Welcome to The Breakfast Club! We’re a disorganized group of rebel lefties who hang out and chat if and when we’re not too hungover we’ve been bailed out we’re not too exhausted from last night’s (CENSORED) the caffeine kicks in. Join us every weekday morning at 9am (ET) and weekend morning at 10:30am (ET) to …

Tag: News TMC News

Jan 04 2014

The Health Care We Deserve

In a NYT‘s op-ed in New Year’s Day, Michael Moore called the ACA awful

I believe Obamacare’s rocky start – clueless planning, a lousy website, insurance companies raising rates, and the president’s telling people they could keep their coverage when, in fact, not all could – is a result of one fatal flaw: The Affordable Care Act is a pro-insurance-industry plan implemented by a president who knew in his heart that a single-payer, Medicare-for-all model was the true way to go. When right-wing critics “expose” the fact that President Obama endorsed a single-payer system before 2004, they’re actually telling the truth.

What we now call Obamacare was conceived at the Heritage Foundation, a conservative think tank, and birthed in Massachusetts by Mitt Romney, then the governor. The president took Romneycare, a program designed to keep the private insurance industry intact, and just improved some of its provisions. In effect, the president was simply trying to put lipstick on the dog in the carrier on top of Mitt Romney’s car. And we knew it.

Emergency Room visits have increased for those with insurance rather than decrease. This is probably due to the problem of finding a physician who will accept the patient’s insurance plan. What was needed was a mandate that physicians and hospitals accept all insurance plans.

Access to Health Care May Increase ER Visits, Study Suggests

Supporters of President Obama’s health care law had predicted that expanding insurance coverage for the poor would reduce costly emergency room visits as people sought care from primary care doctors. But a rigorous new study conducted in Oregon has flipped that assumption on its head, finding that the newly insured actually went to the emergency room more often.

The study, published in the journal Science, compared thousands of low-income people in the Portland area who were randomly selected in a 2008 lottery to get Medicaid coverage with people who entered the lottery but remained uninsured. Those who gained coverage made 40 percent more visits to the emergency room than their uninsured counterparts. The pattern was so strong that it held true across most demographic groups, times of day, and types of visits, including for conditions that were treatable in primary care settings.

The finding casts doubt on the hope that expanded insurance coverage will help rein in rising emergency room costs just as more than two million people are gaining coverage under the Affordable Care Act.

Instead, the study suggests that the surge in the numbers of insured people may put even greater pressure on emergency rooms and increase costs. Nearly 30 million uninsured Americans could gain coverage under the law, about half of them through Medicaid. The first policies took effect on Wednesday.

This will only push up the costs of health care and increase the costs for consumers and tax payers.

This video explains in less than 8 minutes why healthcare in this country is so expensive and still sucks.

Published on Aug 20, 2013

In which John discusses the complicated reasons why the United States spends so much more on health care than any other country in the world, and along the way reveals some surprising information, including that Americans spend more of their tax dollars on public health care than people in Canada, the UK, or Australia. Who’s at fault? Insurance companies? Drug companies? Malpractice lawyers? Hospitals? Or is it more complicated than a simple blame game? (Hint: It’s that one.)

For a much more thorough examination of health care expenses in America, I recommend this series at The Incidental Economist: http://theincidentaleconomist….

The Commonwealth Fund’s Study of Health Care Prices in the US: http://www.commonwealthfund.or…

Some of the stats in this video also come from this New York Times story: http://www.nytimes.com/2013/06…This is the first part in what will be a periodic series on health care costs and reforms leading up to the introduction of the Affordable Care Act, aka Obamacare, in 2014.

Jan 01 2014

The Return of Irrational Exuberance

Wall Street had a boomer of a year, everyone else not so much.

Stock Market Has Great Year, You… Not So Much

By Mark Gongloff, Huffington Post

This has been the best year for the U.S. stock market in at least 16 years. But that great news is meaningless for many Americans. [..]

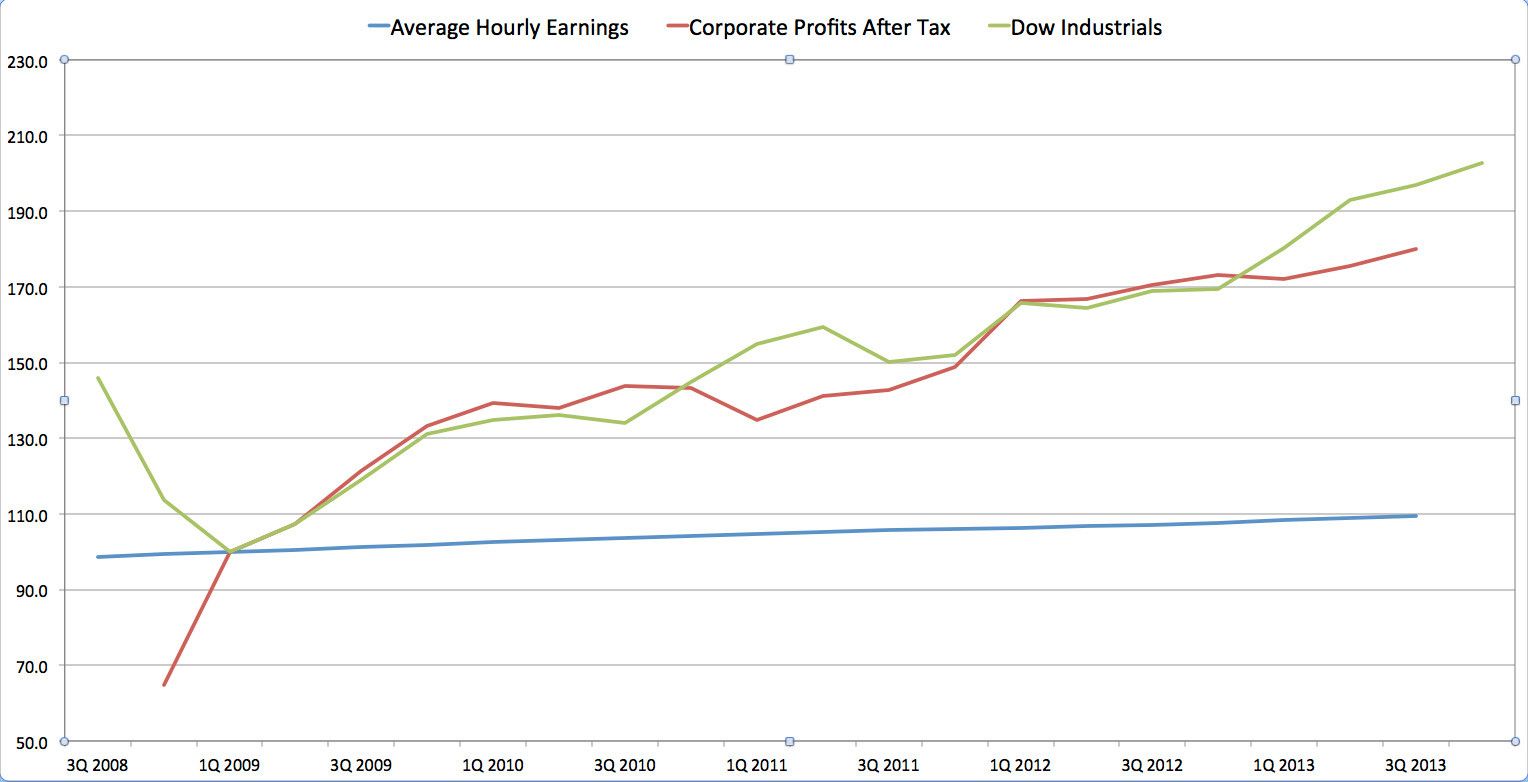

But only about half of Americans own stocks, including those in retirement accounts. Meanwhile, corporate profits are soaring largely because companies have been squeezing costs — especially labor costs. In the chart below, tracking the change in average hourly wages for private-sector workers against corporate profits and stock prices since the stock market bottomed in March 2009, you’ll notice one line is badly lagging.

Click on image to enlargewYou guessed it: The lagging line is your sad hourly earnings. They have barely budged since the market bottomed in 2009, while the Dow has skyrocketed 153 percent. Between November 2012 and November 2013, the latest data available, hourly wages for nonsupervisory workers rose just 2.1 percent, just barely ahead of inflation.

Gongloff concludes that Wall Streeters are “bullish on 2014,” others not so much. Our friend David Cay Johnston looks at tech stocks, like FaceBook and Twitter, that essentially have no profits, yet, through speculators and the Federal Reserve policy of nearly zero interest rates, these stock have greatly exaggerated value.

The coming stock market collapse

By David Cay Johnston, Al Jazeera America

Tech stocks have returned to bubble levels, thanks to PR, weak financial journalism and cheap credit

Markets can benefit from speculators, who take risks that prudent people and institutions should avoid, but speculators should represent the edges, not the core of the market.

It’s bad enough that the financial press allows the inflated commentary of tech companies to go unchallenged. But why in the world should Americans tolerate hedge funds and other speculators being subsidized with cheap and easy credit, thanks to the Federal Reserve’s policy of near-zero interest rates?

Only speculators would buy companies with no profits. And only subsidized speculators would bid up prices on companies with a PR in three digits, like Twitter.

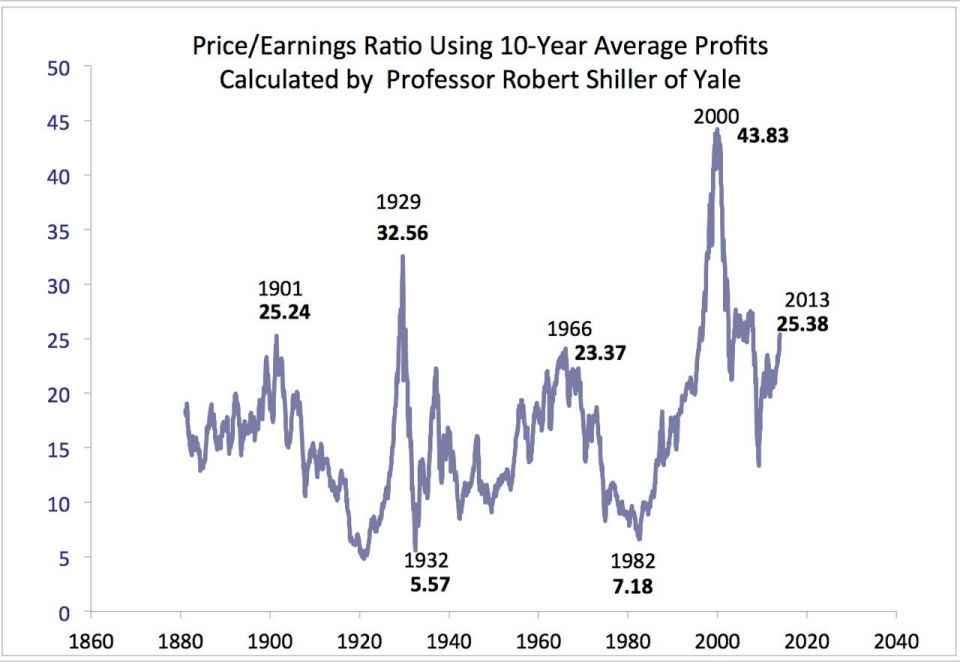

Back in 1995, Alan Greenspan, then chairman of the Federal Reserve, asked a rhetorical question about stock prices, “How do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions, as they have in Japan over the past decade?”

We now suffer through a prolonged period with high unemployment, flat to falling wages for most workers and unrealized potential for economic growth. But the speculators are making out like bandits, thanks to government suppression of interest rates, allowing massive borrowing by offshore hedge funds, and to lax rules for both accounting and trading.

Given the history of stock markets since 1995 and today’s blinking red indicators, no one can rationally claim they were not warned when the next collapse comes, as surely it will.

Click on image to enlarge.

So what will happen to the market when the Fed starts to raise interest rates? 2014 may not be the “boom” that Wall Street expects.

Dec 03 2013

Black Friday: ‘Tis the Reason for the Season

Shopping on Black Friday takes consumer confidence, consumer courage, and a subscription to Sky Mall magazine.

Gloomy Numbers for Holiday Shopping’s Big Weekend

by Elizabeth A. Harris, The New York Times

With the economy bumping along at a lackluster pace, and this year’s shorter-than-usual window between Thanksgiving and Christmas, sales and promotions began weeks before Thanksgiving Day, making this holiday shopping season more diffuse than ever. That left Black Friday weekend itself, the season’s customary kickoff, looking a bit gloomy.

Over the course of the weekend, consumers spent about $1.7 billion less on holiday shopping than they did the year before, according to the National Retail Federation, a retail trade organization. [..]

More than 141 million people shopped online or in stores between Thursday and Sunday, according to a survey released Sunday afternoon by the retail federation, an increase of about 1 percent over last year. And the average amount each consumer spent, or planned to spend by the end of Sunday, went down, dropping to $407.02 from $423.55. Total spending for the weekend this year was expected to be $57.4 billion, a decrease of nearly 3 percent from last year’s $59.1 billion. [..]

Many retailers have been warning of a muted holiday shopping season. Walmart and Target both trimmed their yearly forecasts recently, citing economic factors like slow wage growth, unemployment and sliding consumer confidence. Executives at Best Buy cautioned that intense price competition on some items during the holidays was likely to affect their bottom line, despite its healthier performance recently.

Recent Comments