(2 pm. – promoted by ek hornbeck)

For most Americans the recession never ended as was shown in a study (pdf) done by two former Census Bureau officials, Gordon W. Green Jr. and John F. Coder and explained in the New York Times article by Robert Pear. The household income has continued to drop over the last two years even though the Village has declared that the recession ended in June, 2009.

Between June 2009, when the recession officially ended, and June 2011, inflation-adjusted median household income fell 6.7 percent, to $49,909, according to a study by two former Census Bureau officials. During the recession – from December 2007 to June 2009 – household income fell 3.2 percent.

[]

The full 9.8 percent drop in income from the start of the recession to this June – the most recent month in the study – appears to be the largest in several decades, according to other Census Bureau data. Gordon W. Green Jr., who wrote the report with John F. Coder, called the decline “a significant reduction in the American standard of living.”

[]

In their new study, Mr. Green and Mr. Coder found that income dropped more, in percentage terms, for some groups already making less, a factor that they say may have contributed to rising income inequality.

From June 2007 to June of this year, they said, median annual household income declined by 7.8 percent for non-Hispanic whites, to $56,320, and by 6.8 percent for Hispanics, to $39,901. For blacks, household income declined 9.2 percent, to $31,784.

The study also looks at unemployment, types of jobs, wages, age and education factors in the decline.

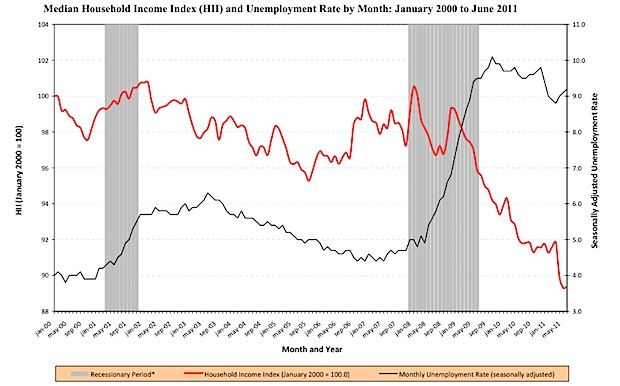

The red line, here, is median real household income, as gleaned from the CPS, indexed to January 2000=100. It’s now at 89.4, which means that real incomes are more than 10% lower today than they were over a decade ago.

More striking still is the huge erosion in incomes over the course of the supposed “recovery” – the most recent two years, since the Great Recession ended. From January 2000 through the end of the recession, household incomes fluctuated, but basically stayed in a band within 2 percentage points either side of the 98 level. Once it had fallen to 96 when the recession ended, it would have been reasonable to assume some mean reversion at that point – that with the recovery it would fight its way back up towards 98 or even 100.

Instead, it fell off a cliff, and is now below 90.

In dollar terms, median household income is now $49,909, down $3,609 – or 6.7% – in the two years since the recession ended. It was as high as $55,309 in December 2007, when the recession began.

Anyone still wondering what is motivating Occupy Wall Street at this point need only to look at this study by Green and Croder.

2 comments

Author

My wife and I need only three data sources: our paychecks, our checking account balance, and the ever-increasing number of jobs I’ve applied for and not gotten since January 2009.

The folks occupying Wall St. speak for me.