While CEO’s are rolling in more money than any average workers could imagine in a lifetime, raising their taxes and closing the tax loop holes that allow then to pay even less or, in some instances, nothing at all. According to a USA Today analysis, CEO’s pay went up 27% in 2010 while workers’ pay rose only 2%.

While CEO’s are rolling in more money than any average workers could imagine in a lifetime, raising their taxes and closing the tax loop holes that allow then to pay even less or, in some instances, nothing at all. According to a USA Today analysis, CEO’s pay went up 27% in 2010 while workers’ pay rose only 2%.

Paychecks as Big as Tajikistan

By Gretchen Morgenson

WHEN does big become excessive? If the question involves executive pay, the answer is “often.”

snip

Answers to that question come fast and furious in a recent, immensely detailed report in The Analyst’s Accounting Observer, a publication of R. G. Associates, an independent research firm in Baltimore. Jack Ciesielski, the firm’s president, and his colleague Melissa Herboldsheimer have examined proxy statements and financial filings for the companies in the Standard & Poor’s 500-stock index. In a report titled “S.& P. 500 Executive Pay: Bigger Than …Whatever You Think It Is,” they compare senior executives’ pay with other corporate costs and measures.

It’s an enlightening, if enraging, exercise. And it provides the perspective that shareholders desperately need, particularly now that they are being asked to vote on corporate pay practices.

Let’s begin with the view from 30,000 feet. Total executive pay increased by 13.9 percent in 2010 among the 483 companies where data was available for the analysis. The total pay for those companies’ 2,591 named executives, before taxes, was $14.3 billion.

That’s some pile of pay, right? But Mr. Ciesielski puts it into perspective by noting that the total is almost equal to the gross domestic product of Tajikistan, which has a population of more than 7 million.

Warming to his subject, Mr. Ciesielski also determined that 158 companies paid more in cash compensation to their top guys and gals last year than they paid in audit fees to their accounting firms. Thirty-two companies paid their top executives more in 2010 than they paid in cash income taxes.

The report also blows a hole in the argument that stock grants to executives align the interests of managers with those of shareholders. The report calculated that at 179 companies in the study, the average value of stockholders’ stakes fell between 2008 and 2010 while the top executives at those companies received raises. The report really gets meaty when it compares executive pay with items like research and development costs, and earnings per share.

Using Disney CEO, Robert Iger and workers at Disney World in Florida as an example, Time looks at the ever widening income gap:

Disney’s Robert Iger got a 45% bigger bonus in 2010

The corporate PR teams are defending these bonuses by saying that the executives deserve the pay because stock prices and earnings are up. A Walt Disney spokesperson says that shareholder return at the company was up nearly 24%, substantially more than the Standard & Poors 500. But haven’t we already learned, through bubble after bubble, that stock prices are a poor indication of anything. They are irrational, give us false positives, and crash.

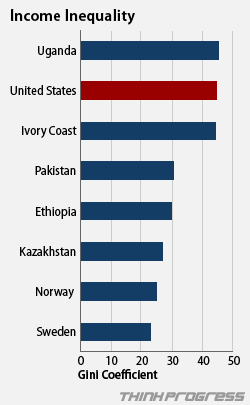

But here’s what is the real problem. Yes, if higher profits and a higher stock price warrant better pay for CEOs, why doesn’t the same ring true for the average employee. Workers at Disney’s Florida amusement park Walt Disney World fought for months last year and early this year for higher wages. What they finally ended up getting, in a new contract settled earlier this month, was an annual raise of 3% to 4% over the next three years. The workers will get a bonus, too, of $650, a mere 20,769 times less than Iger’s bonus. As long as it remains that only a small segment of our population will be rewarded for better performance, while the rest of us do more and more work for the same pay, the wealth gap in America is certain to get worse.

It is very evident that the White House, Congress and many state governors and legislatures have not learned that tax cuts for the wealthy will not improve the economy or create jobs. They have done nothing to reverse the trend of the widening income gap. They have dug themselves and us into a hole so deep that they cannot hear rational ideas for even stopping the spiral into a economic morass.

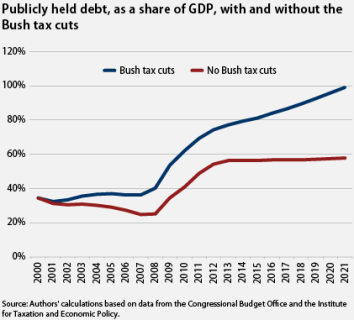

Continuing economic policies the have failed is flat out stupid. Proposing to not only continue with those policies but to reinforce them by making them worse is economic and political suicide. It is the path that the Obama administration and Congress have taken us down by renewing the Bush Tax Cuts until December 2012. Some of the GOP candidates would like to cut taxes even further, so much so that it would cripple the government and widen the socio-economic gap of the haves and have-nots.

Continuing economic policies the have failed is flat out stupid. Proposing to not only continue with those policies but to reinforce them by making them worse is economic and political suicide. It is the path that the Obama administration and Congress have taken us down by renewing the Bush Tax Cuts until December 2012. Some of the GOP candidates would like to cut taxes even further, so much so that it would cripple the government and widen the socio-economic gap of the haves and have-nots. Did you know that the Federal government

Did you know that the Federal government  President Obama in his Saturday address to the nation,

President Obama in his Saturday address to the nation,

Recent Comments