(2 pm. – promoted by ek hornbeck)

In early December, the Guardian covered ALEC’s latest corporate-written attack on freedom, an effort to penalize households that place solar panels on their roof:

In early December, the Guardian covered ALEC’s latest corporate-written attack on freedom, an effort to penalize households that place solar panels on their roof:

An alliance of corporations and conservative activists is mobilising to penalise homeowners who install their own solar panels – casting them as “freeriders” – in a sweeping new offensive against renewable energy, the Guardian has learned. …

For 2014, Alec plans to promote a suite of model bills and resolutions aimed at blocking Barack Obama from cutting greenhouse gas emissions, and state governments from promoting the expansion of wind and solar power through regulations known as Renewable Portfolio Standards.

[Director of the Energy and Policy Institute Gabe] Elsner argued that after its bruising state battles in 2013, Alec was now focused on weakening – rather than seeking outright repeal – of the clean energy standards. “What we saw in 2013 was an attempt to repeal RPS laws, and when that failed … what we are seeing now is a strategy that appears to be pro- clean energy but would actually weaken those pro- clean energy laws by retreating to the lowest common denominator,” he said.

So, is there a particular reason why ALEC going after rooftop solar photo-voltaic installations now, after having to beat a retreat on its 2013 effort to win wholesale repeals of Renewable Energy Portfolio Standards? Why yes, there does appear to be a particular reason for going after the economics of rooftop solar PV.

Solar Energy Prices and the Tipping Point

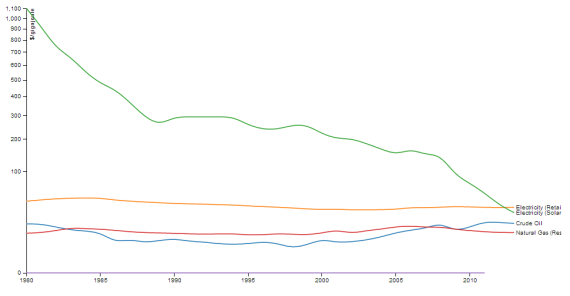

Consider the diagram below, taken from a Seeking Alpha article (free reg’n required for full article) on the immediate past and future prospects of the Solar Photovoltaic Energy industry. The labels are, I understand, largely illegible, but it is a plot on a logarithmic scale. This is a scale where the larger the numbers, the smaller the interval given to the same difference, which is quite useful when examining things that proceed by repeated doublings or, for the case of Solar PV energy, halvings. The blue line is a measure of the cost of petroleum (in terms of energy content), the red line the cost of natural gas, and the yellow line the retail price of electricity.

And the green line is the cost of solar PV electricity:

And you can see the problem for natural gas producers: the cost of Solar PV electricity is dropping below the retail cost of electricity. That means that in some parts of the country ~ Southern California and Hawaii stand out ~ even when natural gas is allowed to impose the cost on future generations implied by dumping CO2 into the atmosphere free of charge, rooftop solar provides cheaper solar to households when the sun is shining than the electricity company is offering.

If the free ride costs of CO2 emissions for natural gas and coal powered electricity were to be included in the market cost of natural gas and coal, the number of states where solar would be cheaper than retail electricity would clearly expand.

So, what is ALEC’s argument? The argument is that the solar power is intermittent, and so the capacity provided by the grid is acting as insurance to the household, and so the household that is producing its own solar power should pay for the privilege of also being connected to the grid. Obviously what ALEC’s argument ignores is the flipside free-riding of their fossil-fuel producing members, since when that is taken into account, the electricity that is produced by the households with solar PV is preventing the emissions of CO2, and so equally well deserves a credit for reducing the fossil-fuel producer’s free-riding.

As Seeking Alpha argued, from the perspective of investors, in January,

For companies and shareholders (unless you want to play these cycle swings), it would actually be best if the industry growth could converge on two basic metrics:

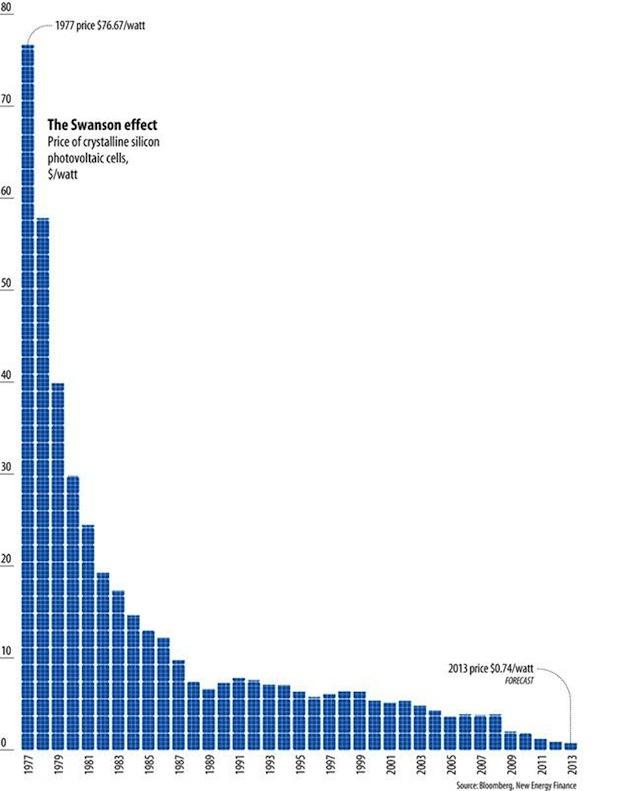

- The long-term decline in cost per watt

- The long-term growth in demand

The first is a function of materials cost, technological advances, and efficiency gains in production. Individually, these are only a couple of percent per year, but all three working together and this amounts to quite a substantial decline over time.

And as we pass through this threshold where solar PV is in large parts of the country already less expensive than the full cost of fossil-fuel power (factoring in climate impacts), and is driving toward being less expensive than the retail cost of electricity, we will increasingly see fossil fuel producers taking political actions to protect their industry self-interest against the public interest. Seeking Alpha, again:

In case you think this isn’t going to affect other energy sources, here is Credit Suisse:

Other key points are that falling wind and solar costs make them competitive with natural gas, even ignoring externalities. As a result, Credit Suisse has cut its natural gas projections considerably. “We estimate renewables slowing the rate of natural gas demand growth from power generation to <0.5 bcf/d through 2020 versus our prior estimate of 1.0-1.2 bcf/d even when taking into account planned coal plant shutdowns and assumed nuclear plant retirements.” [Cleantechnica]

This could very well directly compete with natural gas as a source for electricity generation, and by doing that, putting a cap on the shale gas revolution. And the threat to gas isn’t limited to the US, where natural gas prices are very low compared to much (if not all) of the world.

Obviously, for those of us with children and grandchildren who will have to live through the catastrophic climate change implied by the “shale gas revolution”, putting a cap on the shale gas revolution would be welcome news indeed.

The Feed-In Tariff vs Net Metering controversy

There is a point of controversy that reflects a fight within the ranks of solar energy advocates, rather than between solar energy advocates and the producers of potentially catastrophic amounts of energy from fossil fuels. That is the argument between “Feed In Tariffs” and “Net Metering”.

There is a point of controversy that reflects a fight within the ranks of solar energy advocates, rather than between solar energy advocates and the producers of potentially catastrophic amounts of energy from fossil fuels. That is the argument between “Feed In Tariffs” and “Net Metering”.

“Feed In Tariffs” are the most effective means of expanding the harvest of a “use it or lose it” energy source like wind or solar, where the largest part of the total cost is the fixed cost,

With relatively negligible marginal costs, the producer of existing renewable energy harvesting equipment has an incentive to sell power at prices well below the replacement cost of the equipment. By contrast, coal and natural gas power producers drop out of the market when the rate they are paid for electricity, the “producer tariff”, drops below the cost of fuel plus marginal operating costs of the plant. Therefore, when electricity is priced by constructing an artificial market and setting the price at the price required to bring sufficient power online, the natural gas “peaker” plant is going to be a price maker during peak power demand. By contrast, when there is an abundance of renewable energy available, that displaces the most expensive energy sources and pushes the price of electricity down. So under those market arrangements, the renewable energy producer reduces the average cost of electricity to the producer, but risks pushing the price they are paid below the amount required to meet the finance cost of their equipment.

A Feed-In Tariff addresses this problem by setting a fixed tariff for some or all of the power produced by the harvester of renewable energy, which neither drops when the wholesale price in the artificial wholesale market is below the Feed-In Tariff, nor increases when the wholesale price is above the Feed-In Tariff. Since the Feed-In Tariff increases the incentive to install that equipment, it leads to more renewable energy being available. Depending on how mature the technology is and the competing cost of electricity from existing unsustainable energy sources, Feed-In Tariffs can indeed result in a lower average retail price for power than if the Feed-In Tariff was not in place. This outcome has been most often associated with Windpower, but with declining costs of Solar PV, it is likely to become common for Solar PV as well.

An ideal Feed-In Tariff is “retrogressive”, which means that the tariff paid to the early adopters is higher than the tariff paid to later adopters, which reflect the fact that early adopters face industry start-up and establishment costs that later adopters do not have to face. And while European Feed-In Tariffs have typically had different rates for different energy sources, it is also possible to organize a common Feed-In Tariff for renewable energy sources and have a separate side-payment that accounts for the benefit to grid stability of supply of having a variety of types of renewable energy harvest in the energy portfolio.

However the details of how it is put together, the target of a Feed-In Tariff is to see more rapid investment in sustainable, renewable energy than would occur if investors faced the risks of increased renewable energy supply pushing the price of power below renewable energy equipment replacement costs.

Net-metering has a different starting point. It is focused on protecting the rights of electrical utility customers to draw on the grid when they need it, and provide their power back to the grid when they have a surplus. It is typical for the payment to the customer for power to be at a lower rate than the retail price of power to the customer. At a more aggressive form of the system, the difference is based on the charge included in the bill for use of the grid itself, with the charge added to the retail rate when the customer is using power off the grid, and deducted from the rate when the customer is providing power to the grid. However, it is obviously to the benefit of the utility, and therefore a less effective protection of customer rights, if an additional differential between charges can be introduced.

In more conservative forms of the system, net-metering only acts as a deduction on the utility bill, so a $0 utility bill is the largest effective return on the installation, no matter its capacity, while in more aggressive forms of the system customers may be paid a rebate check in months when their sales to the utility exceed their purchases.

Because of the much greater uncertainty regarding system paybacks when solar PV is installed under a net-metering system, areas that rely on net-metering have seen the rise of solar leasing companies, which lease the right to install PV capacity on a utility customer’s rooftop, with the cost of the installation and an additional return on the leasing company’s investment going to the leasing company out of the payment made for the power produced by the rooftop power. By contrast, the experience in European countries with national Feed-In tariff policies and the financial security that they provide is that a property owner can simply go to the bank and finance the installation of rooftop solar.

The flipside of that is, of course, that the leasing companies are aggressive advocates for the superiority of net-metering over Feed-In Tariffs. , which may be responsible for driving the controversy. For example, quoted in a piece at theenergycollective on the Gainseville, Florida Feed-In Tariff program:

The Gainesville Regional Utilities (GRU) program “came to a screeching halt, it’s over,” said The Alliance for Solar Choice President Bryan Miller. “This shows that FITs don’t build a long term durable market,” added Miller, a VP for the residential solar installer and third party ownership fund manager Sunrun. “Real people are losing real jobs because there is no Gainesville feed-in tariff anymore.” / Gainesville’s City Commissioners voted in December to suspend the tarifffor 2014. GRU will not provide the over-retail rate for solar-generated electricity that has driven the installation of fifteen-plus megawatts of capacity since 2009.

It is, of course, a bit deceptive to say that Gainsville’s Feed-In Tariff program has “come to a screeching halt” ~ Gainesville was successfull in hitting the target capacity for their Feed-In Tariff program, so its closed to new systems, but the existing systems continue to generate solar power for Gainesville and continue to be paid at the Feed-In Tariff rate. Of course, if the system had been set up as a retrogressive Feed-In Tariff, once it had hit the target for the original rate, a new target would be set at a lower rate, and it would continue accepting systems under that lower rate. However, it is true that under net metering, while adoption of solar PV in Gainesville would have proceeded at a slower pace, it also would not have faced a cap in terms of installed capacity.

Girding Our Solar Loins to Fight for Homeowners Rights

Of course, ALEC doesn’t care whether rooftop solar is being installed under Feed-In Tariff policies or net-metering policies.

Of course, ALEC doesn’t care whether rooftop solar is being installed under Feed-In Tariff policies or net-metering policies.

We do have to continue to advocate for Feed-In Tariffs on the utility scale Wind and Concentrated Solar Thermal Power (CSP, I guess because the ‘concentrate’ kind of already implies the ‘thermal’) … but these are areas of the renewable industry that are not going to face internal controversy over net-metering versus Feed-In Tariffs, as these are produced at wholesale levels and connect into the system as wholesale energy producers.

However, it seems politic to focus on net-metering at the household level at present, precisely because net-metering is, at heart, a protection of homeowner rights. Advocates of policies that promote adoption of solar power have a natural coalition of supporters of policies to fight the Climate Suicide club, traditional conservation advocates concerned with the wide range of environmental and ecological damage caused by coal and natural gas production. To this “Green” side of a coalition can be added a “Blue” side among those who would gain employment in the activity of solar panel installations.

Pursuing the fight along the lines of net-metering for household renewable energy production on fair terms without abusive “grid overhead” charges on owners of rooftop PV systems allows us to move beyond our base coalition to include outer suburban and exurban Republican leaning independent homeowners that are the the most brittle portion of aggressive pro-Republican gerrymanders.

We can see that wedge at work in the so-called “Green Tea” splinter in Georgia, where the “competition” propaganda messaging that industry groups have been using to fight regulation of their abuses can come back to bite the hand that propagated them:

Dooley [founder of the Green Tea coalition and co-founder of Atlanta Tea Party Patriots] said the growing use of solar power is pressuring utilities to open their grids to other energy sources that may become even cheaper in the next few years. Customers should have a choice of buying electricity from the grid or making their own at home. “There’s no competition here,” Dooley said in an interview. “Solar is our only way to force them to compete.”

And we can see the fingerprints of the solar leasing companies in this activity as well:

The odd-couple partners also are working to overturn a Georgia law that bars third parties from owning residential rooftop solar projects. The rule keeps developers such as SolarCity from installing rooftop panels at little cost to customers in return for revenue earned from selling solar power over the lifetime of the panels. That forces consumers who want rooftop power systems to shoulder all upfront costs and makes solar prohibitively expensive for most households. Republican lawmakers are discussing lifting a similar ban in North Carolina, where Ruth Samuelson, a Representative from Mecklenberg, helped fight off attempts to gut the state’s renewable energy mandate earlier this year.

This is, of course, primarily a temporary alliance of convenience and not the basis for a permanent political realignment. A permanent political realignment building on wedging some portion of the current “Tea Party” faction would have to find a sustainable way to shift their focus from elected public government to the unelected private governments running transnational corporations, which are effectively manipulating the faction despite being a far more direct example of “government abuse of power” than the elected public governments that are the focus of the “Tea Party” factions attention.

However, given the way that success on this issue can shift the underlying political terrain, it is still well worthwhile. Just as one example, a collection of effective net-metering installation enterprises across the Southeast would also provide a platform from which to push for broader Connie Mae finance of higher cost-to-buy, lower cost-to-own energy conserving home improvements, the next time that an oil price shock and energy price crisis brings that issue back to the front of political debate.

Conclusions & Considerations

So, that is what’s on my mind this week in the sustainable energy and transport policy arena. What’s on your mind?

As always, rather looking for a more ringing conclusion that that, I now open the floor to the comments of those reading.

If you have an issue on some other area of sustainable transport or sustainable energy production, please feel free to start a new main comment. To avoid confusing me, given my tendency to filter comments through the topic of this week’s Sunday Train, feel free to use the shorthand “NT:” in the subject line when introducing this kind of new topic.

If you have a topic in sustainable transport or energy that you want me to take a look at in the coming month, be sure to include that as well.

And, unlike some other regular online communities, no need to introduce yourself or justify your participation first: just jump right in and start participating. Your presence here is sufficient justification.

1 comments

Author

… fossil fuel wealth owners?