(10 am. – promoted by ek hornbeck)

Our fate, for one, but I know that is really depressing(why I don’t write about it as much as I should) because as a whole no party really is going to do anything about it, even the Democratic party who kept the filibuster(despite Sen Merkley and Udall’s efforts to even change it to make it less damaging) after whining about it to you asking for money you don’t have that you gave them in 2008. But they really wanted all that environmental legislation that died in the Senate to pass. At this point Daryl Hanna is putting up more of a fight in my state of TX and kudos to her for her efforts.

But the Keystone pipeline will be a reality regardless of this election like drill baby drill Obama style(we thought we were voting against that in 2008) if the entire population does not emulate her example. So like Charles Ferguson, director of Inside Job, I’m going to concentrate on other real issues no one really paid attention to in this Presidential debate or general election that could be handled more easily without Congress. That is, if those in charge of running the Department of Justice weren’t so pathetically unable to live up to their namesake in the executive branch.

In addition to what the excellent UKMC economist(whose control fraud thesis is being adopted into MMT)/criminologist William K. Black said regarding Lanny Breuer, Marcy Wheeler has been on the case for awhile.

Lanny Breuer Admits That Economists Have Convinced Him Not to Indict Corporations

But the real tell is when he confesses that he “sometimes-though … not always” let corporations off because a CEO or an economist scared him with threats of global markets failing if he held a corporation accountable by indicting it.

To be clear, the decision of whether to indict a corporation, defer prosecution, or decline altogether is not one that I, or anyone in the Criminal Division, take lightly. We are frequently on the receiving end of presentations from defense counsel, CEOs, and economists who argue that the collateral consequences of an indictment would be devastating for their client. In my conference room, over the years, I have heard sober predictions that a company or bank might fail if we indict, that innocent employees could lose their jobs, that entire industries may be affected, and even that global markets will feel the effects. Sometimes – though, let me stress, not always – these presentations are compelling. [my emphasis]

None of this is surprising, of course. It has long been clear that Breuer’s Criminal Division often bows to the scare tactics of Breuer’s once and future client base. (In his speech, he boasts about how well DPAs and NPAs have worked with Morgan Stanley and Barclays, respectively.)

Well isn’t that special? Lanny Breuer believes the deferred prosecution agreements with the Wall St. Market Gods have bestowed market magic upon us plebeians who must worship fraud at their Pantheon so that hopefully grain will rain down from the street, because Mr. Breuer and this DOJ don’t know shit about what it takes for a functioning system. It’s also like the mafia, “nice recovery, it would be a shame if something happened to it” like they have that power. It certainly didn’t work when they were begging Washington for a bailout after loading their balance sheets with junk.

But this is the problem when we let our officials in government practice faith based theoclassical economics. It really is a religion where prayer and the belief in being faithful to Wall St banks that committed fraud over everyone else pumping up huge housing bubbles must be adhered to faithfully or we won’t get our economic blessings from up above from the street. The Oligarchs are our lords and the people must be sacrificed to do their bidding in this miraculous TBTF financial system or there will be no economy left. There must not be doubt, accountability for crimes, and we must have faith in what Wall St. tells us or else. The market works in mysterious ways so they say.

Reality should be important, specifically when it comes to financial and economic matters with so many people suffering. Letting Bankers swindle, defraud, and pump and dump asset bubbles on the public because Lanny Breuer doesn’t want to do his job or live in the real world is unacceptable. This Justice department is unacceptable. This is the sad stark reality, and we better start paying attention to it.

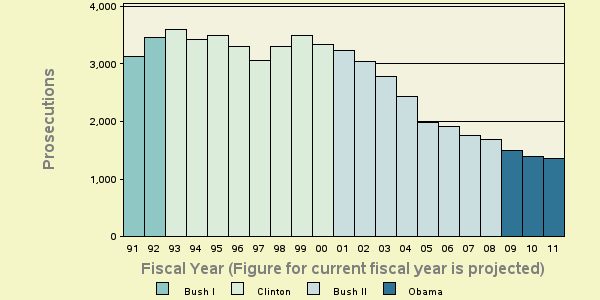

Federal Prosecution Of Financial Fraud Falls To 20-Year Low, New Report Shows

The Obama administration failing to live up to the standards of George W. Bush doesn’t speak well at all for federal prosecution of financial fraud. Those are the facts and it really doesn’t do anyone any favors to downplay it unless one doesn’t care, but there are people who don’t, even loyal so called Democrats. This should be an issue in this campaign, but one can only surmise from the lack of attention by both the candidates that there is not much daylight here between them like there is other issues.

How the Government Failed to Fix Wall Street

Four years have passed since Lehman Brothers’ collapse; two since Obama signed financial reform into law; one since the occupation of Zuccotti Park. But the Justice Department has yet to convict a single high-profile banker. And despite the Dodd-Frank reform package, critics suggest that the system is hardly safer than it was in 2008-from JPMorgan’s beached “whale” to MF Global’s missing billions. In a recent report (PDF), the International Monetary Fund called the capital markets just as “vulnerable” to crash and fraud as they were four years ago.

Why? There’s no simple, satisfactory answer. But in recent weeks, memoirs by crisis insiders, like former Federal Deposit Insurance Corporation Chairman Sheila Bair, have shed new light. Interviews with officials — from former senator Ted Kaufman to former Justice Department prosecutors — lend further color to the crystallizing narrative. The Obama Justice Department was too timid and short-staffed to hunt down the bad guys. The White House, Treasury Department, and Federal Reserve stifled or sold out real financial reform, leaving megabanks too big to fail, and dangerous crisis-era practices untouched.

Months after taking office, Obama told the CEOs of the nation’s third biggest banks, “My administration is the only thing standing between you and the pitchforks.” It has served as an effective shield.

[…….]

Senator Kaufman and his former chief of staff, Jeff Connaughton-author of a new book–recall several frustrating meetings with Justice Department officials. In September 2009, Kaufman met with Lanny Breuer, then Assistant Attorney General for the Criminal Division, to ask why so few cases were underway. According to Kaufman and Connaughton, Breuer explained that “we take the cases the FBI brings to us.”

In an interview, a high-ranking Democratic official and Justice Department veteran called that explanation “disturbing … While some federal prosecutors might just sit and wait to see what comes through the door, the good ones are ready, willing, and able to initiate investigations on their own.” As Barofsky puts it, “I’d be hard pressed to say if a single additional case was made becomes of one of these task forces.” Kaufman adds: “It was pretty damning that there were no referrals from the regulatory agencies on this.”Connaughton says that Kaufman’s office then called a U.S. attorney’s office, a full two months after the Breuer meeting, to ask about prosecutions progress. The office told the senate staff that the Justice Department had only just been in contact, “asking [them] if they were working on any financial fraud cases.” By then, says Kaufman, “the trail had gone cold” on several promising cases, from Washington Mutual’s mortgage lending fraud to charges of false reporting at the ratings agencies. In late-November, 2009, the Justice Department lost its high-profile case against two Bear Stearns hedge-fund managers: a huge blow to morale.

[…….]

The lack of prosecution might be easier to swallow if the banks had been prodded to change their ways. But in the aftermath of the crisis, legislative efforts to institute systemic changes were resisted or outright blocked by the White House, the Treasury, and the Fed. One such effort was a 2010 amendment, proposed by then-Senator Kaufman and Senator Sherrod Brown (D-Ohio), to cap the size of a single bank’s assets to 10 percent of GDP-at the time, that would have required breaking up JPMorgan, Wells Fargo, and Bank of America. As recently as this July, Sandy Weill-the creator of the original superbank, Citigroup-endorsed this proposal.

As has been well documented, Larry Summers, then director of the National Economic Council, and Treasury Secretary Tim Geithner fought this and other reform efforts. Both tried privately to dissuade Senators Brown and Kaufman from pursuing their amendment, and asked other lawmakers to vote against it, according to Kaufman and his staffers. Instead, Geithner reached across the aisle to recruit Republicans in an effort to “water down” extant Dodd-Frank proposals and kill the Brown-Kaufman amendment, writes former FDIC chair Sheila Bair in her just-published memoir. As Kaufman told me, he was “surprised” that he couldn’t “get some Republicans” to vote for his bank breakup.

So there it is. The White House and Tim Geithner specifically were instrumental in defeating the Brown Kaufman amendment which would have broken the banks up. You see, when the White House wants to get something done it can get something done even getting Republicans to defeat Senators Sherrod Brown(whom is worth supporting and luckily will pull it out most likely in Ohio) and Ted Kaufman’s amendment that is still desperately needed. This kills the excuses about the stimulus, the lack of a real bank rescue to fix the TARP model on top of the 7.7 trillion of dollars of bailout money from the Fed (29 trillion globally including guarantees), and having no accountability for Wall St.

The President wanted Tim Giethner, Larry Summers, and he wanted a Too Big to Fail financial system preserved by Dodd Frank that will not prevent bailouts like he said as history will attest. Not only that, derivative contracts are now pricing in the implicit bailouts our President said won’t ever happen again happen while he claimed in the debate Dodd Frank was the most sweeping reforms since the Great Depression. That is false, so the whole debate on Dodd Frank flustered him and Romney was then allowed to criticize it (for the undefined provisions which are undefined and thus ineffective) while pretending he wanted some effective regulation which is also BS.

There are some who scoff when we complain about Tim Giethner. I can only surmise “they got theirs” so they don’t care and instead just want to be part of a club because they’re already in an elite club. I just wish they would be honest about it instead of pretending they care about people who will be ruined when the next crash comes in a year or two most likely.

As Bob Herbert says, there are no excuses. Wall St. is still not a popular institution and though not all the big money has shifted, a lot of of it has shifted to Romney so the whole “he can’t fight big money because he needs it excuse” as a reason to not even acknowledge these issues is totally bunk. Preserving the owners of this system over everyone else as the Bush and Obama administration have so far done letting them get away with fraud while ripping everyone off will not be looked kindly upon in the economic history book.

Now is the time to be demanding these issues be brought to the forefront and asking if not now, when? I don’t know how else you think a second term will be wrought with any real qualitative progress unless you fight to make it part of the 2012 presidential campaign. Our system is volatile and one month’s good job numbers and unemployment report won’t fix the volatility which could turn things around with a quickness, specifically since the theoclassical(h/t Stephanie Kelton) deficit terrorist economic religious cult in both parties that do not understand national accounting, double entry bookkeeping, and sectoral balances(trade deficit) showing why we will need deficits specifically with the dumbass sequester from the debt ceiling sellout coming up in this BS fiscal cliff debacle coming up.

As we know from Iceland’s example for the most part, and even the S&L crisis, upholding the rule of law is absolutely essential for any functioning financial and economic system. I don’t think I can put it better than when I first wrote about this so I will end on this note

I don’t think enough normal Democratic voters understand that wide ranging legal principle really does apply to any microeconomic future aspiration anyone might have. This includes any mortgage, student loan agreement to go back to school, or any other legal contract anyone may want to enter into in the future to improve one’s financial standing assuming that is still possible at all in this new Gilded Age. If it is possible all of it, absolutely all of it is actually factually dependent on making those with big pockets and political access follow the law.

If you don’t demand rule of law for it all, specifically when it comes to the big stuff, the whole foundation of our system, financial or otherwise, even what’s behind our money, doesn’t exist. It should exist and it should be as strong as it has been in the past because it defines who we are as a country. Don’t let any politician convince you that giving that up is all right. It’s not!

It’s wrong! Nation states and the economies their laws support are not legit and cannot function for everyone unless we demand our so called Representatives from the president on down adhere to and respect the rule of law. The rule of law is not just a foreign policy issue or a Constitutional issue, as many think of when it’s spoken. The rule of law is the most important aspect of our entire economy(Monetary and fiscal policy) and our entire economic system.

It’s not going to be OK if you just have faith. You have to learn to think, not just how to believe. The kinds of laws you passively accept being unenforced(whether by loyalty to the president or Democrats in Congress) do construct the kind of economy you actually live in, live with, and how this economy actually functions. This is true whether you like it or not or whether you like the way I said it or not.

If you don’t demand the economy you want, if you don’t demand the kind of country you want, or if you don’t demand the type of economic system you want you will be left entirely out of the debate and right now you are for the most part.

Recent Comments