Up Date 20:04 EST The House Republican leadership has decided to put the Senate bill on the floor for an up or dowm vote later tonight.

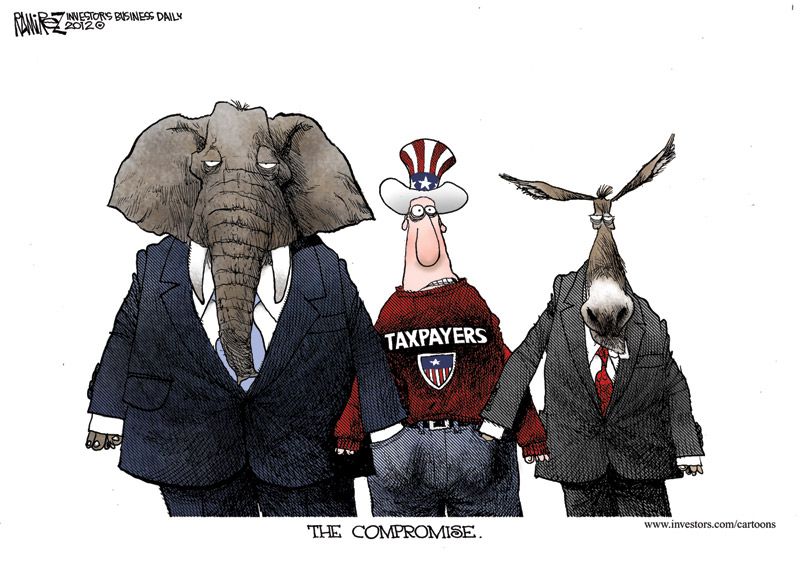

Early this morning the Senate passed the “Fiscal Cliff Bill” by vote of 89 – 8. Voting in opposition for various reasons were Democratic Senators Tom Carper (D-DE), Tom Harkin (D-IA), and Michael Bennet (D-CO) along with Republican Senators Mike Lee (R-UT), Richard Shelby (D-AL), Rand Paul (R-KY), Chuck Grassley (R-IA), and Marco Rubio (R-FL). At the Washington Post‘s Wonk Blog, Suzie Khimm gives us a cheat sheet for the deal which included a one year extension of the farm bill. However, no matter how you look at this bill that raises taxes on incomes over $450,000, taxes for the middle class will go up:

Early this morning the Senate passed the “Fiscal Cliff Bill” by vote of 89 – 8. Voting in opposition for various reasons were Democratic Senators Tom Carper (D-DE), Tom Harkin (D-IA), and Michael Bennet (D-CO) along with Republican Senators Mike Lee (R-UT), Richard Shelby (D-AL), Rand Paul (R-KY), Chuck Grassley (R-IA), and Marco Rubio (R-FL). At the Washington Post‘s Wonk Blog, Suzie Khimm gives us a cheat sheet for the deal which included a one year extension of the farm bill. However, no matter how you look at this bill that raises taxes on incomes over $450,000, taxes for the middle class will go up:

Taxes will rise on the middle class even if this deal passes, because it doesn’t include an extension of the payroll tax holiday. That means that the paychecks for more than 160 million Americans will be 2 percent smaller starting in January, as the payroll tax will jump from 4.2 percent to 6.2 percent. And a huge number of those hit will be middle class or working poor (Two-thirds of those in the bottom 20 percent would be affected by a payroll tax hike.).

The reality is that the payroll tax holiday hurt contribution to Social Security and was a back door to tying it to the debt/deficit argument. What would have been better for the lowest 20% of tax payers was the Earned Income Tax Credit that the payroll tax cut had replaced two years ago.

All of this may now be moot. As of the afternoon, the Republican feral children led by Rep. Eric Cantor (R-VA) are against the bill and want to amend it.

Eric Cantor (R-Va.), the influential House majority leader, emerged from a two-hour meeting with GOP colleagues and said he opposes the Senate bill, which would let income taxes rise sharply on the rich. Rep. Jeff Flake (R-Ariz.) said Cantor “forcefully” expressed his concerns during the closed -door session, during which other GOP members expressed grave doubts about the agreement.

Cantor’s opposition likely dooms the chances for fast House passage of the legislation without changes, which could prolong efforts to avert the automatic tax increases and spending cuts that technically took effect on Tuesday. If there is no agreement by the end of the current Congress at noon on Thursday, negotiations would have to start over in the next Congress. Many economists believe that the fiscal cliff’s full effect would drive the economy back into recession.

The Republicans are scheduled to meet at 5:15 PM EST. Regardless of what goes on in the House, the Senate has adjourned until Jan. 3 when the new session begins and it is highly unlikely that they would return.

This will certainly puts Speaker of the House John Boehner (R-OH) in a bad position since he had supported an “up or down vote” on the bill that was crafted by Vice President Joe Biden and Senate Minority Leader Mitch McConnell (R-SC), since it now appears that he has completely lost control of the House Republican. The biggest objection of to the bill is the lack of spending cuts as Ryan Grym at “Huffington Post” reports, highlighting the probelms for Boehner:

“We’ve got to provide responsible spending balance long-term,” said Rep. Nan Hayworth (R-N.Y.) “This bill does not do that.” Republicans who filed out of the House GOP meeting sounded cautionary notes about the fiscal cliff deal, suggesting it faces serious trouble.

House GOP sources said that Rep. Paul Ryan (R-Wisc.), a leader of the conservative wing and a potential threat to House Speaker John Boehner, is expected to vote against the Senate deal if it comes to the floor, breaking the leadership unity that existed around Boehner’s “Plan B.” And Republicans leaving the meeting said that Majority Leader Eric Cantor (R-Va.), Boehner’s leading rival, spoke against the bill, BuzzFeed’s John Stanton reported.

“Leadership is currently listening to the members so as to figure out the best path forward,” Cantor spokesman Doug Heye said.

Cantor told CNN’s Deirdre Walsh flatly, “I do not support the bill,” and said no decisions have been made on how to proceed.

Rep. Tim Huelskamp (R-Kan.) told the National Review’s Robert Costa that there are “real divisions” between Boehner and Cantor, and that Cantor was vociferous in his opposition, with the upcoming leadership elections hanging over the meeting. He said that conservatives were heartened to see Cantor take on Boehner in front of the entire conference.

The Congressional Budget Office (CBO) is reporting that the Senate’s bill would add $4 trillion to the deficit over a decade.

The House Democrats have their hands tied at this point but if the bill does make it to the floor for debate they do have some action they can take:

If Republicans attempt to offer amendments — as is expected — Democrats will oppose a rule to allow that to happen procedurally.

If the GOP then tries to pass an amended bill, “they will have to do it with their own votes,” said Rep. James Clyburn, (D- S.C.), a member of the leadership. Either scenario would kill the deal.

If the GOP doesn’t offer an up or down vote on the Senate deal, well, that would kill the deal, too.

And then what? “Well, I say that then we wait for the new Congress to come in on Thursday. We’ll have better numbers, more members on our side,” said Clyburn. “Then we offer a new bill that they will like even less. They didn’t like the 450 (thousand dollar in household income) floor on the tax increase? Let’s see how much they like it when we push it back down to 250 (thousand)!”

Former Clinton Labor Secretary and professor at University of California, Robert Reich has voiced the opinion that no deal is a better than a bad deal and advocates going over the cliff.

Up dates to follow.

Early this morning the

Early this morning the

Recent Comments