Author's posts

Jun 07 2012

The European Version of Too Big To Fail

By Peter Spiegel in Brussels, Victor Mallet in Madrid and Ralph Atkins in Frankfurt

European officials are weighing up a bailout programme for Spain that would aid its fragile domestic banking sector while imposing only “very limited conditionality” on Madrid, a concession that could make a reluctant Spanish government more willing to accept international assistance.

Unlike earlier bailouts for Greece, Portugal and Ireland, the proposed Spanish rescue would require few austerity measures beyond reforms already agreed with the EU and could even dispense with the close monitoring by international lenders that has proved contentious in Athens and Dublin, according to people familiar with the plans.

EU support would instead be contingent on increased external oversight and accelerated restructuring of the Spanish financial sector to address lingering concerns about political interference and cronyism in the cajas, the regional savings banks that loaded up on questionable real estate loans during the housing bubble.

Mario Draghi, president of the European Central Bank, added to the pressure building on EU and Spanish officials on Wednesday, after he left interest rates unchanged and put the onus to solve the eurozone debt crisis squarely on the continent’s politicians. While saying the ECB stood “ready to act”, Mr Draghi insisted that most of the problems befalling the eurozone have “nothing to do with monetary policy”.

by Nicholas Kulish and Raphael Minder

The question has seemingly become one of when, and not if, Spain’s banks will receive assistance from European countries, with investors on Wednesday predicting an imminent rescue and pushing up stocks and bonds on both sides of the Atlantic.

Spain, the euro zone’s fourth-largest economy, is too big to fail and possibly too big to steamroll, changing the balance of power in negotiations over a bailout. Political leaders in Madrid are insisting that emergency aid to their banks avoid the stigma in capital markets that has hobbled countries like Greece, Portugal and Ireland after accepting tough rescue terms. They are also fighting to slow the pace of austerity and economic change that have pushed those smaller countries into deeper recessions.

Spain has the added advantage of seeking help in a changed political environment in which calls for growth have begun to outweigh German insistence on austerity. Unlike Greece, Spain’s government did not run large budget deficits before the crisis, giving it leverage to argue that European aid to its banks should not come weighed down with a politically delicate loss of decision-making power over its own economic and fiscal policies.

Yves Smith take on what to do about the teetering European Banks:

Although markets reacted as if a deal was imminent, the FT makes it sound as if quite a few details need to be ironed out. And no wonder: the ECB, the one institution that could act unilaterally, has indicated it will only play a limited role and is leery of making long-term loans to Spanish banks or buying their debt. In addition, Spain appears to be taking an unwise posture, of asking for as little money for its banks as it thinks it will need. Rumors from Spanish officials come in at €40 billion, while European officials are looking at numbers more than twice that large. The big rule of fundraising is always raise a good bit more than you think you need in the first round; it will be vastly more expensive if you need to come to the well later.

Given that the shape of a Spanish bank rescue is very much in play, posts by European experts may well influence the outcome. While some of these recommendations might sound like the banking versions of apple pie and motherhood, it’s important to recognize that few of these basic principles have been adopted in recent bailout programs.

Jun 07 2012

On This Day In History June 7

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

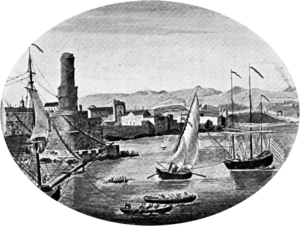

Click on image to enlarge

June 7 is the 158th day of the year (159th in leap years) in the Gregorian calendar. There are 207 days remaining until the end of the year.

On this day in 1692, a massive earthquake devastates the infamous town of Port Royal in Jamaica, killing thousands. The strong tremors, soil liquefaction and a tsunami brought on by the earthquake combined to destroy the entire town.

Port Royal was built on a small island off the coast of Jamaica in the harbor across from present-day Kingston. Many of the buildings where the 6,500 residents lived and worked were constructed right over the water. In the 17th century, Port Royal was known throughout the New World as a headquarters for piracy, smuggling and debauchery. It was described as “most wicked and sinful city in the world” and “one of the lewdest in the Christian world.”

Earthquakes in the area were not uncommon, but were usually rather small. In 1688, a tremor had toppled three homes. But four years later, late in the morning on June 7, three powerful quakes struck Jamaica. A large tsunami hit soon after, putting half of Port Royal under 40 feet of water. The HMS Swan was carried from the harbor and deposited on top of a building on the island. It turned out to be a refuge for survivors.

Port Royal provided a safe harbour initially for privateers and subsequently for pirates plying the shipping lanes to and from Spain and Panama. Buccaneers found Port Royal appealing for several reasons. Its proximity to trade routes allowed them easy access to prey, but the most important advantage was the port’s proximity to several of the only safe passages or straits giving access to the Spanish Main from the Atlantic. The harbour was large enough to accommodate their ships and provided a place to careen and repair these vessels. It was also ideally situated for launching raids on Spanish settlements. From Port Royal, Henry Morgan attacked Panama, Portobello, and Maracaibo. Roche Brasiliano, John Davis (buccaneer), and Edward Mansveldt (Mansfield) also came to Port Royal.

Since the English lacked sufficient troops to prevent either the Spanish or French from seizing it, the Jamaican governors eventually turned to the pirates to defend the city.

By the 1660s, the city had gained a reputation as the Sodom of the New World where most residents were pirates, cutthroats, or prostitutes. When Charles Leslie wrote his history of Jamaica, he included a description of the pirates of Port Royal:

Wine and women drained their wealth to such a degree that… some of them became reduced to beggary. They have been known to spend 2 or 3,000 pieces of eight in one night; and one gave a strumpet 500 to see her naked. They used to buy a pipe of wine, place it in the street, and oblige everyone that passed to drink.

The taverns of Port Royal were known for their excessive consumption of alcohol such that records even exist of the wild animals of the area partaking in the debauchery. During a passing visit, famous Dutch explorer Jan van Riebeeck is said to have described the scenes:

The parrots of Port Royal gather to drink from the large stocks of ale with just as much alacrity as the drunks that frequent the taverns that serve it.

There is even speculation in pirate folklore that the infamous Blackbeard met a howler monkey while at leisure in a Port Royal alehouse whom he named Jefferson and formed a strong bond with during the expedition to the island of New Providence. Port Royal benefited from this lively, glamorous infamy and grew to be one of the two largest towns and the most economically important port in the English colonies. At the height of its popularity, the city had one drinking house for every ten residents. In July 1661 alone, forty new licenses were granted to taverns. During a twenty-year period that ended in 1692, nearly 6,500 people lived in Port Royal. In addition to prostitutes and buccaneers, there were four goldsmiths, forty-four tavern keepers, and a variety of artisans and merchants who lived in 2000 buildings crammed into 51 acres of real estate. 213 ships visited the seaport in 1688. The city’s wealth was so great that coins were preferred for payment rather than the more common system of bartering goods for services.

Following Henry Morgan’s appointment as lieutenant governor, Port Royal began to change. Pirates were no longer needed to defend the city. The selling of slaves took on greater importance. Upstanding citizens disliked the reputation the city had acquired. In 1687, Jamaica passed anti-piracy laws. Instead of being a safe haven for pirates, Port Royal became noted as their place of execution. Gallows Point welcomed many to their death, including Charles Vane and Calico Jack, who were hanged in 1720. Two years later, forty-one pirates met their death in one month.

Although a work of historical fiction, James Michener’s The Caribbean details the history, atmosphere and geography of Port Royal accurately.

Jun 06 2012

Punting the Pundits

“Punting the Pundits” is an Open Thread. It is a selection of editorials and opinions from around the news medium and the internet blogs. The intent is to provide a forum for your reactions and opinions, not just to the opinions presented, but to what ever you find important.

Thanks to ek hornbeck, click on the link and you can access all the past “Punting the Pundits”.

Wednesday is Ladies’ Day

Follow us on Twitter @StarsHollowGzt

Margaret Kimberley: Freedom Rider: Criminal Injustice System

If police states are ranked by the number of persons imprisoned, then the U.S. is the world’s worst and biggest police state. The system runs on greed and racism. “Being ‘tough on crime’ is a metaphor for keeping black people under control.” It is a place where being a “big black guy” means conviction, and where “prosecutors routinely overcharge defendants with long sentences, and force innocent people to plead guilty in order to avoid decades behind bars.”

There are so many things amiss in the United States that one hardly knows where to begin discussing them all. Yet of all the calamitous situations faced by Americans, the cruelest by far is the criminal justice system. America is the world’s prison capital, and just one state, Louisiana, has an incarceration rate 13 times higher than China’s and 5 times higher than Iran’s.

Bryce Covert: How the Paycheck Fairness Act Can Help Democrats Win Elections for Years to Come

The latest shot across the bow in the battle for women’s hearts and votes: a push for the passage of the Paycheck Fairness Act. The Senate will begin debate on the bill later today now that it’s back in session, with a vote lined up for tomorrow. The bill is expected to fail, and it looked even more doomed after the House voted not to consider it on Thursday. Yet this bill doesn’t just make policy sense for all the women earning less than their male counterparts. It makes political sense for Democrats, giving women a reason to head to the polls and, perhaps more important, more financial firepower to spend on political campaigns for years to come.

The act is undoubtedly sound policy. The gender wage gap has barely budged in recent decades, and the bill aims to help reduce it by protecting workers from retaliation if they compare wages. The Institute for Women’s Policy Research has found that nearly half of all workers are either forbidden or strongly discouraged from sharing that information, yet “pay secrecy makes it difficult for women and men to find out whether they are paid fairly, and undermines attempts to reduce the gender wage gap.” As Irin Carmon wrote last week, this secrecy is likely a root cause of the lack of pay discrimination cases brought against employers. It may be illegal to pay women differently for the same work, but they’ll be in the dark about what’s going on unless they can compare their pay to their coworkers’.

It’s hard to say what is weirder:

A Sister of Mercy writing about the Kama Sutra, sexual desire and “our yearnings for pleasure.”

Or the Vatican getting so hot and bothered about the academic treatise on sexuality that the pope censures it, causing it to shoot from obscurity to the top tier of Amazon.com’s best-seller list six years after it was published.

Just the latest chapter in the Vatican’s thuggish crusade to push American nuns – and all Catholic women – back into moldy subservience.

Even for a church that moves glacially, this was classic. “Just Love: a Framework for Christian Sexual Ethics,” by Sister Margaret Farley – a 77-year-old professor emeritus at Yale’s Divinity School, a past president of the Catholic Theological Society of America and an award-winning scholar – came out in 2006.

Michelle Chen: Unwelcome Guests: Work Visa Programs Cheat Global Labor, Build Global Capital

When immigration comes up in Washington, politicians either politely ignore the issue or engage in lively debate on how best to punish and get rid of undocumented workers. Yet lawmakers give a strikingly warm embrace to certain types of immigrants. Those are the “legal” ones who enter with special visas under the pretext of having special skills or filling certain labor shortages–like Silicon Valley tech jobs or seasonal blueberry harvesting. So what makes one kind of immigrant valuable and another kind criminal?

So-called guestworker programs attest to the arbitrary politics of immigration that has generated a perfectly legal, global traffic in migrant labor. A new report by the advocacy group Global Workers Justice Alliance reveals how various federal visa programs funnel workers into special high-demand sectors, like amusement park staff or computer programmers. Like their “illegal” counterparts, these workers are inherently disempowered: they may be dependent on employers for legal status in the U.S., have their wages regularly stolen, or suffer sexual or physical abuse. Many lack the access to the health care and overtime pay that citizen workers often take for granted. As products of globalization, they’re sometimes compelled to endure virtual indentured servitude to provide critical wage remittances to their families back home.

The economic logic is simple, according to the report: externalize the costs to those who can’t afford to challenge authority.

Liz Dwyer: American Students Need to Copy Canada’s Tuition Protests

In the past four months, the Canadian province of Quebec has become a hotbed of Occupy Wall Street-style protests-marches with hundreds of thousands of protesters, and battles with tear gas throwing, pepper-spraying police. And it all started over proposed tuition increases at Quebec’s public universities.

Indeed the Quebec Spring first blossomed in February when the government proposed hiking tuition from $2,168 to $3,793 over the next five years. Thousands of students went on strike and the government, led by Premier Jean Charest, decided to play hardball and crack down with the now-infamous Bill 78, a law that limits protest rights.

Since then the protests and student boycotts have only grown. Nearly 200,000 students across the province have gone on strike. And the situation has revealed deeper frustrations with the government’s willingness to bail out businesses but not help the average student-or citizen. On May 22nd nearly 400,000 people-a full quarter of Montreal’s residents-participated in a protest march.

Susan Casey-Lefkowitz: Black Out, Speak Out: Canadians Protest War on Nature and Democracy

After the fall of the Berlin wall, I worked with environmental groups in Eastern Europe. They were looking at good examples of democracy and free speech from around the world to help build their own democratic societies. Canadian freedom of speech, respect for environmental laws, and ability of the public to participate in decision-making was a shining model. Over the last decade that I have worked with partners in Canada how things have changed. I have seen firsthand how the expanding tar sands bubble in Alberta has not only skewed the economy of Canada, but also pushed the government, environmental laws and even free speech and democracy to bow to the oil industry. Today NRDC will black out our webpage – along with hundreds of other groups across North America – to speak out and protest what in Canada has become an all out attack on democracy and nature in order to safeguard the interests of the tar sands oil industry. See, Black Out, Speak Out in Canada for more. Tar sands oil is expensive and puts us all on a path of worsening climate change at a time when people across America are suffering from unusual heat, floods, tornados and other extreme weather. When tar sands starts to take away basic individual rights, it is past time to call a halt and focus on cleaner forms of energy.

Jun 06 2012

On This Day In History June 6

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

Click on image to enlarge

June 6 is the 157th day of the year (158th in leap years) in the Gregorian calendar. There are 208 days remaining until the end of the year.

On this day in 1933, eager motorists park their automobiles on the grounds of Park-In Theaters, the first-ever drive-in movie theater, located on Crescent Boulevard in Camden, New Jersey.

The drive-in theater was the creation of Camden, New Jersey, chemical company magnate Richard M. Hollingshead, Jr., whose family owned and operated the R.M. Hollingshead Corporation chemical plant in Camden. In 1932, Hollingshead conducted outdoor theater tests in his driveway at 212 Thomas Avenue in Riverton. After nailing a screen to trees in his backyard, he set a 1928 Kodak projector on the hood of his car and put a radio behind the screen, testing different sound levels with his car windows down and up. Blocks under vehicles in the driveway enabled him to determine the size and spacing of ramps so all automobiles could have a clear view of the screen. Following these experiments, he applied August 6, 1932, for a patent of his invention, and he was given U.S. Patent 1,909,537 on May 16, 1933. That patent was declared invalid 17 years later by the Delaware District Court.

Hollingshead’s drive-in opened in New Jersey June 6, 1933, on Admiral Wilson Boulevard at the Airport Circle in Pennsauken, a short distance from Cooper River Park. It offered 500 slots and a 40 by 50 ft (12 by 15 m) screen. He advertised his drive-in theater with the slogan, “The whole family is welcome, regardless of how noisy the children are.” (The first film shown was the Adolphe Menjou film Wife Beware.) The facility only operated three years, but during that time the concept caught on in other states. The April 15, 1934, opening of Shankweiler’s Auto Park in Orefield, Pennsylvania, was followed by Galveston’s Drive-In Short Reel Theater (July 5, 1934), the Pico in Los Angeles (September 9, 1934) and the Weymouth Drive-In Theatre in Weymouth, Massachusetts (May 6, 1936). In 1937, three more opened in Ohio, Massachusetts and Rhode Island, with another 12 during 1938 and 1939 in California, Florida, Maine, Maryland, Massachusetts, Michigan, New York, Texas and Virginia. Michigan’s first drive-in was the Eastside, which opened May 26, 1938, in Harper Woods near Detroit.

Early drive-in theaters had to deal with noise pollution issues. The original Hollingshead drive-in had speakers installed on the tower itself which caused a sound delay affecting patrons at the rear of the drive-in’s field. Attempts at outdoor speakers next to the vehicle did not produce satisfactory results. In 1941, RCA introduced in-car speakers with individual volume controls which solved the noise pollution issue and provided satisfactory sound to drive-in patrons.

Jun 06 2012

Against Their Own Best Interests

Last week the Irish voted against their own (s)elf interest, which according to Yanis Varoufakis, professor of economics at the University of Athens, when they “voted in favour of the EU’s fiscal compact which specifies that which is both impossible to attain and catastrophic if it is attained“:

So, why did the Fine Gael-led Dublin government push so powerfully in favour of this piece of crippling idiocy? And why did the smart, decent Irish voters said Yes, despite their tradition of saying No to euro-silliness? The answer is simple: They were blackmailed. Ireland’s voters were told: Vote No and the flow of money from the troika will cease. And so they voted Yes, even though I suspect that no government minister, no rank and file Fine Gael or Labour Party member, no man or woman on the street believes that the Fiscal Compact they voted for makes sense. [..]

If on 17th June Greeks voted like the Irish did last week (that is, against their reasoning and guided by fear and blackmail), the Eurozone will become history, with terrible consequences for the global economy. This is not the case of the Philosopher Kings blackmailing the plebs to do what is right. This is the case of ‘madmen in authority’, to quote Keynes, who are not only steering the vessel toward the rocks but who are, in the process, punching holes in the life vests that may carry us to safety once the shipwreck is complete. [..]

To conclude, Europe’s peoples are being marched into a catastrophe. They know that this is their predicament. They can see their march is leading them off a mighty cliff. But they are too afraid to veer off, in case there are beaten back into line, in case they get lost in the woods, for reasons that sheep know best. However, the only way this hideous march can end is if someone summons up the courage and does it. And steps out, showing the others that this march can stop and must stop – for everyone’s benefit. Who is that someone? We, Europeans, do not have many options. As I wrote above, the Irish people had a chance but did not take it. In two weeks, the Greeks have their chance. Voting for Syriza would offer us (and by ‘us’ I mean all Europeans) a chance of this circuit-breaker. A chance to say: Enough! Time to change course in order to save the Eurozone, so as to prevent the Great Postmodern Depression which lurks once the euro-system fragments formally.

Varoufakis gives his reasons for supporting Sariza: first, that Sariza is the only party that understands that Greece needs to stay in the EuroZone and that the Eurozone won’t survive if it doesn’t give up austerity; second, the economic team that will negotiate on Greece’s behalf are good and persuasive with a clear understanding of the situation; and third, Syriza will not be the sole arbiter of the Greek government. It will be a coalition, so there is no need to fear the party’s extreme leftism.

I hope the Greeks’ come to their senses unlike the Irish and Wisconsins.

Jun 06 2012

What Is Wrong With Wisconsin?

MSNBC and other news outlets are calling the Wisconsin recall of Republican Governor Scott Walker for Gov. Walker.

Scott Walker, the embattled Republican governor of Wisconsin, narrowly survived a recall vote on Tuesday, defeating a union-led effort to remove him from office for pushing laws to restrict the collective bargaining rights of state workers.

The state’s labor movement had marshaled widespread anger earlier this year to force a recall vote just two years into Mr. Walker’s four-year term. Democrats collected close to one million signatures in the petition drive to oust him.

That effort led to the closely-watched rematch between Mr. Walker and the Democratic opponent he beat in 2010, Tom Barrett, the mayor of Milwaukee. In the voting Tuesday, Mr. Walker once again bested Mr. Barrett for the state’s top job.

The results were a victory for the national Republican Party and conservative groups from around the country, which had rallied behind Mr. Walker with tens of millions of dollars. Mr. Walker will now complete his term.

Unless, he’s indicted.

Jun 05 2012

Punting the Pundits

“Punting the Pundits” is an Open Thread. It is a selection of editorials and opinions from around the news medium and the internet blogs. The intent is to provide a forum for your reactions and opinions, not just to the opinions presented, but to what ever you find important.

Thanks to ek hornbeck, click on the link and you can access all the past “Punting the Pundits”.

Follow us on Twitter @StarsHollowGzt

Richard (RJ) Eskow: “Middle-Class Millionaires”? Dissecting a Democrat’s Misguided Move

Once again, a Democrat’s letting the Right set the terms of the debate. This time it’s House Minority Leader Nancy Pelosi, who’s undercutting her party’s tax policy in an odd way: by redefining “middle class” so that it includes people making a million dollars a year.

Pelosi’s proposal would be great for millionaires — and bad for everyone else.

It hurts the nation economically by depriving the government of revenue when it should be providing more stimulus funding. It also muddies her party’s messaging, and reinforces the unpatriotic idea that taxes are punishment rather than a fair exchange. Nancy Pelosi is better than this.

Robert Kuttner: Can Merkel Be Moved?

Berlin — Ever since the march to European union began in the late 1940s, French-German collaboration has been at the heart of the project. Until the recent defeat of French President Nicolas Sarkozy, his close alliance with German Chancellor Angela Merkel continued this tradition, albeit on behalf of policies that have driven Europe deeper into depression and inflicted brutal austerity on smaller nations such as Greece and Portugal.

With the May 6 election of French Socialist Francois Hollande on an anti-austerity program, Paris and Berlin are now at odds. If a Social Democratic-Green coalition wins next year’s German elections, expected in September 2013, that would create a progressive Paris-Berlin axis.

There are, however, two huge problems. September 2013 is an eternity away and the European project could go up in smoke in the meantime. The other problem is German public opinion.

Last week’s May jobs numbers were bad news, regardless of how you look at them. Job growth over the last three months has averaged slightly less 100,000 a month, roughly the pace needed to keep pace with labor force growth. The unemployment rate ticked up to 8.2% and the employment to population ratio is still just 0.4 percentage points above its trough for the downturn. And real wages almost certainly declined in May.

However bad this story is, the usual gang of pundits cited in the media had their usual burst of over-reaction. There were many talking of a worldwide slowdown and a possible recession. This is a serious misreading of the jobs report and other recent economic data.

The main story of the apparent weakness of the last three months is the apparent strength of the prior three months. In other words, the story is still the weather. The relatively strong growth in jobs and other measures that was the result of a relatively mild winter meant that we would see weaker growth than normal in the spring.

Chris Hedges: Northern Light

I gave a talk last week at Canada’s Wilfrid Laurier University to the Congress of the Humanities and Social Sciences. Many in the audience had pinned small red squares of felt to their clothing. The carre rouge, or red square, has become the Canadian symbol of revolt. It comes from the French phrase carrement dans le rouge, or “squarely in the red,” referring to those crushed by debt.

The streets of Montreal are clogged nightly with as many as 100,000 protesters banging pots and pans and demanding that the old systems of power be replaced. The mass student strike in Quebec, the longest and largest student protest in Canadian history, began over the announcement of tuition hikes and has metamorphosed into what must swiftly build in the United States-a broad popular uprising. The debt obligation of Canadian university students, even with Quebec’s proposed 82 percent tuition hike over several years, is dwarfed by the huge university fees and the $1 trillion of debt faced by U.S. college students. The Canadian students have gathered widespread support because they linked their tuition protests to Quebec’s call for higher fees for health care, the firing of public sector employees, the closure of factories, the corporate exploitation of natural resources, new restrictions on union organizing, and an announced increase in the retirement age. Crowds in Montreal, now counting 110 days of protests, chant “On ne lâche pas“-“We’re not backing down.”

Bill McKibben: The Planet Wreckers

First came the giant billboard with Unabomber Ted Kacynzki’s face plastered across it: “I Still Believe in Global Warming. Do You?” Sponsored by the Heartland Institute, the nerve-center of climate-change denial, it was supposed to draw attention to the fact that “the most prominent advocates of global warming aren’t scientists. They are murderers, tyrants, and madmen.” Instead it drew attention to the fact that these guys had over-reached, and with predictable consequences.

A hard-hitting campaign from a new group called Forecast the Facts persuaded many of the corporations backing Heartland to withdraw $825,000 in funding; an entire wing of the Institute, devoted to helping the insurance industry, calved off to form its own nonprofit. Normally friendly politicians like Wisconsin Republican Congressman Jim Sensenbrenner announced that they would boycott the group’s annual conference unless the billboard campaign was ended.

Joe Nocera: Turning Our Backs on Unions

“The Great Divergence” by Timothy Noah is a book about income inequality, and if you’re thinking, “Do we really need another book about income inequality?” the answer is yes. We need this one.

It stands out in part because Noah, a columnist for The New Republic, is not content to simply shake his fists at the heavens in anger. He spends exactly one chapter on what he calls the “rise of the stinking rich” – that is, the explosion in executive pay and what he calls “the financialization of the economy,” which has enriched one small segment of society at the expense of everyone else.

Mostly, he grapples with the deep, hard-to-tickle-out reasons that the gap between the rich and the middle class in the United States has widened to such alarming proportions. How much have technological advances contributed to income inequality? Globalization and off-shoring? The necessity of having a college education to land a decent-paying job? The decline of labor unions?

Wendell Potter: Guess Who Would Benefit From Privatizing Medicare?

If you think the idea of privatizing Medicare has gone away, that the health insurance industry has thrown in the towel on one of its biggest goals, there was fresh evidence last week that you would be wrong.

As I wrote more than a year ago — when Rep. Paul Ryan (R.-Wis.) unveiled his plan to replace the Medicare system with one that would essentially be run by private insurers — Democrats would be foolish to think that Ryan couldn’t get the public to support the concept. I noted then that insurers would be investing heavily in efforts to convince people that Ryan’s plan represented the only way to save the Medicare program from insolvency.

One of the tried-and-true tactics insurers have used many times to influence public opinion is the enlistment of “third-party advocates” to disseminate industry talking points. Last week an industry friend in high places — Thomas Scully, who headed the Medicare program during much of the George W. Bush administration — weighed in on the matter. It is only a matter of time, Scully told Kaiser Health News, before politicians on both sides of the aisle endorse Ryan’s proposal of providing Medicare beneficiaries with a set amount of money every year to buy coverage from private insurers.

Jun 05 2012

The Megabank Fantasy By The FDIC

After the latest gambling losses by JP Morgan Chase with its “London Whale” deal, the FDIC is still trying to sell the fantasy that they can resolve the problems created by the megabanks. Yves Smith at naked capitalism takes on that myth that was propagated by acting FDIC Chairman, Martin Gruenberg to continue with business as usual:

The guts of the latest FDIC scheme is to resolve only the holding company and keep the healthy subsidiaries, including all foreign subsidiaries, going on a business-as-usual basis:

…the most promising resolution strategy from our point view will be to place the parent company into receivership and to pass its assets, principally investments in its subsidiaries, to a newly created bridge holding company. This will allow subsidiaries that are equity solvent and contribute to the franchise value of the firm to remain open and avoid the disruption that would likely accompany their closings. Because these subsidiaries will remain open and operating as going-concern counterparties, we expect that qualified financial contracts will continue to function normally as the termination, netting and liquidation will be minimal.

The subsidiaries would be moved over to a new holding company; the equity in NewCo would become an asset of the holding company now in receivership. The old equityholders would likely be wiped out and the bondholders may wind up taking losses.

This all sounds wonderfully tidy and neat, right? Problem is it won’t work. [..]

Remember that in the US, banks (ex Morgan Stanley) have their derivatives booked in the depositary, which means any losses to depositors as a result of derivatives positions gone bad would be borne by taxpayers. And as we’ve written at excruciating length with respect to the Lehman bankruptcy, the magnitude of the losses cannot be explained by overvalued assets plus the costs resulting from the disorderly collapse. Derivatives positions blowing out (as well as counterparties taking advantage of options in how contracts can be closed out and valued) were a major contributor to the size of the Lehman black hole. [..]

It would have been much better for the authorities to make a full bore effort to discourage the use of products that have limited social value and contribute to the excessive integration of firms and markets. Credit default swaps and complex over-the-counter derivatives top our list. But despite the severity of the crisis, regulators and politicians were unwilling to challenge the primacy of the bankers, with the result that the FDIC continues to pretend that an inadequate approach like Dodd Frank resolutions will work. With distress in Europe rising and Morgan Stanley looking wobbly, we are likely to see sooner rather than later how much the failure to implement real reforms will cost us all.

If this sounds all too familiar, it’s because this is just a repeat of the old an stale propping up of TBTF that got the economy into this mess in the first place. In other words, the tax payers will foot the bill for the megabanks gambling losses once again. Obama needs a whole new council of economic advisors with people who have better ideas like Paul Krugman and Yves.

Jun 05 2012

On This Day In History June 5

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

Click on image to enlarge

June 5 is the 156th day of the year (157th in leap years) in the Gregorian calendar. There are 209 days remaining until the end of the year

1933, the United States went off the gold standard, a monetary system in which currency is backed by gold, when Congress enacted a joint resolution nullifying the right of creditors to demand payment in gold. The United States had been on a gold standard since 1879, except for an embargo on gold exports during World War I, but bank failures during the Great Depression of the 1930s frightened the public into hoarding gold, making the policy untenable.

Soon after taking office in March 1933, Roosevelt declared a nationwide bank moratorium in order to prevent a run on the banks by consumers lacking confidence in the economy. He also forbade banks to pay out gold or to export it. According to Keynesian economic theory, one of the best ways to fight off an economic downturn is to inflate the money supply. And increasing the amount of gold held by the Federal Reserve would in turn increase its power to inflate the money supply. Facing similar pressures, Britain had dropped the gold standard in 1931, and Roosevelt had taken note.

Prolongation of the Great Depression

Some economic historians, such as American professor Barry Eichengreen, blame the gold standard of the 1920s for prolonging the Great Depression. Others including Federal Reserve Chairman Ben Bernanke and Nobel Prize winning economist Milton Friedman lay the blame at the feet of the Federal Reserve. The gold standard limited the flexibility of central banks’ monetary policy by limiting their ability to expand the money supply, and thus their ability to lower interest rates. In the US, the Federal Reserve was required by law to have 40% gold backing of its Federal Reserve demand notes, and thus, could not expand the money supply beyond what was allowed by the gold reserves held in their vaults.

In the early 1930s, the Federal Reserve defended the fixed price of dollars in respect to the gold standard by raising interest rates, trying to increase the demand for dollars. Its commitment and adherence to the gold standard explain why the U.S. did not engage in expansionary monetary policy. To compete in the international economy, the U.S. maintained high interest rates. This helped attract international investors who bought foreign assets with gold. Higher interest rates intensified the deflationary pressure on the dollar and reduced investment in U.S. banks. Commercial banks also converted Federal Reserve Notes to gold in 1931, reducing the Federal Reserve’s gold reserves, and forcing a corresponding reduction in the amount of Federal Reserve Notes in circulation. This speculative attack on the dollar created a panic in the U.S. banking system. Fearing imminent devaluation of the dollar, many foreign and domestic depositors withdrew funds from U.S. banks to convert them into gold or other assets.

The forced contraction of the money supply caused by people removing funds from the banking system during the bank panics resulted in deflation; and even as nominal interest rates dropped, inflation-adjusted real interest rates remained high, rewarding those that held onto money instead of spending it, causing a further slowdown in the economy. Recovery in the United States was slower than in Britain, in part due to Congressional reluctance to abandon the gold standard and float the U.S. currency as Britain had done.

Congress passed the Gold Reserve Act on 30 January 1934; the measure nationalized all gold by ordering the Federal Reserve banks to turn over their supply to the U.S. Treasury. In return the banks received gold certificates to be used as reserves against deposits and Federal Reserve notes. The act also authorized the president to devalue the gold dollar so that it would have no more than 60 percent of its existing weight. Under this authority the president, on 31 January 1934, fixed the value of the gold dollar at 59.06 cents.

Jun 05 2012

Republicans Off The Track, Democrats Enable Them

Thomas Mann of the Brookings Institution and Norman Ornstein of the American Enterprise Institute make their first appearance on a Sunday news program since the release of their controversial new book, “It’s Even Worse Than It Looks: How the American Constitutional System Collided with the New Politics of Extremism.” Mann and Ornstein talk with Up host Chris Hayes and panelists Michelle Bernard, of the Bernard Center, and MSNBC political analyst Michael Steele talk about what they say is the extreme rightward drift of the Republican Party.

From Raw Story:

Mann explained that the separation of powers provided for by our Constitution deliberately creates a situation in which that Congressional majorities are unable to act without some degree of cooperation with the other party. Now that “one of those political parties has veered off the tracks” and become “aggressively oppositional,” it has many tools available to prevent legislation from being passed or enforced.

Ornstein singled out the filibuster as a large part of the problem, because it is being “used routinely,” even on non-controversial legislation. However, he also pointed to Republicans voting even against their own bills in order to avoid giving President Obama anything that would look like a victory.

The elephant in the room is that ideology and obstruction may now be the norm but the Democrats had the opportunity, and still do, to stop the filibuster in the Senate. Thus, the Democrats become the enablers of bad behavior.

Recent Comments