“Punting the Pundits” is an Open Thread. It is a selection of editorials and opinions from around the news medium and the internet blogs. The intent is to provide a forum for your reactions and opinions, not just to the opinions presented, but to what ever you find important.

Thanks to ek hornbeck, click on the link and you can access all the past “Punting the Pundits”.

Wednesday is Ladies’ Day

Follow us on Twitter @StarsHollowGzt

Katrina vanden Heuvel: It’s time to break up the big banks

Consider $2 billion lost on a bad bet, plus billions more as investors dumped the stock, a providential warning. When Jamie Dimon, the imperious head of JPMorgan Chase, revealed that the bank had lost so much on a derivatives trade gone bad, it was clear warning that, four years after blowing up the economy, the big banks are still playing with bombs. [..]

When Dimon testified before the Financial Crisis Inquiry Commission in 2010, he said that when his daughter asked him what a financial crisis was, he told her “it’s something that happens every five to seven years.” He seems intent on validating his prediction.

But the United States went for decades without a financial crisis after the New Deal regulations shackled the banks. It was only with deregulation under Reagan and Clinton that financial crises have been inflicted on us regularly. Now Dimon’s bank’s bad bets have given us one last warning: It is time to break up the big banks

Maira Sutton: Internet Freedom Activists Protest Secret Trade Agreement Being Negotiated This Week

The U.S. content industry will try anything to preserve its profit margin and power over the creative content market at the expense of the Internet. They will use any tactic that circumvents democratic processes to make new rules for the Internet that favor their interests and not the interests of Internet users or the technical community that actually builds the Internet as we know it. The Trans-Pacific Partnership (TPP) is yet another example of these tactics.

The TPP is a secretive plurilateral1 agreement that includes provisions dealing with intellectual property, including online copyright enforcement, anti-circumvention measures, and Internet intermediary liability. Due to the secrecy of the negotiations, we do not know what is in the current version of the TPP’s IP chapter; the general public has only seen a leaked February 2011 version of the U.S. IP chapter proposal pdf. Based on the one-sided nature of the groups directly involved, and the content of what has already leaked, we should all be concerned about the prospect of the TPP including provisions that will harm online expression, privacy and innovation on the Internet.

J.P. Morgan’s CEO Jamie Dimon once sarcastically complained that all his traders would need to talk to a psychiatrist in order to comply with regulations. Now, in the absence of strict regulations, every trader on the street is psychoanalyzing Dimon’s every word in order to try to make money off J.P. Morgan’s very large mistake.

Back in February, Dimon famously told Fox Business that because of the Volcker Rule for “every trader, we are going to have to have a lawyer, a compliance officer, a doctor to see what their testosterone levels are, and a shrink, ‘what is your intent?’ ” But now it is J.P. Morgan’s intent in a $100 billion bet that has sent the financial media abuzz with questions. The $2 billion loss that J.P. Morgan has incurred related to this position has only further fueled the speculations about what, exactly, J.P. Morgan was trying to do with this trade.

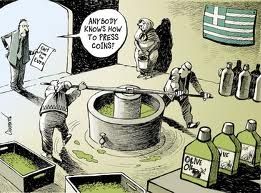

Robin Wells: German voters must break the Merkel mindset that got them into this

Greece’s euro membership was as much the German elite’s fault as anyone’s. Can it find the leadership to resolve the crisis?

Sunday’s regional German elections offer a small ray of hope. Merkel’s party received a thrashing in North Rhine-Westphalia, home to nearly one in five Germans. Rejecting the conservatives’ hard-line platform of more austerity and finger-pointing, German voters instead voted for the Social Democrats, for a platform of more spending and, shockingly, for more debt. This caps a series of defeats in state elections for Merkel and makes it increasingly clear that her government is in serious jeopardy.

Perhaps, just perhaps, German voters are waking up. And therein lies the possibility that the euro can be saved.

But it’s a race against time at this point. Precious time, credibility and resources have been lost. Lives have been up-ended and shattered, voters are angry and restive, markets are in a hostile and unforgiving mood. It is said that leaders are born of great crises. It is now or never for Germany.

Jessica Valenti: Year of the (Young) Woman

Komen. Sandra Fluke. Transvaginal. The reason these words are instantly recognizable-the reason the “war on women” is now part of the national conversation-is largely thanks to younger women and online organizing. Behind every recent battle against the onslaught of sexism has been the energy and activism of young people-on blogs, Twitter, Tumblr and Faebook. And in a long-overdue but welcome change of message, the mainstream feminist movement that once claimed young women didn’t care about feminism is finally catching on. Some are even walking the walk.

Last week, NARAL Pro-Choice America President Nancy Keenan announced that she would be stepping down from her role to make way for younger activists. She told Sarah Kliff at the Washington Post, “There’s an opportunity for a new and younger leader.”

“People give a lot of lip service to how we’re going to engage the next generation, but we can’t just assume it will happen on its own.”

Sarah Anderson: Nurses Push Tax on Trades to Help Sick

Of all the street actions leading up to the NATO summit, the one that might seem most perplexing is a nurses’ rally for a tax on securities trades. Financial markets are pretty remote from hospital bedsides, you might think.

Why would nurses get mixed up in an issue like that?

RoseAnn DeMoro, executive director of National Nurses United, says there’s a simple explanation: “The big banks, investment firms and other financial institutions, which ruined the economy with trillion-dollar trades on people’s homes and pensions and similar reckless gambling, should pay for the recovery.”

Nurses have been on the front lines of the crisis, seeing firsthand the health impacts of skyrocketing poverty and record high rates of uninsured Americans.

Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the

Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the

Recent Comments