(10 am. – promoted by ek hornbeck)

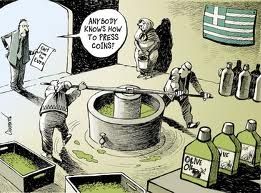

Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the moderate Democratic Left party in Greece says it will not join pro-bailout parties in a coalition without the more radical far-left Syriza. It doesn’t sound promising but technically President Karolos Papoulias has until Thursday when Parliament reconvenes:

Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the moderate Democratic Left party in Greece says it will not join pro-bailout parties in a coalition without the more radical far-left Syriza. It doesn’t sound promising but technically President Karolos Papoulias has until Thursday when Parliament reconvenes:

Without the support of Democrat Left, a decidedly “pro-European” force which won 19 seats in parliament, the New Democracy party and centre-left Pasok party fall two seats short of being able to achieve a workable majority.

Syriza, an alliance of leftists and ecologists that emerged as the poll’s surprise runner-up – and has since seen its popularity surge on the back of anti-austerity sentiment – rejected the idea of participating in a government that it claimed was bent on “destroying Greece”. Alexis Tsipras, Syriza’s young firebrand leader, refused to even attend the negotiations. [..]

Syriza, whose popularity has risen on a platform of rejecting such measures, is projected to win the election with as much as 27%, according to polls conducted over the past week. Tsipras, an unabashed populist who counts Hugo Chávez among his heroes, has promised to renegotiate the painstakingly acquired bailout agreement Athens has signed with foreign lenders.

With the radical left fast dominating a political landscape whose traditional parties have been decimated for backing policies now blamed for record levels of poverty and unemployment, analysts believe it is only a matter of time before Greece is cut loose from Europe. The result, they say, will be a dramatic decline in living standards as the debt-stricken country, bereft of international rescue funds, slips ever deeper into poverty.

The markets reacted negatively with the prospect of a Greek withdrawal from the euro:

Financial and energy shares fell the most among 10 groups in the Standard & Poor’s 500 Index. JPMorgan Chase & Co. (JPM) and Bank of America Corp. (BAC) sank at least 2.6 percent as European lenders slumped. Alcoa Inc. (AA) and Schlumberger Ltd. (SLB) slid more than 1.5 percent to pace declines in commodity producers. Symantec Corp. (SYMC), the biggest seller of security software, retreated 1.4 percent after Goldman Sachs Group Inc. cut its recommendation.

The S&P 500 slid 1.1 percent to 1,338.35 at 4 p.m. New York time, the lowest since Feb. 2. The Dow fell 125.25 points, or 1 percent, to 12,695.35. The Chicago Board Options Exchange Volatility Index, which measures the cost of using options as insurance against S&P 500 losses, rose 10 percent to an almost four-month high of 21.87. About 6.6 billion shares changed hands on U.S. exchanges, in line with the three-month average.

Meanwhile, German Chancellor Andrea Merkel’s Christian Democratic Union was handed a defeat in Sunday’s election in Germany’s most populous state, North Rhine-Westphalia, receiving only 26% of the vote:

The outcome will be seen as a rejection by voters of the strict austerity policy promoted by Ms Merkel’s party at both local and national level, and a boost for the opposition. It will encourage the SPD and Greens to campaign all out for a “red-green” coalition at national level when Ms Merkel stands for re-election in autumn 2013. [..]

Opinion polls suggested that voters did not regard Ms Merkel’s national and European policies as relevant, and opted instead for the popular “red-green” coalition in the state, headed by Hannelore Kraft of the SPD, which had governed without an absolute majority for the past two years. The surprise election was caused by the defeat of Ms Kraft’s annual budget by the CDU, FDP and the far-left Linke party.

The defeat is the worst suffered by Ms Merkel’s CDU since the party lost control last year of the state of Baden-Württemberg in the wake of the Fukushima nuclear disaster.

Chancellor Merkel has chosen to ignore the defeat at home and stuck to her position on austerity agreement with Greece:

Merkel tells Greece to back cuts or face euro exit

Greece may be forced to leave the euro if the country refuses to implement spending cuts agreed with the European Union, Angela Merkel warned. [..]

Yesterday, Mrs Merkel raised the spectre of Greece leaving the euro. She is under increasing pressure in Germany to force the country out of the single currency to avert several more years of uncertainty. “I believe it’s better for the Greeks to stay in the euro area, but that also requires that we set out a path on which Greece gets back on its feet step by step,” said the chancellor.

“The solidarity for the euro will end only if Greece just says, ‘We’re not keeping to the [austerity] agreement.’ But I don’t expect that to happen. I do think they are making an effort. There are many, many people in Greece who actually want it.”

The worries over will happen to the Greek economy should they exit from the euro are really unknown. From Paul Krugman:

In particular, I keep reading that Argentina’s example is irrelevant, because Greece has hardly any exports. [..]

What is true is that Greece doesn’t export a lot of goods. But it exports a lot of services – shipping and tourism (pdf). How might these respond to the devaluation of the new drachma? [..]

This isn’t a prediction that everything will be fine, but it is a caution that the pessimism about Greek prospects once the turmoil is past may be overdone.

If the left wing holds out and wins enough of a majority in June to form a new government, we’ll find out sooner than later who’s right about Greek prospects without the euro.

1 comments

Author