One of the architects of the audit of the Federal Reserve was former Rep. Alan Grayson (D-FL) who is running for his old house seat. He appeared with Keith Olbermann to discuss the Bloomberg report on the secret no strings, 0% interest $7.7 trillion had out to the banks that they also reaped another $13 billion in profits. As Rep. Grayson points out it is far worse than even the Bloomberg report.

So what does the Obama administration have to say about this? Apparently not a lot. The president is too busy raising campaign money from those who benefited most from this bailout. Obama’s minions on Twitter and in so-called “progressive” blogs have rushed in to defend him against any appearance that he sides with the banks. They ignore the history of the president’s part in the dilution of the Dodd/Frank regulations which has yet to take affect. So here is a brief refresher to keep this based in reality.

Way back at the beginning of Barack Obama’s administration and in the aftermath of the 2008 Wall St/Banking meltdown, financial reform had strong bipartisan support. The original Dodd-Frank Bill contained a provision for regular audits to the end the secrecy of the Federal Reserve. It was introduced in the House by Rep. Alan Grayson (D-FL) and Rep, Ron Paul (R-TX) with strong support from on the Senate side from Sen. Bernie Sanders (I-VT) and Sen. Jim DeMint (R-SC). However, the amendment was opposed by not only Wall St. and the Federal Reserve, it was also opposed by the Obama administration so strenuously that Obama threatened to veto the entire Dodd/Frank bill if the audit was included. That amendment failed and a second one was crafted for the one time audit which was just as adamantly opposed by Obama and company.

Deal Killer? White House Takes Aim At Fed Audit Provision

by Brian Beutler | May 4, 2010,

Possibly today, but if not today then soon, the Senate will decide whether or not to follow the House’s lead and adopt a provision requiring government auditors to open up the books at the Federal Reserve. The measure enjoys a great deal of popularity on both the left and the right, but is so fiercely opposed by powerful interests that it could nonetheless become a stumbling block in the way of financial regulatory legislation.

Right now Sen. Bernie Sanders (I-VT) is trying to round up 60 or more votes to overcome a likely filibuster and include an “audit the Fed” provision in the Senate’s bill. There are just a few small obstacles: the White House, major financial institutions, and the Fed itself. Their resistance is fierce–but the measure is so popular that killing it will be difficult for them and that, in their eyes, threatens to put a grenade at the center of efforts to to tighten the rules on Wall Street. [..]

That’s why, according to the Wall Street Journal they’ll “fight to stop it at all costs.” The White House is hoping to cut off “audit the Fed” in the Senate, so that they’ll have a stronger hand when House and Senate negotiators meet to iron out the differences between their regulatory reform bills. If the Senate bill does not include Sanders’ amendment, then the House will be in a weak position vis-a-vis the Senate and White House and the provision could be easily stripped.

If Sanders prevails, then the White House will be all but out of options and President Obama will likely be left with the choice of vetoing the legislation, or signing it and raising the ire of very powerful people. Stay tuned.

Sanders’ amendment for a one time only audit prevailed and was conducted this past year that has revealed a massive handout to banks. We now know why the Federal Reserve and the banks didn’t want this audit. The question now is what is going to be done to prevent the Federal Reserve from dong this again. It’s fairly obvious what the president’s policy is, he sides with Wall St and the banks, the 1%.

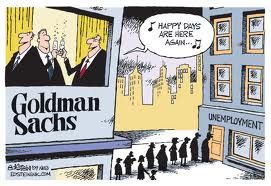

After receiving a $10 billion of tax payer money in the financial crisis bailout and making a record $2.7 billion profit in the first quarter of 2011, Goldman Sachs will lay off 1,000 American workers and

After receiving a $10 billion of tax payer money in the financial crisis bailout and making a record $2.7 billion profit in the first quarter of 2011, Goldman Sachs will lay off 1,000 American workers and

Recent Comments