The U.S. economy contracted slightly in the fourth quarter of last year, shrinking by 0.1 percent. The main factor that is being blamed is cuts in government spending. The report, as Pat Garofalo at Think Progress notes, might have been worse but if the House Republicans let the sequester kick in, as they seem want to do, the US economy is in for another deeper dip:

According to Macroeconomic Advisers, the sequester will knock 0.7 percent off of GDP growth this year. The Bipartisan Policy Center estimates that the sequester will kill one million jobs. [..]

Of course, scrapping the sequester – which includes equal cuts from defense spending and non-defense discretionary spending – does not mean the government simply has to plow that money back into the Pentagon. Domestic spending is headed toward historic lows. The country has a huge infrastructure gap that needs to be filled. And the American Jobs Act, which Republicans filibustered, would have significantly boosted growth according to several independent analyses.

Journalist and author, David Cay Johnston, a specialist in economics and tax issues, discusses why the Republicans keep pushing spending cuts.

Meanwhile, as Suzie Madrak at Crooks and Liars observed, hell may have just froze over at the conservative think tank, American Enterprise Institute where conservative economist John H. Mankin just told the deficit hawks, in so many words, to “shut up about austerity”.

Japan’s lessons for America’s budget warriors

by John H. Makin, American Enterprise Institute

Lessons for the United States

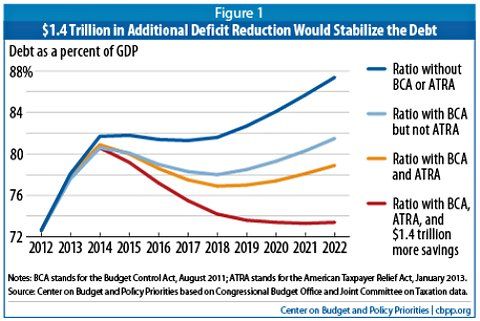

Congress, take note. Although American deficits do need to be reduced and debt accumulation does need to be slowed and eventually reversed, cries of imminent disaster from “unsustainable” deficits and a supposed bond market collapse will not accomplish this goal. Persistently rising bond prices in Japan and the United States have undercut the “sky-is-falling” rationale for deficit reduction. [..]

If fiscal austerity is applied too rapidly, US growth will drop and the debt-to-GDP ratio will rise, boosting the nation’s debt burden. If the Fed tries to stem the rise with too much money printing, inflation could rise and drive up interest rates, exacerbating the US debt burden. [..]

Congress and the president need to avoid excessive austerity with respect to changes in fiscal policy this year. Over the past four years, on average, the fiscal boost applied to the American economy has been worth about 3 percent of GDP. This year, with tax increases and sequestration, fiscal drag will be about 1.5 percent of GDP. [..]

The lessons from Europe and Japan are that austerity, per se, is not the way to move to a sustainable fiscal stance. Rather, the US economy needs a combination of tax reform to boost growth and legislation enacted now to stabilize the future growth of outlays on entitlement programs.

Economist Paul Krugman, at his NYT blog, Conscience of a Liberal, talks about “incestuous amplification” which happens when “a closed group of people repeat the same things to each other – and when accepting the group’s preconceptions itself becomes a necessary ticket to being in the in-group“.

Which brings me to the fiscal debate, characterized by the particular form of incestuous amplification Greg Sargent calls the Beltway Deficit Feedback Loop. I’ve already blogged about my Morning Joe appearance and Scarborough’s reaction, which was to insist that almost no mainstream economists share my view that deficit fear is vastly overblown. As Joe Weisenthal points out, the reality is that among those who have expressed views very similar to mine are the chief economist of Goldman Sachs; the former Treasury secretary and head of the National Economic Council; the former deputy chairman of the Federal Reserve; and the economics editor of the Financial Times. The point isn’t that these people are necessarily right (although they are), it is that Scarborough’s attempt at argument through authority is easily refuted by even a casual stroll through recent economic punditry.

Will AEI’s resident economics scholar, John Mankin’s warnings be heeded? Or will the “incestuous amplification” continue?

Back to the grind.

Back to the grind.

Recent Comments