Wall Street had a boomer of a year, everyone else not so much.

Stock Market Has Great Year, You… Not So Much

By Mark Gongloff, Huffington Post

This has been the best year for the U.S. stock market in at least 16 years. But that great news is meaningless for many Americans. [..]

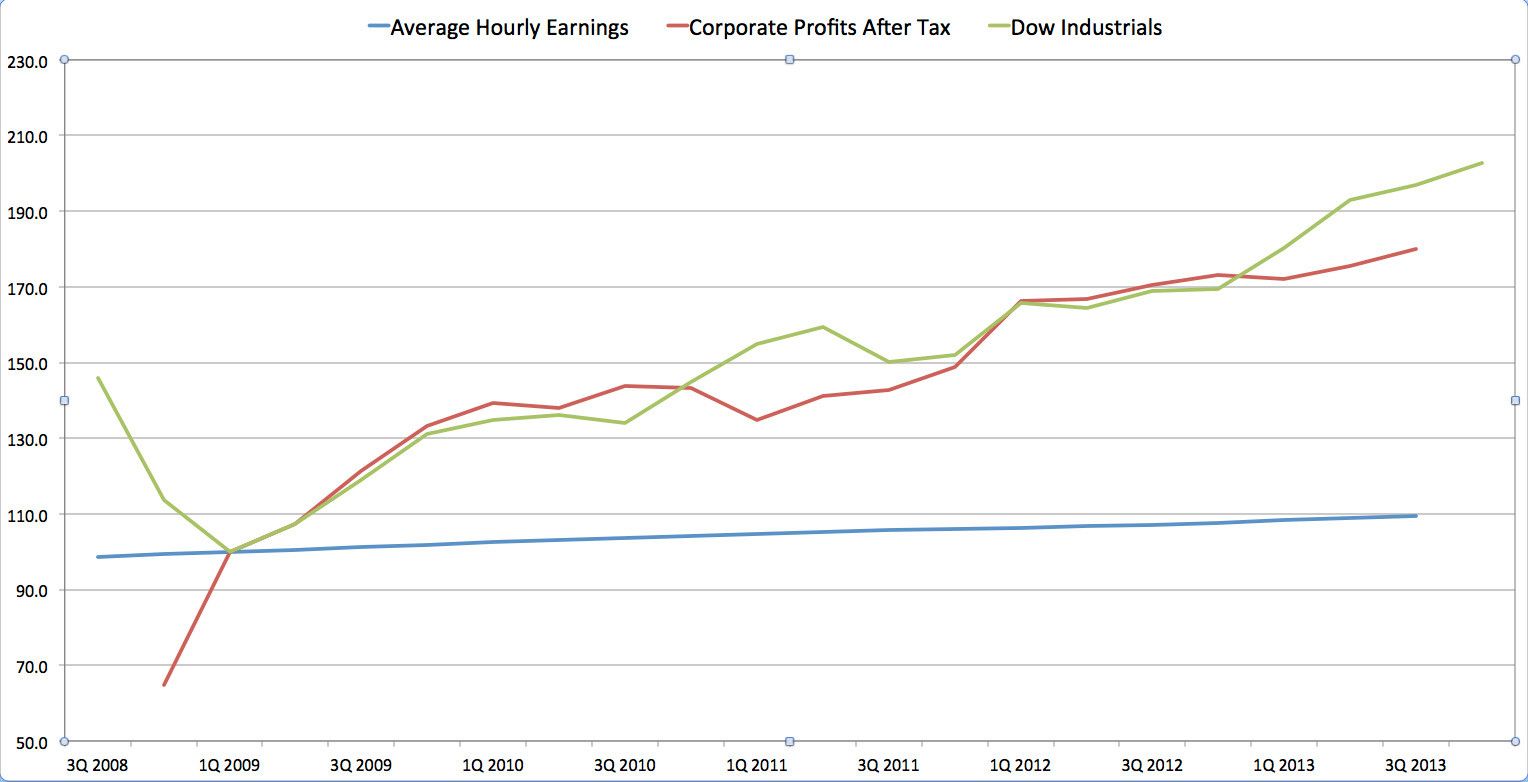

But only about half of Americans own stocks, including those in retirement accounts. Meanwhile, corporate profits are soaring largely because companies have been squeezing costs — especially labor costs. In the chart below, tracking the change in average hourly wages for private-sector workers against corporate profits and stock prices since the stock market bottomed in March 2009, you’ll notice one line is badly lagging.

Click on image to enlargewYou guessed it: The lagging line is your sad hourly earnings. They have barely budged since the market bottomed in 2009, while the Dow has skyrocketed 153 percent. Between November 2012 and November 2013, the latest data available, hourly wages for nonsupervisory workers rose just 2.1 percent, just barely ahead of inflation.

Gongloff concludes that Wall Streeters are “bullish on 2014,” others not so much. Our friend David Cay Johnston looks at tech stocks, like FaceBook and Twitter, that essentially have no profits, yet, through speculators and the Federal Reserve policy of nearly zero interest rates, these stock have greatly exaggerated value.

The coming stock market collapse

By David Cay Johnston, Al Jazeera America

Tech stocks have returned to bubble levels, thanks to PR, weak financial journalism and cheap credit

Markets can benefit from speculators, who take risks that prudent people and institutions should avoid, but speculators should represent the edges, not the core of the market.

It’s bad enough that the financial press allows the inflated commentary of tech companies to go unchallenged. But why in the world should Americans tolerate hedge funds and other speculators being subsidized with cheap and easy credit, thanks to the Federal Reserve’s policy of near-zero interest rates?

Only speculators would buy companies with no profits. And only subsidized speculators would bid up prices on companies with a PR in three digits, like Twitter.

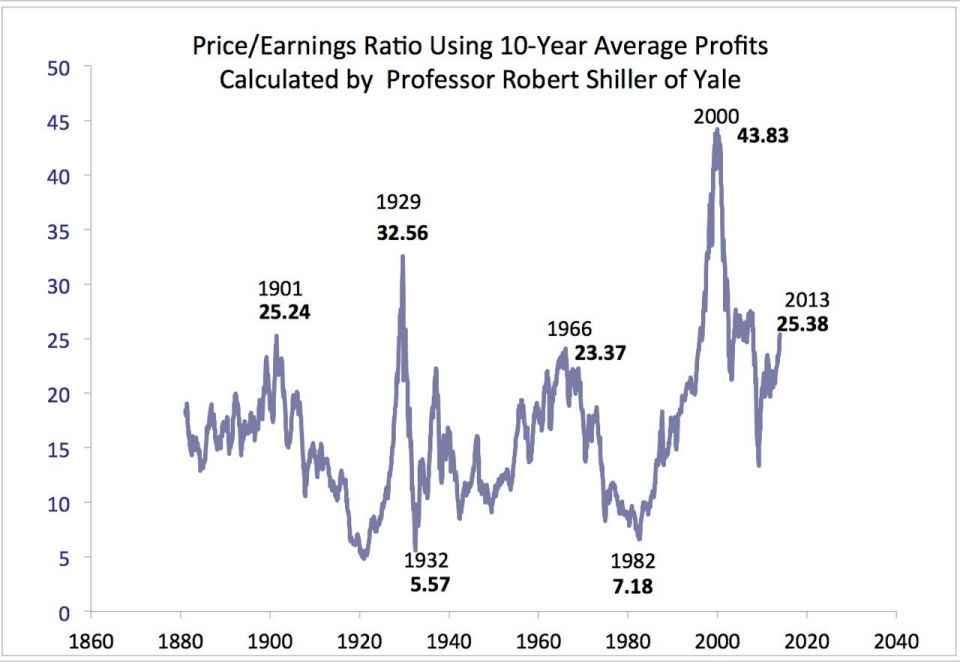

Back in 1995, Alan Greenspan, then chairman of the Federal Reserve, asked a rhetorical question about stock prices, “How do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions, as they have in Japan over the past decade?”

We now suffer through a prolonged period with high unemployment, flat to falling wages for most workers and unrealized potential for economic growth. But the speculators are making out like bandits, thanks to government suppression of interest rates, allowing massive borrowing by offshore hedge funds, and to lax rules for both accounting and trading.

Given the history of stock markets since 1995 and today’s blinking red indicators, no one can rationally claim they were not warned when the next collapse comes, as surely it will.

Click on image to enlarge.

So what will happen to the market when the Fed starts to raise interest rates? 2014 may not be the “boom” that Wall Street expects.

Recent Comments