At the Senate Banking Committee hearing on Tuesday, titled “Assessing the Effects of Consumer Finance Regulations,” Senator Elizabeth Warren (D-MA) took a former Federal Reserve deputy director to the woodshed on his role in the run-up to the 2008 fiscal crisis. The Republicans’ lead witness Leonard Chanin, former Deputy Director of the Division of Consumer …

Tag: Senate Banking Committee

Jul 17 2013

Liz Warren Slays CNBC

CNBC’s Squackbox invited Sen. Elizabeth Warren on to discuss her bipartisan supported 21st Glass-Stegall Bill. I will only say, Elizabeth Warren for President 2016.

That had to hurt.

Jul 16 2013

Sen. Warren Revives Glass-Steagall, Break up TBTF

Last week Sen Elizabeth Warren (D-MA), along with Senators John McCain (R-Ariz.), Sens. Maria Cantwell (D-Wash.) and Angus King (I-Maine), introduced legislation that rein in the excesses of the Too Big Too Fail banks. The bill would require banks that accept federally insured deposits to focus on traditional lending and would bar them from engaging in risky securities trading. It would also bar banks that accept insured deposits from dealing swaps or operating hedge funds and private equity enterprises.

The legislation introduced today would separate traditional banks that have savings and checking accounts and are insured by the Federal Deposit Insurance Corporation from riskier financial institutions that offer services such as investment banking, insurance, swaps dealing, and hedge fund and private equity activities. This bill would clarify regulatory interpretations of banking law provisions that undermined the protections under the original Glass-Steagall and would make “Too Big to Fail” institutions smaller and safer, minimizing the likelihood of a government bailout.

“Since core provisions of the Glass-Steagall Act were repealed in 1999, shattering the wall dividing commercial banks and investment banks, a culture of dangerous greed and excessive risk-taking has taken root in the banking world,” said Senator John McCain. “Big Wall Street institutions should be free to engage in transactions with significant risk, but not with federally insured deposits. If enacted, the 21st Century Glass-Steagall Act would not end Too-Big-to-Fail. But, it would rebuild the wall between commercial and investment banking that was in place for over 60 years, restore confidence in the system, and reduce risk for the American taxpayer.”

“Despite the progress we’ve made since 2008, the biggest banks continue to threaten the economy,” said Senator Elizabeth Warren. “The four biggest banks are now 30% larger than they were just five years ago, and they have continued to engage in dangerous, high-risk practices that could once again put our economy at risk. The 21st Century Glass-Steagall Act will reestablish a wall between commercial and investment banking, make our financial system more stable and secure, and protect American families.”

Five Facts About the New Glass-Steagall

by Simon Johnson, Bloomberg The Ticker

Naturally, Wall Street will respond with a huge disinformation campaign, saying that the bill would cause the sky to fall. As the debate intensifies, keep in mind the following five points.

1) The bill would actually help small banks, because it would force the taxpayer-subsidized megabanks and related financial companies to break up. [..]

2) The simplifying intent of the 21st century Glass-Steagall Act is complementary to other serious reform efforts underway, including plans for the “resolution,” or managed liquidation, of any financial firm that fails. [..]

3) Proponents of big banks will claim that the breakdown of the original Glass-Steagall Act (which separated commercial and investment banking) did not contribute to the crisis of 2007-08. [..]

4) As the preamble to the 21st century Glass-Steagall Act points out, it represents a convergence with European reform thinking, as seen in the Vickers Report (for the U.K.) and the Liikanen Report (for Europe more broadly). [..]

5) The Treasury Department is not going to welcome the legislation — in fact, it may assist in mobilizing opposition. At this stage, this is an advantage, not a problem. Treasury has a severe case of reform fatigue. It’s time for someone else to carry the ball.

Remember Citigroup

by Simon Johnson, Huffington Post

The strangest argument against the Act is that it would not have prevented the financial crisis of 2007-08. This completely ignores the central role played by Citigroup.

It is always a mistake to suggest there is any panacea that would prevent crises — either in the past or in the future. And none of the senators — Maria Cantwell of Washington, Angus King of Maine, John McCain of Arizona, and Elizabeth Warren of Massachusetts — proposing the legislation have made such an argument. But banking crises can be more or less severe, depending on the nature of the firms that become most troubled, including their size relative to the financial system and relative to the economy, the extent to which they provide critical functions, and how far the damage would spread around the world if they were to fall.

Executives at the helm of Citigroup argued long and hard, over decades, for the ability to expand the scope of their business — breaking down the barriers between conventional commercial banking and all of forms of financial transactions, including the most risky. In effect, the decline of the restrictions established by the original Glass-Steagall — at first gradual but ultimately dramatic — allowed Citigroup to increase the scale and complexity of gambles that it could take backed by deposits and ultimately backed by the government.

What are the chances of this bill getting passed? Probably not all that good considering the Wall St. cronies like Sen. Chuck Schumer (D-NY) who most certainly oppose it. Even if it makes it through the Senate relatively intact in intent, the wild children in the House will most certainly kill it. We need more Liz Warrens in both houses of congress.

Mar 12 2013

Why Wasn’t the Death Penalty Warranted?

Once again Sen. Elizabeth Warren demonstrated why the voters of Massachusetts sent her to the Senate when in a Senate Banking Committee hearing about money laundering, she questioned why British bank HSBC is still doing business in the U.S., with no criminal charges filed against it, despite confessing to what one regulator called “egregious” money laundering violations

Her comments came just a day after the attorney general of the United States confessed that some banks are so big and important that they are essentially above the law. His Justice Department’s failure to bring any criminal charges against HSBC or its employees is Exhibit A of that problem.

(..) Warren grilled officials from the Treasury Department, Federal Reserve and Office of the Comptroller of the Currency about why HSBC, which recently paid $1.9 billion to settle money laundering charges, wasn’t criminally prosecuted and shut down in the U.S. Nor were any individuals from HSBC charged with any crimes, despite the bank confessing to laundering billions of dollars for Mexican drug cartels and rogue regimes like Iran and Libya over several years.

Defenders of the Justice Department say that a criminal conviction could have been a death penalty for the bank, causing widespread damage to the economy. Warren wanted to know why the death penalty wasn’t warranted in this case.

“They did it over and over and over again across a period of years. And they were caught doing it, warned not to do it and kept right on doing it, and evidently making profits doing it,”

“How many billions of dollars do you have to launder for drug lords and how many economic sanctions do you have to violate before someone will consider shutting down a financial institution like this?”

“You sit in Treasury and you try to enforce these laws, and I’ve read all of your testimony and you tell me how vigorously you want to enforce these laws, but you have no opinion on when it is that a bank should be shut down for money laundering?”

“If you’re caught with an ounce of cocaine, the chances are good you’re gonna go to jail. If it happens repeatedly, you may go to jail for the rest of your life,” Warren said. “But evidently if you launder nearly a billion dollars for drug cartels and violate our international sanctions, your company pays a fine and you go home and sleep in your bed at night — every single individual associated with this. And I think that’s fundamentally wrong.”

As staunch an opponent of the death penalty as I am, I would have voted for it and watched the “execution” of HSBC with glee.

Feb 15 2013

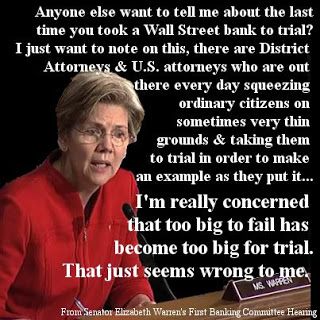

Not Ready to Make Nice

Heads up folks, there’s a new sheriff in town and she’s not ready to make nice. Freshman Senator Elizabeth Warren (D-MA) made her debut on the Senate Banking Committee making it very clear to the bank regulators from the alphabet soup of agencies sitting before her, that she was not pleased:

Heads up folks, there’s a new sheriff in town and she’s not ready to make nice. Freshman Senator Elizabeth Warren (D-MA) made her debut on the Senate Banking Committee making it very clear to the bank regulators from the alphabet soup of agencies sitting before her, that she was not pleased:

The Democratic senator from Massachusetts had a straightforward question for them: When was the last time you took a Wall Street bank to trial? It was a harder question than it seemed.

“We do not have to bring people to trial,” Thomas Curry, head of the Office of the Comptroller of the Currency, assured Warren, declaring that his agency had secured a large number of “consent orders,” or settlements.

“I appreciate that you say you don’t have to bring them to trial. My question is, when did you bring them to trial?” she responded.

“We have not had to do it as a practical matter to achieve our supervisory goals,” Curry offered. [..]

The financial regulators can blame, at least in part, Wall Street lobbyists (along with outgoing Treasury Secretary Tim Geithner and Senate Republicans) for their embarrassing turn at the hearing. Warren would have been on the panel herself representing the Consumer Financial Protection Bureau, instead of a sitting senator, if her nomination to head the agency hadn’t been thwarted in 2011.

After getting the essentially the same answer from the others at the table, Sen. Warren, who was a friend and admirer of the late Internet activist Aaron Swartz who all too briefly was her constituent, alluded to his suicide chastised the lack of any criminal prosecutions:

“There are district attorneys and United States attorneys out there every day squeezing ordinary citizens on sometimes very thin grounds and taking them to trial in order to make an example, as they put it. I’m really concerned that ‘too big to fail’ has become ‘too big for trial.”

Sen. Warren is part of the “new breed” of Senate Democrats who are not going to sit quietly in the background, as digby said, “for at least four years before they were allowed to assert themselves in even the tiniest ways.” But is she rally that “awesome?”

At naked capitalism, Yves Smith is more reserved in her assessment and believes that Sen. Warren is hamstrung by the time constraints for questions and answers that “produce “sound-bites, grand-standing, and run-out-the-clock obfuscation rather than meaningful interaction:”

So while Warren fans are happy with her debut, these star turns are useful for signaling, but they are not how she will make a difference, if she can make a difference. The Senate gives her ready media access, but the convention in the Senate is for newbies keep a low profile for the first six months. Warren might be allowed some liberties on banking issues, given her expertise in this arena. Notice how she breezily overstepped her time limits in the video clip. But expect her to hew to convention elsewhere, otherwise she could undermine her ability to get things done. Remember, Hillary Clinton had to bring fellow Senators coffee as a freshman to prove she didn’t have airs.

That also means we are likely to remain in the dark about where Warren stands on other issues that affect middle class families, like social insurance programs and the progressivity of taxes, until after the deficit pact is done (Warren will be expected to fall in with the party position), unless we have another kick-the-can deal in March and real fights take place when she is in a position to operate a bit more freely.

So the early signs of how tough-minded Warren intends to be will come through the letters, speeches, and positions she takes on banking matters outside the formal Committee sessions. Her early talk is promising, but we need to see how she follows up with action.**

Meanwhile, the lack of clear, simple regulation that was the hallmark of the Glass – Steagall Act has Wall Steet manipulating Dodd – Frank to “bypass new regulations aimed at limiting reckless speculation, enhancing the prospect of another derivatives crisis, warn some market participants.”

Under the Dodd-Frank financial reform law adopted by Congress in 2010, investors are required to set aside significant sums of cash to cover losses on their derivatives trades — money they could otherwise plow into additional investments. That policy came in response to the financial crisis that began in 2007, when major financial institutions found themselves unable to cover hundreds of billions of dollars in shortfalls on derivatives trades.

But traders have recently forged a path around these so-called margin requirements in order to allow them to harvest larger profits via larger bets: They are repackaging some derivatives known as swaps into another financial product known as futures. Futures are less stringently regulated, meaning investors can stake out larger positions while reserving smaller amounts of cash.

I don’t expect that President Obama’s nominee for Treasury Secretary, Jack Lew, will be any better the Tim Geithner since he has been a steady defender of deregulation and repeatedly said that he didn’t “believe that deregulation was the proximate cause” of the banking crisis. As President Bill Clinton’s head of OMB, Mr. Lew organized the gutting of Glass-Steagall protections against banker adventurism.

It seems that Sen. Warren has struck a nerve when she said:

At one point, Warren asked why big banks’ book value was lower, when most corporations trade above book value, saying there could be only two reasons for it.

“One would be because nobody believes that the banks’ books are honest. Second, would be that nobody believes that the banks are really manageable. That is, if they are too complex either for their own institutions to manage them or for the regulators to manage them” {..}

That set off angry responses to Politico’s Morning Money. “While Senator Warren had every right to ask pointed questions at today’s Senate Banking Committee hearing, her claim that ‘nobody believes’ that bank books are honest is just plain wrong,” emailed a “top executive” to the financial newsletter. ” Perhaps someone ought to remind the Senator that the campaign is over and she should act accordingly if she wants to be taken seriously.” [..]

In an email, a GOP bank lobbyist said, “Republicans also would like to know why the Democratic donor base has avoided trial. Maybe she should subpoena the DSCC and Obama’s super PAC to answer her question.”

Consumer Bankers Association CEO Richard Hunt was slightly more diplomatic. “We have been through more tests and thorough exams than any college student over the past four years, including many conducted by the CFPB. The results of the Hamilton Partners Financial Index and the testimony of OCC Comptroller [Thomas] Curry were very clear: the United States banking system is safe and sound, supported by historic and permanent capital ratios. We are working every day to fulfill the financial needs of the American consumer and small business and will continue to work with any and all lawmakers who seek to assist in this extremely important process.”

Awww, she hurt their feelings.

Sen. Warren has a Mt. Everest size hill to climb. We wish her luck.

Jun 13 2012

JP Morgan’s CEO And The Grand Lie

“We are not in the hedge fund business.”

Jamie Dimon, CEO JP Morgan Chase

JP Morgan Chase CEO Jamie Dimon testified today before the Senate Banking Committee about the $2 billion plus loss from it’s “London Whale” gambling with depositor and tax payer money. He was hardly contrite. Not only did Dimon whine about the complexity of the federal regulatory system but he lied, blatantly, this from Yves Smith at naked capitalism:

In Senate testimony, Dimon revealed his idea of “portfolio hedging” to be even more egregious than the harshest critics thought. Dimon presented the job of the CIO to be to make modest amounts of money in good times and to make a lot of money when there’s a crisis. (That does not appear to be narrowly true, since in the last couple of years, during which there was no crisis, the CIO’s staff were among the best paid in the bank and produced significant profits for the bank. That is a bald faced admission that the CIO’s mandate had nothing to do with hedging. A hedge is a position taken to mitigate losses on an underlying exposure should they occur. Instead, Dimon has admitted that the mission of the CIO is to place bets on tail risks that are unrelated to JP Morgan’s exposures. A massive, systemically destructive strategy like the Magnetar trade would fit perfectly within the CIO’s mandate.

Needless to say, this definition is an inversion of not just what the Volcker rule was meant to stand for (limiting financial firm gambles with taxpayer money), it’s NewSpeak, or in this case, DimonSpeak: “a hedge is whatever I say it is, no more and no less.” Another bit of DimonSpeak was his specious response when he was arguing against the Volcker rule. The JP Morgan chief asserted that a customer loan could be construed to be a prop trade. Um, no, Volcker applies to trading books. The fact that he’d run a line like that shows how little he thinks of the intelligence of the Senate Banking Committee and the public generally. [..]

It was instructive to see how effective confident misrepresentation can be. Most of the Republican senators fawned over Dimon after the ritual scolding at the top of the hearings, and I suspect most of the media will simply replay his lines uncritically. There were a few that will work against him, like his reluctant admission that the Volcker rule might have prevented the failed London trade. But in general, reducing complex situations to soundbites allows for obfuscation and misdirection, which is exactly what Dimon and his ilk are keen to have happen.

During the testimony, Dimon admitted to responsibility for the failed trade that could possibly lead to criminal charges for violation of Sarbanese-Oxley, but even under this Democratic administration, no one believes that, certainly not Yves or David Dayen at FDL:

Dimon also deflected blame for the losses. David Dayen recounts the conference call that took place during the hearing with economists Rob Johnson and Bill Black:

Dimon tried to blame the losses on a lot of factors, and in such a way that doesn’t trip up his priorities later. As economist Rob Johnson mentioned in a conference call, Dimon has been lobbying vociferously against things like the Volcker rule. So he doesn’t want this Fail Whale mix-up to lead to a stronger regulatory environment. He tried to explain the trades as a hedge (never saying that they were one, but that he “believed” they were one, to keep him out of trouble), that would make small amounts of money in good times and more money when things went bad. They were also specifically tied to business in Europe. Bill Black, who was also on the call, targeted this as a non sequitur. “He said that senior management ordered the CIO to get out of the risk out of this underlying supposed hedge,” Black said. “But a hedge is supposed to be reducing risk, and it was protecting you from Europe going bad, when Europe is going bad. So it should have been making more money at this time.”

Black continued. “Instead of reducing the risk, the CIO went into a vastly more complex series of derivatives and went far larger, and they hid the losses. I mean, my God. They violated direct orders, lose a ton of money and lie about it. Dimon described a massive insurrection by the CIO.”

Most of the senators soft peddled their questions and Sen. Jim DeMint (R-SC) actually asked Dimon for advice about banking regulations and Sen. Richard Shelby (R-AL) doesn’t believe in second guessing the banksters. The closest any of the questioners came to holding Dimon accountable for the losses was Sen Jeff Merkley (D-OR). It was during that exchange that Dimon admitted he was responsible for the losses.

All in all another farce by our politicians who are owned by the man before them.

May 22 2012

JP Morgan’s Whale Still Growing

That $2 billion failed London Whale has burgeoned up to a hefty $7 billion:

That $2 billion failed London Whale has burgeoned up to a hefty $7 billion:

The crisis at JP Morgan escalated yesterday as it emerged its trading losses in London could rise to as much as $7bn (£4.5bn) and the US bank cancelled a share buyback. Fears were growing that the losses could spiral from an initial $2bn, which was declared on 10 May, as JP Morgan struggles to unwind the massive bets made by the so-called “London Whale” trader Bruno Iksil. [..]

The main index on which Mr Iksil’s credit default swaps trades were based has calmed down in recent days, which suggests that JP Morgan has decided to trade out of its positions gradually rather than take one massive hit. Mr Dimon originally said the bank would deal with the positions to “maximise economic value”. But there is a danger in taking the long view. Mr Iksil was betting on the credit-worthiness of corporate America and if that starts to fall JP Morgan’s losses could mount further.

But in the meantime, Dimon decided to suspend the $15 billion stock buy back:

Two months after announcing a $15 billion share buyback program, JPMorgan Chase reversed course on Monday, saying it was halting the repurchases after the bank’s multibillion-dollar trading loss. [..]

Mr. Dimon said the bank intended to keep its dividend of 30 cents a quarter unchanged. Bank officials have repeatedly emphasized that the company has no plans to reduce it despite the trading loss. Initially estimated by the bank at $2 billion, the trading loss on credit derivatives now stands at more than $3 billion, according to traders and regulators. [..]

The decision to halt the repurchases – a move the company said it made on its own, not at the behest of regulators – sent JPMorgan’s shares sliding again Monday, closing at their lowest level since late last year.

As the losses from London Whale increase and Dimon’s reputation as the “saviour” of JP Morgan is tarnished, the calls for better and tighter regulations for banking increase. That’s the problem faced by the Senate Banking Committee as they consider the “Volker Rule”. As David Dayen pointed out today the rule should not so complex that it just creates more loopholes:

The Fail Whale trades showed that massive, as-yet unregulated risk still exists in our financial system, with the potential to bring down the economy once again and trigger massive taxpayer bailouts. Since the Administration already passed a law that was supposed to deal with that, they’re scrambling to restore what little of value existed in those laws. [..]

The article intimates that independent regulators have authority over writing things like the Volcker rule, and that the White House and the Treasury Department have limited ability to ensure that the rule properly follows from the legislative mandate. Given that a senior Administration official told reporters just yesterday that the losses at JPMorgan Chase would “inform… how the ultimate contours of the Volcker ruler come out-make sure that it is strong,” it’s clear that not even the Administration believes that. They appointed the regulators, and Treasury has plenty of control over almost everything related to Dodd-Frank. If they want a stronger Volcker rule, they’ll get it.

But will the Banking Committee come out with strong, simple rules regulating the gambling that banks are doing with depositor funds? There is a lot of doubt considering that not only are the Senators on the banking committee “financed” by the banks and lobbied heavily, a former lobbyist for JP Morgan Chase, Dwight Fettig is the staff director for the Senate Banking Committee. As our friend watertiger at Dependable Renegade observed “Well, isn’t that conVEEEEENient”:

The Senate Banking Committee is responding to outrage over the news that J.P. Morgan lost some $3 billion in customer money because of a risky trading strategy. The committee is preparing for two hearings with regulators, and Senator Tim Johnson (D-SD), chair of the committee, is hoping that Jamie Dimon will testify in the near future. “Our due diligence has made it clear that the Banking Committee should hear directly from JPMorgan Chase’s CEO Jamie Dimon,” Johnson said in a statement last week.

Luckily for Dimon, the professional staff in charge of managing the banking committee will be quite familiar to him and his team of lobbyists. That’s because the staff director for the Senate Banking Committee is none other than a former J.P. Morgan lobbyist, Dwight Fettig.

In 2009, Fettig was a registered lobbyist for J.P. Morgan. His disclosures show that he was hired to work on “financial services regulatory reform” and the “Restoring American Financial Stability Act of 2009″ on behalf of the investment bank. Now, as staff director for the Senate Banking Committee, he will be overseeing the hearings on J.P. Morgan’s risky proprietary trading.

I agree with Yves Smith in her NYT op-ed opinion that “for starters, reinstate Glass – Steagall”:

Preventing blow-ups like the JPMorgan “hedge” that bears no resemblance to any known hedge isn’t difficult. What makes preventing it difficult is that banks that exist only by virtue of state-granted charters – and more recently, huge transfers from the public – have persuaded public officials and regulators that they have a God-granted right not just to high levels of profit but also high levels of employee and executive compensation. [..]

Maybe it’s time to recognize that these firms are too big and in too many complex businesses to be managed. Jamie Dimon was touted as a star who could supervise a sprawling firm running huge risks, and he fell short because no one can do the job adequately. A less disaster-prone financial system requires more simplicity and redundancy. Re-instituting Glass-Steagall or other variants on the narrow banking theme isn’t a full solution, but it would make for a good start.

Recent Comments