The progressive Democrats of the Senate got Larry Summers to withdraw from consideration for chair of the Federal Reserve over the weekend. So now they’re yellin’ for Yellen. Well, folks Janet Yellen the current vice chair of the Federal Reserve is just the distaff version of Larry minus the misogyny.

Huffington Post‘s senior political economy reporter Zach Carter gives a rundown of Ms. Yellen’s policy history before and during her tenure as chair of Council of Economic Advisers in the Clinton administration. During that time she backed the repeal of the landmark Glass-Steagall bank reform, supported the 1993 North American Free Trade Agreement and pressured the government to develop a new statistical metric intended to lower payments to senior citizens on Social Security. Yes, dears, that last one would be an earlier version of the Chained CPI.

But in the 1990s, Yellen and Summers both served in the Clinton administration, and pursued many of the same policies. Yellen began serving as Chair of President Bill Clinton’s Council of Economic Advisers in 1997, and publicly endorsed repealing Glass-Steagall’s separation between traditional bank lending and riskier securities trading during her Senate confirmation hearing. Yellen referred to deregulating banking as a way to “modernize” the financial system, and indicated that breaking down Glass-Steagall could be the beginning of a process allowing banks to merge with other commercial and industrial firms. [..]

At the same event, Yellen endorsed establishing a new statistical metric that would allow the federal government to reduce Social Security payments over time, by revising the consumer price index, or CPI, the government’s standard measurement for inflation. [..]

Before Yellen joined the Clinton administration, she was a respected economist at the University of California at Berkeley. In 1993, she joined dozens of other academics in signing a letter to Clinton advocating for the North American Free Trade Agreement. The letter was signed by prominent conservative economists including Milton Friedman, but also by many economists who are now considered progressive, including Paul Krugman and former Obama adviser Christina Romer. Krugman has since expressed disappointment with some of the trade pact’s effects.

(all emphasis mine)

The full transcript of Ms. Yellen’s Feb. 5, 1997 conformation hearing can be read here (pdf).

To be fair on the Glass-Steagall repeal, Ezra Klein weighed in at his Washington Post Wonkblog:

Another point here is that Glass-Steagall really wasn’t behind the crisis. Wonkblog’s Glass-Steagall explainer has much more detail on this, but perhaps the simplest way to make the point is to quote Sen. Elizabeth Warren, the lead sponsor behind the bill to restore Glass-Steagall. When Andrew Ross Sorkin asked her whether the law would’ve prevented the financial crisis or JP Morgan’s subsequent losses, she said, “the answer is probably ‘No’ to both.” There are good reasons to bring back Glass-Steagall, but they’re separate from the events of 2007 and 2008.

Which is only to say that supporting the repeal of Glass-Steagall in 1997 doesn’t say that much about somebody’s opinions on regulating Wall Street today. And, in general, we don’t know very much about Janet Yellen’s views on the subject. As I’ve argued before, the support for her on this dimension (as opposed to on the monetary policy dimension) really comes from an anybody-but-Summers impulse.

Carter also noted in his article that Ms. Yellen is more consumer friendly. During her tenure as president of the San Francisco Federal Reserve from June 14, 2004 until 2010, she identified the housing bubble and urged stronger regulation to limit its damage.

This still leaves a lot of questions about whether she would support the chained CPI, that is very unpopular among seniors and the public in general, or support regulation to rein in the TBTF banks. As lambert at Corrente puts it:

“Be careful what you wish for; you might get it” was made for situations like this.

So let’s not confuse a solid base hit with a game-winning grand slam, OK?

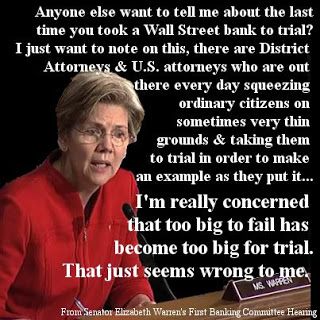

Heads up folks, there’s a new sheriff in town and she’s not ready to make nice. Freshman Senator Elizabeth Warren (D-MA) made her debut on the Senate Banking Committee making it very clear to the bank regulators from the alphabet soup of agencies sitting before her,

Heads up folks, there’s a new sheriff in town and she’s not ready to make nice. Freshman Senator Elizabeth Warren (D-MA) made her debut on the Senate Banking Committee making it very clear to the bank regulators from the alphabet soup of agencies sitting before her,

Recent Comments