(4 pm. – promoted by ek hornbeck)

But the efficiency gains of electric traction are only half of the story for sustainable transport, since its not fully sustainable unless that electricity is generated in a sustainable way.

And when following online discussion of renewable energy at the Energy Collective, which attracts both advocates for and detractors of investment in renewable energy resources, a perennial source of ammunition for attacks on renewable energy are the challenges of meeting demand for electricity with the harvest of a variable source of energy that is available on its own schedule, and not ours.

This is a topic I have touched on before (cf , ), Inspired by the article at the Energy Collective: Will Natural Gas Peaker Plants Become Obsolete?, I am coming back to today. What I want to focus on today is the opportunities offered by dispatchable demand for better integration of variable renewable energy. And I would be happy if you would join me to discuss this topic (or any other topic involving sustainable transport), below the fold.

Terms of discussion

The discussion of variable renewable energy as a sustainable source of energy brings together the language of resource economics, the language of ecological economics, the language of management of electricity systems by utility companies, and the language of the management of liquid and gas fuel supply systems by companies supplying petroleum and/or natural gas products. Also (by observation) it also invites substantial invention of terminology that attempts to emotionally beg the question (that is, build the conclusion into the assumptions) by making the pro- position of the commentator sound “nice” and the anti- position of the commentator sound “nasty”.

First, a term that we often take from either resource economics or ecological economics without thinking much about it: resource. An resource is a source or a supply from which a benefit is produced. So an economic resource is a source or supply from which an economic benefit is produced. An ecological resource is a source or supply from which an ecological benefit is produced. A commercial resource is a source or supply from which a commercial benefit is produced.

Our economies are embedded in ecosystems, so economic resources are a subset of ecological resources. And sometimes an existing market price that helps determine commercial benefit is a lie, so sometimes economic resources are not commercial resources … and commercial resources are not economic resources.

Note that sometimes use of these terms will confuse commercial benefit as always implying an economic benefit, or an actual “full cost” economic benefit as somehow being separate from ecological benefit. I try to avoid those mistakes (including below).

I will also direct your attention to the fact that, above, I have been calling variable renewable energy “variable”, and not “intermittent”. The most obvious connotation of “intermittent” is “on again, off again”, so “intermittent energy” brings our focus on the shut down of an energy supply. The most obvious intermittence in renewable energy is solar photovoltaic (PV), where energy is generated as the sun shines on the panel, so when the sun goes down, the supply stops.

But, as implied in another Energy Collective article, No Fuel Costs: The Sexy Seduction of Renewables, most variable renewable have little or no incremental cost of supplying electricity to the grid, when the renewable energy is available to be harvested. So an economically sensible plan does not pick and choose between which variable renewable energy to use: it uses all available.

That means that its not the availability of a single source that is critical, but the total availability. And when you add together variable renewable energy resources, the hours of the day when there is none available starts to drop. Pacific Northwest wind is very intermittent. Western Great Lakes wind is less intermittent. Northern Great Plains wind is much less intermittent. Northern Great Plains solar is very intermittent, with great seasonal swings. But add them all together, and most of the hours that neither Pacific Northwest wind, Northern Great Plains wind and western Great Lakes wind is not producing are hot, still, summer days when Northern Great Plains solar is very productive.

So actual intermittence of the total renewable energy portfolio may go away when you have enough diversity of types of supply and supply regions in the portfolio. However, variability does not go away. The total supply will still swing up and down … partly predictably (we know that weather systems are likely to be coming through, we know that the sun will rise and set), and partly unpredictably.

My preference for “variable renewables” is reinforced by the number of times that I encounter “intermittent renewables” by people who really do mean, “the sun goes down, therefore the cost of solar power has to include enough storage to turn it into baseload power”, which typically results in totally bogus estimates of renewable energy cost, in support of a pre-ordained conclusion in favor of some other energy source.

Our Traditional Coping with Variability

Our electricity supply system is designed to cope with variability. But the primary focus of this is to copy with variability of demand … variability in “the load”. As discussed in more detail in Sunday Train: The Myth of Baseload Power, load can be divided between the load we can expect will occur with some confidence, and the balance of the load that is unexpected. {Image to right by (C) Matthew D. Wilson, Creative Commons Share-alike with attribution, from Wikimedia}

Our electricity supply system is designed to cope with variability. But the primary focus of this is to copy with variability of demand … variability in “the load”. As discussed in more detail in Sunday Train: The Myth of Baseload Power, load can be divided between the load we can expect will occur with some confidence, and the balance of the load that is unexpected. {Image to right by (C) Matthew D. Wilson, Creative Commons Share-alike with attribution, from Wikimedia}

With an electricity supply system that is primarily based on fueled power, we often have the following situation:

- There is a generator with less expensive fuel costs, but it has higher capital cost (cost of plant and equipment)

- There is a generator with more expensive fuel costs, but lower capital costs

… and the reason we see that so often is that generators with both higher fuel costs and higher capital costs are more expensive source of electricity in all circumstances, so we knew that in advance, we just wouldn’t build them.

When we have that situation, it makes sense to split total expected demand for electricity into “baseload”, provided for 24hrs by the high fixed cost, low fuel cost generator, and “load following”, provided to meet the part of the expected load that the “baseload” plant does not offer.

This cost ladder may extend to three rungs, if there is a very low capital cost generator, with the highest fuel costs, and a generator that is “in the middle” for both capital costs and fuel costs. Then we have “baseload power”, and a second type of generator we bring on whenever load is above the “baseload”, and a third type of generator we bring on “to handle demand peaks”.

People often treat “baseload demand” and “load-following demand” as if they are two different categories of demand … but in reality, the split is projected onto the expected demand for electricity by the economics of fueled power plants.

Of course, much of our “baseload power” supply in the United States is from coal fired power plants. But if we charged coal power the full cost of CO2 emissions, it would lose that status, because the fuel cost of coal would rise to be higher than the cost of natural gas even under normal natural gas prices, so we would always turn on Natural Gas Combined Cycle (NGCC) generators before turning to coal power.

This would have consequences for how we cope with variable loads. Between the load that we can expect with confidence and the load that the grid experiences is a margin of unpredictable load. And since NGCC works better as “load-following” generation than coal does, it seems likely that coal plants would shut down.

The economic driving force for using something as a baseload generator is its lower fuel cost. But this also means that we tend to use the same plants at the “opposite end” of spectrum. One way to cope with unexpected changes in demand is to have fueled power plants that are up and running, and operating at less than full load, so that when additional supply is needed at short notice, you can increase the load that is placed on them. This is reserve electricity supply. When the reserve is in the form of generator turbines that are kept running faster than required to generate the load being place on them, and with an ability to quickly ramp up the amount of fuel being burned, that is “spinning reserve”. The cost of the reserve is the cost of the fuel wasted by operating turbine generators as spinning reserve.

Cheaper fuel costs confer an economic advantage in offering spinning reserve, so the same power plants that sell “baseload power” also often sell into markets for “reserve power”. And so charging the full economic cost of fossil-fuel would not just kill the economics of much of our “baseload power” supply … it would change the economics of providing “reserve power”

Providing Reserve Power in an Advanced Energy Economy

This is a challenge that must be addressed as we transition away from fossil fueled electricity generation to low and no carbon electricity. It is not a show stopper, since fueled spinning reserve is not the only spinning reserve, and spinning reserve is not the only way to provide reserve … but it is a challenge.

This is a challenge that must be addressed as we transition away from fossil fueled electricity generation to low and no carbon electricity. It is not a show stopper, since fueled spinning reserve is not the only spinning reserve, and spinning reserve is not the only way to provide reserve … but it is a challenge.

One part of our spinning reserve will be available dammed hydro power … and, indeed, as we increase the effective fuel cost of using fossil fuels for spinning reserve, that will increase the benefit of dammed hydro available as spinning reserve. Using the hydro power as spinning reserve means there is no fuel cost. But we have a given dammed hydro resource, and so the various available uses of that hydro power must be traded off against each other. There will be an optimal amount of dammed hydro power to use as spinning reserves, and in many parts of the country this will be less than the reserve supply that is needed.

Once we are using the optimal amount of dammed hydro for spinning reserve, an alternative to spinning reserves is stored reserves. This comes in many forms:

- For the very highest frequency variability, where the inertia of generating turbines is helping to stabilize the grid, that inertia can be used with a flywheel.

- Battery storage can help cope with fairly high frequency stabilization. Many of the costs of battery storage are driven by the total storage capacity, so the more times that the battery is charged and then discharged per day, the lower the cost of storage per kWh stored.

- Thermal storage is an option where energy is generated from heat, so that the collection or creation of the heat can be separated in time from the use of the heat to generate electricity. This includes applications such as concentrated solar power (CSP), or methane gas combined-cycle (NGCC) generation where the heat from exhaust from a natural gas turbine powers a steam power plant.

- Pumped Hydro Storage (PHS) is hydropower used as a “gravity battery”, where there is a reservoir at the bottom and a reservoir at the top. In storage mode, the turbines are used as pumps to fill the top reservoir, then in generating mode, they are used as generators. The round trip efficiency for modern PHS is about 80%. PHS have low operating cost when operating at “grid scale”, but relatively high capital costs, so the more complete storage cycles per year, the lower their cost per kWh stored.

Storage does not provide reserve by adding new energy, but by time-shifting energy. It stabilizes load by providing a controllable load to store the energy to be used as reserve, and then by providing a controllable source of energy when the reserve is required. This means it allows a better fit between generating capacity and total demand … and in the traditional baseload / load-following / peak system, this means it reduces the need for separate peak supply.

The new area of dispatchable demand does the same thing. The lead-off link above refers to an article about the use of “Nest” thermostats by Austin Energy to monitor energy use, and better anticipate peak demands. The use of “Nest” thermostats led to less energy use during peak electricity periods, so Austin Energy is now offering subsidies for customers that use smart thermostats.

The next step from this is offering to pay people to cut back on electricity usage during peak periods. And this extends past simple energy efficiency to shifting energy consumption away from those peak periods into lower demand periods.

Heating, Ventilation and Air Conditioning (HVAC) applications are a natural starting point, since many are already controlled by a thermostat, so controlling it with a smarter thermostat is a relatively small step, especially if the utility subsidizes its cost. Another natural starting point is electric vehicle charging, since a typical electric car (or e-bike) will charge in less time than the car (or e-bike) sits parked between coming home from work and leaving the next day.

Once a household is plugged into getting electricity discounts through making some of their electricity demands dispatchable, that reduces the hurdle for other, smaller scale dispatchable demands, such as “smart-start” dishwashers or smart thermostat refrigerators, and depending on the price savings could also lead to larger scale dispatchable demands, such as a “heat storage” bank to time shift the energy demand for space heating in and summertime air dehumidifier.

With enough dispatchable demand, we might be able to eliminate the requirement for “peaker” plants entirely. That’s important in its own right. But its even more important in the context of rolling out a high level of renewable energy supply.

Coping With the Variability of Variable Renewables

If we switch our focus from the status quo, largely fossil fueled, electricity supply, to a portfolio of Variable Renewables, the baseload / load-following distinction vanishes.

Start with windpower. Windpower has a relatively high Energy Return on (Energy) Invested (EROI) in the range of 20. It has predicted levelized costs of power (for generating capacity entering service in 2019), according to the EIA (pdf) of $80.30/MWh (Thousand Watt Hours). In terms of full economic costs, this makes it economically less expensive than Natural Gas Combined Cycle, where the levelized cost of NGCC with carbon capture and storage is $91.3/MWh, and much less expensive than coal power, where the levelized cost of integrated gasification coal with carbon capture and storage is $147.40. Its even cheaper than hydropower at $84.50.

And of course, taking the economic cost of Natural Gas and Coal by using the CCS numbers are likely to be generous. Carbon capture and storage technologies being developed do not capture all carbon emissions, so with full cost carbon pricing, there would still be an increase in the net cost of their fuel. And if the cost of CCS is a net after a payment for use of the CO2 in “Enhanced Oil Recovery”, that is a commercial benefit that should actually be counted as an economic cost, which will go away if we decide to leave the grease in the ground. But that is not the topic of tonight’s Sunday Train, so I will leave that to one side.

Since the EIA figures do not give a cost of gas peaker plants with CCS (because the capital costs of CCS would be prohibitive for plants used as little as 5% of the hours of the day), I don’t have a ready-made EIA figure for the cost of peaker natural gas. A very rough estimate based on the EIA figures would be about $132, based on:

- A high enough carbon price to shut down all conventional coal plants in favor of coal-CCS plants

- assumption that Natural Gas emits 57% as much CO2 per kWh as coal

- various simplifying assumptions that should err in the side of reducing the natural gas peaker cost estimate, such as all operating costs as fuel costs, taking bituminous coal for coal CO2 emissions, using a single NG CO2 emissions when peaker emissions would be higher and NGCC lower, etc.

- {… and, of course, this is a shadow price, since unless the carbon pricing also shuts down all Natural Gas peaker plants, its not working.}

So back to wind. Cheapest readily rolled out, mature variable renewable resource out there. So go with wind all the way?

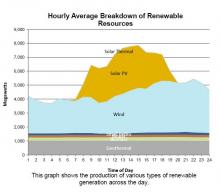

Well, no. Onshore wind tends to be most abundant at night, and least abundant during the day. So the supply offered by a combination of wind and solar is a better fit to normal demand for electricity than either one alone. So a better fit with load is provided by onshore wind plus solar PV.

Suppose the total energy is supplied at a 4:2 ratio (wind:solar), that is an average levelized cost of $97/kWh. This is cheaper than a mix of NGCC-CCS and peaker NG with more than 12% coming from the peaker NG … and does not include any risk of future fuel price increases above the levels allowed for in the EIA cost projection.

But it still does not complete the picture, since installing a combination of wind (and transmission to the areas with the strongest wind resource) and solar so that the maximum expected renewable generation satisfies all load would still mean many hours of the year where renewables generation is less than half of the load.

We can add more varieties of renewable energy to get a better match to demand … but these break down into categories of limited supply and high cost. Run of river hydro, which has levelized costs similar to dammed hydro ($84.50/MWh), also faces substantial resource constraints, so is only able to play a supporting role in the portfolio. Biogas, which is included within the average $102.60 for biomass, has a limited resource from landfill gas, livestock manure treatment, sewage treatment.

By contrast, off-shore wind is an abundant resource in many parts of the US (the Atlantic coast, parts of the Gulf coast, shallower parts of the Great Lakes, and a few regions off the Pacific coast). And off-shore wind make an attractive complement to onshore wind plus solar, since it tends to peak after sunrise, when on-shore wind is typically dropping, and after sunset, when solar PV has dropped off. But it has a predicted EIA levelized cost is $204.10/MWh, so with a 4:2:1 mix of onshore wind : solar : offshore wind, the EIA levelized cost is $112.19/MWh.

To fit the variables renewables into the grid to meet ongoing demand we need some mix of:

- Oversupply and Curtailment. An option that is always available, but at an increasing cost that more it is relied upon, is to deliberately build more capacity than you can use at peak supply, and simply not harvest all the available supply when there is a surplus over demand. This allows you to integrate a larger total supply of renewable energy … but at a higher cost. Spilling 10% of total available windpower means you are paying for 100%, but only using 90%, so the costs will be (100%/90%)=11% higher. This can be effective in relatively small does, but the more it is relied upon, the worse the impact on costs will be: spilling 25% would make the costs 33% higher, and spilling 50% would make the costs 100% higher.

- New dispatchable renewables (or other dispatchable low or no carbon generation). This is particularly important for supply drops that are predicted in advance and for for seasonal variability. A level of variables that peaks around total load during the normal day in the strongest season of variables generation may well fall well short on either an overcast day or in the weakest season of variables generation. And the financing of the other means of coping with variability of renewables supply work best if the amount of mismatch is similar from one day to the next, where scheduling an appropriate amount of dispatchable renewables can bring the (dispatchable+variable) renewables up into this range.

- In terms of renewable energy, this can come from addition of generation capacity to existing hydro reservoirs, new large hydro, and new small hydro, and from biomass energy. Of course, new large hydro is often a fraught political issue in the area that faces being flooded for the reservoir. And existing biomass energy production is often unsustainable, so a strong policy intervention would be required to re-channel biomass energy into a sustainable direction.

- New Storage. This offers an alternative to oversupply and curtailment … oversupply at one time and shift the supply to a different point in time. An important part of encouraging the roll-out of new storage is allowing new storage to be paid for the high frequency services they can provide in stabilizing the grid. Another part is structuring any guaranteed feed-in tarriffs for variable renewables so that they receive a higher price when they are producing within their average yield, and lower prices when they are producing more than their average yield, as total variables supply approaches/exceeds total load.

- Part of the good news here is that battery costs are dropping, so there is a high frequency range of uses with the economic shifting in favor of battery storage reserves even at the current highly subsidized cost of fossil fuel fired spinning reserves. Pumped Hydro Storage is a mature technology, and while the US only has 2.2% of our energy generated by PHS, some countries have substantially higher shares. Japan, for instance, has 19% of its energy generated by PHS. The best locations for PHS in the US that are disconnected from natural rivers and lakes are concentrated in rugged terrain, so opportunities PHS would benefit greatly from the improvements in our transmission system called for by the first Quadrennial Energy Review would substantially improve the opportunities for new PHS projects in the US.

- … And Dispatchable Demand. Just as with storage, the greater the share of the total demand that can be shifted in response to the availability of energy, the more opportunity there is to build out the variable renewables so that their peak yield is greater than total load, with dispatchable demand used to consume energy during those surplus generation periods, while conserving energy during the parts of the day when variables supply is less than total load.

How Dispatchable Demand, Storage, and Curtailment work together

All of these pieces are useful for integration of variable renewables. At low levels of penetration, we can simply treat variable renewables as a subtraction from total load, and rely on existing grid capacity to respond to the demand that is left. But if low levels of variable renewables penetration means that we are continuing to rely primarily on fossil fuels for electricity, then we are toast.

At higher levels of penetration … up to roughly 20% onshore windpower, therefore perhaps up to something like 25% onshore windpower, 10% solar PV and 5% offshore windpower, we can rely on expanding our transmission capacity, using inter-regional trading of power to “smooth out” local swings in consumption and local swings in renewables, along with firming from existing reservoir hydropower resources.

But to go beyond that to an economy based primarily on renewable energy, we can benefit from the way that these work together.

The economics of storage benefits if the storage is used a lot, because you primarily pay for the “ability to store”, and the more times per year that you use the ability to store, the lower the capital cost per kWh stored. So storage and dispatchable demand can work together well:

- Suppose that the dispatchable demand is from a biocoal power plant or a bank of direct carbon fuel cells powered by biocoal. They work at the best efficiency if they are operated at a fairly steady pace.

- So in advance of the time that the load is required, start up the dispatchable demand, and store the energy;

- As load increases, you can vary the amount you store to cope with unexpected changes in net load (load minus variable renewables);

- Then as load increases beyond the capacity of the dispatchable demand, draw power from the storage, varying the draw for the storage in response to unexpected variability in net load;

- Then as load drops back down past the output of the dispatchable demand, continue to produce, storing the surplus;

- That lets operate the dispatchable demand at peak efficiency and then shut it down sooner;

- So the storage may be cycled twice in a single cycle of turning dispatchable demand on and off, and is constantly providing services in stabilizing the grid, both when being charged and when generating power.

What about dispatchable demand? Suppose the dispatchable demand is not there, and the the only options for handling oversupply of variables are storage and curtailment. You use the storage for both small surpluses and large surpluses, and for large surpluses you also curtail output … so the storage gets used more frequently than the curtailment. That is good economics, because frequent use makes storage easier to afford, and the less frequently you use the curtailment, the better the economic performance of the wind turbines and solar panels (and etc.).

Now add a substantial amount of dispatchable demand. Now you can use the storage up to capacity, and past that point you can time-shift demand from high load period to lower load periods, and only when you have “used up” dispatchable demand do you have to curtail. You can let the surplus grow by the amount of dispatchable demand available. That means that the frequency of using the storage goes up further, so its cost per kWh drops. And the frequency of curtailment drops, so the economic performance of the wind turbines and solar panels (and etc.) improves.

If moving to a larger share of renewables would be a good target for the decade ahead, we also need to consider what we need to be doing in this coming decade to be prepared to move further in the decade after that.

And this brings me back to the article on Austin Energy and NEST thermostats. Deborah Lawrence quotes the MIT technological review:

Eventually, the effects of demand response could be profound. Austin’s program is designed to manage demand only during the 50 hours each year when electricity consumption tests the grid’s limits most. But if demand response can expand to cover the 300 or 400 hours of peak usage, it could entirely shut down the market for “peakers,” or gas-fired plants that come online only to sell expensive electricity. “That’s a big chunk of money that’s at stake,” says Tom Osterhus, CEO of Integral Analytics, a Cincinnati-based maker of smart-grid analytics software. “It’s in the billions.”

And that is what puts dispatchable demand into a special category of areas to keep an eye on. In the context of a high penetration roll-out of renewables, the more dispatchable demand capacity we have, the better.

But It doesn’t need that roll-out to get started. It can get started now.

Conclusions and Conversations

![]() So, what do you think? Do you have a preferred mix of variable renewables? Do you have particular renewables that you would rather shy away from?

So, what do you think? Do you have a preferred mix of variable renewables? Do you have particular renewables that you would rather shy away from?

And how worried are you that “Big Data” might use dispatchable demand as an excuse to increase the reach of the Commercial Panopticon?

1 comments

Author

… renewables at an increasing rate, and if they have to curtail some windpower until they finish building the transmission to bring the power to the cities … well, in that case they just curtail the windpower and keep building.

Which is kind of a reminder that it aint just the US making these decisions. If the US doesn’t work out how to catch up on the challenges of running a 21st century energy system, it doesn’t seems likely that the rest of the world will just wait around until we decide to get started.