Crossposted from DocuDharma

A Rare Look at Why The Government Won’t Fight Wall Street

Matt Taibbi, Rolling Stone

September 18, 10:28 AM ET

The great mystery story in American politics these days is why, over the course of two presidential administrations (one from each party), there’s been no serious federal criminal investigation of Wall Street during a period of what appears to be epic corruption. People on the outside have speculated and come up with dozens of possible reasons, some plausible, some tending toward the conspiratorial – but there have been very few who’ve come at the issue from the inside.

…

There are some damning revelations in this book, and overall it’s not a flattering portrait of key Obama administration officials like SEC enforcement chief Robert Khuzami, Department of Justice honchos Eric Holder (who once worked at the same law firm, Covington and Burling, as Connaughton) and Lanny Breuer, and Treasury Secretary Tim Geithner.

…

Connaughton writes about something he calls “The Blob,” a kind of catchall term describing an oozy pile of Hill insiders who are all incestuously interconnected, sometimes by financial or political ties, sometimes by marriage, sometimes by all three. And what Connaughton and Kaufman found is that taking on Wall Street even with the aim of imposing simple, logical fixes often inspired immediate hostile responses from The Blob; you’d never know where it was coming from.

…

when Kaufman tried to advocate for rules that would have prevented naked short-selling, Connaughton was warned by a lobbyist that it would be “bad for my career” if he went after the issue and that “Ted and I looked like deranged conspiracy theorists” for asking if naked short-selling had played a role in the final collapse of Lehman Brothers. Naked short-selling is another controversial practice. Essentially, when you short a stock, you’re supposed to locate shares of that stock before you go out and sell it short. But what hedge funds and banks have discovered is that the rules provide “leeway” – you can go out and sell shares in a stock without actually having it, provided you have a “reasonable belief” that you can locate the shares.

This leads to the obvious possibility of companies creating false supply in a stock by selling shares they don’t have. Without getting too much into the weeds here, there is an obvious solution to the problem, which essentially would be forcing companies to actually locate shares before selling them. In their attempt to change the system, Kaufman and Connaughton discovered that the Depository Trust Clearing Corporation, the massive quasi-private organization that clears most all stock trades in America, had come up with just such a fix on their own.

…

A roundtable to discuss the idea was scheduled by the SEC on September 24, 2009. Of the nine invited participants, “all but one” were for the status quo. Connaughton expected the DTCC representatives to unveil their reform idea, but they didn’t.

The Banker Who’d Cut Social Security and Medicare – and May Become Treasury Secretary

Richard (RJ) Eskow, Huffington Post

09/17/2012 11:08 pm

Before entering public life Bowles was a banker with Morgan Stanley. He now serves on Morgan Stanley’s board, and has done so through a series of that bank’s legal issues. As Dean Baker notes, Bowles was also on the General Motors Board “from June of 2005 until it went into bankruptcy in the spring of 2009,” and “joined the board of Morgan Stanley, the Wall Street investment bank, near the peak of the housing bubble in December of 2005.”

Bowles is also on the Board of Facebook, whose IPO has been the subject of controversy and scandal. (Baker offers a fun, interactive graph of the economic performance of the companies on whose boards Bowles has served. It isn’t pretty.)

…

The Simpson/Bowles proposal is often marketed — falsely — as the product of their deadlocked and failed Presidential Deficit Commission. It claims to be “centrist” because it offers unspecified tax increases as well as cuts — probably by decimating the middle class by eliminating tax deductions for employer health care, dependent children, and home mortgage interest. It also claims “bipartisanship” because Bowles the banker is also Democratic Party insider.

The “Simpson Bowles” austerity cuts to U.S. government spending closely resemble the cuts that have devastated the economies of Europe and Great Britain. Their plan would also cut Medicare and Social Security benefits — while providing drastically lower tax rates for billionaires and millionaires.

When you look at it carefully, Simpson/Bowles only differs from the radical right-wing Republican budget in a few areas, the most important of which is this: While the Republican plan calls for no tax increases at all, the Simpson/Bowles plan says it would offset its billionaire tax cuts. But since they also lower tax rates for billionaires, millionaires and corporations, they’re left to rely like Romney on unspecified loopholes, or “tax expenditures,” which could eviscerate the tax deductions that help the middle class get health insurance and pay their mortgages.

…

Washington insiders scoff at anybody who dares question the sanctity of the “Simpson Bowles” concept. But once you leave Washington, that includes pretty much everybody. About 96 percent of the country’s voters reject their emphasis on deficits as our top priority, according to recent polling. The same poll showed that 37 percent of those polled considered “the economy and jobs” their top priority. That’s nearly ten times as many people.

That tracks closely with other poll results which showed that seventy percent of Americans were either “very uncomfortable” or “somewhat uncomfortable” with the Simpso(n)/ Bowles plan when it was released.

Meanwhile polls show that Medicare is a key issue in three battleground states, with Paul Ryan’s unpopular plan giving Democrats a decided edge on that issue. The selection of Bowles would damage that advantage if it was announced before the election, and would create a sense of betrayal if announced afterwards.

That particular form of right-wing wealth redistribution is what allows Simpson, Bowles, their funders and supporters to keep bragging that their plan is “brave.” If they were really brave they’d admit that they’re offering a right-wing austerity plan, not a “nonpartisan” solution to a long-term issue that’s receiving attention that should be focused on today’s jobs crisis.

Since Romney Raised the Issue of Freeloaders, What Is Erskine Bowles?

Dean Baker, cepr

Tuesday, 18 September 2012 04:42

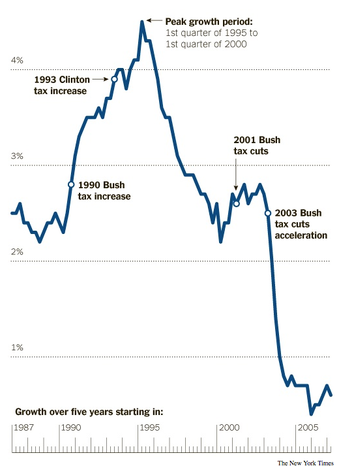

Mr. Bowles has earned millions of dollars sitting on corporate boards over the last decade. The stock prices of the companies on whose boards he sat have mostly plummeted. Since 2003 the Erskine Bowles stock index has lost more than one third of its value. By comparison, the S&P 500 has risen by more than 50 percent. If Mr. Bowles was trying to serve shareholders, he has not done a very good job.

If people think that this is a private matter, with Mr. Bowles just ripping off shareholders while Governor Romney’s freeloaders are ripping off taxpayers, think again. One of the companies on whose board Mr. Bowles sat, General Motors, went bankrupt with substantial costs to the government. Another, Morgan Stanley, would have gone bankrupt without extraordinary assistance from the Fed and Treasury, which continues to this day in the form of implicit too big to fail insurance.

So, if we want to have a debate about people who freeload on the rest of the country, we should have folks like Erskine Bowles at center stage. Of course he is in a much higher income bracket than the folks who get Social Security or unemployment insurance from the government, but that fact should not be allowed to color the debate.

Originally published in David Claypoole’s American Daily Advertiser on September 19, 1796 under the title “The Address of General Washington To The People of The United States on his declining of the Presidency of the

Originally published in David Claypoole’s American Daily Advertiser on September 19, 1796 under the title “The Address of General Washington To The People of The United States on his declining of the Presidency of the One of the first things you notice in the chart is that the American economy was not especially healthy even before the financial crisis began in late 2007. By 2007, remarkably, the economy was already on pace for its slowest decade of growth since World War II. The mediocre economic growth, in turn, brought mediocre job and income growth – and the crisis more than erased those gains.

One of the first things you notice in the chart is that the American economy was not especially healthy even before the financial crisis began in late 2007. By 2007, remarkably, the economy was already on pace for its slowest decade of growth since World War II. The mediocre economic growth, in turn, brought mediocre job and income growth – and the crisis more than erased those gains.

Recent Comments