Sign the petition to Mint the Coin

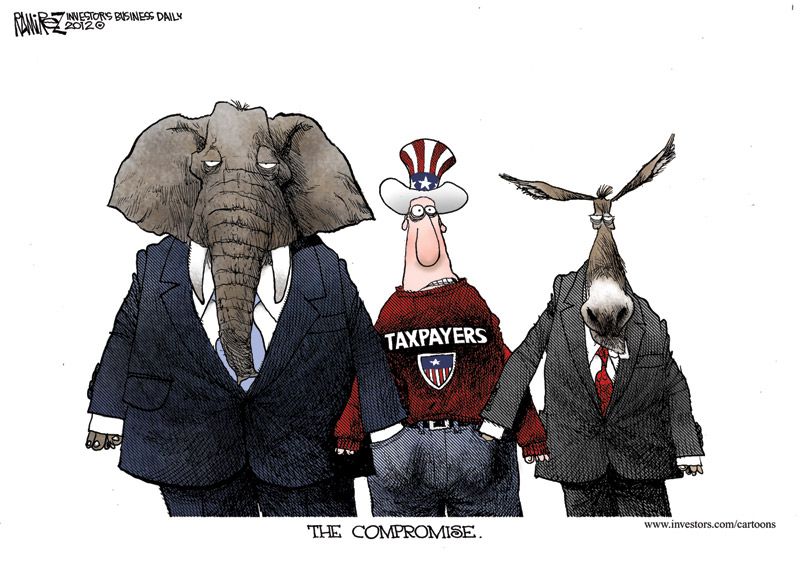

The next “plateau” in the on going “Mythical Cliff” debate is the unconstitutional debt ceiling which the Republicans are now threatening to take hostage to demand draconian cuts to social security and other programs while sparing defense. With the settlement over the Obama tax cuts out of the way, the $1 trillion dollars in sequestration cuts are scheduled to take effect in two month at the same time authorized spending will “hit the roof,” setting up the showdown between the feral Tea Party dominated Republican held House, the roadblocked filibustered Senate and the ever capitulating White House. Still very much in danger are Social Security and Medicare which President Barack Obama has refused to take off the table and keeps offering up as sacrifice as part of an agreement. To get what they want the Republicans are willing to let the government default on its debt

The next “plateau” in the on going “Mythical Cliff” debate is the unconstitutional debt ceiling which the Republicans are now threatening to take hostage to demand draconian cuts to social security and other programs while sparing defense. With the settlement over the Obama tax cuts out of the way, the $1 trillion dollars in sequestration cuts are scheduled to take effect in two month at the same time authorized spending will “hit the roof,” setting up the showdown between the feral Tea Party dominated Republican held House, the roadblocked filibustered Senate and the ever capitulating White House. Still very much in danger are Social Security and Medicare which President Barack Obama has refused to take off the table and keeps offering up as sacrifice as part of an agreement. To get what they want the Republicans are willing to let the government default on its debt

Sen. Pat Toomey (R-Pa.) said on MSNBC’s “Morning Joe” this week, “we Republicans need to be willing to tolerate a temporary, partial government shutdown” in order to achieve spending cuts and entitlement reforms.

On Friday morning, meanwhile, House Speaker John Boehner (R-Ohio) told members that he was prepared to use the debt ceiling fight as leverage to get spending cuts. According to a source in the room, Boehner showed fellow lawmakers the results of a survey by the Winston Group, a GOP polling firm, which showed that 72 percent of Americans “agree any increase in the nation’s debt limit must be accompanied by spending cuts and reforms of a greater amount.”

“The debate is already under way,” the speaker said.

Elsewhere on Friday morning, Sen. John Cornyn (R-Texas), the second-ranking Senate Republican, penned an op-ed making a similar argument.

Republicans are more determined than ever to implement the spending cuts and structural entitlement reforms that are needed to secure the long-term fiscal integrity of our country.

The coming deadlines will be the next flashpoints in our ongoing fight to bring fiscal sanity to Washington. It may be necessary to partially shut down the government in order to secure the long-term fiscal well being of our country, rather than plod along the path of Greece, Italy and Spain. President Obama needs to take note of this reality and put forward a plan to avoid it immediately.

Calling this a “government shutdown,” even a partial shut down, is just plain spin that will result in an even deeper recession than the last one from which we have yet to fully recover. In a letter from Matthew E. Zames, a managing director at JPMorgan Chase and the chairman of the Treasury Borrowing Advisory Committee lists what will happen if the debt ceiling is not raised:

First, foreign investors, who hold nearly half of outstanding Treasury debt, could reduce their purchases of Treasuries on a permanent basis, and potentially even sell some of their existing holdings. [.]] Second, a default by the U.S. Treasury, or even an extended delay in raising the debt ceiling, could lead to a downgrade of the U.S. sovereign credit rating. [..]

Third, the financial crisis you warned of in your April 4th Letter to Congress could trigger a run on money market funds, as was the case in September 2008 after the Lehman failure. [..]

Fourth, a Treasury default could severely disrupt the $4 trillion Treasury financing market, which could sharply raise borrowing rates for some market participants and possibly lead to another acute deleveraging event. [..]

Fifth, the rise in borrowing costs and contraction of credit that would occur as a result of this deleveraging event would have damaging consequences for the still-fragile recovery of our economy. [..]

Finally, (..) because the long-term risks from a default are so large, a prolonged delay in raising the debt ceiling may negatively impact markets well before a default actually occurs.

Obviously, the Republicans did not learn from the last hostage threat that resulted in a market down turn and the downgrade of the US credit rating. That debacle resulted in an extension of the Bush tax cuts and, now the permanent Obama tax cuts. Without tax increases as leverage the President and the Democrats have very little wiggle room.

That brings us to the elephant in the room that most of the MSMS, some so called progressive blogs and pundits, including Nobel Prize winning economist Paul Krugman, have laughed off as “not serious,” the “Trillion Dollar Platinum Coin Solution” (TPC). Guess what, they aren’t laughing at this any more. We may not be able to print money but we can mint coins of any denomination. From Paul Krugman:

The peculiar exception is that clause allowing the Treasury to mint platinum coins in any denomination it chooses. Of course this was intended as a way to issue commemorative coins and stuff, not as a fiscal measure; but at least as I understand it, the letter of the law would allow Treasury to stamp out a platinum coin, say it’s worth a trillion dollars, and deposit it at the Fed – thereby avoiding the need to issue debt. [..]

In reality, to pursue the thought further, the coin really would be as much a Federal debt as the T-bills the Fed owns, since eventually Treasury would want to buy it back. So this is all a gimmick – but since the debt ceiling itself is crazy, allowing Congress to tell the president to spend money then tell him that he can’t raise the money he’s supposed to spend, there’s a pretty good case for using whatever gimmicks come to hand.

But there is a solution to preventing a real fiscal crisis and Josh Barrow at Bloomberg has an ingenious solution to both the debt ceiling and the TPC and why we need to “go off the platinum cliff”:

This law was intended to allow the production of commemorative coins for collectors. But it can also be used to create large-denomination coins that Treasury can deposit with the Fed to finance payment of the government’s bills, in lieu of issuing debt.

What the law should say is that the executive branch may borrow to pay whatever obligations the federal government has, but may not print. Unfortunately, when we hit the debt ceiling, the situation will be backwards: The administration will not be allowed to borrow, but it can print in unlimited quantities.

This points toward an interesting solution.

If Republicans start issuing a list of demands that must be met before they will raise the debt ceiling, Obama should simply say that he will issue platinum coins as necessary to pay government bills if he cannot borrow. But, to avoid causing long-term inflation expectations to skyrocket, he should pledge that he will have the Treasury issue enough bonds to buy back all the newly issued currency as soon as it is allowed to do so.

And then he should offer to sign a bill revoking his authority to issue platinum coins — so long as that bill also abolishes the debt ceiling. The executive branch will give up its unwarranted power to print if the legislative branch will give up its unwarranted restriction on borrowing to cover already appropriated obligations.

Here that Barack? Dare them to destroy the face and credit of this country, then flip that coin on the table along with the bill. Wanna bet they’ll bite?

Meanwhile, we need to encourage our weak kneed president to do what Atrios said

Sign the petition to Mint the Coin

Early this morning the

Early this morning the

Recent Comments