Apparently, US Attorney General Eric Holder thinks it is far more important to protect corporations from intellectual property (IP) theft than to protect us from predatory and fraudulent banking practices that has led to collapse of the economy. He is more concerned that you or your neighbor are illegally downloading movies or songs from the internet or receiving pharmaceuticals from Canada.

On November 29, Mr. Holder held a press conference to announce a serious crack down on IP theft:

As our country continues to recover from once-in-a-generation economic challenges, the need to safeguard intellectual property rights – and to protect Americans from IP crimes – has never been more urgent. But, in many ways, this work has also never been more difficult.

Recent technological advances – particularly in methods of manufacturing and distribution – have created new opportunities for businesses of all sizes to innovate and grow. But these quantum leaps have also created new vulnerabilities, which tech-savvy criminals are eager to exploit. As a result, we’re seeing an alarming rise in IP crimes – illegal activities that can not only devastate individual lives and legitimate businesses, but undermine our nation’s financial stability and prosperity.

Make no mistake: IP crimes are anything but victimless. For far too long, the sale of counterfeit, defective, and dangerous goods has been perceived as “business as usual.” But these and other IP crimes can destroy jobs, suppress innovation, and jeopardize the health and safety of consumers. In some cases, these activities are used to fund dangerous – and even violent – criminal enterprises and organized crime networks. And they present a significant – and growing – threat to our nation’s economic and national security.

But we are fighting back – in bold, comprehensive, and collaborative ways.

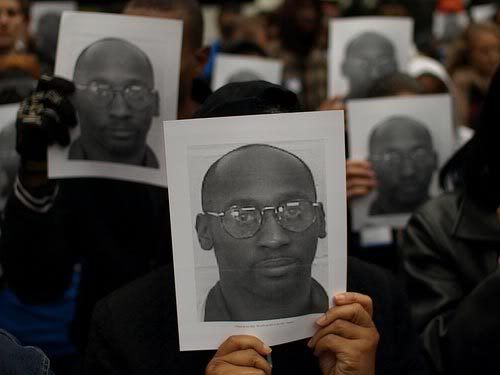

One of those “bold, comprehensive, and collaborative ways” is a series of series of television, radio, and Internet public service announcements that will ask the public to spy on their neighbors.

We shouldn’t be surprised by this since, as reported in the Wired:

The Justice Department under President Barack Obama has seen a sea change in attitude when it comes to intellectual-property enforcement, which could have been predicted by the number of former Recording Industry Association of America attorneys appointed by the Obama administration. (Hollywood votes and donates Democratic).

Meanwhile, as Matt Stoller writes, mortgage fraud continues unabated and unprosecuted:

In 2004, the FBI warned Congress of an “epidemic of mortgage fraud,” of unscrupulous operators taking advantage of a booming real estate market. Less than two years later, an accounting scandal at Fannie Mae tipped us off that something was very wrong at the highest levels of corporate America.

Of course, we all know what happened next. Crime invaded the center of our banking system. Wall Street CEOs were signing on to SEC documents knowing they contained material misstatements. The New York Fed, riddled with conflicts of interest, shoveled money to large banks and tried to hide it under the veil of central bank independence. Even Tim Geithner noted that Lehman had “air in the marks” in its valuations of asset-backed securities, as the bankruptcy examiner’s report showed that accounting manipulation to disguise the condition of the balance sheet was a routine management tool at the bank. [..]

And yet, no handcuffs. [..]

And what happens when this kind of fraud goes unprosecuted? It continues, even today. The same banks that ran the corrupt home mortgage securitization chain are now committing rampant fraud in the foreclosure crisis. Here’s New Orleans Bankruptcy Judge Elizabeth Magner discussing problems at Lender Processing Services, the company that handles 80 percent of foreclosures on behalf of large banks. [..]

The bad behavior is so rampant that banks think nothing of a contractor programming fraud into the software. This is shocking behavior and has led to untold numbers of foreclosures, as well as the theft of huge sums of money from mortgage-backed securities investors.

It would be nice if the Obama Justice Department devoted the same man power, resources and efforts into prosecuting the banks and mortgage service lenders who pushed fraudulent loans and have illegally foreclosed on thousands of homes. The attitude of Obama administration continues to be that they must bail out banks and protect corporations while the public gets sold out by the government that is suppose to protect us.

Recent Comments