Recognizing that wages in America have been stagnating for years, JP Morgan Chase CEO Jamie Dimon announced that the bank was giving 18,000 of its lowest waged employees a 20% pay raise. Now, that sounds really generous except when you looked at the details and realize just how laughable it is. In a vain glorious …

Tag: Banks

Apr 28 2015

The Real Reason AG Lynch Should Not Have Been Confirmed

Last week the Senate finally confirmed Loretta Lynch as the 83rd Attorney General after a 5 month delay. She was sworn in on Monday by Vice President Joe Biden. The reasons the Republican majority made for the hold on her confirmation were baseless and revealed just how dysfunctional the congress really is. Using the fight over abortion provisions in an human trafficking bill that Democrats found untenable, looked more like hostage taking than politics. Ms. Lynch had sailed through her other confirmations with unanimous bipartisan support. She has a history of being tough on political corruption and police brutality. She famously prosecuted the New York City Police officers who had brutally abused Abner Louima and was investigating the officer involved in the choke hold death of Eric Garner last year.

But the one really good reason the Republicans had to not confirm her was never mentioned by them or the media, the banks. As the article by William K. Black, a professor of economics and law, discusses, “(Ms.) Lynch’s failure to prosecute HSBC and its officers exemplified a real Obama scandal, the effective end of the rule of law for criminal bankers.”

GOP opposition to Lynch was a missed opportunity

By William K. Black, Al Jazeera

The Republicans’ failed tactics against Loretta Lynch reveal the big banks’ hold on both parties

The reason Lynch was such a godsend to the GOP never appeared in the Times article: HSBC. The biggest bank in Europe and the most disreputable large bank in the world, HSBC was the subject of the most important case Lynch ever handled. It demonstrated that Lynch’s “formidable reputation as a prosecutor” is undeserved, making Republican opposition to her nomination legitimate. More important, her failure to prosecute HSBC and its officers exemplified a real Obama scandal, the effective end of the rule of law for criminal bankers.

Lynch’s sweetheart deal with HSBC, her indefensible reactions to the bank’s failures to comply even with the sweetheart deal and the bank’s continued commission of thousands of felonious transactions after the sweetheart deal offered Republican leaders the ideal circumstances to attack the Obama administration. The Republicans did not need to suddenly develop investigative skills and honest congressional reports. The Democrats, Lynch’s appointee as HSBC’s monitor and the whistleblowers have done all the heavy investigative lifting for the GOP. The ultrashort version is that HSBC and its personnel were caught red-handed having laundered over $1 billion for Mexico’s Sinaloa drug cartel – one of the most violent cartels in the world – and helped Sudan and Iran violate U.S. anti-terrorism and anti-genocide sanctions with impunity. This was all documented in a Senate investigation by former Sen. Carl Levin – a Democrat and Congress’ most respected and competent investigator – in a report that the Republicans could have joyfully quoted. The bank was found to have engaged in massive efforts to aid and abet tax fraud. HSBC’s monitor discovered that the bank was not complying with even the sweetheart nonprosecution agreement that Lynch negotiated. She nevertheless failed to prosecute any of the numerous felonies at HSBC outlined in the Levin report.

Remarkably, the supposedly liberal New York Times and GOP leaders have something in common: Both refused to mention HSBC as a key reason for rejecting Lynch’s nomination. What the GOP’s embarrassingly self-destructive strategy for opposing Lynch proves is that even when the Republicans have the perfect opportunity to embarrass the Obama administration and highlight one of its largest scandals – the failure to prosecute a single bank officer who led the most destructive epidemics of financial fraud in history that caused our Great Recession – the Republicans refused, lest they upset their leading source of political contributions. The approval of the Lynch nomination demonstrates that bipartisanship does exist on Capitol Hill: when it favors the big banks and their lobbyists

Prosecuting these bank criminals was too hard for former AG Eric Garner, it obviously will be for AG Lynch, as well. The banks not only own congress, they own the White House and the Department of Justice.

Feb 17 2014

Yes, Now the Banks Really Do Own Everything

“The banks own the place.” Sen. Dick Durban said that back in 2009 when he was trying to get 60 votes lined up for bankruptcy reform. at the time he was referring to Congress.

“And the banks — hard to believe in a time when we’re facing a banking crisis that many of the banks created — are still the most powerful lobby on Capitol Hill. And they frankly own the place,” he said on WJJG 1530 AM’s “Mornings with Ray Hanania.” Progress Illinois picked up the quote.

The banks have now gone beyond just financing. According to Matt Taibbi at Rolling Stone, in their most devious scam yet, ” Banks are no longer just financing heavy industry. They are actually buying it up and inventing bigger, bolder and scarier scams than ever”

Most observers on the Hill thought the Financial Services Modernization Act of 1999 – also known as the Gramm-Leach-Bliley Act – was just the latest and boldest in a long line of deregulatory handouts to Wall Street that had begun in the Reagan years. [..]

…

…it would take half a generation – till now, basically – to understand the most explosive part of the bill, which additionally legalized new forms of monopoly, allowing banks to merge with heavy industry. A tiny provision in the bill also permitted commercial banks to delve into any activity that is “complementary to a financial activity and does not pose a substantial risk to the safety or soundness of depository institutions or the financial system generally.”

Complementary to a financial activity. What the hell did that mean?[..]Today, banks like Morgan Stanley, JPMorgan Chase and Goldman Sachs own oil tankers, run airports and control huge quantities of coal, natural gas, heating oil, electric power and precious metals. They likewise can now be found exerting direct control over the supply of a whole galaxy of raw materials crucial to world industry and to society in general, including everything from food products to metals like zinc, copper, tin, nickel and, most infamously thanks to a recent high-profile scandal, aluminum. And they’re doing it not just here but abroad as well: In Denmark, thousands took to the streets in protest in recent weeks, vampire-squid banners in hand, when news came out that Goldman Sachs was about to buy a 19 percent stake in Dong Energy, a national electric provider. The furor inspired mass resignations of ministers from the government’s ruling coalition, as the Danish public wondered how an American investment bank could possibly hold so much influence over the state energy grid [..]

(B)anks aren’t just buying stuff, they’re buying whole industrial processes. They’re buying oil that’s still in the ground, the tankers that move it across the sea, the refineries that turn it into fuel, and the pipelines that bring it to your home. Then, just for kicks, they’re also betting on the timing and efficiency of these same industrial processes in the financial markets – buying and selling oil stocks on the stock exchange, oil futures on the futures market, swaps on the swaps market, etc.

Allowing one company to control the supply of crucial physical commodities, and also trade in the financial products that might be related to those markets, is an open invitation to commit mass manipulation. It’s something akin to letting casino owners who take book on NFL games during the week also coach all the teams on Sundays [..]

…

…The situation has opened a Pandora’s box of horrifying new corruption possibilities, but it’s been hard for the public to notice, since regulators have struggled to put even the slightest dent in Wall Street’s older, more familiar scams. In just the past few years we’ve seen an explosion of scandals – from the multitrillion-dollar Libor saga (major international banks gaming world interest rates), to the more recent foreign-currency-exchange fiasco (many of the same banks suspected of rigging prices in the $5.3-trillion-a-day currency markets), to lesser scandals involving manipulation of interest-rate swaps, and gold and silver prices.But those are purely financial schemes. In these new, even scarier kinds of manipulations, banks that own whole chains of physical business interests have been caught rigging prices in those industries [..]

…When does the fun part start?

It would seem the “fun” has already begun for the banks while the pillaging continues under the watchful eyes of the congress, the Department of Justice and banking regulators.

Jul 24 2013

Hoarding Commodities: Big banks making a buck off of…a can of soda?

In the New York Times late last week there was a report how Goldman Sachs is manipulating aluminum commodities that is costing American consumer billions of dollars. This is how it works:

The story of how this works begins in 27 industrial warehouses in the Detroit area where a Goldman subsidiary stores customers’ aluminum. Each day, a fleet of trucks shuffles 1,500-pound bars of the metal among the warehouses. Two or three times a day, sometimes more, the drivers make the same circuits. They load in one warehouse. They unload in another. And then they do it again.

This industrial dance has been choreographed by Goldman to exploit pricing regulations set up by an overseas commodities exchange, an investigation by The New York Times has found. The back-and-forth lengthens the storage time. And that adds many millions a year to the coffers of Goldman, which owns the warehouses and charges rent to store the metal. It also increases prices paid by manufacturers and consumers across the country. [..]

Only a tenth of a cent or so of an aluminum can’s purchase price can be traced back to the strategy. But multiply that amount by the 90 billion aluminum cans consumed in the United States each year – and add the tons of aluminum used in things like cars, electronics and house siding – and the efforts by Goldman and other financial players has cost American consumers more than $5 billion over the last three years, say former industry executives, analysts and consultants.

All In host Chris Hayes spoke with Sen. Sherrod Brown (D-OH) about the newly revealed practice by Goldman Sachs to skirt price regulations on a product we use every day-aluminum-costing American consumers billions of dollars and it ain’t just aluminum.

U.S. Weighs Inquiry Into Big Banks’ Storage of Commodities

by Gretchen Morgenson and David Kocieniewski, New York Times

The overarching question is whether banks should control the storage and shipment of commodities, and whether such activities could pose a risk to the nation’s financial system.

But other crucial issues are expected to arise as well. Among them is how Wall Street’s push into these markets has affected the prices paid by manufacturers and ultimately consumers. Another is whether Goldman and Morgan Stanley have operated their storage facilities at arms’ length from their banking business, as required by regulators.

Goldman has exploited industry pricing regulations set by the London Metal Exchange by shuffling tons of aluminum each day among the 27 warehouses it controls in the Detroit area, The Times reported on Sunday. The maneuver lengthens the storage time and generates millions a year in profit for Goldman, which charges rent to store the metal for customers, the investigation found. The C.F.T.C. issued the notices late last week, and it was unclear on Monday whether the agency or other authorities would open a full-fledged investigation into banks’ activities.

Senate Scrutiny of Potential Risk in Markets for Commodities

by Edward Wyat, New York Times

The hearing, convened by the Senate Financial Institutions and Consumer Protection subcommittee, came as Goldman Sachs, JPMorgan Chase and others face growing scrutiny over their role in the commodities markets and the extent to which their activities can inflate prices paid by manufacturers and consumers. The Federal Reserve is reviewing the potential risks posed by the operations, which have generated many billions of dollars in profits for the banks. [..]

Several witnesses at Tuesday’s hearings warned that letting the country’s largest financial institutions own commodities units that store and ship vast quantities of metals, oil and the other basic building blocks of the economy could pose grave risks to the financial system. The ability of those bank subsidiaries to gather nonpublic information on commodities stores and shipping also could give the banks an unfair advantage in the markets and cost consumers billions of dollars, the witnesses said.

Goldman Sachs isn’t alone in this game.

Not Just Goldman Sachs: Koch Industries Hoards Commodities as a Trading Strategy

by Lee Fang, The Nation

Worth noting: Koch Industries, a company often inaccurately described as simply an oil or manufacturing concern, is highly active in the commodity speculation business akin to the big hedge funds and banks like Goldman Sachs.

As Fortune magazine reported, when oil prices dropped from a record high in July of 2008 to record lows in December of that year, Koch bought up the cheap oil to take it off of the market. Koch leased a number of giant oil tankers, including the 2-million-barrel-capacity Dubai Titan, to store the oil offshore. The decrease in supply increased the price for consumers that year, while Koch took advantage of selling the oil off later at higher prices.

Koch Industries’ executive David Chang later boasted, “The drop in crude oil prices from more than US$145 per barrel in July 2008 to less than US$35 per barrel in December 2008 has presented opportunities for companies such as ours. In the physical business, purchases of crude oil from producers and storing offshore in tankers allow us to benefit from the contango market where crude prices are higher for future delivery than for prompt delivery.”

The company took advantage when the prices were low, but they also gained when the prices were high. A leaked document I obtained shows Koch among the largest traders (including Goldman Sachs and Morgan Stanley) speculating on the price of oil in the summer of 2008.

Elizabeth Warren Wants To Take This Goldman Sachs Aluminum Story And Run Right Over Wall Street With It

by Linette Lopez, Business Insider

Back in 2003 the Federal Reserve decided to temporarily allow banks to purchase commodities directly. That means oil, power, copper, aluminium etc. This September, that temporary regulatory relaxation is set to expire, and if it does, a big chunk of Wall Street’s business will expire with it.

And now that the ruling is up for discussion, Congress gets to weigh in. Wall Street be warned, if this hearing was any indication, the Senate is coming down on the side of culling the commodities business.

Warren decried the idea that banks would use “other people’s money” in pension and retirement savings “to pave the way for big banks to be able to control an electric plant or an oil refinery.” [..]

The witnesses didn’t just talk about prices either, they talked monopolies. Since her rise to prominence as a regulator and then a Senator, Warren has been saying that banks are getting too big, too interconnected, and too complicated. (Joshua) Rosner’s testimony corroborated that idea, and added to it the specter of commodities

controlling, allencompassing banking behemoths backstopped by the government (too big too fail).

It is more than past time to break up these banks and for the Federal Reserve to be more transparent in how it regulates the banks.

Mar 25 2013

A Back Door For Gutting Regulation

Gaius Publius of Americablog succinctly defined one of those vague terms that we heard so often since the banking crisis began in 2007, Credit Default Swaps (CDS) :

Credit default swaps are pure casino bets. They were originally designed as a form of insurance against bond and other credit defaults (“I’ll pay you a monthly fee and you pay me my losses if these bonds default.”)

It’s a simple concept, but CDSs soon evolved. Turns out you don’t have to actually hold the bonds to insure them. This means that one guy can sit at a table with a bunch of bonds (or bundles of mortgages), while another guy can insure them. Meanwhile, at 50 other tables, 50 more guys can buy the same “insurance” on the same bonds from anyone who will sell it to them. Keep in mind, only the first guy actually holds the bonds. The other guys just know they exist.

That’s 50 side-bets on one set of bonds. Placing side-bets on someone else’s property is like betting on a ball game you’re just watching. Like I said, pure casino money.

Do you see the problem? One guy’s bonds default and suddenly 51 guys in that room, everyone who sold “insurance,” they’re all wiped out. Why? Because the dirty secret of derivatives bets is that the people offering the “insurance” rarely have the money. They’re betting that they can collect “insurance” fees forever and the defaults will never come. That’s what happened with mortgage-backed bets in 2007, and that’s what’s happening today.

In 2010, the Democratic held Congress passed the Dodd-Frank Wall St. Reform and Consumer Protection Act to rein in the worst practices of the banks and Wall St. Needless to say, it is overly complicated, inadequate and has yet to be fully implemented.

That has not stopped the now Republican held House, along with some Democrats, to end some of the regulations. Less that week after Sen. Carl Levin released a scathing report on the $6.7 billion loss (pdf) of JP Morgan Chase in the infamous “London Whale” deal, the House Agriculture Committee, go figure that logic, approved seven bills that would gut regulation of the derivatives market and once again, if the banks lose, the tax payer makes good the losses. Sound familiar? Does TARP ring a bell? The housing market crash?

In his Salon article David Dayen asks if JP Morgan is a farmer?

It turns out that the Agriculture Committees have held jurisdiction over derivatives since the mid-19th century, when farmers used derivatives to achieve stability over future prices. Traders still use derivatives for corn and other commodities, but the world of derivatives has grown far more sophisticated over the decades. Nevertheless, congressional committees zealously guard their jurisdictions, and so a bunch of lawmakers from rural states get to determine a major aspect of financial policy. [..]

To see how this all works, just look at the hearing on these derivatives bills, held last week. When Ag Committee chairman Frank Lucas wasn’t openly parroting industry scare tactics about energy price spikes from regulation, he called on a list of witnesses that included four industry trade group representatives and one public advocate from Americans for Financial Reform, Wallace Turbeville. (He did great (pdf).) Or for an even clearer indication, read these PowerPoint slides created for Ag Committee staff by the Coalition for Derivatives End-Users, an industry-backed lobbyist organization. This extremely one-sided perspective on the issue simply becomes the default position for committee members and their staffs, an example of the “cognitive capture” in D.C. that sidelines alternative voices. And it all happens under the radar.

One of the Democratic House members who is sponsoring these bills, is Rep. Jim Himes, a former Goldman Sachs vice president who represents the Connecticut bedroom communities of Wall Street traders. It’s not hard to imagine why he defended his support of these bills when asked by the press. The Democratic members of the committee who voted with the 25 Republicans to send these bills to the House floor are: Pete Gallego (TX-23); Ann Kuster (NH-2); Sean Patrick Maloney (NY-18); Mike McIntyre (NC-07); David Scott (GA-13); and Juan Vargas (CA-51).

These are the bills that were passed by the committee:

H.R. 634 (pdf), the Business Risk Mitigation and Price Stabilization Act of 2013

· H.R. 677 (pdf), the Inter-Affiliate Swap Clarification Act

· H.R. 742 (pdf), the Swap Data Repository and Clearinghouse Indemnification Correction Act of 2013

· H.R. 992 (pdf), the Swaps Regulatory Improvement Act

· H.R. 1003 (pdf), To improve consideration by the Commodity Futures Trading Commission of the costs and benefits of its regulations and orders.

· H.R. 1038 (pdf), the Public Power Risk Management Act of 2013

· H.R. 1256 (pdf), the Swap Jurisdiction Certainty Act

Even if these bills all get passed, they will never see the light of day in the Senate.

Sheila Bair, the longtime Republican who served as chair of the Federal Deposit Insurance Corporation (FDIC) during the fiscal meltdown five years ago, joins Bill to talk about American banks’ continuing risky and manipulative practices, their seeming immunity from prosecution, and growing anger from Congress and the public.

“I think the system’s a little bit safer, but nothing like the dramatic reforms that we really need to see to tame these large banks, and to give us a stable financial system that supports the real economy, not just trading profits of large financial institutions,” Bair tells Bill.

Mar 12 2013

Mind blowing. First the Rand Paul filibuster; now a speech at CPAC for breaking up TBTF banks

Within one week Republicans are going to grab the national spotlight on two huge issues that should be the realm of the party who stands up for the little guy. That party used to be the Democratic party. How can they let this happen?

On Friday, at the CPAC convention, Federal Reserve Bank of Dallas President Richard Fisher is going to call for breaking up the big banks in the wake of a failed Dodd-Frank bill.

This is mind blowing. First a Republican, Rand Paul, filibusters to get answers about the targeted killing program and now at CPAC, a speech calling for breaking up the TBTF banks. Where are the Democrats?? The last thing we heard from the party was that the executives can’t be held criminally liable, via Eric Holder and Lanny Breuer.

End “Too Big to Fail” Once and for All

In advance of his speech on Friday to the Conservative Political Action Conference, Federal Reserve Bank of Dallas President Richard Fisher writes with Harvey Rosenblum about the failure of the Dodd-Frank financial reform law to adequately address financial institutions that are “too big to fail.”

[…]

“Third, we recommend that the largest financial holding companies be restructured so that every one of their corporate entities is subject to a speedy bankruptcy process, and in the case of banking entities themselves, that they be of a size that is ‘too small to save.'”[Emphasis added]

Feb 21 2013

Five biggest TBTF banks are among least reputable companies in America

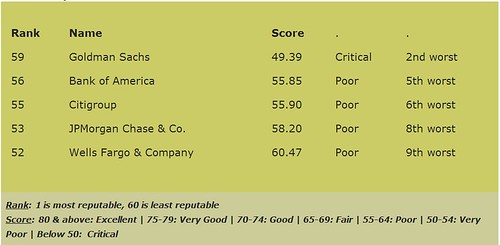

Harris Interactive’s annual “Reputation Quotient” survey for 2013 finds that the five biggest “too big to fail” (TBTF) U.S. banks have some of the lowest reputations in the country according to their survey of the general public. All five of them are ranked in the lowest eight slots among the sixty most visible companies measured.

The maximum “reputation quotient” is 100. Any quotient lower than 64 is considered to be “poor” and anything below 50 is considered “critical”. All of the big five TBTF banks scored lower than 64 and Goldman Sachs is below 50, so its reputation is in “critical” condition.

Bank of America and JP Morgan have seen some improvement in their score this year, but their reputation still falls into the “poor” range.

Harris Interactive also ranks industry reputations. The banking and financial services industries rank above only two other industries: government and tobacco. Banking and financial services have improved over last year, however, by seven and eight percentage points, respectively. Technology, travel and retail are the top three.

This poll has been published for fourteen consecutive years. This year, more than fourteen thousand interviews were conducted for data collection.

Bank Size (1 is the largest)

Harris Reputation Index

Sources:

FFIEC – Top 50 holding companies (HCs) as of 12/31/201

relbanks.com – The Largest US Banks

The Harris Poll 2013 RQ® Summary Report – A Survey of the U.S. General Public Using the Reputation Quotient® (This file is a PDF)

Feb 04 2013

Preventing Future Economic Failures. Maybe

In the “I’ll believe this when I see it” category, there are two bits of news about banking and Wall Street have been too long in the coming and if it happens, there will be a lot of happy dances in places like Zucotti Park.

George Osborne told executives from JPMorgan that the days of banks being “too big to fail” are over in Britain, and that taxpayers shouldn’t be expected to bail out the lenders. The next time a crisis hits, he wants more options to act. [..]

The new measure gives regulators the power to force a complete separation of a lender’s retail business from its investment banking. Risky investments undermined banks’ stability in 2008, leading to taxpayer bailouts of two big U.K. banks. [..]

The banking standards commission said that the scandal of manipulating key lending indexes (LIBOR) had “exposed a culture of culpable greed far removed from the interests of bank customers.” [..]

Other countries and regulators are also grappling with how to prevent future bailouts. In the United States, legislation known as the Dodd-Frank act seeks to bar banks them from engaging in risky trading on their own account. The European Union is also examining how banks might separate their riskier investment banking operations from the rest of their business.

Besides that, new international rules – known as Basel III – will require banks to hold more financial reserves to protect against possible losses. The requirements will be phased in over the coming years, but banks have said they are too demanding.

The second is the report that the US Department of Justice and state prosecutors intend to file civil charges again the rating service, Standard & Poors, alleging wrong doing in its rating of mortgage bonds before the financial crisis erupted in 2008. According to the report in The Wall Street Journal

The likely move by U.S. officials would be the first federal enforcement action against a credit-rating firm for alleged illegal behavior related to the crisis. Several state attorneys general are expected to join the case, making it one of the highest-profile and widest-ranging enforcement crisis-era crackdowns.

The expected civil charges against S&P follow the breakdown of long-running settlement talks between the Justice Department and S&P, the people said. [..]

All three credit-rating firms have faced intense criticism from lawmakers for giving allegedly overly rosy ratings to thousands of subprime-mortgage bonds before the housing market collapsed.

The Financial Crisis Inquiry Commission concluded two years ago that the top credit-rating agencies were “key enablers of the financial meltdown.”

The Justice Department and other law-enforcement agencies have long been investigating whether the rating firms broke securities laws or simply failed to predict the housing crisis.

Over at Zero Hedge, Tyler Durdin questions why S&P is being targeted and not the other ratings agencies:

Certainly if S&P is being targeted so will be the Octogenarian of Omaha’s pet rating company, Moody’s as well, not to mention French Fitch. Or maybe not: after all these were the two raters who sternly refused to downgrade the US when the country boldly penetrated the 100% debt/GDP target barrier, and which at last check has some 105% in debt/GDP with no actual plan of trimming spending. As in ever.

And in these here united banana states, it is only reasonable to expect that such crony, corrupt behavior is not only not punished but solidly rewarded.

I expect to be disappointed. Fool me.

Feb 04 2013

DOJ Turns A Blind Eye to Shockingly Bad Behavior

Rolling Stone‘s Matt Taibbi joins Bill to discuss the continuing lack of accountability for “too big to fail” banks which continue to break laws and act unethically because they know they can get away with it. Taibbi refers specifically to the government’s recent settlement with HSBC – “a serial offender on the money laundering score” – who merely had to pay a big fine for shocking offenses, including, Taibbi says, laundering money for both drug cartels and banks connected to terrorists.

Taibbi also expresses his concern over recent Obama appointees – including Jack Lew and Mary Jo White – who go from working on behalf of major banks in the private sector to policing them in the public sector.

Matt has more on Mary Jo White and her involvement with squashing the insider trading case against future Morgan Stanley CEO John Mack by Sec investigator Gary Aguirre.

There are a few more troubling details about this incident that haven’t been disclosed publicly yet. The first involve White’s deposition about this case, which she gave in February 2007, as part of the SEC Inspector General’s investigation. In this deposition, White is asked to recount the process by which Berger came to work at D&P. There are several striking exchanges, in which she gives highly revealing answers.

First, White describes the results of her informal queries about Berger as a hire candidate. “I got some feedback,” she says, “that Paul Berger was considered very aggressive by the defense bar, the defense enforcement bar.” White is saying that lawyers who represent Wall Street banks think of Berger as being kind of a hard-ass. She is immediately asked if it is considered a good thing for an SEC official to be “aggressive”:

Q: When you say that Berger was considered to be very aggressive, was that a positive thing for you?

A: It was an issue to explore.

Later, she is again asked about this “aggressiveness” question, and her answers provide outstanding insight into the thinking of Wall Street’s hired legal guns – what White describes as “the defense enforcement bar.” In this exchange, White is essentially saying that she had to weigh how much Berger’s negative reputation for “aggressiveness” among her little community of bought-off banker lawyers might hurt her firm.

Q: During your process of performing due diligence on Paul Berger, did you explore what you had heard earlier about him being very aggressive?

A: Yes.

Q: What did you learn about that?

A: That some people thought he was very aggressive. That was an issue, we really did talk to a number of people about.

Q: Did they expand on that as to why or how they thought he was aggressive?

A: I think and as a former prosecutor, sometimes people refer to me as Attila the Hun. I understand how people can get a reputation sometimes. We were trying to obviously figure out whether this was something beyond, you always have a spectrum on the aggressiveness scale for government types and was this an issue that was beyond real commitment to the job and the mission and bringing cases, which is a positive thing in the government, to a point. Or was it a broader issue that could leave resentment in the business community or in the legal community that would hamper his ability to function well in the private sector?

It’s certainly strange that White has to qualify the idea that bringing cases is a positive thing in a government official – that bringing cases is a “positive thing . . . to a point.” Can anyone imagine the future head of the DEA saying something like, “For a prosecutor, bringing drug cases is a positive, to a point?”

Somehow this sounds like more of the same at the from the Obama administration.

Dec 31 2012

FBI and Banks Supressed “Terrorist” #OWS

If anyone had any doubts that the US Government is no longer a “government of the people” but of corporation and Wall St, you need only read the recently released FBI documents that labeled Occupy Wall Street a “terrorist group” and coordinated with banks and cities nationwide to suppress the protests with strong arm tactics and targeted assassinations (see pg 61 of document). This all started before the protest even began without evidence that the protests would be anything but peaceful and despite the internal acknowledgment that the movement opposed violent tactics. The documents prove that the government blatantly lied about the Department of Homeland Security involvement in coordinating the violent crackdown in New York City, Oakland and other major cities. Partnership for Civil Justice obtained the heavily redacted FBI documents revealing that the surveillance began at least a month before the protest in Zuccotti Park began and that the #OWS movement was being treated as potential criminal and terrorist activity.

The PCJF has obtained heavily redacted documents showing that FBI offices and agents around the country were in high gear conducting surveillance against the movement even as early as August 2011, a month prior to the establishment of the OWS encampment in Zuccotti Park and other Occupy actions around the country.

“This production, which we believe is just the tip of the iceberg, is a window into the nationwide scope of the FBI’s surveillance, monitoring, and reporting on peaceful protestors organizing with the Occupy movement,” stated Mara Verheyden-Hilliard, Executive Director of the Partnership for Civil Justice Fund (PCJF). “These documents show that the FBI and the Department of Homeland Security are treating protests against the corporate and banking structure of America as potential criminal and terrorist activity. These documents also show these federal agencies functioning as a de facto intelligence arm of Wall Street and Corporate America.”

“The documents are heavily redacted, and it is clear from the production that the FBI is withholding far more material. We are filing an appeal challenging this response and demanding full disclosure to the public of the records of this operation,” stated Heather Benno, staff attorney with the PCJF.

Author and activist Naomi Wolf reported in The Guardian that these “new documents prove what was once dismissed as paranoid fantasy: totally integrated corporate-state repression of dissent.”

It was more sophisticated than we had imagined: new documents show that the violent crackdown on Occupy last fall – so mystifying at the time – was not just coordinated at the level of the FBI, the Department of Homeland Security, and local police. The crackdown, which involved, as you may recall, violent arrests, group disruption, canister missiles to the skulls of protesters, people held in handcuffs so tight they were injured, people held in bondage till they were forced to wet or soil themselves – was coordinated with the big banks themselves.

The Partnership for Civil Justice Fund, in a groundbreaking scoop that should once more shame major US media outlets (why are nonprofits now some of the only entities in America left breaking major civil liberties news?), filed this request. The document – reproduced here in an easily searchable format – shows a terrifying network of coordinated DHS, FBI, police, regional fusion center, and private-sector activity so completely merged into one another that the monstrous whole is, in fact, one entity: in some cases, bearing a single name, the Domestic Security Alliance Council. And it reveals this merged entity to have one centrally planned, locally executed mission. The documents, in short, show the cops and DHS working for and with banks to target, arrest, and politically disable peaceful American citizens.

The documents, released after long delay in the week between Christmas and New Year, show a nationwide meta-plot unfolding in city after city in an Orwellian world: six American universities are sites where campus police funneled information about students involved with OWS to the FBI, with the administrations’ knowledge (p51); banks sat down with FBI officials to pool information about OWS protesters harvested by private security; plans to crush Occupy events, planned for a month down the road, were made by the FBI – and offered to the representatives of the same organizations that the protests would target; and even threats of the assassination of OWS leaders by sniper fire – by whom? Where? – now remain redacted and undisclosed to those American citizens in danger, contrary to standard FBI practice to inform the person concerned when there is a threat against a political leader (p61).

Mara Verheyden-Hilliard, executive director of the PCJF, sat down for an interview with Amy Goodman on Democracy Now!

Transcript can be read here

So much for paranoia. The government is out to stop peaceful protest in anyway they can.

Recent Comments