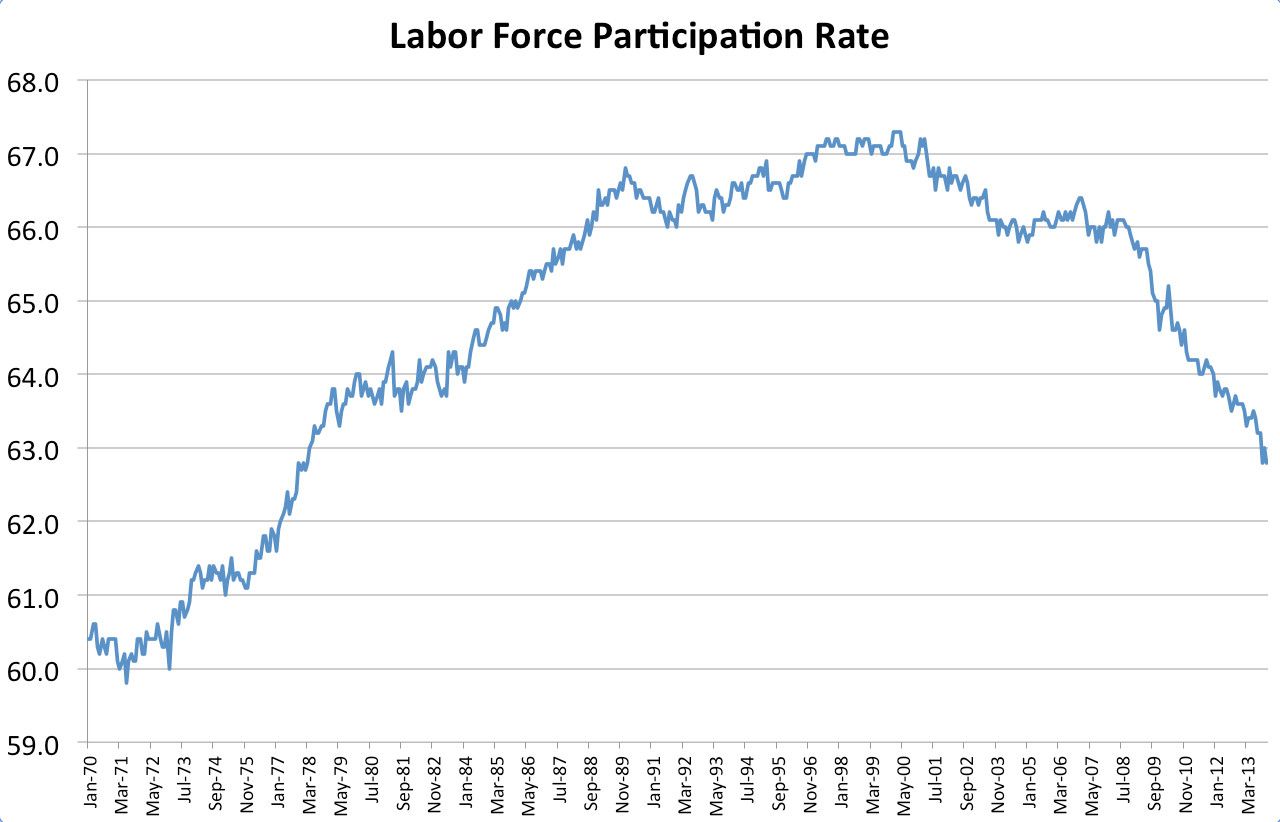

The proportion of people working or looking for work fell to 62.8 percent, matching a nearly 36-year low.

As Huffington Post‘s Mark Gongloff writes “unemployment is falling for al the wrong reasons”

One reason for the big drop in unemployment in December was that many, many people dropped out of the labor force — 347,000, to be exact. They stopped looking for work, which made them no longer “unemployed” in the eyes of the Bureau of Labor Statistics.

Click on image to enlarge.Some of this is due to the fact that Baby Boomers retiring — but only some. Most of it has to do with the fact that the economy is still too weak to create enough jobs to draw people into the market. This is most clearly evident in the fact that younger people are leaving the labor force, too — or never even entering it — because they can’t find jobs.

Meanwhile, Charles Pierce reports that the Republicans keep finding new ways for “screwing the unemployed”

Rob Portman of Ohio, who might have been the 2012 Republican vice-presidential nominee had the Romney people not been terrified that, if they put Romney and Portman on the same stage together, the earth would spin into a dark region of the galaxy made up only of the primeval tedium whence the cosmos came, and we’d all come out named Tagg or something. Now, though, he’s back in the Senate being “reasonable,” which means that Portman felt free to allow an extension of unemployment benefits to come to a vote in the Senate, so Portman then could devise a way to sabotage those benefits because that is reasonable and bipartisan and centrist, and nobody will yell at him on the radio too loudly back in Columbus or Elyria.

It depends, he said, on whether lawmakers find a way to pay for the $6.4 billion cost. Wednesday, Portman said he has just such a way. He said that people drawing two other kinds of government aid — Social Security disability insurance payments (SSDI) and trade adjustment assistance (TAA) — can simultaneously get unemployment benefits, which he thinks is wrong.It depends, he said, on whether lawmakers find a way to pay for the $6.4 billion cost. Wednesday, Portman said he has just such a way. He said that people drawing two other kinds of government aid — Social Security disability insurance payments (SSDI) and trade adjustment assistance (TAA) — can simultaneously get unemployment benefits, which he thinks is wrong.

The “compromise” on offer is to help the unemployed while stoking the usua; anger at a vague claque of disabled freeloaders elsewhere. Where ever did Portman get the idea that the country’s economy is beset by double-dipping cripples?

The Labor Department reported Friday that in December, the average unemployed person had been out of work for more than 37 weeks.

Meanwhile, “Christiegate.”

Aug 31 2013

Who Can Live on Today’s Minimum Wage?

If you're stuck working minimum wage jobs like I am, you know what everyone else who earns the lowest pay allowed by law knows: You can't live on minimum wage, certainly not on the part-time hours employers give.

That's why it's heartening to see fast food workers across the nation going on strike to demand better pay. I pull in $8.30 an hour at around twenty hours a week. I can't afford even the cheapest of apartments on that. As a single white male with no dependents, I am ineligible for most public assistance, including welfare, housing assistance, and medical assistance (Medicaid). I get a pittance in food stamps every month, but it's not enough to keep me fed on a regular basis. I'm lucky if I can eat once a day.

My entire paycheck is spent paying bills before I even get it deposited to my bank account, which is typically at or near empty. That is the reality for me and for everyone else who works a minimum wage job.

Some stupid motherfucker was posting on a friend's Facebook page yesterday about how unfair it would be if fast food workers got an increase in wages to earn the same amount as he does in his construction job, because he doesn't expect that an increase in the minimum wage would necessarily bring an increase in his own pay. According to him, we minimum wage monkeys don't do any real labor, and therefore don't deserve to make anywhere near the same amount of money as someone whose job involves backbreaking physical labor. This same stupid asshole thinks that we can get higher paying jobs if we wanted to, and that we don't want to. Bullshit. If I could get a job working construction, I'd be working it right now. I've applied for those jobs and they haven't even granted so much as one interview. Most require that I have my own transportation, which I can't afford because I don't make enough to afford my own vehicle. Those that don't haven't deigned to give me an interview either.

I can tell you right now that this ignoramus wouldn't last even one full shift working at McDonald's. He couldn't keep up with the fast pace, and he certainly couldn't deal with impatient, often angry customers, standing on his feet for eight hours or more. I've done that and it's exhausting. My back is still screwed up from nearly three years of bending over a work table marinating, trussing, and spitting chicken carcasses for roasting, and I left that job in 2005 — eight years ago. These days I grind lenses for an eyewear company for barely above my state's minimum wage. I have to clock out for lunch if I work over six hours, costing me a half hour's pay, because the corporation for which I work doesn't want to pay me for a shift that's long enough to necessitate taking a few minutes to restore my energy levels.

News articles about the fast food strike state that the demand for fifteen dollars per hour would raise pay for full-time workers to thirty-one thousand annually, more than double the current annual average of fifteen thousand. Some, however, quote workers pointing out that most minimum wage jobs don't provide full time hours. They allow twenty or under, meaning someone like me might make $7,500 a year or less, and very often it's a lot less.

In an article on NBC Washington, it's revealed that financial woes actually have a negative impact on a person's IQ. That is, the sheer stress of not being able to afford even the basics, like adequate food and drink, is literally making people dumber. Starvation wages lead to actual starvation, so the body can't get the nutrients it needs to maintain a healthy brain. Financial worries force people to devote more of their mental power to worrying over how they'll afford to live, leaving much less time and energy for other matters.

Who the hell can live on the current minimum wage? No one, not without public assistance, which is already slashed to the bone with Republicans and Democrats cutting the social safety net even further. Many of us are either homeless or soon shall be (myself included). No one is out there advocating for us. No one is doing a damned thing to lighten our financial burden. The vast majority of our tax dollars (yes, we poor folk do pay taxes) go to fund wars and Wall Street, with things like education, housing, food, and Social Security getting less and less. Yet we're told by ignorant assholes to “suck it up”, stop asking for “handouts”, to pull ourselves up by the bootstraps and make do or die. If we could do that on what we get paid, we would. But we can't, and even though we work and pay taxes (unlike the obscenely rich), we aren't allowed to have a say in how our tax dollars are spent.

So what's to be done? Well, I don't know about you, but I for one have no intention of crossing any picket lines, and neither should you. Don't let striking fast food workers do this all by themselves. Support them in whatever way you can. Join them, in fact. If you know in your heart that everyone has the right to work “a useful and remunerative job” that pays enough to live on, then join them in solidarity and demand an increase in the minimum wage to fifteen dollars an hour. Call and write members of Congress in both houses, call and write the White House, march on Washington in the millions and shut the place down, join striking workers on the picket line, donate whatever money and food you can afford to help people who are starving.

This country and this planet are going to hell in a hand basket, but only if We the people let them. Don't let them.

Aug 03 2013

Jobs & Economy Still Not Good Enough

Don’t let the enthusiasm of the stock market or some financial reports that the job market and unemployment are improving or that the economy is growing faster. It’s not. None of today’s economics news is good. As a matter of facr, it’s rather depressing.

Better Than Expected Second Quarter Growth? Is the Post Kidding

by Dean Baker, Center for Economic Policy and Research

I somehow missed this Post article touting the 1.7 percent growth rate reported for the second quarter as better than expected. First it is incredible that the piece would leave readers with the impression that this strong growth, [..]

The economy’s rate of potential growth is generally estimated as being between 2.2-2.5 percent. This means that rather than making up some of the 6 percentage point gap between potential output and actual output, the gap increased in the second quarter. [..]

The GDP data released on Wednesday also included revisions to prior quarters’ data. The revision to the prior three quarters’ growth rate (Table 1A) were sharply downward lowering growth over this period by 1.3 percentage points or an average of 0.4 percent per quarter. With the revised data, growth over the last year has been just 1.4 percent. This is supposed to be a justification for withdrawing stimulus?

July Jobs Report Masks Real Problems In U.S. Labor Market

by Mark Gongloff, The Huffington Post

Fed Chairman Ben Bernanke has said the official U.S. unemployment rate could mask the real problems in the labor market. He got proof of that in July’s jobs report.

The unemployment rate dipped to 7.4 percent in July, the lowest rate since December 2008, the Bureau of Labor Statistics reported on Friday, down from 7.6 percent in June.

But payroll growth was anemic, wages dropped and more discouraged workers headed for the sidelines, continuing the slowest job-market recovery since World War II. [..]

Employers added just 162,000 jobs to non-farm payrolls in July, the Bureau of Labor Statistics reported on Friday, down from 188,000 in June, which was revised lower from an initial reading of 195,000. Together, revisions to May and June figures subtracted 26,000 jobs from payrolls, another sign of weakness. [..]

The unemployment rate, meanwhile, fell in part because 37,000 workers dropped out of the labor force, meaning they gave up looking for work. The labor-force participation rate, which measures the percentage of working-age Americans who are working or looking for work, fell to 63.4 percent in July, near a 35-year low.

The civilian employment-population ratio, which measures how many working-age Americans actually have jobs, was flat at 58.7 percent, near the lowest in 30 years and down from more than 63 percent before the recession. [..]

The majority of the jobs that have been created during the recovery have been low-paying jobs, worsening income inequality and keeping the economy sluggish.

The job market is a long way from recovery and with the slow rate of job creation there could be a deficit of 4.6 million jobs in May 2016. Not only that but the quality of the jobs that have been created are not conducive to economic stimulus:

More than half of the jobs added last month were either in retail trade or “food services and drinking places.” People employed in those sectors tend to have much shorter work weeks and much lower hourly wages than everyone else.

Even worse, a recent paper (pdf) by Canadian researchers suggests that many of the people taking these jobs are relatively over-educated. The authors argue that, since 2000, globalization and technological advancement have reduced the demand for “high-skilled” workers. Desperate for employment, these workers ended up pushing the “lower-skilled” out of the job market entirely. This may help explain why the share of people aged 25 to 54 counted as being in the labor force has plunged by 3.5 percentage points since 2000.

The quality of jobs being created is probably connected to the depressing performance of incomes and the decline in the work week. Hourly pay has grown by just 1.9 percent over the past 12 months — basically unchanged since the end of 2009. The data from the BEA tell a similar story. Real after-tax incomes fell in June. Americans still have less purchasing power than they did in November 2012. Our standard of living has barely improved over the past year.

None of this is good news. The other question is what will the Federal Reserve do? Chairmen Benjamin Bernanke has promised to keep its target interest rate near zero at least until unemployment is below 6.5 percent.

The Fed’s chairman, Ben S. Bernanke, said in June that the Fed wanted to end its current round of bond buying around the time the rate hits 7 percent, which he predicted would happen by the middle of next year. That prediction is looking conservative, suggesting the Fed could start tapering when its policy-making committee meets in September.

But Fed officials have cautioned that they want unemployment to fall because people are finding jobs, not because they’re leaving the labor force. And by broader measures, the job market remains weak. Growth is sluggish – just a 1.4 percent annualized pace in the first half of the year – and the share of American adults with jobs has actually fallen since the recession ended.

So the decision is unlikely to be clear-cut, particularly because Fed officials are divided about the benefits and the costs of the bond-buying campaign.

And the decision is not going to be made this week. Officials will see six more weeks of economic data, including one more jobs report.

I’m not all that well versed in economics but it seems fairly clear that there needs to be a huge influx of investment into the economy. Since it doesn’t appear to be coming from the private sector, which is more concerned about profits than quality job creation, then it need to start coming from the government. The likelihood of that happening any time soon is still rather grim.

Mar 27 2013

Curing Capitalism

Economist Richard Wolff discusses how austerity is making economic problems worse and the cure for these economic woes.

As Washington lawmakers pushes new austerity measures, economist Richard Wolff calls for a radical restructuring of the U.S. economic and financial systems. We talk about the $85 billion budget cuts as part of the sequester, banks too big to fail, Congress’ failure to learn the lessons of the 2008 economic collapse, and his new book, “Democracy at Work: A Cure for Capitalism.” Wolff also gives Fox News host Bill O’Reilly a lesson in economics 101.

Full transcript here

AMY GOODMAN: Professor Wolff, before we end, I want to turn back to the crisis in Cyprus and relate it to what’s happening here. Bill O’Reilly of Fox News warned his audience last week that Cyprus and other European countries are facing economic hardships because they’re so-called “nanny states.”

BILL O’REILLY: Greece, Italy, Spain, Portugal, Ireland, now Cyprus, all broke. And other European nations are close. Why? Because they’re nanny states, and there are not enough workers to support all the entitlements these progressive paradises are handing out.

AMY GOODMAN: That’s Bill O’Reilly of Fox News. Richard?

RICHARD WOLFF: You know, he gets away with saying things which no undergraduate in the United States with a responsible economic professor could ever get away with. If you want to refer to things as nanny states, then the place you go in Europe is not the southern tier-Portugal, Spain and Italy; the place you go are Germany and Scandinavia, because they provide more social services to their people than anybody else. And guess what: Not only are they not in trouble economically, they are the winners of the current situation. The unemployment rate in Germany is now below 5 percent. Ours is pushing between 7 and 8 percent. So, please, get your facts right, Mr. O’Reilly.

The nanny state, you call it, the program of countries like Germany and Scandinavia, who tax their people heavily, by all means, but who provide them with social services that would be the envy of the United States-a national health program that takes care of you, whether you’re employed or not, and gives you proper healthcare. In France, for example, the law says when you go to work, you get five weeks’ paid vacation. That’s not an option; that’s the law. You get support when you’re a new parent for your child care and so forth. They provide services. And they are successful in Germany and Scandinavia, much more than we are in the United States and much more than those countries in the south.

So they’re not broken, the south, because they’re nanny states, since the nanny states, par excellence, are doing better than everyone. The actual truth of Mr. O’Reilly is the opposite of what he says. The more you do nanny state, the better off you are during a crisis and to minimize the cost of the crisis. That’s what the European economic situation actually teaches. He’s just making it up as he goes along to conform to an ideological position that is harder and harder for folks like him to sustain, so he has to reach further and further into fantasy.

H/t Heather at Crooks and Liars

Capitalism efficient? We can do so much better

by Richard Wolff, The Guardian

For all its vaunted efficiency, capitalism has foisted wasteful inequality and environmental ruin on us. There is an alternative

What’s efficiency got to do with capitalism? The short answer is little or nothing. Economic and social collapses in Detroit, Cleveland and many other US cities did not happen because production was inefficient there. Efficiency problems did not cause the longer-term economic declines troubling the US and western Europe.

Capitalist corporations decided to relocate production: first, away from such cities, and now, away from those regions. It has done so to serve the priorities of their major shareholders and boards of directors. Higher profits, business growth, and market share drive those decisions. As I say, efficiency has little or nothing to do with it.

Many goods and services once made in the US and western Europe for those markets are now produced elsewhere and transported back to them. That wastes resources spent on the costly relocation and consequent return transportation. The pollution (of air, sea and soil) associated with vast transportation networks – and the eventual cleaning up of that pollution – only enlarges that waste.

Mar 18 2013

The Three Budgets

Like the tale of the three bears, the congressional budget battle has three budget proposals one from the House Republicans penned by Rep. Paul Ryan (R-WI), chair of the House Budget Committee; another from the Senate Democrats that was worked out by Sen. Patty Murray (D-WA), chair of the Senate Budget Committee; and a third called the “Back to Work” budget presented by the Congressional Progressive Caucus. Each one has is proponents and opponents and, like that bear tale, it has one that’s too hard, one that’s too soft and one that’s just right.

Paul Ryan’s budget, which is getting the most press, the most negative reaction and is “dead on arrival” so to speak, is a rehash of his last two budgets only worse. The proposal would slash Medicare, Medicaid and repeals Obamacare, which even Fox News host Chris Wallace acknowledges, isn’t happening. It proposes balancing the federal budget with the usual draconian cuts to all non-defense spending and reduction of the already smaller federal work force by another 10%. The Ryan proposal would slash $4.6 trillion over 10 years. The budget plan includes no cuts in Social Security. Pres. Obama has suggested changing an inflation measurement to cut more than $100 billion from the program, which makes no sense since Social Security does not contribute to the debt or the deficit.

The there is the Senate Budget proposal which the Republican leadership insisted the Democrats produce even though, constitutionally, all budget and spending bills must originate in the House. That budget would seek $975 billion in spending reductions over the next 10 years as well as $975 billion in new tax revenue, which Sen. Murray said would be raised by “closing loopholes and cutting unfair spending in the tax code for those who need it the least.” It includes a $100 billion in spending on infrastructure repair and educational improvements and the creation of a public-private infrastructure bank.

Then there is that third budget proposal from the House Progressive Caucus that is just right balance of spending, revenue increases and spending cuts. The basic plan is the put Americans back to work, by as Ezra Klein explains fixing the jobs crisis:

It begins with a stimulus program that makes the American Recovery and Reinvestment Act look tepid: $2.1 trillion in stimulus and investment from 2013-2015, including a $425 billion infrastructure program, a $340 billion middle-class tax cut, a $450 billion public-works initiative, and $179 billion in state and local aid. [..]

Investment on this scale will add trillions to the deficit. But the House Progressives have an answer for that: Higher taxes. About $4.2 trillion in higher taxes over the next decade, to be exact. The revenues come from raising marginal tax rates on high-income individuals and corporations, but also from closing a raft of deductions as well as adding a financial transactions tax and a carbon tax. They also set up a slew of super-high tax rates for the very rich, including a top rate of 49 percent on incomes over $1 billion.

But to the House Progressives, these taxes aren’t just about reducing the deficit – though they do set debt-to-GDP on a declining path. They’re also about reducing inequality and cutting carbon emissions and slowing down the financial sector. They’re not just raising revenues, but trying to solve other problems. But they might create other problems, too. Adding this many taxes to the economy all at once is likely to slow economic growth.

As for the spending side, there’s more than $900 billion in defense cuts, as well as a public option that can bargain down prices alongside Medicare. But this budget isn’t about cutting spending. Indeed, the House Progressives add far more spending than they cut.

On Sunday’s Up w/ Chris Hayes, host Chris Hayes discussed the various budget proposals released by Republicans and Democrats in Congress this week with his guests Representative Kyrsten Sinema (D-AZ); Representative Jerrold Nadler (D-NY); Sam Seder, host of The Majority Report, co-host of Ring of Fire; and Heidi Moore, economics and finance editor for The Guardian newspaper.

Nov 12 2012

One Economy under God by T’Pau

Has it occurred to you how strange it is that your job can slip across international boundaries, but you are prohibited from crossing the same border to follow that job? It should.

Has it occurred to you how strange it is that your job can slip across international boundaries, but you are prohibited from crossing the same border to follow that job? It should.

Multinational Corporations have been busy for the last twenty years creating a new type of serf. In feudal Europe and Asia, serfs were tied to the land by a master, called the lord, and obligated to work for him. Now, the 1% are creating serfs out of whole nations of people. Sure, those lands are huge-nations-but they are still boundaries that bind you, and prevent you for selling your work freely, while multinational corporations are borderless entities.

Seeking to continue the tail spin to the bottom of wages, big business has been busy writing international treaties, allowing jobs to shift to ever lower paying environments with the least protections for workers. Australia, Brunei, Chile, Malaysia, New Zealand, Peru, Singapore, United States, and Vietnam are already involved in the latest negotiations, the Trans-Pacific Partnership. If signed the treaty will be a “docking agreement” open to any country to sign later. Canada and Mexico are expected to join this month. Japan and China are being courted to join. It is the largest trade agreement the world has ever seen.

The treaty creates an über-government superseding and overriding existing law in sovereign nations–seeking to stamp out democracy. In old feudalism, it was the Catholic church that held dominion over the nations of man. Now “the market” has taken the place of God. Profits are all that matters. Anything the market endorses is right because the market is infallible, unchallengeable. Keep democracy out of it.

The powerful and wealthy have finally found a way to regain the power they once held in feudal times. They have done it in ways intentionally hidden from the majority. Most of us don’t even realize we are in a battle for the type of global governance we will have in the future. For the last 50 years corporate leadership have simply bought our democracies and media outlets, making it easy for corporations to gain the upper hand, and convince voters to support governance that is secretive and totalitarian, without letting voters know they are doing so. Now the 1% want to solidify that power into an actual international treaty. They are seeking one economy under the rule of American corporations. They are, in fact, seeking world dominion.

Sep 08 2012

“Rev’ Your Engines”

Former Michigan Governor Jennifer Granholm gave an animated and rousing speech about jobs and the suto industry at the 2012 Democratic National Convention.

Now that’s energy.

The full transcript can be read here. H/T Real Clear Politics

Apr 23 2012

How to Safe Guard Social Security: Put People to Work & Expose the Lies

In an article for FDL Action, Jon Walker sites a Gallup Poll that there are 150 million people around the world who would immigrate to the United States:

WASHINGTON, D.C. — About 13% of the world’s adults — or more than 640 million people — say they would like to leave their country permanently. Roughly 150 million of them say they would like to move to the U.S. — giving it the undisputed title as the world’s most desired destination for potential migrants since Gallup started tracking these patterns in 2007.

The relevant worth of the poll, argues Jon,

[..] because the annual Social Security Trust Fund report should be released today. As a result there will likely be much hyperventilating about how the Social Security trust fund is projected to run out of money in roughly 25 years, even though continuing payroll taxes would still be able to fund a high level of Social Security payments given current assumptions.

While the Administrators try hard to make their projections accurate, any very long term projections are inherently going to be somewhat unreliable. Trying to guess how many working Americans there will be and their average incomes in the year 2030 is basically impossible.

While current demographic trends point in one direction, it is completely possible that at some time in the next decade we could adopt policies that would increase the number of working Americans – and the collection of payroll taxes to support Social Security – well above current assumptions.

Richard (RJ) Eskow gives us the headlines that we won’t see:

“Social Security Trust Fund Even Larger Than It Was Last Year”

“Growing Wealth Inequity Will Lead to Social Security Imbalance Later This Century”

“For-Profit Healthcare Poses Threat to Medicare, Federal Deficit, and Overall Economy in Coming Decades”

“Public Consensus Grows For Taxing Wealthy to Restore Long-Term Entitlement Imbalance”

He chastises Stephen Ohlemacher at the Associated Press for touting the standard doom and gloom spin on the state of Social Security and Medicare with this erroneous headline, “Aging workforce strains Social Security, Medicare”:

Ohlemacher’s article was occasioned by the latest report from the Trustees of the fund that handles Social Security and Medicare, which will be released today. He writes that “both programs (Social Security and Medicare) are on a path to become insolvent in the coming decades, unless Congress acts, according to the trustees.”

Unfortunately the piece provides no context for the use of the term “insolvent,” which most people associate with bankruptcy or running out of funds. As Sarah Kliff explains, nobody is suggesting that either of these programs will ever run out of funds. And when programs have ongoing sources of income, the temporary absence of a surplus isn’t the same as “insolvency” as that term is commonly understood.

In fact the report will clearly state that Social Security’s Trust Fund has grown to $2.7 trillion dollars, and that Social Security will be able to pay all its benefits in full for a quarter of a century. After that, if no changes are made, it will be able to pay 75 percent of scheduled benefits without changes.

Nor is the “aging workforce” the cause for any of today’s concerns, despite the millions of dollars in advocacy money meant to make us believe that it is. We’ve known about the baby boom ever since it ended in the 1960’s, and it was fully addressed in past adjustments to the program. That’s why the program was considered perfectly solvent for the foreseeable future after the Greenspan Commission raised the retirement age and made its other adjustments in the 1980s.

Media Matters points out the how the MSM gives a hand to the “Ponzi” lie ever since Texas Gov. Rick Perry “described the program as a “Ponzi scheme”:

Social Security is not a Ponzi scheme. People who call it a Ponzi scheme are not “wrong but partially right,” they’re not “called wrong by critics” — they’re just wrong.

A Ponzi scheme is a criminal endeavor that involves opaque financial dealings that promise investment returns when none or next to none actually exist. Social Security’s finances are crystal clear, and the interest generated by its trust fund is quite real.A Ponzi scheme eventually collapses. According to last year’s report, Social Security can continue as it is, paying full benefits for nearly 25 years, and 77 percent of promised benefits thereafter. [..]

The same false attack is likely to continue as long as newspapers insist on publishing “he said-she said” stories alongside conservative columnists intent on undermining Social Security for ideological reasons.

These false attacks are reinforced by much read and respected newspapers and on-line news sites who report comments by Social Security critics without ever challenging the reality if the accusations. Conservative hacks, like Charles Krauthammer of The Washington Post and syndicated columnist, John Stossel, continue to repeat this lie ad nauseum without correction by the editorial boards of their newspapers. Truth and facts merely get in the way.

As both writers and Media Matters point out, the solution to preserving Social Security and Medicare as we know it, is the increase the number of people in the work force (you know, real jobs), closing the income inequality gap, and either lifting the payroll tax cap or eliminating it altogether making all income subject to the tax. You know simple real solutions, not hand wringing, misleading spin and lies.

Recent Comments