“Memory believes before knowing remembers. Believes longer than recollects, longer than knowing even wonders. Knows remembers believes a corridor in a big long garbled cold echoing building of dark red brick … where in random erratic surges, with sparrowlike childtrebling, orphans in identical and uniform blue denim in and out of remembering but in knowing constant as the bleak walls, the bleak windows where in rain soot from the yearly adjacenting chimneys streaked like black tears.”

–William Faulkner, 1932

“Infants process a great deal of information through mechanisms involving procedural memory and begin to assemble their repertoire of survival-based learning long before conscious memory is developed.”

— Robert Scaer, 2005

Child poverty is a form of child abuse perpetrated by society as a whole on its most vulnerable, helpless members, and its effects are permanent and devastating. After reviewing some newly released data on child poverty in America, this essay discusses some of the devastating impacts of child poverty on a personal level.

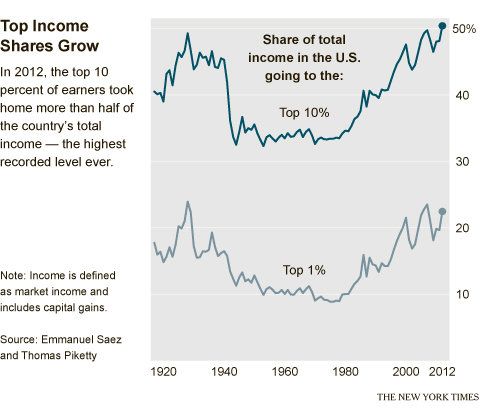

Even as mainstream economists tout macro-economic data showing the economy picking up steam, poverty in the U.S. remains stubbornly high, according to data released last week by the Census Bureau.

For the eleventh time in twelve years, poverty has worsened or gotten no better. The official poverty rate–which greatly understates actual poverty–remains at 15%, meaning that 46.5 million Americans are living on less than $18,300 for a family of three, including 21.8% of all children (16.1 million kids), 27.2% of African-Americans, 25.6% of Hispanics and more than 28% of people with disabilities.

That’s $6,000 a year per person, or $500 per month. Try living on that some time and then tell me, like that entitled billionaire boob Michael Bloomberg, that America’s poor aren’t really poor.

From 2000 to 2012, poverty increased overall by 3.7%, and by 5.6% among children, even as median income for non-elderly households fell from $64,843 to $57,353, a decline of $7,490, or 11.6%.

In 2012, more than one-third (34.6%) of all people living in poverty were children, including 37.9% of black children and 33.8% of Hispanic children. The poverty rate for families with children headed by single mothers was 40.9%, and of the 7.1 million families with children living in poverty, 4.1 million (57.7%) are headed by a single mother.

But nearly half of the poor-43.9% or 20.4 million Americans-live below one-half of the poverty line, or $9,150 for a family of three. Thus 6.6% of the total population lives in “deep poverty,” including 7.16 million children.

Also remaining stagnant last year at 106 million Americans was the number of those living in “near poverty,” below twice the poverty line-less than $36,600 for a family of three. This means that more than one in three Americans are either already poor or are living one catastrophe-a job loss or serious illness-away from poverty.

“Personal problems are political problems. There are no personal solutions at this time. There is only collective action for a collective solution.”

— Carol Hanisch, 1969

Recent Comments