Author's posts

May 24 2012

On This Day In History May 24

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

May 24 is the 144th day of the year (145th in leap years) in the Gregorian calendar. There are 221 days remaining until the end of the year.

On this day in 1775, John Hancock is elected president of the Second Continental Congress.

ohn Hancock is best known for his large signature on the Declaration of Independence, which he jested the British could read without spectacles. He was serving as president of Congress upon the declaration’s adoption on July 4, 1776, and, as such, was the first member of the Congress to sign the historic document.

John Hancock graduated from Harvard University in 1754 at age 17 and, with the help of a large inherited fortune, established himself as Boston’s leading merchant. The British customs raid on one of Hancock’s ships, the sloop Liberty, in 1768 incited riots so severe that the British army fled the city of Boston to its barracks in Boston Harbor. Boston merchants promptly agreed to a non-importation agreement to protest the British action. Two years later, it was a scuffle between Patriot protestors and British soldiers on Hancock’s wharf that set the stage for the Boston Massacre.

Hancock’s involvement with Samuel Adams and his radical group, the Sons of Liberty, won the wealthy merchant the dubious distinction of being one of only two Patriots-the other being Sam Adams-that the Redcoats marching to Lexington in April 1775 to confiscate Patriot arms were ordered to arrest. When British General Thomas Gage offered amnesty to the colonists holding Boston under siege, he excluded the same two men from his offer.

With the war underway, Hancock made his way to the Continental Congress in Philadelphia with the other Massachusetts delegates. On May 24, 1775, he was unanimously elected President of the Continental Congress, succeeding Peyton Randolph after Henry Middleton declined the nomination. Hancock was a good choice for president for several reasons. He was experienced, having often presided over legislative bodies and town meetings in Massachusetts. His wealth and social standing inspired the confidence of moderate delegates, while his association with Boston radicals made him acceptable to other radicals. His position was somewhat ambiguous, because the role of the president was not fully defined, and it was not clear if Randolph had resigned or was on a leave of absence. Like other presidents of Congress, Hancock’s authority was limited to that of a presiding officer. He also had to handle a great deal of official correspondence, and he found it necessary to hire clerks at his own expense to help with the paperwork.

Hancock was president of Congress when the Declaration of Independence was adopted and signed. He is primarily remembered by Americans for his large, flamboyant signature on the Declaration, so much so that “John Hancock” became, in the United States, an informal synonym for signature. According to legend, Hancock signed his name largely and clearly so that King George could read it without his spectacles, but this fanciful story did not appear until many years later.

May 23 2012

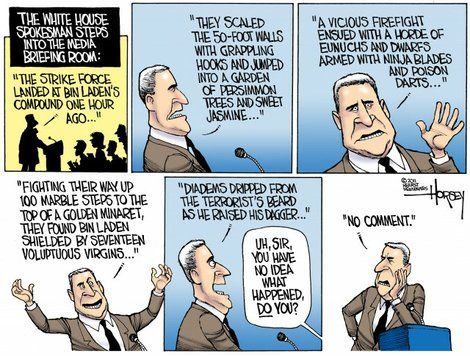

The White House Appoints “Death Sentence Czar”

Meet the new “Death Sentence Czar” appointed by President Barack Obama to choose who will be targeted for assassination by unmanned drone without due process

Meet the new “Death Sentence Czar” appointed by President Barack Obama to choose who will be targeted for assassination by unmanned drone without due process

WASHINGTON-White House counter-terror chief John Brennan has seized the lead in choosing which terrorists will be targeted for drone attacks or raids, establishing a new procedure for both military and CIA targets.

The effort concentrates power over the use of lethal U.S. force outside war zones within one small team at the White House.

The process, which is about a month old, means Brennan’s staff consults with the State Department and other agencies as to who should go on the target list, making the Pentagon’s role less relevant, according to two current and three former U.S. officials aware of the evolution in how the government goes after terrorists.

John Brennan,a top CIA aide to George Tenet during the Bush Administration, was President Obama’s choice for CIA Director. He voluntarily withdrew his name because of the controversy over his support of the Bush policies of the torture of terrorist detainees and the governments extraordinary rendition program. Instead the president appointed Brennan as his counter-terrorism chief and now has put him in charge of killing accused terrorists around the world.

Glenn Greenwald reports that Brennan has been caught lying on a number of occasions about the circumstances surrounding some high profile cases.

{..}including falsely telling the world that Osama bin Laden “engaged in a firefight” with U.S. forces entering his house and “used his wife as a human shield,” and then outright lying when he claimed about the prior year of drone attacks in Pakistan: “there hasn’t been a single collateral death.” Given his history, it is unsurprising that Brennan has been at the heart of many of the administration’s most radical acts, including claiming the power to target American citizens for assassination-by-CIA without due process and the more general policy of secretly targeting people for death by drone.

Brennan will be the sole arbiter of who to recommend to President Obama to target for assassination. No evidence presented in court, no judge, no jury, no chance for the victim to defend himself and in total secrecy It has now become extremely easy to have someone killed, all this under the guise of “Change” with the blessing of the winner of the Nobel Peace Prize.

What is even more disconcerting is the loyalists to this President who defend or conveniently ignore all of the things they decried just a short 4 years ago: Torture, the Patriot Act, warrant-less eavesdropping, rendition, Guantanamo, indefinite detention. All of this is now acceptable under this president. Dick Cheney must be so proud.

N.B. Greenwald provides links to two amazing exchanges by Charles Davis that demonstrate the twisted logic used by Obama fanatics to either justify or ignore Obama’s policies.

May 23 2012

Punting the Pundits

“Punting the Pundits” is an Open Thread. It is a selection of editorials and opinions from around the news medium and the internet blogs. The intent is to provide a forum for your reactions and opinions, not just to the opinions presented, but to what ever you find important.

Thanks to ek hornbeck, click on the link and you can access all the past “Punting the Pundits”.

Follow us on Twitter @StarsHollowGzt

Wednesday is Ladies’ Day

Katrina vanden Huevel: The GOP’s fear-mongering on defense

House Republicans voted last week to break last summer’s deal to raise the debt ceiling and avoid default. “We are here to meet our legal and our moral obligations to lead,” Budget Committee Chairman Paul Ryan (R-Wis.) said of the occasion, without a hint of irony.

The original debt deal required a bipartisan “supercommittee” to find $4 trillion in deficit savings, or “sequestration” would automatically be triggered – an across-the-board cut of $1.2 trillion in each party’s priority: domestic programs and defense. Even under that self-imposed sword of Damocles, Congress failed to do its job, setting the cuts in motion. But House Republicans argued that the requisite cuts to defense funding would harm national security. Take the money from food stamps and health care for the poor, they cried, as they cradled the defense industry in their arms.

Never mind that the Republicans are, as Jon Stewart said, turning a “suicide pact” into a “murder pact.” Is this fear-mongering warranted? Will the looming cuts to the Pentagon’s budget really threaten our security?

Yves Smith: Earth to Dimon: Banks Don’t Have a Right to Profit

Preventing blow-ups like the JPMorgan “hedge” that bears no resemblance to any known hedge isn’t difficult. What makes preventing it difficult is that banks that exist only by virtue of state-granted charters – and more recently, huge transfers from the public – have persuaded public officials and regulators that they have a God-granted right not just to high levels of profit but also high levels of employee and executive compensation.

Banks enjoy state support because they provide essential services, like a payments system and a repository for deposits. One proposal to limit them to these vital services is “narrow banking,” or requiring that deposits be invested in only safe and liquid instruments. This idea was put forward by Irving Fisher and Henry Simons in the 1930s, and has been championed by the right (Milton Friedman), the left (James Tobin) and banking experts (Lowell Bryan of McKinsey). [..]

Maybe it’s time to recognize that these firms are too big and in too many complex businesses to be managed. Jamie Dimon was touted as a star who could supervise a sprawling firm running huge risks, and he fell short because no one can do the job adequately. A less disaster-prone financial system requires more simplicity and redundancy. Re-instituting Glass-Steagall or other variants on the narrow banking theme isn’t a full solution, but it would make for a good start.

Last week, the city of Philadelphia’s school system announced that it expects to close 40 public schools next year, and 64 schools by 2017. The school district expects to lose 40% of its current enrollment, and thousands of experienced, qualified teachers.

But corporate media in other cities made no mention of these massive school closings — nor of those in Chicago, Atlanta, or New York City. Even in the Philadelphia media, the voices of the parents, students and teachers who will suffer were omitted from most accounts.

It’s all about balancing the budgets of cities that have lost revenues from the economic downturn. Supposedly, there is simply no money for the luxury of providing an education for the people.

Where will those children find an education? Where will the teachers find work? Almost certainly in an explosion of private sector “charter schools,” where the quality of education — from the curriculum to books to the food served at lunch — will be sacrificed to the lowest bidder, and teachers’ salaries and benefits will be sacrificed to the profits of the new private owners, who will also eat up many millions of dollars of taxpayer subsidies.

Ilyse Hogue: Et Tu, Cory Booker? The Pathology of False Equivalence

There is a disease spreading across our political punditry, and the beloved mayor of Newark, Cory Booker, seems to have contracted it. On Sunday’s Meet The Press, Booker disavowed the new ad campaign attacking Mitt Romney’s tenure at Bain Capital, and in doing so, compared the Obama team’s decision to air the ads to the right-wing invocation of Reverend Wright to take down the president. Booker released a retraction video hours later, but the incident indicates just how advanced the sickness of false equivalence is in our national dialogue. The plague has now infected a normally sharp public official unlikely to confuse a thinly veiled racist play against the first African-American president with an examination of the economic track record of his challenger. [..]

The problem of false equivalence is so rife in our country that the president dedicated a chunk of his speech at the Associated Press luncheon in April to the issue. While it doesn’t rank explicitly on the list of voter concerns, this habit contributes to the high rates of American distrust in the news media. The American people are smart enough to know when a commentator or anchor holds an opinion and forgiving when this is made apparent. Attempts to cover up personal bias with false equivalence does not make one objective, but it does make one complicit in obscuring the dynamics of that lead to political gridlock and an unresponsive democracy. I’d expect Cory Booker, who’s built his entire political career on being responsive, to be immune to such an affliction.

Ellen Cantarow: How Rural America Got Fracked: The Environmental Nightmare You Know Nothing About

If the world can be seen in a grain of sand, watch out. As Wisconsinites are learning, there’s money (and misery) in sand — and if you’ve got the right kind, an oil company may soon be at your doorstep.March in Wisconsin used to mean snow on the ground, temperatures so cold that farmers worried about their cows freezing to death. But as I traveled around rural townships and villages in early March to interview people about frac-sand mining, a little-known cousin of hydraulic fracturing or “fracking,” daytime temperatures soared to nearly 80 degrees — bizarre weather that seemed to be sending a meteorological message.

In this troubling spring, Wisconsin’s prairies and farmland fanned out to undulating hills that cradled the land and its people. Within their embrace, the rackety calls of geese echoed from ice-free ponds, bald eagles wheeled in the sky, and deer leaped in the brush. And for the first time in my life, I heard the thrilling warble of sandhill cranes.

Harriet Rowan: A Sea of Robin Hoods Tell the G8, It’s Time to Tax Wall Street!

Thousands of nurses from around the world descended upon Daley Plaza, in the heart of Chicago on May 18, to demand that the richest nations in the world put an end to austerity politics and start asking the people who collapsed the global economy to do more to “heal the world.”

Wearing red National Nurses United (NNU) scrubs calling for “an economy for the 99%” and zippy green Robin Hood hats, made for them in Europe, the nurses were joined by Occupy Chicago and thousands of community activists in what may be one of the most colorful demonstrations in days of protests marking the G8 meeting at Camp David and the NATO Summit in Chicago.

The man who took from the rich to give to the poor is the international symbol of a grassroots campaign for a financial speculation tax, a tiny tax on stocks, futures and options with the potential to raise billions a year in revenue for critical public services. Nurses around the globe are campaigning on the idea as a public policy alternative to the cut, cut, cut mentality of pro-austerity politicians. The tax is supported by the leaders of Germany and France and the European Union is working on its implementation, but England and the U.S. have been major roadblocks to a global transaction tax.

May 23 2012

On This Day In History May 23

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

May 23 is the 143rd day of the year (144th in leap years) in the Gregorian calendar. There are 222 days remaining until the end of the year.

Click on images to enlarge

On this day in 1873, the Canadian Parliament establishes the North West Mounted Police, the forerunner of the Royal Canadian Mounted Police.

The RCMP has its beginnings in the North-West Mounted Police (NWMP). The police was established by an act of legislation from the Temporary North-West Council the first territorial government of the Northwest Territories. The Act was approved by the Government of Canada and established on May 23, 1873, by Queen Victoria, on the advice of her Canadian Prime Minister, John A. Macdonald, with the intent of bringing law and order to, and asserting sovereignty over, the Northwest Territories. The need was particularly urgent given reports of American whiskey traders, in particular those of Fort Whoop-Up, causing trouble in the region, culminating in the Cypress Hills Massacre. The new force was initially to be called the North West Mounted Rifles, but this proposal was rejected as sounding too militaristic in nature, which Macdonald feared would antagonize both aboriginals and Americans; however, the force was organized along the lines of a cavalry regiment in the British Army, and was to wear red uniforms.

The NWMP was modelled directly on the Royal Irish Constabulary, a civilian paramilitary armed police force with both mounted and foot elements under the authority of what was then the United Kingdom of Great Britain and Ireland. First NWMP commissioner, Colonel George Arthur French visited Ireland to learn its methods.

The initial force, commanded by Commissioner French, was assembled at Fort Dufferin, Manitoba. They departed on July 8, 1874, on a march to what is now Alberta.

The group comprised 22 officers, 287 men – called constables and sub-constables – 310 horses, 67 wagons, 114 ox-carts, 18 yoke of oxen, 50 cows and 40 calves. A pictorial account of the journey was recorded in the diary of Henri Julien, an artist from the Canadian Illustrated News, who accompanied the expedition.

Their destination was Fort Whoop-Up, a notorious whiskey trading post located at the junction of the Belly and Oldman Rivers. Upon arrival at Whoop-Up and finding it abandoned the troop continued a few miles west and established headquarters on an island in the Oldman, naming it Fort MacLeod.

Historians have theorized that failure of the 1874 March West would not have completely ended the Canadian federal government’s vision of settling the country’s western plains, but could have delayed it for many years. It could also have encouraged the Canadian Pacific Railway to seek a more northerly route for its transcontinental railway that went through the well-mapped and partially settled valley of the North Saskatchewan River, touching on Prince Albert, Battleford and Edmonton, and through the Yellowhead Pass, as originally proposed by Sandford Fleming. This would have offered no economic justification for the existence of cities like Brandon, Regina, Moose Jaw, Swift Current, Medicine Hat, and Calgary, which could, in turn, have tempted American expansionists to make a play for the flat, empty southern regions of the Canadian prairies.

The NWMP’s early activities included containing the whiskey trade and enforcing agreements with the First Nations peoples; to that end, the commanding officer of the force arranged to be sworn in as a justice of the peace, which allowed for magisterial authority within the Mounties’ jurisdiction. In the early years, the force’s dedication to enforcing the law on behalf of the First Nations peoples impressed the latter enough to encourage good relations between them and the Crown. In the summer of 1876, Sitting Bull and thousands of Sioux fled from the US Army towards what is now southern Saskatchewan, and James Morrow Walsh of the NWMP was charged with maintaining control in the large Sioux settlement at Wood Mountain. Walsh and Sitting Bull became good friends, and the peace at Wood Mountain was maintained. In 1885, the NWMP helped to quell the North-West Rebellion led by Louis Riel. They suffered particularly heavy losses during the Battle of Duck Lake, but saw little other active combat.

May 22 2012

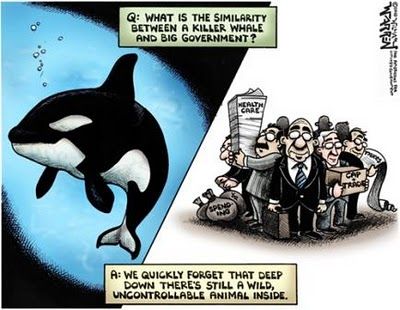

JP Morgan’s Whale Still Growing

That $2 billion failed London Whale has burgeoned up to a hefty $7 billion:

That $2 billion failed London Whale has burgeoned up to a hefty $7 billion:

The crisis at JP Morgan escalated yesterday as it emerged its trading losses in London could rise to as much as $7bn (£4.5bn) and the US bank cancelled a share buyback. Fears were growing that the losses could spiral from an initial $2bn, which was declared on 10 May, as JP Morgan struggles to unwind the massive bets made by the so-called “London Whale” trader Bruno Iksil. [..]

The main index on which Mr Iksil’s credit default swaps trades were based has calmed down in recent days, which suggests that JP Morgan has decided to trade out of its positions gradually rather than take one massive hit. Mr Dimon originally said the bank would deal with the positions to “maximise economic value”. But there is a danger in taking the long view. Mr Iksil was betting on the credit-worthiness of corporate America and if that starts to fall JP Morgan’s losses could mount further.

But in the meantime, Dimon decided to suspend the $15 billion stock buy back:

Two months after announcing a $15 billion share buyback program, JPMorgan Chase reversed course on Monday, saying it was halting the repurchases after the bank’s multibillion-dollar trading loss. [..]

Mr. Dimon said the bank intended to keep its dividend of 30 cents a quarter unchanged. Bank officials have repeatedly emphasized that the company has no plans to reduce it despite the trading loss. Initially estimated by the bank at $2 billion, the trading loss on credit derivatives now stands at more than $3 billion, according to traders and regulators. [..]

The decision to halt the repurchases – a move the company said it made on its own, not at the behest of regulators – sent JPMorgan’s shares sliding again Monday, closing at their lowest level since late last year.

As the losses from London Whale increase and Dimon’s reputation as the “saviour” of JP Morgan is tarnished, the calls for better and tighter regulations for banking increase. That’s the problem faced by the Senate Banking Committee as they consider the “Volker Rule”. As David Dayen pointed out today the rule should not so complex that it just creates more loopholes:

The Fail Whale trades showed that massive, as-yet unregulated risk still exists in our financial system, with the potential to bring down the economy once again and trigger massive taxpayer bailouts. Since the Administration already passed a law that was supposed to deal with that, they’re scrambling to restore what little of value existed in those laws. [..]

The article intimates that independent regulators have authority over writing things like the Volcker rule, and that the White House and the Treasury Department have limited ability to ensure that the rule properly follows from the legislative mandate. Given that a senior Administration official told reporters just yesterday that the losses at JPMorgan Chase would “inform… how the ultimate contours of the Volcker ruler come out-make sure that it is strong,” it’s clear that not even the Administration believes that. They appointed the regulators, and Treasury has plenty of control over almost everything related to Dodd-Frank. If they want a stronger Volcker rule, they’ll get it.

But will the Banking Committee come out with strong, simple rules regulating the gambling that banks are doing with depositor funds? There is a lot of doubt considering that not only are the Senators on the banking committee “financed” by the banks and lobbied heavily, a former lobbyist for JP Morgan Chase, Dwight Fettig is the staff director for the Senate Banking Committee. As our friend watertiger at Dependable Renegade observed “Well, isn’t that conVEEEEENient”:

The Senate Banking Committee is responding to outrage over the news that J.P. Morgan lost some $3 billion in customer money because of a risky trading strategy. The committee is preparing for two hearings with regulators, and Senator Tim Johnson (D-SD), chair of the committee, is hoping that Jamie Dimon will testify in the near future. “Our due diligence has made it clear that the Banking Committee should hear directly from JPMorgan Chase’s CEO Jamie Dimon,” Johnson said in a statement last week.

Luckily for Dimon, the professional staff in charge of managing the banking committee will be quite familiar to him and his team of lobbyists. That’s because the staff director for the Senate Banking Committee is none other than a former J.P. Morgan lobbyist, Dwight Fettig.

In 2009, Fettig was a registered lobbyist for J.P. Morgan. His disclosures show that he was hired to work on “financial services regulatory reform” and the “Restoring American Financial Stability Act of 2009″ on behalf of the investment bank. Now, as staff director for the Senate Banking Committee, he will be overseeing the hearings on J.P. Morgan’s risky proprietary trading.

I agree with Yves Smith in her NYT op-ed opinion that “for starters, reinstate Glass – Steagall”:

Preventing blow-ups like the JPMorgan “hedge” that bears no resemblance to any known hedge isn’t difficult. What makes preventing it difficult is that banks that exist only by virtue of state-granted charters – and more recently, huge transfers from the public – have persuaded public officials and regulators that they have a God-granted right not just to high levels of profit but also high levels of employee and executive compensation. [..]

Maybe it’s time to recognize that these firms are too big and in too many complex businesses to be managed. Jamie Dimon was touted as a star who could supervise a sprawling firm running huge risks, and he fell short because no one can do the job adequately. A less disaster-prone financial system requires more simplicity and redundancy. Re-instituting Glass-Steagall or other variants on the narrow banking theme isn’t a full solution, but it would make for a good start.

May 22 2012

Punting the Pundits

“Punting the Pundits” is an Open Thread. It is a selection of editorials and opinions from around the news medium and the internet blogs. The intent is to provide a forum for your reactions and opinions, not just to the opinions presented, but to what ever you find important.

Thanks to ek hornbeck, click on the link and you can access all the past “Punting the Pundits”.

Follow us on Twitter @StarsHollowGzt

New York Times Editorial: Their Learnable Moment

On Tuesday, the Senate Banking Committee is holding a hearing on reforming derivatives – not a topic one would expect to draw a lot of energy or attention. But in the wake of JPMorgan Chase’s stunning trading loss, now reportedly at $3 billion and counting, committee members need to push the regulators testifying – and each other – to explain why, four years after the financial meltdown, speculative trading in these risky instruments has not been reined in. [..]

The committee’s ranking Republican, Senator Richard Shelby of Alabama, has vowed to repeal Dodd-Frank altogether. The panel’s chairman, Senator Tim Johnson of South Dakota, and Senator Charles Schumer, a Democrat of New York, have called for looser rules on banks’ international derivatives trades.

After JPMorgan’s losses came to light, Mr. Johnson issued a statement saying that it shows “why opponents of Wall Street reform must not be allowed to gut important protections for the financial system and taxpayers.” He is right. Now and he other committee members, and the regulators, need to show what they have learned.

Richard (RJ) Eskow: JPMorgan Chase: Break Up the Big Banks Now. Here’s How.

When Jamie Dimon revealed that JPMorgan Chase had lost billions through risky and legally questionable trading, he said the losses would be about $2 billion and maybe more. Apparently it is more — a lot more. People in a position to know are saying the real figure is probably in the $5-7 billion range.

The JPMorgan Chase scandal — and yes, it is a scandal — shows us why we need to break up the big banks as quickly as possible.

But that won’t happen unless we can get our hands around the real scope of the problem, which is probably far greater than we’re being told. That means cutting through the enveloping shroud of jargon, euphemisms and double talk — “crap,” if you will — that keeps us from seeing the situation as it really is.

In the wake of this week’s House votes on the 2013 National Defense Authorization Act – which left the NDAA’s domestic military detention provisions even more noxious than they were before – one might legitimately wonder what country we live in.

Once again, our nation has demonstrated that the “land of the free” is an empty slogan, a vestigial nod to a constitutional vision that has long inspired the world yet seems wasted on our own shores. For what purpose, exactly, did the United States squander decades, trillions of dollars, and thousands of lives during the Cold War?

FDR was right: “The only thing we have to fear is fear itself.” More so than any terror threat, it is the fear mongering about national security that presents the greatest danger to our Republic’s future. No “home of the brave” would be brow-beaten by fears of “giving rights to terrorists” into resigning its own rights, inviting repression upon itself by allowing government powers long used to define authoritarianism.

Dean Baker: Mortgage and Securitization Fraud: Where Is the Task Force?

It was almost four years ago that Federal Reserve Board Chairman Ben Bernanke, Treasury Secretary Henry Paul Paulson, and then New York Fed Bank President Timothy Geithner ran to Congress warning that the end of the world was near. They told members of Congress that the banks were drowning in bad debt and without a massive bailout they would soon be forced into bankruptcy. Congress quickly coughed up the money in the form of $700 billion in TARP loans. The Fed contributed trillions more.

Undoubtedly most of the bad debt was due to stupidity, which does not seem to be in short supply on Wall Street despite the high paychecks. The folks running the major banks somehow could not see the largest asset bubble in the history of the world. The fact that house prices had risen by more than 70 percent above their trend level, with no plausible explanation in the fundamentals of the housing market, did not trouble these high-flyers.

Wendel Potter: Insurers Laying the Groundwork to Remove Consumer Protections if Mandate in Obamacare Is Tossed

I learned that Mitt Romney had won the Nebraska Republican presidential primary last week via a “Breaking News” e-mail alert from POLITICO. It wasn’t the news from the Cornhusker state, however, that caught my eye. It was instead the health insurance industry’s decision to spend our premium dollars on an Internet ad — an ad warning of dire consequences if the Supreme Court doesn’t rule the way insurers want on the constitutionality of Obamacare.

The worst-case scenario for insurers is if the high court strikes down the provision of the law requiring us to buy coverage (the so-called individual mandate), but allows the law’s important consumer protections to go forward.

The reason Obamacare is built around the individual mandate is because of the relentless lobbying by insurers, and not just on Capitol Hill. Representatives of the industry made frequent trips to the White House during the debate on reform to twist the arm of President Obama, who had campaigned against the mandate when he was running for president.

Jim Hightower: Feeding Obesity

Attention foodies: There’s a new craze in Cuisine World, and it’s going 180 degrees in the opposite direction from the much-publicized healthy-eating movement.

It has nothing to do with dressing locally sourced beets and arugula with artisan balsamic vinegar. We’re talking a big gooey Pizza Hut pepperoni pie with a long looping hot dog stuffed right into the crust around the entire circumference.

Hey, some might see the growing global problem of obesity as a crisis, but YUM! Brands, Inc., the conglomerate that owns Pizza Hut, sees it as a money-making opportunity.

That’s why the worldwide pizza peddler has introduced another belt-buster ringed by a dozen mini cheeseburgers. Sadly, you can only order one if you travel to Dubai, Saudi Arabia, or the other Middle Eastern countries where Pizza Hut operates.

May 22 2012

On This Day In History May 22

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

On this day in 1843, the Great Emigration departs for Oregon

A massive wagon train, made up of 1,000 settlers and 1,000 head of cattle, sets off down the Oregon Trail from Independence, Missouri. Known as the “Great Emigration,” the expedition came two years after the first modest party of settlers made the long, overland journey to Oregon.

In what was dubbed “The Great Migration of 1843” or the “Wagon Train of 1843”, an estimated 700 to 1,000 emigrants left for Oregon. They were led initially by John Gantt, a former U.S. Army Captain and fur trader who was contracted to guide the train to Fort Hall for $1 per person. The winter before, Marcus Whitman had made a brutal mid-winter trip from Oregon to St. Louis to appeal a decision by his Mission backers to abandon several of the Oregon missions. He joined the wagon train at the Platte River for the return trip. When the pioneers were told at Fort Hall by agents from the Hudson’s Bay Company that they should abandon their wagons there and use pack animals the rest of the way, Whitman disagreed and volunteered to lead the wagons to Oregon. He believed the wagon trains were large enough that they could build whatever road improvements they needed to make the trip with their wagons. The biggest obstacle they faced was in the Blue Mountains of Oregon where they had to cut and clear a trail through heavy timber. The wagons were stopped at The Dalles, Oregon by the lack of a road around Mount Hood. The wagons had to be disassembled and floated down the treacherous Columbia River and the animals herded over the rough Lolo trail to get by Mt. Hood. Nearly all of the settlers in the 1843 wagon trains arrived in the Willamette Valley by early October. A passable wagon trail now existed from the Missouri River to The Dalles. In 1846, the Barlow Road was completed around Mount Hood, providing a rough but completely passable wagon trail from the Missouri river to the Willamette Valley-about 2,000 miles.

May 21 2012

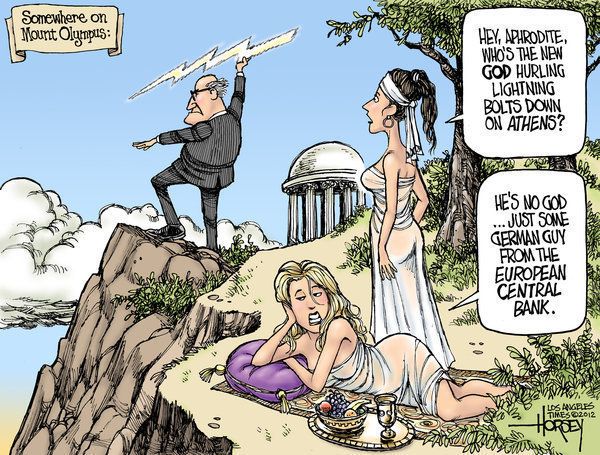

Austerity Is Economic Suicide

The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting.

The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting.

William K. Black, an associate professor of economics and law at the University of Missouri-Kansas City, former litigation director for the Federal Home Loan Bank Board and a white-collar criminologist, takes reporters at the New York Times task for their profound ignorance on covering Europe’s financial, social, and political crises. He explains why they are so wrong:

Economists have known for roughly 75 years that adopting austerity in response to recession or depression will make the economic crisis grow and last far longer. Austerity is to economics as bleeding was to medicine. [..]

The NYT article focuses on Alexis Tsipras, the Greek political leader whose party rose to prominence by promising to reject the loan-for-austerity program that the disgraced former Greek government agreed to at Berlin’s diktat. The article’s theme is that Tsipras is endangering all of Europe by demanding an end to austerity being imposed on Greece. The reporters write, as if it were undisputed fact, that Tsipras has started “a high-stakes game of chicken with Europe’s leaders.” But that reverses the facts.

The game that Berlin designed required the Greek to agree (1) to drive their economy off a cliff into a deepening Great Depression through increased austerity, (2) to force an enormous reduction in working class wages, (3) to sell Greek islands to private parties, and (4) to give up other aspects of sovereignty so that hostile, foreign, and private entities such as the IMF and the ECB could monitor its governmental actions. The Greeks are now refusing to commit economic, political, and social suicide. The Germans are demanding that they drive off the cliff because “a deal is a deal.”

If Greece were to drive off the cliff by adopting greater austerity it would likely destroy the EU. Austerity would force Greece into a deepening depression, eventually lead to a default on Greek sovereign debt, and tear Greece apart. Austerity has already generated a substantial neo-Nazi party in Greece. Few Americans recall the Greek civil war between the right and the left that began in World War II and continued for several years after the war or the post-war coup. Greeks recall the civil war and the coup and fear their resumption. Proponents of the Berlin Consensus already have blood on their hands because of the suicides engendered by mass unemployment, small business failures, and hopelessness. If the Berlin Consensus sparks a civil war or coup it could be fatal to the EU.

The EU crisis was also the topic of a heady discussion on this Sunday’s Up with Chris Hayes. Prof. Black was joined on the “Uppers” panel by Betsey Stevenson, former chief economist for the Obama Labor Department, Karl Smith, assistant professor of economics and government at the University of North Carolina at Chapel Hill; and MSNBC policy analyst Ezra Klein.

Mr Hayes’ assessment of the political situation in Greece was challenged by a commenter at his blog. Carol P Christ wrote with regards to the political and social responses to the crisis:

Since you are a member of the Progressive Left, you might reconsider calling Syriza the ‘far” Left in comparison to ‘far’ right Golden Dawn. There is no comparison between the 2. Syriza is a coaliton of parties to the left of centrist PASOk and to the “right” of KKE the Communist Party. You might be voting for them if you were in Greece, but you surely would NOT be voting for Golden Dawn. There is NO “comparison” between the 2. Continuing to compare the 2 parties makes it seem that all Greeks are irrational. There is nothing irrational about voting for Syriza. [..]

The “austerity” programs of the EU and banking systems have already destroyed our economy. To blame immigrants as Golden Dawn does is illogical. To ask voters to reject the terms of the second austerity package which is leading to massive unemployment and daily failures of small businesses is by no means irrational.

The Green Party is also against the austerity packages. And we are not “irrational” either.

The dualistic thinking of the west (ironically a legacy of Plato) leads to the demonization of the “other” as irrational. Unfortunately Greece has been portrayed as the “irrational” other within Europe for some time now.

Greece does need to change, but punishing the poor and middle classes is not a “rational” policy. [..]

Let me add that the European union and the Euro should not be confused. The Euro has only been in existence for 11 years. England with one of the largest economies in Europe is not a member of the Euro, nor is Sweden. They are still part of Europe and the European Union.

In Greece the Euro led to a massive rise in prices (a cup of coffee from $1 to $3-5, etc.) without a concomitant rise in wages. For example a tour bus driver makes E700 a month and a radiologist E1400, wages that are near poverty level in the US. depending on family size. Yet the cost of living is as high or higher than in the US, thanks to the price rises that the Euro brought. Gasoline is over $10 a gallon. Sales tax is 23%.

The European Union is a good thing, but the Euro was driven more by market forces and the desire to sell goods freely in Europe, than by a concern for world peace, the environmental protection, or any of the other good things the European Union is working on.

The Euro has not been a good thing for Greece, in my opinion.

(I have taken the liberty of posting most of Ms. Christ’s comments because I think they go straight to the heart of the misrepresentation that is taking place in the traditional news media.)

In another article at the New Economic Perspective, Prof. Black reports that the former head of the European Central Bank (ECB), Jean-Claude Trichet, thinks that by giving European politicians the power to declare a sovereign state bankrupt and take over its fiscal policy it would salvage the euro. To quote Prof. Black, “austerians have decided that since democracy is the problem, imperialism is the answer.”

Nor are fixing the problems of the euro a solution for the austerians:

Trichet, however, says that answer is impossible: “For the European Union, a fully fledged United States of Europe where nation states cede a large chunk of fiscal authority to the federal government appears politically unpalatable, Trichet said.” Democracy remains the stumbling block, but Trichet has an answer to that problem – crush democracy. He proposes that the EU:

“[T]ake a country into receivership when its political leaders or its parliament cannot implement sound budgetary policies approved by the EU. The action would have democratic accountability if it were approved by the European Council of EU heads of states and the elected European Parliament, he said.”

Of course, the “sound budgetary policies” he means are the suicidal, and failed policies of trying to balance the budget during a Great Recession. He does not understand even now that a nation in a severe recession cannot simply decide to run a budget surplus. It can try to do so, by cutting spending or raising taxes, but those policies are likely to reduce already sharply inadequate public and private sector demand, which increases unemployment, increases demand for public services, and reduces government revenue – all factors likely to increase the budget deficit. I am sure that the Greeks will consider the loss of their sovereignty at the hands of hostile foreign powers who openly sneer at the Greek people to represent the epitome of “democratic accountability.”

And what was the reaction of Berlin to Trichet’s policy to force suicidal austerity on the Greeks and bleed their economy while removing their sovereignty and right to democratic rule? You know the answer.

As Prof Black so aptly noted that that austerity is “a policy where you’re handed a gun and told to shoot yourself. Eventually people say, ‘Now exactly why should I do that?’. [..]

Whether Greece is the good or the bad, the policy is stupid.”

The United States is not Greece. It has its own sovereign currency and a bond market which it controls. We do not need to follow the EU and shoot ourselves with austerity.

May 21 2012

Punting the Pundits

“Punting the Pundits” is an Open Thread. It is a selection of editorials and opinions from around the news medium and the internet blogs. The intent is to provide a forum for your reactions and opinions, not just to the opinions presented, but to what ever you find important.

Thanks to ek hornbeck, click on the link and you can access all the past “Punting the Pundits”.

Follow us on Twitter @StarsHollowGzt

Paul Krugman: Dimon’s Déjà Vu Debacle

Sometimes it’s hard to explain why we need strong financial regulation – especially in an era saturated with pro-business, pro-market propaganda. So we should always be grateful when someone makes the case for regulation more compelling and easier to understand. And this week, that means offering a special shout-out to two men: Jamie Dimon and Mitt Romney.

I’ll come back shortly to the troubles at JPMorgan Chase, the bank Mr. Dimon runs. First, however, let me talk about Mr. Romney, whose remarks about those troubles were so off-point that they constitute a teachable moment.

Here’s what the presumptive Republican presidential nominee said about JPMorgan’s $2 billion loss (which may actually have been $3 billion, or $5 billion, or more, but who’s counting?): “This was a loss to shareholders and owners of JPMorgan and that’s the way America works. Some people experienced a loss in this case because of a bad decision. By the way, there was someone who made a gain.”

Please remember that Jamie and Barry are BFF’s. America is so effing screwed.

Bernard Harcourt: Welcome, Nato, to Chicago’s police state

The Nato summit will come and go, but Mayor Emanuel has authorised a ‘new normal’ of militarised social control in Chicago

With Nato delegates arriving Saturday night, the City of Chicago has been turned into a police state. Courtesy of Mayor Rahm Emanuel, who several months ago began implementing new draconian anti-protest measures, Chicago has gone on security lockdown. Starting early Friday night, 18 May 2012, the Chicago Police Department began shutting down – prohibiting cars, bikes, and pedestrians – miles and miles of highways and roads in the heart of Chicago to create a security perimeter around downtown and McCormick Place (where the Nato summit is being held). [..]

So, welcome, Nato, to the Chicago police state 2012. It may be hard to see or experience the security measures from within the perimeter, but for Chicagoans, the new experience is chilling. As one Chicagoan reportedly told NBC Chicago, the mass of security equipment “made her feel like she was on ‘lockdown’.”

And you thought the Bush/Cheney regime was bad

PARIS — The good news: Austerity is finally on the defensive. At the Camp David G-8 summit, all the other national leaders pressed German Chancellor Angela Merkel to relent and to allow Europe’s ravaged economy to grow.

The bad news: The shift is mainly at the level of rhetoric and token policy changes. Nobody in the political mainstream is seriously proposing the kind of radical reform that would allow growth to occur.

Two weeks of interviews with progressive leaders in Europe — academics, the left wing of labor and social democratic parties, NGO groups — suggest a remarkable consensus on what needs to be done. You can see it in any of several manifestos from groups like Social Europe, the European Trade Union Confederation (pdf), Re-Define, Foundation for European Progressive Studies, Finance Watch, the British group Compass, among several others.

Simon Johnson: Jamie Dimon Should Resign From the Board Of The New York Fed

Jamie Dimon, CEO of JP Morgan Chase, is a member of the board of the New York Federal Reserve Bank. Mr. Dimon’s role there is sometimes presented as “advisory” but he sits on the Management and Budget Committee; here is the committee’s charter, which includes reviewing and endorsing “the framework for compensation of the Bank’s senior executives (Senior Vice President and above)”. His advice apparently extends to important aspects of how the New York Fed operates, including aspects of its personnel policies. [..]

To have Mr. Dimon involved in overseeing the management of the New York Fed, an organization that oversees his activities, decisions, and potential losses, is no longer acceptable. We do not accept such conflicts of interest in other parts of American society and we should not accept them in this instance.

Leonard Pitts, Jr.: Tough on Crime, Tough on Justice

So the people got sick of it, all those criminals being coddled by all those bleeding heart liberal judges with all their soft-headed concern for rights and rehabilitation. And a wave swept this country in the Reagan years, a wave ridden by pundits and politicians seeking power, a wave that said, no mercy, no more. From now on, judges would be severely limited in the sentences they could hand down for certain crimes, required to impose certain punishments whether or not they thought those punishments fit the circumstances at hand. From now on, there was a new mantra in American justice. From now on, we would be “tough on crime.”

We got tough on Jerry Dewayne Williams, a small-time criminal who stole a slice of pizza from a group of children. He got 25 years.

We got tough on Duane Silva, a guy with an IQ of 71 who stole a VCR and a coin collection. He got 30 to life.

We got tough on Dixie Shanahan, who shot and killed the husband who had beaten her for three days straight, punching her in the face, pounding her in the stomach, dragging her by the hair, because she refused to have an abortion. She got 50 years. [..]

May 21 2012

On This Day In History May 21

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

Click on image to enlarge

May 21 is the 141st day of the year (142nd in leap years) in the Gregorian calendar. There are 224 days remaining until the end of the year.

On this day in 1881, the American Red Cross was established in Washington, D.C. by Clara Barton, who became the first president of the organization.

Clara Barton (1821-1912) had a career as a teacher and federal bureaucrat when the American Civil War broke out. Barton liked teaching when she was younger. All of her older siblings became teachers. Her youngest sibling was 12 years of age, when Barton was born. Her brother David was always like a teacher to her. She taught her first class, at age 17. She also expanded her concept of soldier aid, traveling to Camp Parole, Maryland, to organize a program for locating men listed as missing in action. Through interviews with Federals returning from Southern prisons, she was often able to determine the status of some of the missing and notify families.

After performing humanitarian work during and after the conflict, on advice of her doctors, in 1869, she went to Europe for a restful vacation. There, she saw and became involved in the work of the International Red Cross during the Franco-Prussian War, and determined to bring the organization home with her to America.

When Barton began the organizing work in the U.S. in 1873, no one thought the country would ever again face an experience like the Civil War. However, Barton was not one to lose hope in the face of the bureaucracy, and she finally succeeded during the administration of President Chester A. Arthur on the basis that the new American Red Cross organization could also be available to respond to other types of crisis.

As Barton expanded the original concept of the Red Cross to include assisting in any great national disaster, this service brought the United States the “Good Samaritan of Nations” label in the International Red Cross. Barton became President of the American branch of the society, known officially as the American National Red Cross. Soon after the initial May 1881 meeting in Washington, on August 22, 1881, the first local chapter of the Red Cross was formed in village of Dansville, New York, where Barton kept a part-time residence between 1876 and 1886. Subsequent local chapters were established in Rochester and Syracuse. Ultimately, John D. Rockefeller, along with four others and the federal government, gave money to create a national headquarters in Washington, D.C., located one block from the White House.

Recent Comments