Or as Shakespeare’s Juliet said, “what’s in a name? that which we call a rose; By any other name would smell as sweet.” Not quite.

In this case calling chained CPI, “superlative CPI to make it more palatable to the voters and politicians who oppose it as a cut to future Social Security benefit, does not make it any less noxious or toxic:

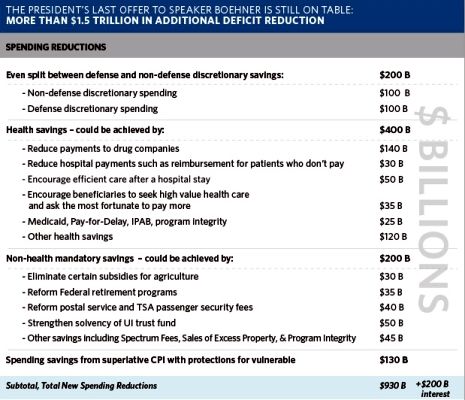

Click image to view it in full size

Spending savings from superlative CPI with protections for vulnerable $130 B

As Pres. Obama’s idol, Pres. Lincoln said, “You can fool some of the people all of the time, and all of the people some of the time, but you can not fool all of the people all of the time.”

No, Barack, we will not be fooled by you.

Up Date: 3/3/13 23:18 AM EST: Post and learn. It seems that there is a “superlative CPI”, from letgetitdone in a comment at Corrente:

Hi TMC, There is a “superlativeCPI ,” but it’s not “the chained CPI” which is really “the Catfood CPI.” An actual superlative CPI, would cost adjust for the higher proportion of seniors’ household budget they must spend on rapidly increasing health care costs. It would also adjust for living area. so that seniors who live in high cost areas, can remain there if they choose, rather than moving to lower cost areas where their meagre SS pensions don’t go very far. In the real world, living costs in New York City are 2 1/2 times more than living costs in say, rural Kansas or the UP of Michigan. SS payments should be adjusted for these important regional differences.

Up Date: 3/6/13 12:39 AM EST A cut is a cut. I want to thank Hugh at Corrente for this explanation.

Then there is the Chained CPI which is a modification of the CPI-U. It is being pushed by the anti-old, austerity-minded as a replacement for the particular version of the CPI-W I just described above which already tends to understate inflationary effects on Social Security recipients. And there is the annoying Administration reference to it as the superlative CPI. Again context is important. The CPI survey collects information on prices. These are first averaged individually by geographic area. This is called “lower-level aggregation”. The example which they use is the price of one item (apples) in one locality (Chicago). The BLS then does what it calls “higher-level aggregation” (note the use of the comparative): the price of apples regionally and nationally, the price of food nationally, the price of all items nationally, etc. The Chained CPI involves another level of analysis and what must follow the comparative but the superlative? (..)

http://www.bls.gov/cpi/cpisupq…

The example used is that the CPI-U and the CPI-W have prices for pork and beef. What the Chained CPI seeks to measure is, in the event of a price increase in pork, the effect of consumers switching to beef. The BLS example is, of course, innocuous. The one some of us are more concerned about is seniors being forced to choose between beef and cat food. Substitution basically reduces the effects of inflation. Calculating a CPI based on it will inherently be lower then others (CPI-U and CPI-W) which do not. What it ignores, some would say deliberately, is quality of life. (..)

http://www.bls.gov/cpi/cpieart…

What is important to understand is that the various schemes to cut the size of the Social Security COLA, including the one currently in place are cumulative. You have no doubt heard of the miracle of compound interest. Well, what these schemes amount to is negative compound interest being charged against our seniors. What is always left off the table is the question of what constitutes a living retirement, perhaps because it would lead to the related discussion of what constitutes a living wage. Instead we get a numbers game, divorced from the very social issue the number is supposed to address.

Back to the grind.

Back to the grind.

Recent Comments