The US Supreme Court handed a conservative challenge to one person, one vote principle a unanimous defeat. In Evenwel v Abbott the court ruled (pdf) that states could count the total population, not just eligible voters, in drawing legislative districts. The plaintiffs claimed that redrawing electoral districts based on the population of citizens and non-citizens …

Tag: 14th Amendment

Oct 10 2013

President Obama Gave Speaker Boehner the Debt Ceiling to Play With in 2010

Disclaimer: This forum rules as do the moderators. You know who I am talking about.

And here we are again! It started in 2010. The Bush tax cuts were about to expire. There was leverage to negotiate a debt ceiling raise or to just let them expire. How do I know there was leverage? I know Republicans like tax cuts for the rich, and there was a deal for the purpose of extending them with Republican votes. It passed with those Republican votes, which led to this whole thing because there was no debt ceiling raise included.

Maybe others are unaware of this? I don’t know. It doesn’t matter though; the uninformed shouldn’t dictate fantasy as reality in a reality based community. This is the actual reality and why we are worried about a global financial calamity with regard to a possible political default on the public debt, which is a choice and otherwise impossible for a sovereign currency issuer.

Obama on the Debt Limit – December 2010

Q Mr. President, thank you. How do these negotiations affect negotiations or talks with Republicans about raising the debt limit? Because it would seem that they have a significant amount of leverage over the White House now, going in. Was there ever any attempt by the White House to include raising the debt limit as a part of this package?

THE PRESIDENT: When you say it would seem they’ll have a significant amount of leverage over the White House, what do you mean?

Q Just in the sense that they’ll say essentially we’re not going to raise the – we’re not going to agree to it unless the White House is able to or willing to agree to significant spending cuts across the board that probably go deeper and further than what you’re willing to do. I mean, what leverage would you have –

THE PRESIDENT: Look, here’s my expectation – and I’ll take John Boehner at his word – that nobody, Democrat or Republican, is willing to see the full faith and credit of the United States government collapse, that that would not be a good thing to happen. And so I think that there will be significant discussions about the debt limit vote. That’s something that nobody ever likes to vote on. But once John Boehner is sworn in as Speaker, then he’s going to have responsibilities to govern. You can’t just stand on the sidelines and be a bomb thrower.

You know, we on the left knew what this would lead to. You don’t trust John Boehner with the full faith in credit of the United States unless one is completely clueless or an economic nihilist. The resulting signs we are starting to see of a financial panic in response to the prospects of a default on top of the ongoing depression, the jobs crisis, the continuing climate and ecological crisis all converging into one huge Epochal crisis, point to a special kind of disdain for the public that all our elected leaders have for us. I mean, we have enough problems without adding to them through a self induced global financial then economic crisis caused by the President’s pursuit of a deficit terrorist grand bargain whether through incompetence or outright corruption.

Oct 05 2013

Galbraith: Government Doesn’t Have to Borrow to Spend

cross-posted from Voices on the Square

James K. Galbraith in Government Doesn’t Have to Borrow to Spend quite clearly and without economic jargon explains why the debt ceiling debate is puppet theater:

The debt ceiling was enacted in 1917 for one purpose: to fool the rubes back home. Just as Congress started running up debts to pay for the war, they voted in the ceiling to pretend otherwise. And that is why whenever reached, it must be raised.

…

In the modern world, when the Treasury writes you a check, your bank credits your account. That’s how money creation works. The Treasury then issues bonds to absorb that money. Banks like this because bonds pay more interest than reserves. But there is nothing economically necessary about the bonds. This is obvious since the Federal Reserve buys back many of them, leaving the public with the cash it would have had in the first place.

…

Under present law, Jack Lew could even pay off public debt held by the Federal Reserve by issuing a high-value, legal-tender coin – so long as the coin happened to be platinum. A coin is not debt, so that simple exchange would retire the Fed’s debt holdings and lower the total public debt below any given ceiling.

James Galbraith admits that this is a gimmick … but then, so is the debt ceiling, so it would be one gimmick fixing the fact that one faction of one political party is holding the faith and credit of the US government hostage over what was originally and has always been since a gimmick.

Sep 21 2013

Calling the Debt Ceiling Bluff: Taking It To The Owners

Joe Firestone has written an excellent piece at New Economic Perspectives on the phony fear mongering about the risk that the Republicans might not vote to raise the debt ceiling. He uses as his point of departure exquisitely fraudulent framing that Ezra Klein adopted for the proposal to trade a budget continuing resolution without defunding Obamacare, for taking the fight to the debt ceiling.

Joe Firestone has written an excellent piece at New Economic Perspectives on the phony fear mongering about the risk that the Republicans might not vote to raise the debt ceiling. He uses as his point of departure exquisitely fraudulent framing that Ezra Klein adopted for the proposal to trade a budget continuing resolution without defunding Obamacare, for taking the fight to the debt ceiling.

The reason the Republican leadership is making the case for that trade is that a continuing resolution has to pass both Chambers, and the version that defunds Obamacare is Dead On Arrival in the Senate, which will amend the bill to restore Obamacare funding and refuse to budge in reconciliation. So sooner or later, the House will have to pass a continuing resolution that includes funding for Obamacare, or else shoulder the political blame for shutting down government.

But what Joe focuses on is the framing of trading off a budget fight for a debt ceiling fight, in which Ezra says:

his is terrifying that this is the argument. And the analogy I would use is this is like trading a bad flu for septic shock. it is the worst trade in the history of all trades you could imagine . . .

Trading a bad flu for septic shock might be the worst trade in the history of all trades, but the only thing that makes the debt ceiling dangerous is the administration’s refusal to call the bluff. As Joe lays out, there are not one, not two, not three, not four, but five options, and three of them would succeed in eliminating the threat that the debt ceiling vote can every again be used for political blackmail.

Apr 04 2013

The Myth of Equal Justice

March 18 marked the fiftieth anniversary of Gideon v. Wainwright, the landmark case by the Supreme Court that required states under the 14th amendment to provide counsel in criminal cases for defendants who are unable to afford to pay their own attorneys, extending the identical requirement made on the federal government under the 6th Amendment.

But is justice now equal?

The Legacy of Gideon v. Wainwright

by John Light, Moyers & Company

Anthony Lewis, The New York Times journalist whose masterwork chronicled the Supreme Court’s landmark Gideon v. Wainwright decision, died earlier this week at the age of 85. The court’s ruling, handed down 50 years ago last week, established a criminal defendant’s right to an attorney, even if that defendant cannot afford one. [..]

Here are some resources on Anthony Lewis and the legacy of Gideon v. Wainwright.

1. Gideon’s Trumpet

In 1964, Lewis, a two-time Pulitzer Prize winner, published his book Gideon’s Trumpet. In it, he described Clarence Earl Gideon as a wrongly convicted Florida man convinced that he was entitled to legal representation even though the state of Florida said otherwise. [..]

2. Defending Gideon

A new documentary from The Constitution Project and the New Media Advocacy Project examines the impact of Gideon v. Wainwright and includes a recent interview with Anthony Lewis as well as an archival interview from the 1960s with Gideon, who explains that he was surprised to hear from the trial judge that he was not entitled to a lawyer. [..]

3. “The Silencing of Gideon’s Trumpet”

Ten years ago, on the 40th anniversary of Gideon v. Wainwright, Lewis described in The New York Times Magazine the “endless failures to bring the promise of Gideon to life.” He wrote, “Even more alarming is the assertion by the Bush administration that in a whole new class of cases it can deny the right to counsel altogether. [..]

4. Adam Liptak on Lewis’s Transformative Journalism

Adam Liptak, one of Lewis’s successors as Supreme Court correspondent for The New York Times, wrote the paper’s obituary of its former reporter and columnist. He noted that Gideon’s Trumpet has never been out of print from the day it was published, and that Lewis’s knowledgeable and thorough coverage of the court during the years Earl Warren served as its chief justice made him almost as essential to its history as the judges themselves. [..]

5. Andrew Cohen on Lewis and Gideon today

Writing in The Atlantic earlier this month, legal scholar Andrew Cohen described how, in the story of Gideon v. Wainwright, Lewis found material for one of the “best nonfiction works written about the Supreme Court and the American legal system.” [..]

But the thrust of Cohen’s essay is that Gideon’s legacy has not fared so well. A Brennan Center for Justice report found that many court appointed lawyers are overworked and spend less than six minutes per case at hearings where they counsel their clients to plead guilty. Lawmakers haven’t funded public defenders adequately, Cohen says, and the Supreme Court has not required them to do so.

On March 29th’s Moyers & Company, host Bill Moyers discussed the system’s failures, and ongoing struggles at the crossroads of race, class and justice with attorney and legal scholar Bryan Stevenson. Then Mr. Moyers is joined by journalists Martin Clancy and Tim O’Brien, authors of Murder at the Supreme Court, to examine the fatal flaws of the death penalty.

The broadcast closes with a Bill Moyers Essay on the hypocrisy of “justice for all” in a society where billions are squandered for a war born in fraud while the poor are pushed aside.

Full transcript can be read here

Jan 08 2013

Krugman Calls for President to Mint the Coin

Sign the petition to Mint the Coin

This past week calls by Republicans to not raise debt ceiling got little push back from the talking heads this Sunday as Senate Minority Leader Mitch McConnell made the morning rounds insinuating that it might not be so bad. Lets get something straight that the MSM village is allowing to happen here. The Republicans are conflating passing a budget bill (future spending) with making the payment on those expenditures (past spending). Those two things are NOT the same. The debt ceiling addresses the later and the consequences of even threatening to not pay US debts would have the same, if not greater, negative results as it did in 2011 when the feral children of the House held it hostage. The result of that debacle was the current sequestration bill and “fiscal cliff” crisis.

This past week calls by Republicans to not raise debt ceiling got little push back from the talking heads this Sunday as Senate Minority Leader Mitch McConnell made the morning rounds insinuating that it might not be so bad. Lets get something straight that the MSM village is allowing to happen here. The Republicans are conflating passing a budget bill (future spending) with making the payment on those expenditures (past spending). Those two things are NOT the same. The debt ceiling addresses the later and the consequences of even threatening to not pay US debts would have the same, if not greater, negative results as it did in 2011 when the feral children of the House held it hostage. The result of that debacle was the current sequestration bill and “fiscal cliff” crisis.

The inflation that everyone from the Federal Reserve to Wall St. wants to the one thing that would put the US in the same boat as Greece, facing increasingly higher interest rate payments. In other words the debt ceiling and the budget resolution are NOT the same and should not be treated the same. The sequester and the budget resolution are negotiable; the debt ceiling is not.

This idea of holding the debt ceiling is in fact so dangerous to the world economy that politicians, economist and pundits are calling for President Barack Obama to act by using possibly the only legal means he may have, mint a Trillion Dollar Platinum Coin. Even New York Times columnist and economist, Paul Krugman has change his mind calling for the president to be ready to mint that coin:

Should President Obama be willing to print a $1 trillion platinum coin if Republicans try to force America into default? Yes, absolutely. He will, after all, be faced with a choice between two alternatives: one that’s silly but benign, the other that’s equally silly but both vile and disastrous. The decision should be obvious. [..]

It’s easy to make sententious remarks to the effect that we shouldn’t look for gimmicks, we should sit down like serious people and deal with our problems realistically. That may sound reasonable – if you’ve been living in a cave for the past four years.Given the realities of our political situation, and in particular the mixture of ruthlessness and craziness that now characterizes House Republicans, it’s just ridiculous – far more ridiculous than the notion of the coin.

So if the 14th amendment solution – simply declaring that the debt ceiling is unconstitutional – isn’t workable, go with the coin.

If you think that this possibility isn’t serious, consider the fact that the feral children of the House now do introducing legislation to prevent the president from minting the coin

And now a US Congressman has come out against the coin idea and is proposing a law to ban it (via Matthew O’Brien). Ironically, this action actually legitimizes the coin option. [..]

In the past, hiking the debt ceiling was pretty painless, but some in the GOP are staunchly opposed to doing it, raising the specter that the US will default on its obligations.

It’s because of this that some people are getting more excited about the “Platinum Option,” which refers to a technical loophole in the law that allows the Treasury to create platinum coins in any denomination, theoretically up to a trillion and beyond. [..]

We’ve posted his full press release below, but the key thing here is that the idea is now legitimized, as a GOP Congressman implicitly acknowledges that the coin idea is currently legal.

Note that in his press release, the Congressman uses the flawed analogy of comparing the US government to a small business. Unlike governments, small businesses can’t print money. And small businesses can’t “deficit spend,” the way governments can.

The opponents of this idea are also wrong. Josh Borrow, who writes at Bloomberg‘s The Ticker, enumerates why their arguments are all wrong and concludes:

Minting the platinum coin would be less economically damaging than any of the above options, which is why Obama should announce he will pursue it if the debt ceiling is not raised. Hopefully, inflation hawks will be so alarmed by the president’s intention to use his direct monetary authority that they will choose to cut a deal and we’ll never actually get to the minting stage.

But if Republicans call Obama’s bluff, he should be ready to mint that coin – – and to save the economy by doing so.

Sign the petition to Mint the Coin

Jan 04 2013

Going Platinum: Sign The Petition

Sign the petition to Mint the Coin

The next “plateau” in the on going “Mythical Cliff” debate is the unconstitutional debt ceiling which the Republicans are now threatening to take hostage to demand draconian cuts to social security and other programs while sparing defense. With the settlement over the Obama tax cuts out of the way, the $1 trillion dollars in sequestration cuts are scheduled to take effect in two month at the same time authorized spending will “hit the roof,” setting up the showdown between the feral Tea Party dominated Republican held House, the roadblocked filibustered Senate and the ever capitulating White House. Still very much in danger are Social Security and Medicare which President Barack Obama has refused to take off the table and keeps offering up as sacrifice as part of an agreement. To get what they want the Republicans are willing to let the government default on its debt

The next “plateau” in the on going “Mythical Cliff” debate is the unconstitutional debt ceiling which the Republicans are now threatening to take hostage to demand draconian cuts to social security and other programs while sparing defense. With the settlement over the Obama tax cuts out of the way, the $1 trillion dollars in sequestration cuts are scheduled to take effect in two month at the same time authorized spending will “hit the roof,” setting up the showdown between the feral Tea Party dominated Republican held House, the roadblocked filibustered Senate and the ever capitulating White House. Still very much in danger are Social Security and Medicare which President Barack Obama has refused to take off the table and keeps offering up as sacrifice as part of an agreement. To get what they want the Republicans are willing to let the government default on its debt

Sen. Pat Toomey (R-Pa.) said on MSNBC’s “Morning Joe” this week, “we Republicans need to be willing to tolerate a temporary, partial government shutdown” in order to achieve spending cuts and entitlement reforms.

On Friday morning, meanwhile, House Speaker John Boehner (R-Ohio) told members that he was prepared to use the debt ceiling fight as leverage to get spending cuts. According to a source in the room, Boehner showed fellow lawmakers the results of a survey by the Winston Group, a GOP polling firm, which showed that 72 percent of Americans “agree any increase in the nation’s debt limit must be accompanied by spending cuts and reforms of a greater amount.”

“The debate is already under way,” the speaker said.

Elsewhere on Friday morning, Sen. John Cornyn (R-Texas), the second-ranking Senate Republican, penned an op-ed making a similar argument.

Republicans are more determined than ever to implement the spending cuts and structural entitlement reforms that are needed to secure the long-term fiscal integrity of our country.

The coming deadlines will be the next flashpoints in our ongoing fight to bring fiscal sanity to Washington. It may be necessary to partially shut down the government in order to secure the long-term fiscal well being of our country, rather than plod along the path of Greece, Italy and Spain. President Obama needs to take note of this reality and put forward a plan to avoid it immediately.

Calling this a “government shutdown,” even a partial shut down, is just plain spin that will result in an even deeper recession than the last one from which we have yet to fully recover. In a letter from Matthew E. Zames, a managing director at JPMorgan Chase and the chairman of the Treasury Borrowing Advisory Committee lists what will happen if the debt ceiling is not raised:

First, foreign investors, who hold nearly half of outstanding Treasury debt, could reduce their purchases of Treasuries on a permanent basis, and potentially even sell some of their existing holdings. [.]] Second, a default by the U.S. Treasury, or even an extended delay in raising the debt ceiling, could lead to a downgrade of the U.S. sovereign credit rating. [..]

Third, the financial crisis you warned of in your April 4th Letter to Congress could trigger a run on money market funds, as was the case in September 2008 after the Lehman failure. [..]

Fourth, a Treasury default could severely disrupt the $4 trillion Treasury financing market, which could sharply raise borrowing rates for some market participants and possibly lead to another acute deleveraging event. [..]

Fifth, the rise in borrowing costs and contraction of credit that would occur as a result of this deleveraging event would have damaging consequences for the still-fragile recovery of our economy. [..]

Finally, (..) because the long-term risks from a default are so large, a prolonged delay in raising the debt ceiling may negatively impact markets well before a default actually occurs.

Obviously, the Republicans did not learn from the last hostage threat that resulted in a market down turn and the downgrade of the US credit rating. That debacle resulted in an extension of the Bush tax cuts and, now the permanent Obama tax cuts. Without tax increases as leverage the President and the Democrats have very little wiggle room.

That brings us to the elephant in the room that most of the MSMS, some so called progressive blogs and pundits, including Nobel Prize winning economist Paul Krugman, have laughed off as “not serious,” the “Trillion Dollar Platinum Coin Solution” (TPC). Guess what, they aren’t laughing at this any more. We may not be able to print money but we can mint coins of any denomination. From Paul Krugman:

The peculiar exception is that clause allowing the Treasury to mint platinum coins in any denomination it chooses. Of course this was intended as a way to issue commemorative coins and stuff, not as a fiscal measure; but at least as I understand it, the letter of the law would allow Treasury to stamp out a platinum coin, say it’s worth a trillion dollars, and deposit it at the Fed – thereby avoiding the need to issue debt. [..]

In reality, to pursue the thought further, the coin really would be as much a Federal debt as the T-bills the Fed owns, since eventually Treasury would want to buy it back. So this is all a gimmick – but since the debt ceiling itself is crazy, allowing Congress to tell the president to spend money then tell him that he can’t raise the money he’s supposed to spend, there’s a pretty good case for using whatever gimmicks come to hand.

But there is a solution to preventing a real fiscal crisis and Josh Barrow at Bloomberg has an ingenious solution to both the debt ceiling and the TPC and why we need to “go off the platinum cliff”:

This law was intended to allow the production of commemorative coins for collectors. But it can also be used to create large-denomination coins that Treasury can deposit with the Fed to finance payment of the government’s bills, in lieu of issuing debt.

What the law should say is that the executive branch may borrow to pay whatever obligations the federal government has, but may not print. Unfortunately, when we hit the debt ceiling, the situation will be backwards: The administration will not be allowed to borrow, but it can print in unlimited quantities.

This points toward an interesting solution.

If Republicans start issuing a list of demands that must be met before they will raise the debt ceiling, Obama should simply say that he will issue platinum coins as necessary to pay government bills if he cannot borrow. But, to avoid causing long-term inflation expectations to skyrocket, he should pledge that he will have the Treasury issue enough bonds to buy back all the newly issued currency as soon as it is allowed to do so.

And then he should offer to sign a bill revoking his authority to issue platinum coins — so long as that bill also abolishes the debt ceiling. The executive branch will give up its unwarranted power to print if the legislative branch will give up its unwarranted restriction on borrowing to cover already appropriated obligations.

Here that Barack? Dare them to destroy the face and credit of this country, then flip that coin on the table along with the bill. Wanna bet they’ll bite?

Meanwhile, we need to encourage our weak kneed president to do what Atrios said

Sign the petition to Mint the Coin

Jul 20 2011

Congressional Game of Chicken: Invoke the 14th Amendment Option

I have no idea what President Obama is thinking. What I do know is that he is partly responsible for the brinkmanship that is being played out as the debt ceiling looms putting the US credit rating on the line and many Americans at dire financial risk. Susie Madrak at Crooks and Liars says she thinks former President Bill Clinton may know what Obama is thinking as the deadline to raise the debt ceiling nears. What ever Obama is thinking, Pres. Clinton offers some very audacious advice. In an interview with columnist Joe Conason, he said:

I have no idea what President Obama is thinking. What I do know is that he is partly responsible for the brinkmanship that is being played out as the debt ceiling looms putting the US credit rating on the line and many Americans at dire financial risk. Susie Madrak at Crooks and Liars says she thinks former President Bill Clinton may know what Obama is thinking as the deadline to raise the debt ceiling nears. What ever Obama is thinking, Pres. Clinton offers some very audacious advice. In an interview with columnist Joe Conason, he said:

{} he would invoke the so-called constitutional option to raise the nation’s debt ceiling “without hesitation, and force the courts to stop me” in order to prevent a default, should Congress and the President fail to achieve agreement before the August 2 deadline.

Sharply criticizing Congressional Republicans in an exclusive Monday evening interview with The National Memo, Clinton said, “I think the Constitution is clear and I think this idea that the Congress gets to vote twice on whether to pay for [expenditures] it has appropriated is crazy.”

Lifting the debt ceiling “is necessary to pay for appropriations already made,” he added, “so you can’t say, ‘Well, we won the last election and we didn’t vote for some of that stuff, so we’re going to throw the whole country’s credit into arrears.”

Having faced down the Republican House leadership during two government shutdowns when he was president — and having brought the country’s budget from the deep deficits left by Republican presidents to a projected surplus — Clinton is unimpressed by the GOP’s sudden enthusiasm for balanced budgets. But he never considered invoking the Fourteenth Amendment — which says “the validity of the US public debt shall not be questioned” – because the Republicans led by then-Speaker Newt Gingrich didn’t threaten to use the debt ceiling as a weapon in their budget struggles with him.

I am fairly certain that Clinton would do just that. Would that President Obama had that courage.

Jun 29 2011

The Constitutional Game of Chicken: The Debt Ceiling & The 14th Amendment (Up Date)

The 14th Amendment of the United States Constitution:

The 14th Amendment of the United States Constitution:

The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned. But neither the United States nor any State shall assume or pay any debt or obligation incurred in aid of insurrection or rebellion against the United States, or any claim for the loss or emancipation of any slave; but all such debts, obligations and claims shall be held illegal and void.

Republican economist Bruce Bartlett, who believes that the Republicans are playing with “the financial equivalent of nuclear weapons”, argues that Section 4 renders the debt ceiling unconstitutional, and obligates the President to consider the debt ceiling null and void.

. . . .I believe that the president would be justified in taking extreme actions to protect against a debt default. In the event that congressional irresponsibility makes default impossible to avoid, I think he should order the secretary of the Treasury to simply disregard the debt limit and sell whatever securities are necessary to raise cash to pay the nation’s debts. They are protected by the full faith and credit of the United States and preventing default is no less justified than using American military power to protect against an armed invasion without a congressional declaration of war.

Furthermore, it’s worth remembering that the debt limit is statutory law, which is trumped by the Constitution and there is a little known provision that relates to this issue. Section 4 of the 14th Amendment says, “The validity of the public debt of the United States…shall not be questioned.” This could easily justify the sort of extraordinary presidential action to avoid default that I am suggesting.

snip

Constitutional history is replete with examples where presidents justified extraordinary actions by extraordinary circumstances. During the George W. Bush administration many Republicans defended the most expansive possible reading of the president’s powers, especially concerning national security. Since default on the debt would clearly have dire consequences for our relations with China, Japan and other large holders of Treasury securities, it’s hard to see how defenders of Bush’s policies would now say the president must stand by and do nothing when a debt default poses an imminent national security threat.

Mr. Bartlett is not alone, Garret Epps, journalist and professor of law at Baltimore University, agrees and proposes the President should give a speech declaring, ‘The Constitution Forbids Default’.

Democratic members of the Senate, too, have begun exploring the possibility of declaring the debt ceiling unconstitutional:

“This is an issue that’s been raised in some private debate between senators as to whether in fact we can default, or whether that provision of the Constitution can be held up as preventing default,” Sen. Chris Coons (D-Del.), an attorney, told The Huffington Post Tuesday. “I don’t think, as of a couple weeks ago, when this was first raised, it was seen as a pressing option. But I’ll tell you that it’s going to get a pretty strong second look as a way of saying, ‘Is there some way to save us from ourselves?'”

By declaring the debt ceiling unconstitutional, the White House could continue to meet its financial obligations, leaving Tea Party-backed Republicans in the difficult position of arguing against the plain wording of the Constitution. Bipartisan negotiators are debating the size of the cuts, now in the trillions, that will come along with raising the debt ceiling.

Sen. Patty Murray (D-Wash.), head of the Democratic Senatorial Campaign Committee, said that the constitutional solution puts the question in its proper context — that the debate is over paying past debts, not over future spending.

“The way everybody talks about this is that we need to raise the debt ceiling. What we’re really saying is, ‘We have to pay our bills,'” Murray said. The 14th Amendment approach is “fascinating,” she added.

Let the games continue.

Up dates below the fold.

Aug 23 2010

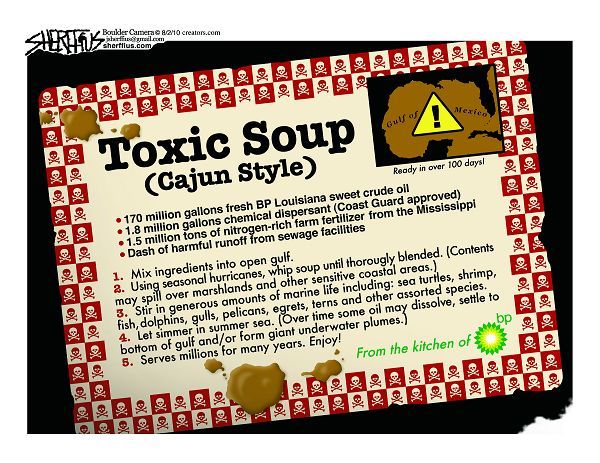

The Week in Editorial Cartoons, Part I – BP’s Soup Recipe

Crossposted at Daily Kos and Docudharma

|

|

|

|

|

Note: Due to a deluge of editorial cartoons over the past week or so, I’m going to, time permitting, post Part II of this weekly diary in the next few days. In addition to some of the issues covered in this edition, I’ll include more cartoons on the floods in Pakistan, the withdrawal of combat U.S. forces in Iraq, and Rupert Murdoch’s $1 million contribution to the GOP.

- 1

- 2

Recent Comments