Sunday the Washington Post put up a piece by Dylan Matthews that gives relatively serious treatment to Modern Monetary Theory.

You know the deficit hawks. Now meet the deficit owls.

Posted by Dylan Matthews, Washington Post

10:10 AM ET, 02/19/2012

In contrast to “deficit hawks” who want spending cuts and revenue increases now in order to temper the deficit, and “deficit doves” who want to hold off on austerity measures until the economy has recovered, Galbraith is a deficit owl. Owls certainly don’t think we need to balance the budget soon. Indeed, they don’t concede we need to balance it at all. Owls see government spending that leads to deficits as integral to economic growth, even in good times.

The term isn’t Galbraith’s. It was coined by Stephanie Kelton, a professor at the University of Missouri at Kansas City, who with Galbraith is part of a small group of economists who have concluded that everyone – members of Congress, think tank denizens, the entire mainstream of the economics profession – has misunderstood how the government interacts with the economy. If their theory – dubbed “Modern Monetary Theory” or MMT – is right, then everything we thought we knew about the budget, taxes and the Federal Reserve is wrong.

‘Relatively’ is the key word and there are some serious flaws in Matthew’s piece that letsgetitdone discusses in a 6 part, 4 part series over at Corrente.

WaPo Covers MMT, But Does Its Usual Bad Job: Part One, Some Basics and Solvency

letsgetitdone, Corrente

Tue, 02/21/2012 – 5:48pm

Deficit owls, believe that there is no structural deficit, and that most of the present US deficit will go away when full employment is reached, but probably not all of it, unless the private savings levels in the economy are balanced by an equal or greater foreign sector deficit (trade surplus). They also believe that in times of unused productive capacity like these, Government deficits are caused by the state of the economic system, and that explicitly managing them by taxing more or spending less will not improve its condition, but only result in a downward economic spiral making conditions still worse.

On the other hand, if real economic problems like unemployment, alternative energy capacity and production, infrastructure renewal, education, and industrial innovations are addressed through Government deficit spending, then aggregate demand spurring private sector business activity and ending U6 unemployment will result. In addition, deficit owls believe that in a fiat money system, where there is no debt in foreign currencies, and no “peg” to such currencies, solvency is never a problem for the Government, and that while inflation partly caused by Government deficit spending can become a problem in such a system, this can only happen when full employment is achieved.

…

(N)ecessary for currency sovereignty is to have a non-convertible currency, a floating exchange rate, and no debt in a currency not your own. These qualifications are very important because examples (e.g. Weimar, Zimbabwe) that are often given contradicting the claim that there’s no solvency problem for Governments like the US don’t fulfill these conditions.

WaPo Covers MMT, But Does Its Usual Bad Job: Part Two, Inflation/Hyperinflation

letsgetitdone, Corrente

Wed, 02/22/2012 – 1:00am

(I)t’s easy to wave off MMT by saying there is a risk of inflation in using deficit spending to create full employment, but it is entirely another matter to say what the level of risk is, and to provide compelling arguments about why that risk is appreciable, and more costly than the effects of chronic unemployment in a stagnating economy. This Mankiw doesn’t begin to do. I think Dylan should have pointed this out, rather than just mentioning Mankiw’s opinion. Who cares about his opinion? It’s his arguments, his theories, for expecting inflation that we care about. So, why doesn’t Dylan outline what these are and critically evaluate them?

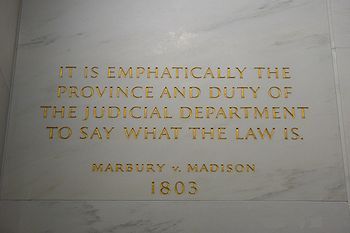

When Mankiw tells us that default might be a better option than risking inflation by printing money, he is going way beyond his claimed area of expertise in economics. The 14th Amendment to the US constitution prohibits even questioning Government debt, much less defaulting on it. Mankiw in his capacity as an economist is unqualified to say whether a violation of the US constitution is a better option than taking the risk of triggering hyperinflation by “printing money.”

…

What MMT replies is that bond issuance isn’t an inevitability, but a result of choices made by the US Congress and the Executive Branch of Government. The Congress could place the Fed under the authority of the Treasury Secretary in the Executive Branch, and then no debt would have to be issued to deficit spend, since the Fed could just mark up the Treasury General Account (TGA) under orders from the Secretary.

MMT also points out that the Fed controls the Federal Funds Rate which, in turn, heavily influences all bond rates. If the Fed targets a near zero FFR, and the Treasury issues no bonds longer than say, three months in duration, then bond interest rates can be kept near zero no matter how much debt is issued. Japan has proved this is the case since its debt-to-GDP ratio is now in excess of 200% while its interest rates are very near zero on short-term debt instruments.

…

If the Fed buys bonds with money it prints, this will increase reserves in the private sector, but it won’t increase Net Financial Assets (NFA), because buying the bonds is just an asset swap. So with no new NFA being added to the private sector by the Government, this sort of Fed operation won’t be inflationary, as its massive QE programs have just demonstrated empirically. In fact, by removing the payment of interest on bonds from the private sector, and given that most of the Fed profits are returned to the Treasury, some MMT economists say that the end result of such operations may well be deflationary.

WaPo Covers MMT, But Does Its Usual Bad Job: Part Three, Banking, and Default vs. "Hyperinflation"

letsgetitdone, Corrente

Wed, 02/22/2012 – 4:00pm

(I)ncreasing the amount of reserves does not lead to increased borrowing, because banks don’t need more reserves to make loans. All they need are credit worthy borrowers and access to the Fed discount window to make whatever quantity of loans they want to. This is one of the main points about the banking system MMT makes. Put simply: lending is not reserve constrained! It’s constrained by bank willingness to lend to credit worthy borrowers.

…

MMT’s Sectoral Financial Balances (SFB) model is exactly right in its explanations, since they are able to run surpluses without disaster, only because, unlike the United States, the foreign sectors of their economies run deficits (that is Canada and Australia run trade surpluses) large enough to accommodate the private sector savings desires of Australians and also the Government’s desire to run a budget surplus. The US however, currently has a need to run Government deficits of 10% to support both our private sector savings desires of 6% of GDP, and our foreign sector’s desires to export 4% of US GDP to US consumers so they can accumulate US dollars in the form of electronic credits.

…

Governments can voluntarily default if they choose to. MMT economists have always said this and still say it. So why is political stupidity or perfidy counted against the truth of the MMT proposition that Governments sovereign in their currency have no fiscal solvency problems, only voluntary constraints and political problems?

On the contrary, I think the Russian case is one of the primary illustrations of a point that deficit owls have been trying to spread far and wide. Namely, that sometimes default is due to stupidity and perfidy and not to economic forces and that citizens in a democracy need to be aware of that, and of the full capabilities of currency sovereign Governments to always pay debts incurred in their fiat currency and to spend whatever is necessary to enable full employment in their nations. They are never, never, out of money except by choice. So, the real questions are:

- why are they choosing to default?

- Who will benefit from this political choice?

- And who will be asked to pay the price?

And how does the Russian case “prove” that: “Default, while technically always avoidable, is sometimes the best available option”? Is Dylan, through this quote from Gregory Mankiw suggesting that “public purpose” in Russia was better served by its voluntary default than it would have been if the Russians repaid their ruble debts in the rubles they might have created had they wished to? I’m afraid that both Dylan and Mankiw will have to prove that statement to me, since Russian citizens seem to have suffered quite a lot by taking the default choice and accepting austerity when they didn’t have to do so.

WaPo Covers MMT, But Does Its Usual Bad Job: Part Four, The Victory

letsgetitdone, Corrente

Thu, 02/23/2012 – 1:00am

For many years now, MMT economists and others who write in support of them have been trying to make a very important point to the mainstream. And that is that the claim:

The Government is running out of money,

is a myth, a fairy tale, or a deadly innocent fraud.

Dylan doesn’t say that in so many words. But he and the economists he cites, even Greg Mankiw grant this very important MMT/deficit owl point in passing.

If this post is any indication, mainstream economics, and certainly deficit doves, and hawks like Mankiw, now acknowledge that a nation like the US which is sovereign in its own fiat currency can never run out of money, or be prevented by the pure fiscal aspects of any situation from paying its debts or buying whatever goods and/or services it needs that are available for sale in its own sovereign currency.

So, that part of the great debate is now over. It will be very hard from here on, for the deficit hawks to maintain their deficit/insolvency terrorism in the face of the general recognition in economics that the Federal Government is not like a household, because it can never run out of the currency that it has the sole legitimate power to issue.

If they try, they will now be the ones facing ridicule and marginalization. And, increasingly, those politicians who try to claim we are running out of money, will also face ridicule and be viewed as ignoramuses by others.

…

Every critic of MMT cited in the post raises the objection either implicitly or explicitly that MMT policy proposals will lead to worrisome inflation, or hyperinflation. Now, that’s progress, because unlike the level of one’s national debt, or the size of one’s deficit in the abstract, or the nonsense debt-to-GDP ratio, which means nothing in itself, inflation is a real issue, not an artifact of some economist’s fevered theories.

…

In other words, let’s get real. Let’s talk about real problems of real people that can be alleviated through fiscal policy and Government programs. Let’s stop taking about fairy tales, myths, and bogeymen. And let’s get on with the job of rebuilding the United States for our children and grandchildren and using every tool we have, including our fiat currency system, to realize the blessings of liberty and equality of opportunity for everyone.

The WaPo MMT Post Explosion: Dean Baker Weighs In on MMT

letsgetitdone, Corrente

Fri, 02/24/2012 – 12:58am

(Th)ere are some differences that are very significant for policy activism between a Keynesian deficit dove approach employed by people like Paul Krugman, Brad DeLong, Robert Reich, and Dean Baker (op.cite, link added), and a Modern Monetary Theory (MMT) approach employed by people like Warren Mosler, L. Randall Wray, Bill Mitchell, Jamie Galbraith, Stephanie Kelton, Marshall Auerback, Scott Fullwiler, and Pavlina Tcherneva. So, here are some contrasts between the two approaches on seven important issues.

The WaPo MMT Post Explosion: Jared Bernstein’s Cool Up To a Point

letsgetitdone, Corrente

Thu, 02/23/2012 – 12:19pm

- Tax Cuts Hard to Unwind? Not If You Legislate Properly!

- Default vs. Hyperinflation? A False Choice for the US?

- Debt Should Grow More Slowly Than GDP? Why?

- Deficits Must Respond Dynamically To Growth? They Will If They’re the Right Deficits

- MMT Not Effective in Deficit Reduction Mode; or Congress Ineffective In Its Legislation?

- Fiscal Sustainability and the Health Care Issue or Mis-allocation of Net Financial Assets to the Health Care Industry at the Cost of Weakening Our Democracy?

- Does Jared Bernstein Really Understand MMT, Yet?

…

Finally, I also think that Jared doesn’t fully understand that MMT is not just an approach to economic policy and analysis, but primarily embodies certain Macroeconomic propositions and propositions about how modern money works, and what policies could be followed to achieve public purpose. If he did, then why would he keep making objections to MMT policy proposals based on his ideas about how Congress will act in reply to them?

In the end, it’s not MMT’s responsibility to propose policies that Congress will legislate. It is, instead, up to MMT to propose policies that will achieve full employment with price stability and other favorable social, cultural and political impacts for our democracy.

From that point on, it is up to political advocates to make these policies popular enough to get Congress and the President to pass them. And any failings in passing these policies are not failings of MMT economics, but failngs of the oligarchy which will not pass the policies it recommends.

On this day in Japan, the Plum Blossom Festival is held. The Festival at the Kitano Tenmangu Shrine in Kyoto is one one of the most beautiful. The shrine was built in 947, to appease the angry spirit of bureaucrat, scholar and poet Sugawara no Michizane, who had been exiled as a result of political maneuvers of his enemies in the Fujiwara clan.

Sugawara no Michizane, August 1, 845 – March 26, 903, was a scholar, poet, and politician of the Heian Period of Japan. He is regarded as an excellent poet, particularly in Chinese poetry.

I’m not sure about the rest of you, but I need a break from reality, at least for a few hours. The chance to sit in front of the big tube with a drink and a bowl of popcorn or other finger food and watch the glitz and glamor as the stars walk down the red carpet and make fools of themselves bumbling the lines of acceptance speeches.

I’m not sure about the rest of you, but I need a break from reality, at least for a few hours. The chance to sit in front of the big tube with a drink and a bowl of popcorn or other finger food and watch the glitz and glamor as the stars walk down the red carpet and make fools of themselves bumbling the lines of acceptance speeches. In perusing the internet for new treats that would be suitable for the event, I found a great piece in the New York Times that has the recipes for

In perusing the internet for new treats that would be suitable for the event, I found a great piece in the New York Times that has the recipes for  On this day in

On this day in

Recent Comments