(2 pm. – promoted by ek hornbeck)

From Earth Insight by Nafeez Ahmed, hostsed by the Gardian, Former BP geologist: peak oil is here and it will ‘break economies’:

From Earth Insight by Nafeez Ahmed, hostsed by the Gardian, Former BP geologist: peak oil is here and it will ‘break economies’:

Dr. Richard G. Miller, who worked for BP from 1985 before retiring in 2008, said that official data from the International Energy Agency (IEA), US Energy Information Administration (EIA), International Monetary Fund (IMF), among other sources, showed that conventional oil had most likely peaked around 2008.

Dr. Miller critiqued the official industry line that global reserves will last 53 years at current rates of consumption, pointing out that “peaking is the result of declining production rates, not declining reserves.” Despite new discoveries and increasing reliance on unconventional oil and gas, 37 countries are already post-peak, and global oil production is declining at about 4.1% per year, or 3.5 million barrels a day (b/d) per year:

“We need new production equal to a new Saudi Arabia every 3 to 4 years to maintain and grow supply… New discoveries have not matched consumption since 1986. We are drawing down on our reserves, even though reserves are apparently climbing every year. Reserves are growing due to better technology in old fields, raising the amount we can recover – but production is still falling at 4.1% p.a. [per annum].”

Wait a Minute, I Thought the Peak Oil Theory Was Debunked!

Big Oil has, of course, worked hard on spinning the peak oil argument. After all, if we cannot count on the availability of petroleum as an energy source, then that creates an obvious coalition of interest between those concerned with climate change, who argue for investing in alternatives to CO2 emitting energy sources, and those who are simply concerned with securing a long term energy supply for their economic activities … which can be secured by investing in alternatives to CO2 emitting energy sources.

Big Oil has, of course, worked hard on spinning the peak oil argument. After all, if we cannot count on the availability of petroleum as an energy source, then that creates an obvious coalition of interest between those concerned with climate change, who argue for investing in alternatives to CO2 emitting energy sources, and those who are simply concerned with securing a long term energy supply for their economic activities … which can be secured by investing in alternatives to CO2 emitting energy sources.

Propagandizing the impression that the “Peak Oil” argument has been debunked is therefore an essential political wedge action by Big Oil, preventing that natural coalition of interest from coming together.

Of course, when engaged in a well-financed spin campaign, what one does is take all the arguments one can find, based on whatever partial or misrepresented evidence one can muster, and send them through focus groups to find the arguments that appear to be most effective. And then put them out there in as many channels as required, including direct issues advertising, various propaganda mills willing to reach a conclusion for hire, and by giving both money and messaging support to politicians available for lease in both the Republican and Democratic party.

Dr. Miller punctures a key talking point here: growing reserves prove that the “Peak Oil” hypothesis was wrong.

The Peak Oil hypothesis is based on the fact that new discoveries are lagging behind depletion of existing fields, so that given the normal production profile of an oil field, a certain time after the peak of new discoveries, we will arrive at the peak of new production. And, as Dr, Miller reminds us, the growth in reserves is not due to new discoveries outpacing consumption … it is due to new production techniques that are more effective at extending the production lifespan of existing oil fields and recovering more of the petroleum contained in the field.

Now, slowing the rate of decline and postponing the retiring of existing oil fields could defer a production peak … if new discoveries were being made and exploited rapidly enough to bridge the now smaller decline in what the existing fields are producing. That plausibility may well be part of why this talking point would have done well in focus groups.

But according to Dr. Miller, the actual facts on the ground are that new production of conventional oil coming on stream is not outpacing the declines in production in existing fields. And so, plausible or not, that link between increasing reserves and increasing total production just is not happening.

Shift the Goal Posts: Change The Object of Discussion

Another element of the messaging strategy that I have seen coming from, among other sources, the current administration, is to shift the topic of the conversation from the actual target of the Peak Oil hypothesis, which is directed toward conventional oil production, so start talking about “liquid supply”. As Dr. Miller notes in this article, conventional oil production has been flat, with all increases in supply coming from natural gas liquids and oil-sand bitumen.

Another element of the messaging strategy that I have seen coming from, among other sources, the current administration, is to shift the topic of the conversation from the actual target of the Peak Oil hypothesis, which is directed toward conventional oil production, so start talking about “liquid supply”. As Dr. Miller notes in this article, conventional oil production has been flat, with all increases in supply coming from natural gas liquids and oil-sand bitumen.

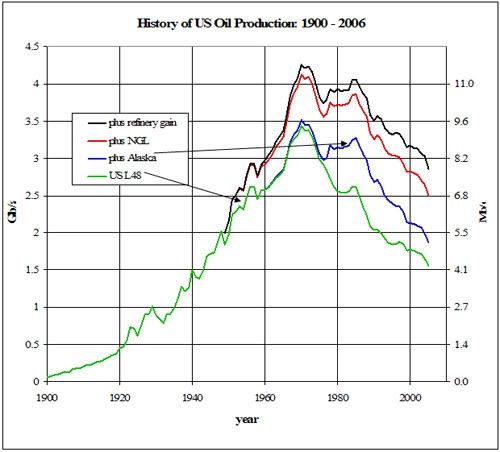

But conventional oil is still the largest component of that “liquid fuels” production. Changing the focus of the political debate does not, in fact, do anything to change the predictive power of the Peak Oil hypothesis. And that means that we can still expect conventional oil production to begin to decline on a world wide basis just as they have been lower (and except for a few years when production from the North Slope of Alaska increased the total, declining) than our domestic peak in 1958 … first relatively slowly, and then more rapidly. And just as with the US, there may be production breakthroughs that temporarily halt or slow the decline, but since those gains are standing on top of a sinking foundation, they are unlikely to bring us back to the original peak.

As we slide down the steepest part of the downward production decline, the production of natural gas liquids ~ ethane, propane, butane, pentane ~ can only partially compensate, since they are no perfect substitutes for petroleum. And as we slide down the steepest part of the downward production decline, a major factor determining the volume of liguid fuel supplies other than conventional oil will be the price that can be extracted.

So for petroleum dependent economies, the “good news” of non-conventional replacements for what will sooner or later be rapidly declining conventional oil production is that there may be some price that is painfully high enough so that the combination of increased production of non-conventional liquid fuels and the economic slowdown due to the liquid fuel price shock will avoid a supply shock.

Of course, that price includes not just the financial cost ~ we have, after all, not quite reached the level of total employment we had at the time of the last oil price shock when crude oil prices reached $150/barrel (which is about $3.60 barrel for the raw material cost, so in excess of $4 after refining and distribution) ~ but also the ecological cost, in particular the fact that we cannot afford to burn a majority of the reserves of all carbon-based fuels in existence, and the more coal and oil-sand bitumen we consume, the less energy we can extract within our rapidly dwindling carbon emissions budget.

This is, of course, not the way that the Big Oil messaging wishes you to understand this “good news”: “hurray, we have alternative sources of carbon emitting energy which will allow us to avoid a complete lack of supply, at the cost of economic slowdown in the medium term and collapse of industrial civilization over the longer term” is not about to be the topic of a new series of “Energy Happy Talk” advertising from Shell or BP.

“I heard that there was a whole lot of XYZ being discovered/exploited”

Another part of Big Oil’s messaging is “did you hear about this new discovery, the equivalent of big-sounding-numbers}’s of oil? This exploits the public’s difficulty in understanding quantities at the scale of millions and billions, and lack of background context as far as how much we are currently using, and how much we need in new daily production to just keep up with the decline in production from old big fields that are long past their prime.

Another part of Big Oil’s messaging is “did you hear about this new discovery, the equivalent of big-sounding-numbers}’s of oil? This exploits the public’s difficulty in understanding quantities at the scale of millions and billions, and lack of background context as far as how much we are currently using, and how much we need in new daily production to just keep up with the decline in production from old big fields that are long past their prime.

Dr. Miller puts some of these into context for us, not just in that quote above, were the annual production decline of 4.1% is highlighted, but also with respect to the “shale oil” bonanza:

Although he is dismissive of shale oil and gas’ capacity to prevent a peak and subsequent long decline in global oil production, Miller recognises that there is still some leeway that could bring significant, if temporary dividends for US economic growth – though only as “a relatively short-lived phenomenon”:

“We’re like a cage of lab rats that have eaten all the cornflakes and discovered that you can eat the cardboard packets too. Yes, we can, but… Tight oil may reach 5 or even 6 million b/d in the US, which will hugely help the US economy, along with shale gas. Shale resources, though, are inappropriate for more densely populated countries like the UK, because the industrialisation of the countryside affects far more people (with far less access to alternative natural space), and the economic benefits are spread more thinly across more people. Tight oil production in the US is likely to peak before 2020. There absolutely will not be enough tight oil production to replace the US’ current 9 million b/d of imports.”

We cannot get to energy independence on the back of shale-oil production, which is likely to peak at 2/3 of current imports … and even if we could, shale-oil production is not like conventional oil production:

“Greater reliance upon tight oil resources produced using hydraulic fracturing will exacerbate any rising trend in global average decline rates, since these wells have no plateau and decline extremely fast – for example, by 90% or more in the first 5 years.”

So if we elect to go pedal to the metal in shale-oil production, when it in turn peaks, the rate of decline in production will be even more rapid than the rate of decline in conventional oil production, which will itself be accelerating by 2020.

Peak Oil Is Real. In All Likelihood, the Peak is In Our Rear View Mirror

In less than a decade, the floor falls out from under the whole petroleum-addiction economic system, even if we scrape the bottom of the barrel with shale-oil production as aggressively as we can. And meanwhile, the flood of money from shale-oil production will continue to flow into our political system over the political cycles between now and then, helping to elect representatives willing to sell out their constituents future for a small piece of that money, sheltered by the convenient fictions crafted by the Big Oil messaging machine.

In less than a decade, the floor falls out from under the whole petroleum-addiction economic system, even if we scrape the bottom of the barrel with shale-oil production as aggressively as we can. And meanwhile, the flood of money from shale-oil production will continue to flow into our political system over the political cycles between now and then, helping to elect representatives willing to sell out their constituents future for a small piece of that money, sheltered by the convenient fictions crafted by the Big Oil messaging machine.

Indeed, the odds are quite high that both candidates in the next Presidential General Election will be at least partly bought and paid for by petroleum-pusher money, to continue the petroleum-pusher policies of the Reagan, George HW Bush, Clinton, George W Bush and Obama administrations.

That suggests to me that those of use who do not wish to see the US economy placed in the rack of oil price shocks in the 20’s followed by our collapse as an industrial economy under the weight of climate chaos by the 50’s or 60’s have to focus below the level of Presidential politics, at the Congressional level and further down into the State Legislatures, Municipal and County governments with zoning authority and, yes, local School Boards to stand up against already-established Big-Oil funded efforts to spread their propaganda among our children.

Conclusions & Considerations

Now, that is what I am expecting regarding the bruising political fights ahead. for. What are you expecting to see?

As always, rather looking for a more ringing conclusion that that, I now open the floor to the comments of those reading.

If you have an issue on some other area of sustainable transport or sustainable energy production, please feel free to start a new main comment. To avoid confusing me, given my tendency to filter comments through the topic of this week’s Sunday Train, feel free to use the shorthand “NT:” in the subject line when introducing this kind of new topic.

If you have a topic in sustainable transport or energy that you want me to take a look at in the coming month, be sure to include that as well.

And no need to introduce yourself or justify your participation first: just jump right in and start participating. Your presence here is sufficient justification.

1 comment

Author