The Department of Homeland Security was created a year after the attacks on the US by Arab militants on September 11, 2001. It was obvious to many of us that it was a knee jerk reaction to bolster the Bush administration’s new “war on terror.” that, eventually, led to the illegal overthrow of the sovereign government of Iraq and the current state of chaos in the Middle East, Near East and parts of Africa.

The newly Republican led congress decided to separate the funding for DHS from the omnibus bill to attempt to use it as a bargaining chip to block President Barrack Obama’s policies on undocumented immigrants. That has led to a stand off that may result in the shut down of most of DHS when funding runs out on Saturday.

GOP leaders are arguing that the three-week funding bill would keep the agency open. They’re also asking their members to vote to go to conference with the Senate. But Senate Democrats say they’ll refuse that request.

Without language overturning Obama’s actions, the GOP may not have the 218 votes necessary to approve the bill – especially with House Democratic leaders urging their members to vote against it.

Democrats are demanding a more permanent funding measure.

The Senate on Friday voted 68-31 to fund the department through the end of the fiscal year. That bill might pass the House, but only if GOP leaders are willing to accept a vote on legislation that would divide their party.

There are many reasons that this may not be the disaster that fear mongering politicians on both sides of the aisle are claiming. There are some who feel that after 14 years, this trillion dollar boondoggle needs to go.

In a commentary at The Guardian, Trevor Timm argues that the department is “George W Bush’s creation is too inefficient, wasteful and disrespectful of privacy to keep around. If Republicans want to shut it down, Democrats shouldn’t stop them.”

Besides the cost to American tax payers of $38.2 billion this year alone, there are these major issues with DHS:

Consider the DHS’ so-called “fusion centers”, which are little more than spying hubs that vacuum up information from federal and local authorities and store it for indefinite amounts of time. A scathing Senate report on the centers, which have cost the DHS at least $1.4 billion dollars, concluded that they produce “predominantly useless information” – one employee was quoted as calling it “a bunch of crap” – and that they also “run] afoul of departmental guidelines meant to guard against civil liberties” and are “possibly in violation of the Privacy Act”. While they’ve spied on many people who [were engaged in purely First Amendment protected activities, they’re not known to have stopped a terrorist attack.

The department has also been a treasure trove for local police departments, giving them millions in military grade gear and specialized spying equipment without accountability. This has lead to some very serious violations of the people’s constitutional rights.

For example, they have a program to hand out funds for local police to buy surveillance drones and give grants to cops for controversial Stingray surveillance devices, which are fake cell phone towers that allow the police to spy on entire neighborhoods at once.

They also have their own Predator drones program (without the missiles like in Pakistan and Yemen) that they fly along the US border as well. A government report released in January derided DHS’s Predator drones as almost entirely ineffective and a giant waste of money. The report didn’t even cover the alarming privacy concerns of having sophisticated spying machines constantly flying over large parts of the country.

Some of the harshest criticism of the DHS has come from within the agency. The Office of Intelligence and Analysis has been mocked by it’s own current and former employees for churning out “intelligence spam” and producing “almost nothing you can’t find on Google.”

The article also noted that the department was criticized for its inability to secure its own buildings from hackers let alone any other government offices and another Senate report that called the DHS cybersecurity “incompetant.” On top of that there is the department’s over paying by hundreds of thousands of dollars for border patrol housing, millions wasted on vehicles that were purchased without any internal oversight or guidelines and misuse of government credit cards for personal expenses to the tune of tens of thousands of dollars.

So if the Republicans can’t figure out how to pass a clean funding bill, the Democrats should just let the DHS close, doing the American tax payers a great favor.

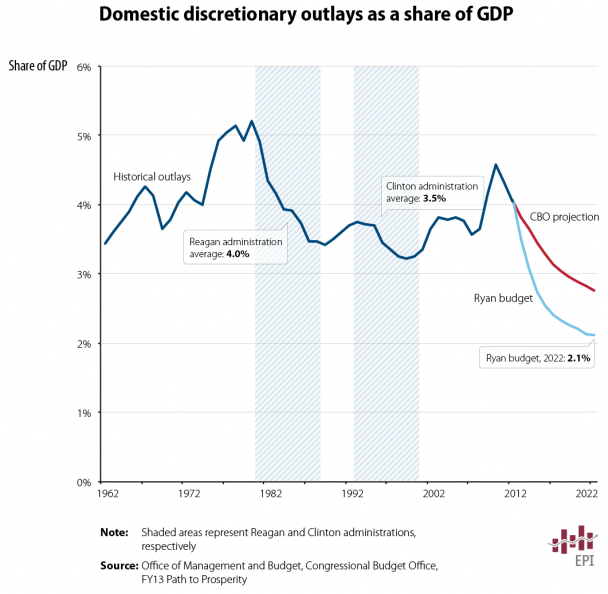

The deadline for the bicameral Super Committee to come up with a deal on deficit reduction is a week away. While many

The deadline for the bicameral Super Committee to come up with a deal on deficit reduction is a week away. While many  Scarecrow at

Scarecrow at

Recent Comments