Author's posts

Sep 06 2015

Formula One 2015: Monza

So it’s Italy and as close to Scuderia Marlboro as you get. The speculation that Monza is done as a venue is a trifle premature as there is every indication that the local goverment is caving to Ecclstone’s every whim.

He’s muzzled the complaints about Pirelli who build the tires he wants anyway (ones that pop if you drive them too hard). Mercedes is testing their 2016 engine with Hamilton on pole, Rosberg is 4th on the 2015 because his blew up. The Scuderia is 2nd and 3rd to put the butts in the seats.

Sep 03 2015

Banana Republic Part II

Guatemalan President Resigns in “Huge Victory” for Popular Uprising

President Otto Pérez Molina of Guatemala Resigns Amid Scandal

By AZAM AHMED and ELISABETH MALKIN, The New York Times

SEPT. 3, 2015

Mr. Pérez Molina, a former general who was the military’s negotiator during talks to end of the nation’s brutal 36-year civil war, offered to present himself for possible charges in a multimillion-dollar customs fraud case, saying he would “face justice and resolve my personal situation.” Before, he had denied wrongdoing and refused to budge from office even as tens of thousands of Guatemalans took to the streets.

…

Mr. Pérez Molina, 64, is the first president in Guatemalan history to resign because of corruption, experts said, offering a rare example in a region long marked by the impunity of its political class. And though the economy and reform efforts in Guatemala have lagged compared with those in other countries in Latin America, the move put it firmly within a wave of efforts elsewhere in the region to make political systems more responsive toward the public, especially the middle class.

…

That peaceful protests have managed to oust a powerful leader who many say was connected to the dark history of the war, in which a United Nations panel concluded that the government was behind the majority of the 200,000 deaths in the conflict, has left those outside and within Guatemala stunned. Even before sunrise, protesters were starting to gather in the Plaza Central of Guatemala City, the nerve center for the widespread protests that started in April.

Guatemala president appears in court as congress accepts resignation

by Jo Tuckman and Nina Lakhani, The Guardian

Thursday 3 September 2015 14.42 EDT

Pérez Molina’s decision to step down is a huge victory for an unprecedented anti-corruption protest movement that has swelled in recent months with regular marches in major cities, road blockades in rural areas and a general strike last Thursday.

…

Noisy celebrations erupted across Guatemala City on Thursday morning as news of his resignation began to spread. Fireworks were set off in public squares and gardens, while people on their way to work honked their car horns. Homes, cars, buses and shops were immediately draped in the blue and white national flag.“We did it, the people did it,” said 33-year-old Gabriel Wer in a phone interview from the main square in the capital. But Wer, one of the organisers behind the huge weekly protests that started in April, warned: “But this is not the end, now we’re looking for justice.”

Sep 03 2015

Bad Blogging

Stupid relatives. I find myself in a place with no cell service and less internet.

The people who told me it’s not so easy from a smart phone are exactly right (I’m now in a Dunkin’ Donuts getting coffee).

I’ll see what I can do, but don’t expect much until tomorrow evening when I return from the back end of beyond.

Sep 02 2015

Clio

You are responsible for this material. It will be on the test.

Told you.

The new SATs everyone’s kids will be preparing for next spring

Rachel Nuwer, Scientific American

Tuesday, Sep 1, 2015 04:30 AM EST

“Fortune favors the prepared mind,” as Louis Pasteur once said. So as school revs up this month, so do SAT prep classes. Students might be surprised, however, at the amount of time dedicated to visual literacy skills. The increased focus on graphics is designed to prepare an estimated 1.6 million college-bound pupils for the first redesign of the standardized college admissions test in more than a decade. Along with other updates, test takers of the March 2016 exam will encounter graphics not only in the math section as in past years but also in the reading and writing and language portions. Students will be asked to interpret information presented in tables, charts and graphs and to correct text so it accurately describes data found in accompanying figures.

Mounting evidence indicates that such literacy is a key skill for success in college, careers and daily life in general. In an increasingly data-rich world, graphics now pop up routinely in formats ranging from political campaign literature to household bills. “Being a literate consumer of that information is valuable regardless of your career,” says Jim Patterson, an executive director at the College Board, the nonprofit corporation that owns and publishes the SAT.

Education experts agree that students in many developed nations, including the U.S., lack experience with visual data. “Apart from basic x- and y- axis graphs, educators [around the world] don’t sufficiently teach students how to represent information graphically,” says Emmanuel Manalo, a professor of education psychology at Kyoto University in Japan. The SAT’s new focus most likely will nudge educators to shift their lesson plans accordingly. Students, in other words, won’t be the only ones with bubble charts or scatter plots on the mind this fall-teachers will, too.

The intellectual work required to interpret a graph taxes our brain more than the effort involved in reading the same information presented as text, according to a new study by Manalo and two researchers at the University of Twente in the Netherlands.

So why do we do info-graphics again? Oh, that’s right. It makes it easier to lie and obfuscate.

Sep 02 2015

It’s worse than that. He’s dead Jim!

As TPP Grinds To A Halt, Asian Countries Start Focusing On Rival Trade Agreement RCE

by Glyn Moody, Tech Dirt

Tue, Sep 1st 2015 3:28am

Techdirt has written dozens of stories about the Trans-Pacific Partnership agreement (TPP). That’s largely because it seemed to be coming to a conclusion, after many years of negotiations, and so it was important to capture the last-minute twists and turns — and the dirty deals — as they happened. But as we reported a few weeks ago, that final breakthrough and completion never happened. Instead, we had the “Maui meltdown”, when a whole bunch of old and new problems raised their heads, with the result that TPP may have missed a key deadline that means it won’t be happening soon, if ever. That may have seemed an extravagant claim, but it is a sentiment that is gradually beginning to spread among commentators in Asia.

…

Techdirt introduced the Regional Comprehensive Economic Partnership (RCEP) back in June, pointing out that it could end up even worse than TPP. But while TPP is at a standstill, RCEP seems to be moving forwards

…

The biggest difference between TPP and RCEP is that China is part of the latter, but not of the former, while for the US, it’s the other way around. China therefore has a big incentive to make RCEP happen quickly, and seems to be grasping the opportunity opened up by TPP’s latest problems.

…

RCEP has a big advantage in that it is not trying to define an ambitious set of new trading rules, as TPP is, but instead is merely attempting to harmonize existing trade agreements among RCEP’s 16 nations, which also include another major economy absent from TPP — India.

Sep 01 2015

The Case for Higher Inflation

First of all, “money” is not a store of value. Your baked mud Ur cow tokens are in fact less useful than Confederate dollars because those at least can be used to start fires or as wallpaper, cat box liners, and fish wrap. Ur is no more, the cows are dead, and the market has been closed for thousands of years.

What does have value are income producing properties and enterprises. These throw off a net positive revenue stream in whatever the current medium of exchange is from Yap stones to electrons. By ‘medium of exchange’ we mean anything that can be used to arbitrarily facilitate the transfer of assets from one person to another and then reused to obtain goods or services from another party that was not initially involved.

Most people think of ‘money’ in terms of a pile of commodities or potential pile that can be measured against other piles. If your pile is bigger, you win! The problem with actual piles is that their economic utility can change.

Say for instance that you controlled 98% of the world’s supply of oil. Surely that must be worth something. Well, it depends. Before the advent of the Industrial Revolution (and a good time after that) the economic utility of oil was primarily as a lubricant. Handy if you had a lot of ox cart axels to grease, a smelly puddle of goo otherwise.

Nor does scarcity dictate value. Your Orange Toaster that belonged to one of the developers of Exec (complete with manuals and beta code) may well be unique, but it should be in a museum next to the cow tokens because you’d probably have to pay to have it hauled away.

In fact cow tokens look better and better because in addition to the milk and meat and little cows, there’s also the fertilizer. People pay you to haul it away.

Forty-six years ago, I started lending money in Larry Bingham’s back room. My first customer was a drover named Penny. He wanted two dollars on a Brindle cow at six percent interest. He said she gave six quarts of milk a day. You know what I made him do? I made him move that cow into my back yard for a whole week. And I watched him milk her every day. Sure enough, she gave an average of six and a half quarts a day, so I gave him the money at six and half percent interest. Not only that, I kept the 60 pounds of manure she left behind. When you show me collateral, madam, you better make sure it’s good collateral. For forty-six years, I’ve been lending money on good, old-fashioned principles. I stand here now to tell you one and all that I’ve never been offered a better piece of collateral that I hold in my hand now!

The big scary negative about inflation is that it takes your ‘money’ which is not invested in income producing properties and enterprises (like cows) and erodes its ‘store of value’ relative to its ability to be exchanged for assets.

This is actually a good thing because it encourages money to be put to productive use instead of being hoarded in the expectation that assets will become cheaper over time. You can buy a heck of a computer today for what that Poly-88 cost in 1977 but you would have been without one for 40 years.

When is inflation not good? Why, when prices are rising faster than wages and productivity, This creates an incentive to consume instead of saving and accumulating capital.

So the important factor is net inflation. If GDP (to the extent that it’s a valid measure of total economic activity which is questionable at best) is rising at 10% annually you can sustain annual inflation of 10% indefinitely with no problem at all except for the math challenged people who have a hard time dealing with zeros. The same is true for any other point of equilibrium be it 2 or 200%.

When you hear about a Weimar or a Zimbabwe you are looking at exceptional cases that prove the rule. Because of foolish adherence to the Gold Standard in which their War Reparations were denominated, Weimar was not a sovereign currency that could seek relative international trading value through devaluation, except domestically- thus hyperinflation. In Zimbabwe 90% of the nation’s wealth was held by corrupt plutocrats who promptly converted it at a fixed rate into foreign currencies so there was domestic devaluation and- hyperinflation.

In a post-Bretton Woods system global devaluation of sovereign currencies results in national competitive advantages that increase trade and promote GDP growth until inflation reaches an equilibrium state.

What makes this relevant is that the Federal Reserve is looking to raise interest rates, making it more attractive to hoard money as opposed to investing it in productive enterprise despite the fact that there is virtually no inflation at all and the economy has not yet recovered from the productivity lost during the Lesser Depression.

The Federal Reserve is about to make a terrible mistake

by David Dayen, Salon

Tuesday, Sep 1, 2015 05:58 AM EST

(T)he Fed is experiencing a fallacy of schedule momentum. They want like to raise rates in September, by God, and a little stumble won’t stand in their way. Aside from stocks, however, the bigger problem is that the Fed’s rush to tighten is absent any conditions necessitating it – and is mostly being done out of concern with being “serious,” which has created nothing but pain this millennium.

The stubbornness was on display last weekend at Jackson Hole, Wyo., site of the Fed’s annual policy conference. Fed vice chair Stan Fischer made the case that inflation will soon move upwards, a key indicator that the central bank will soon raise interest rates. The idea is that falling unemployment will create tightening in the labor market, leading to increased wages and eventually rising prices. To stop prices from running out of control, the Fed needs to slow the economy by increasing interest rates.

There are a few problems with this reasoning. First of all, who exactly thinks the economy is running too hot right now? While unemployment has dropped, wages have been stagnant for the vast majority of workers for 35 years. Somewhat faster wage growth may be on the way, but it’s not here yet, and the idea that the moment when workers get a bit more in their paychecks, the Fed has to take away the punch bowl and make their lives worse doesn’t make much sense.

Because wages have been so low for so long, it would take up to 14 years of above-trend wage growth to rebalance the economy so that workers get their proper share. Rebalancing would transfer money to those who would spend it and have a significant economic impact.

Translation: We shouldn’t fear faster wage growth, we should embrace it.

…

This brings us to higher inflation, which Fischer and several other major central bankers assure us is just around the corner. In reality, the economy has been running below the Fed’s 2 percent inflation target for over three years. And it’s been missing by wider margins as the year has progressed. That’s partially due to low oil prices, which have a powerful effect on inflation because they lower the cost of shipping goods. And we should expect oil to either stay at the current level or drop even more over the next year.In fact, Since the economic recovery hasn’t surged under the current policy framework, there’s a case for a higher inflation target. But for too long, 2 percent has not been a target but a ceiling; even if we’ve run below it for three years, the thinking goes, we must never go above it.

It’s even worse than that, actually. As Kevin Drum noticed, Fischer said this over the weekend: “Because monetary policy influences real activity with a substantial lag, we should not wait until inflation is back to 2 percent to begin tightening.” So just the threat of getting to 2 percent is a ceiling. This attitude ensures inflation will remain well below target forever.

All this adds up to the fact that there’s no urgency to raise rates. The Fed is reaching for a reason to do so, and it’s puzzling to understand why. Some have charged that a pervasive low-rate environment could trigger a “reach for yield” by investors, and create financial bubbles. That’s a concern, but harming the economy isn’t the Fed’s only tool to ameliorate that; they could actually monitor financial institutions to ensure stability.

Others have claimed that the Fed must hike rates because what if they get caught with near-zero rates during a recession, and have no tools to spur a recovery? This is a funny idea, that the Fed must raise rates now so they can lower them later. If we had a functioning Congress willing to use fiscal policy to counteract recessions, this wouldn’t even be a question. But even still, the Fed has additional steps they could take in a downturn, and should probably confine themselves to addressing the policy of today, not hypotheticals some years down the road.

The real reason for increasing rates appears to be coming from outside groups, whether members of Congress or international colleagues, who just want the Fed to “get on with it.” There’s too much drama in thinking about the proper policy, and the central bankers should just rip off the Band-Aid and “return to normalcy.” According to this take, we’re in an “abnormal” rate environment, and central bankers are responsible, sober, normal people. Rates should be higher because rates should be higher. Current economic conditions have nothing to do with it.

…

These important questions shouldn’t be driven by some elite sense of what is “normal.” If the data were allowed to dictate decision-making, there’s no way we’d be talking about a rate hike. The Fed’s biases, only talking to other very serious people and not those affected by its policies, really show here. Workers need the Fed’s help, and central bankers should listen to them.

Aug 31 2015

Anti-Capitalist Meetup: Oil as a social lubricant

By Annieli

Quest for Oil Gamers hunt for the best oil fields in deep water off Qatar and in the North Sea.

And to master the challenge players need to learn and test analytic skills looking for oil on a seismic map.

Once a likely location is assessed, accurate drilling techniques are needed to avert disaster as players test their wits against “an artificially intelligent digital opponent” that is dedicated to making players lose.

Imagine if seismic analysis was not applied to the oceans, a more open frontier despite the Law of the Sea but to the task of fracking, what kind of multi-player online role playing game (MMORPG) could be hypothesized – sim occupants fleeing their devalued homes and with real-time strategy you could predict the earthquake or poisoned water using your smartphone apps. The first step has been taken with the maritime giant Maersk with a recent MMORPG. Rather than bullying feminists, now the misogynist Canadian gamergaters could help terrify thousands with digital tar sands CGI simulations, and maybe even add a Call of Duty patch to kill digital inhabitants of oil producing countries.

Quest for Oil is a multiplayer online game to help supply globalization not unlike America’s Army in the propaganda battle to continue to resource the shock doctrine and hence maintain global armed conflict.

It raises new questions about what gets to be culturally appreciated as though resource accumulation could be a projectable commodity with few renewable substitutes and oil exploration was somehow something like “boldly going where no one has gone before”. OTOH budding geologists could be enticed to see that their work has no apparent social costs or externalities.

Quest for Oil

https://pbs.twimg.com/media/CJBusKBWhttps://agenda.weforum.org/2015/06/how-oil-flows-in-and-out-of-every-major-region-around-the-world/?utm_content=bufferf794e&utm_medium=social&utm_source=twitter.com&utm_campaign=bufferEAAefmv.jpg:large

The Middle East leads the board in crude exports with 850.1 million tonnes shipped out in 2014. It’s followed by Russia (294.8), West Africa (213.9), and Canada (148.6).

In terms of product exports, like gasoline and diesel, the US is No. 1 with 179.9 million tonnes, closely trailed by, again, Russia and the Middle East.

On the flip side, Europe is the biggest importer of both crude (446.9) and product imports (173.5). The US, China, India, Japan, and Australasia are also major consumers of both crude and refined product.

This map also serves as a pretty good tool for seeing who benefitted from the lower oil prices, and who suffered from them.

….the reappearance of structural scarcity in the realm of energy enabled the OPEC countries to multiply the price of oil by ten in the 1970s, i.e. to have it determined by the oilfields where production costs are the highest, thereby assuring the owners of the cheapest oil wells in Arabia, Iran, Libya, etc. huge differential minerals rents.

Marx’s theory of land and mineral rent can be easily extended into a general theory of rent, applicable to all fields of production where formidable difficulties of entry limit mobility of capital for extended periods of time. It thereby becomes the basis of a marxist theory of monopoly and monopoly surplus profits, i.e. in the form of cartel rents (Hilferding, 1910) or of technological rent (Mandel, 1972). Lenin’s and Bukharin’s theories of surplus profit are based upon analogous but not identical reasoning (Bukharin, 1914, 1926; Lenin, 1917).

some links:

http://climateandcapitalism.co…

http://www.jstor.org/stable/12…

Aug 31 2015

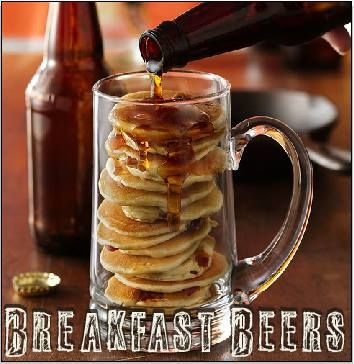

The Breakfast Club (Plans)

They change.

They change.

I find myself suddenly having to cram 2 weeks into one so blogging will be much suckier than usual.

Entertainment

- Garrison Keillor on retiring, the trouble with nostalgia, and the state of America, by Caty Enders, The Guardian

- The Shepherd’s Crown review – Terry Pratchett’s farewell to Discworld, by Amanda Craig, The Guardian

- The scifi fans are alright: I saw the future at the Hugo Awards – and it will never belong to the toxic right-wing trolls, by Arthur Chu, Salon

- Caught in the smart-mean trap: Is “Another Period” funny, or just awkwardly tasteless?, Sonia Saraiya, Salon

- Jennifer Lawrence drops accidental bombshell in New York Times interview, reveals she’s writing screenplay with Amy Schumer, by olin Gorenstein, Salon

- Here’s why Paul Feig’s “Ghostbusters” reboot has even more “girl power” than you thought, by Anna Silman, Salon

- Hunter S Thompson, High Times and how to survive the hangover from hell, by Jill Rothenberg, The Guardian

- Dan Rather: ‘Have the guts to dig into stories people in power don’t want’, by Andy Meek, The Guardian

- ‘Hannibal’ Finale Postmortem: Bryan Fuller Breaks Down That Bloody Ending and Talks Revival Chances, by Laura Prudom, Variety

- Hannibal recap: season three finale – The Wrath of the Lamb, by Brian Moylan, The Guardian

- “Mr. Robot” is the only TV show that actually understands the Internet-down to the last chilling detail, by Sonia Saraiya, Salon

- “Mr. Robot” finale postponed because of graphic scene similar to Virginia TV journalist killings, by Erin Keane, Salon

- From ‘Buffy’ To ‘Mr. Robot’: When Pop Culture Collides With Real-Life Violence, by Jessica Goldstein, Think Progress

- The latest “Game of Thrones” fan-theory about Jon Snow is just about insane enough to be right, by Scott Eric Kaufman

- Stannis Baratheon is not dead – at least in the “Game of Thrones” books, by Anna Silman, Salon

- Hamlet review – Benedict Cumberbatch imprisoned in a dismal production, by Michael Billington, The Guardian

- Benedict Cumberbatch is a bloody good Hamlet, says his mum, by Hannah Ellis-Petersen, The Guardian

- Patrick Stewart Discusses Hilarious New Show ‘Blunt Talk’, By LeftOfCenter, Crooks & Liars

- Stephen Colbert announces eclectic guest list for first week on Late Show, by Alan Yuhas, The Guardian

- The line-up for the first week of “The Late Show with Stephen Colbert” was just announced – and you’re going to want to see this, by Colin Gorenstein, Salon

- Stephen Colbert reveals the truth about his “Colbert Report” character: “I had to actually leave – I had to change”, by Colin Gorenstein, Salon

- Jon Stewart gets slammed during WWE appearance, by Arturo Garcia, Raw Story

- NYPD Asks Disney, Marvel To Abuse IP Law To Help Rid Times Square Of Spiderman, Mickey Mouse, by Tim Cushing, Tech Dirt

Sport

- Five things we learned from the Belgian Grand Prix, by Giles Richards, The Guardian

- ESPN suspends analyst Curt Schilling from Little League World Series coverage for Islamophobic tweet, by Scott Eric Kaufman, Salon

- Little League teams gets hero’s welcome as it returns home, Associated Press

- Column: IndyCar is clearly too risky; time to shut it down, Associated Press

- Scott Dixon wins fourth IndyCar championship in tiebreaker, By Chris Jenkins, USA Today

- A Passion for Hurling, the All-Ireland Game, By DAN BARRY, The New York Times

- Spaniard becomes 12th person to die after being gored by bull, Reuters

- This golfer hit the first hole-in-one of his PGA career. Then he hit another one., By Des Bieler, Washington Post

The aim of art is to represent not the outward appearance of things, but their inward significance.

–Aristotle

Obligatories, News and Blogs below.

Aug 29 2015

The Breakfast Club (Traveling Music)

One of the things about traveling is that a lot of your time is taken up by- well, traveling.

One of the things about traveling is that a lot of your time is taken up by- well, traveling.

If you have a job in a cubicle or on a line and your input is just another unit of labor this is not usually a hardship as your temporary replacement will generally handle the routine minutia and while you may find a big pile of “too difficult” waiting on your return at least it’s not a huge backlog of EVERYTHING!

As a photon artist, particularly one working in the ephemeral field of politics, policy, news, and cultural criticism that I do, for many years I rarely left my desk for more than 12 or 18 hours in a row and all my other ambitions had to be accomplished in that time frame.

The tyrany of deadlines.

Now, upon advice from my therapist and others, I have adopted a more relaxed attitude though each mark missed still evokes torrents of self recrimination.

Yesterday was such a day. I was up at the crack of dawn (which is still cracking pretty early where I am), wrote 2 pieces, and set up the page. I spent the rest of the day (all 16 hours or so) traveling and visiting. Was it fun? Sure, but last night while I was busy not sleeping all I could think about was the fact I’d forgotten to put up a Cartnoon.

I’ll bet you didn’t even notice.

But that’s my craziness. It puts me in mind though, that in times not so long ago people would disappear for months (or 10 years in the case of Odysseus) and literally sail off the end of the Earth (did I mention I had no cell service?).

Today’s Art Music is mostly about such a person, Sinbad, who not only did that, but did it repeatedly. The stories of his travels to distant and fantastic lands make up a large part of 1001 Nights, a collection of Arabian folk tales initially translated by Sir Richard Burton (the explorer, not the actor) who is also remembered as one of the group searching for the source of the Nile and as the first Westerner to visit Mecca.

The conceit of the Arabian Nights is that some Muckety-Muck has the habit of marrying women, spending the night with them, and then executing them in the morning. Scheherazade is selected for this dubious distinction but rather than amorously seduce she tells stories whose cliff hanger dawn breaks led the Muckety-Muck to postpone her disposal for 1001 days at the end of which he pretty much gives up and decides to keep her around.

Needless to say this plot is a long time favorite of writers who can only aspire to be as enthralling as Scheherazade.

In 1888 Nikolai Rimsky-Korsakov, a member of ‘The Five’ (most influential mid-Romantic Russian composers) was at work finishing up Prince Igor, an opera by his good friend Alexander Borodin (also a member of ‘The Five’) who had just died.

Perhaps for relief from this grim task he composed Scheherazade as a symphonic poem. No, I don’t really know the difference a symphonic poem and a symphony except these Romantics were constantly striving for pure emotional effects, structurally they’re virtually the same with 4 movements in different time signatures.

It’s a still a big hit with Figure Skaters and the Santa Clara Vanguard featured it in both their 2004 and 2014 shows.

What? Not into DCI? Oh well, here’s the orchestra version- Vienna Philharmonic at the Salzburg Festival 2005.

Obligatories, News and Blogs below.

Aug 28 2015

Banana Republics

In some places impeachment is not “off the Table.”

Guatemala President Faces Arrest as Business Interests and U.S. Scramble to Contain Uprising

Guatemalan Supreme Court Approves Motion to Impeach President

By Sofia Rada, Truthout

Thursday, 27 August 2015 00:00

Amid a growing political crisis in Guatemala, the country’s Supreme Court issued a unanimous decision on August 25 to approve a motion by the attorney general to impeach the president. The attorney general identified President Otto Pérez Molina as the head of a corruption scheme that led to the resignation of the country’s vice president and a number of other senior officials. The growing crisis has mired the president’s administration for much of this year, but until now the opposition has been unable to get enough votes in congress to lift the immunity granted to Pérez Molina by Guatemalan law.

As opposition to his continuance in office mounted, Guatemalan President Pérez Molina announced on August 23 through a televised address that he would not resign. He categorically denied all claims that he has ties to the corruption scandal, which led to the May resignation of the country’s former vice president, Roxana Baldetti, who was arrested on August 21 and taken to court. The scandal concerns the funneling of taxes into private accounts and offering discounted custom rates for under-the-table payments. Despite growing protests and increasing pressure from those who oppose his continued rule, however, the president continues to reject any responsibility and does not show signs of succumbing to demands for his resignation.

In a statement sent via email to COHA, a U.S. Department of State Spokesperson said the department was closely monitoring the situation in Guatemala. The spokesperson reaffirmed the department’s support in “transparent, independent and impartial legal processes” and noted that the CICIG “has been a proven partner of both the government and people of Guatemala in their efforts to promote the rule of law.” The spokesperson did acknowledge the recent request by Guatemalan prosecutors for the right to impeach the president, but also urged all parties to respect the schedule of national elections and the Guatemalan constitutional process. Earlier in May, the State Department had issued a press release expressing its support of President Pérez Molina and his administration in efforts to address the issue of corruption in Guatemala. The State Department had also urged Guatemalans to support government institutions in investigations and prosecution of corruption and encouraged the president to work closely with the CICIG. However, the CICG has now identified Pérez Molina as complicit in the corruption scandal.

I haven’t forgotten Nancy.

Recent Comments