President Obama announced that millions more underwater homeowners can take advantage of a refinancing program if their loan is owned or guaranteed by Fannie Mae or Freddie Mac. But, there are shortcomings, helpings banks more than homeowners by eliminating liability associated with the origination of the mortgage, including putback liability. From Yves Smith who asks why Obama is bothering to do this:

First, Obama is addicted to the appearance of Doing Something, regardless of whether it is productive. A clear sign is the apparent failure to investigate why HARP was a dud.

[]

Second, this is a sop to the banks, because a refi ends any liability associated with the origination of the mortgage, including putback liability. Now that would seem to be a big “get out of jail free” card for banks engaged in putback litigation. But the reason this is not as nefarious as it might seem is that current mortgages aren’t the big bone of contention in putbacks (even if the originator lied, the borrower is paying, so there are no damages). But it would also end any chain of title issue on that mortgage

At Huffington Post, Zack Carter gives a more detailed explanation:

The newly expanded program would expunge legal liabilities associated with mortgages refinanced through the program for the original lenders of the mortgages. Each time a bank sent a loan to Fannie and Freddie, it certified that the loan met Fannie and Freddie’s safe lending criteria. But many loans sent to the mortgage giants did not, in fact, meet those criteria. Currently, when borrowers default on those ineligible loans, the mortgage giants can “put back” the resulting losses onto the banks that pushed the loans.

Under the modified plan, “put back” liability at banks will be erased for any underwater mortgage that is refinanced through HARP, eliminating Fannie and Freddie’s ability to sack lenders with losses in the event that the mortgage does not pan out.

If borrowers go through HARP, but decide after several months that the modest monthly savings do not outweigh owing tens of thousands of dollars more than their home is worth, taxpayer-owned Fannie and Freddie will have to take the full loss. Even if the original loan was sent to Fannie and Freddie with false or fraudulent guarantees from the bank – promises that may directly be tied to the borrower’s current financial problems – banks will be immune from liability. Fannie and Freddie plan to charge banks “a modest fee” to extinguish this liability, but the administration has yet to determine what that fee will be.

Partial transcript below the fold

Professor William Black of the University of Missouri, Kansas City and Zack Carter of the Huffington Post join Dylan Ratigan to discuss the problems of Obama’s mortgage program

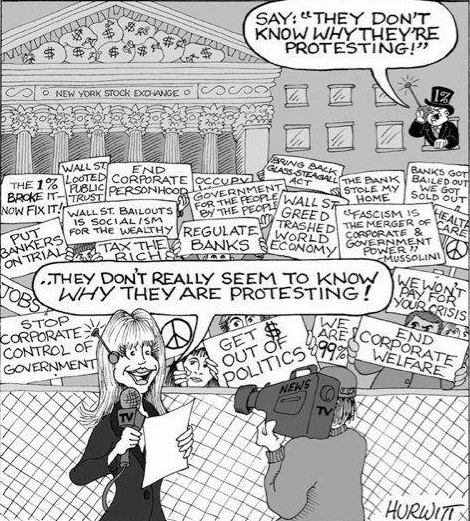

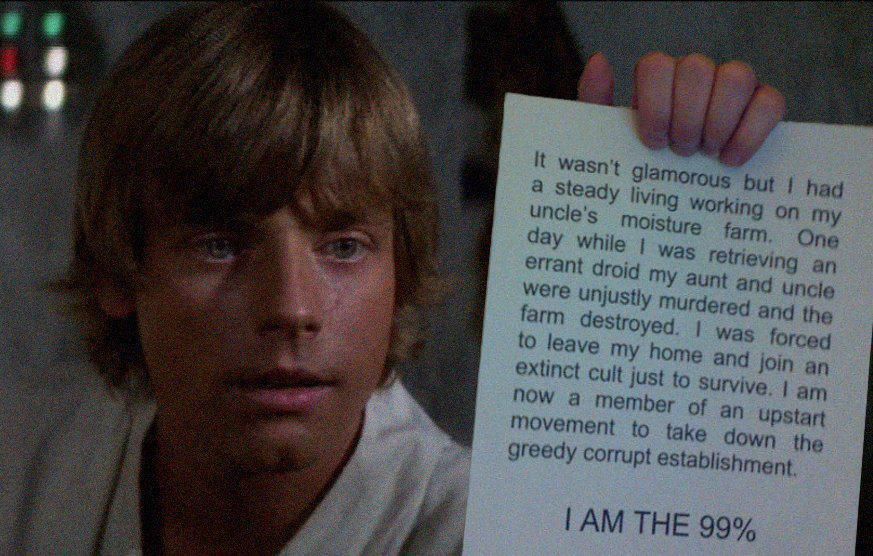

One of the groups that

One of the groups that

Recent Comments