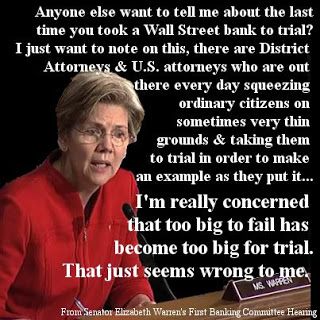

Heads up folks, there’s a new sheriff in town and she’s not ready to make nice. Freshman Senator Elizabeth Warren (D-MA) made her debut on the Senate Banking Committee making it very clear to the bank regulators from the alphabet soup of agencies sitting before her, that she was not pleased:

Heads up folks, there’s a new sheriff in town and she’s not ready to make nice. Freshman Senator Elizabeth Warren (D-MA) made her debut on the Senate Banking Committee making it very clear to the bank regulators from the alphabet soup of agencies sitting before her, that she was not pleased:

The Democratic senator from Massachusetts had a straightforward question for them: When was the last time you took a Wall Street bank to trial? It was a harder question than it seemed.

“We do not have to bring people to trial,” Thomas Curry, head of the Office of the Comptroller of the Currency, assured Warren, declaring that his agency had secured a large number of “consent orders,” or settlements.

“I appreciate that you say you don’t have to bring them to trial. My question is, when did you bring them to trial?” she responded.

“We have not had to do it as a practical matter to achieve our supervisory goals,” Curry offered. [..]

The financial regulators can blame, at least in part, Wall Street lobbyists (along with outgoing Treasury Secretary Tim Geithner and Senate Republicans) for their embarrassing turn at the hearing. Warren would have been on the panel herself representing the Consumer Financial Protection Bureau, instead of a sitting senator, if her nomination to head the agency hadn’t been thwarted in 2011.

After getting the essentially the same answer from the others at the table, Sen. Warren, who was a friend and admirer of the late Internet activist Aaron Swartz who all too briefly was her constituent, alluded to his suicide chastised the lack of any criminal prosecutions:

“There are district attorneys and United States attorneys out there every day squeezing ordinary citizens on sometimes very thin grounds and taking them to trial in order to make an example, as they put it. I’m really concerned that ‘too big to fail’ has become ‘too big for trial.”

Sen. Warren is part of the “new breed” of Senate Democrats who are not going to sit quietly in the background, as digby said, “for at least four years before they were allowed to assert themselves in even the tiniest ways.” But is she rally that “awesome?”

At naked capitalism, Yves Smith is more reserved in her assessment and believes that Sen. Warren is hamstrung by the time constraints for questions and answers that “produce “sound-bites, grand-standing, and run-out-the-clock obfuscation rather than meaningful interaction:”

So while Warren fans are happy with her debut, these star turns are useful for signaling, but they are not how she will make a difference, if she can make a difference. The Senate gives her ready media access, but the convention in the Senate is for newbies keep a low profile for the first six months. Warren might be allowed some liberties on banking issues, given her expertise in this arena. Notice how she breezily overstepped her time limits in the video clip. But expect her to hew to convention elsewhere, otherwise she could undermine her ability to get things done. Remember, Hillary Clinton had to bring fellow Senators coffee as a freshman to prove she didn’t have airs.

That also means we are likely to remain in the dark about where Warren stands on other issues that affect middle class families, like social insurance programs and the progressivity of taxes, until after the deficit pact is done (Warren will be expected to fall in with the party position), unless we have another kick-the-can deal in March and real fights take place when she is in a position to operate a bit more freely.

So the early signs of how tough-minded Warren intends to be will come through the letters, speeches, and positions she takes on banking matters outside the formal Committee sessions. Her early talk is promising, but we need to see how she follows up with action.**

Meanwhile, the lack of clear, simple regulation that was the hallmark of the Glass – Steagall Act has Wall Steet manipulating Dodd – Frank to “bypass new regulations aimed at limiting reckless speculation, enhancing the prospect of another derivatives crisis, warn some market participants.”

Under the Dodd-Frank financial reform law adopted by Congress in 2010, investors are required to set aside significant sums of cash to cover losses on their derivatives trades — money they could otherwise plow into additional investments. That policy came in response to the financial crisis that began in 2007, when major financial institutions found themselves unable to cover hundreds of billions of dollars in shortfalls on derivatives trades.

But traders have recently forged a path around these so-called margin requirements in order to allow them to harvest larger profits via larger bets: They are repackaging some derivatives known as swaps into another financial product known as futures. Futures are less stringently regulated, meaning investors can stake out larger positions while reserving smaller amounts of cash.

I don’t expect that President Obama’s nominee for Treasury Secretary, Jack Lew, will be any better the Tim Geithner since he has been a steady defender of deregulation and repeatedly said that he didn’t “believe that deregulation was the proximate cause” of the banking crisis. As President Bill Clinton’s head of OMB, Mr. Lew organized the gutting of Glass-Steagall protections against banker adventurism.

It seems that Sen. Warren has struck a nerve when she said:

At one point, Warren asked why big banks’ book value was lower, when most corporations trade above book value, saying there could be only two reasons for it.

“One would be because nobody believes that the banks’ books are honest. Second, would be that nobody believes that the banks are really manageable. That is, if they are too complex either for their own institutions to manage them or for the regulators to manage them” {..}

That set off angry responses to Politico’s Morning Money. “While Senator Warren had every right to ask pointed questions at today’s Senate Banking Committee hearing, her claim that ‘nobody believes’ that bank books are honest is just plain wrong,” emailed a “top executive” to the financial newsletter. ” Perhaps someone ought to remind the Senator that the campaign is over and she should act accordingly if she wants to be taken seriously.” [..]

In an email, a GOP bank lobbyist said, “Republicans also would like to know why the Democratic donor base has avoided trial. Maybe she should subpoena the DSCC and Obama’s super PAC to answer her question.”

Consumer Bankers Association CEO Richard Hunt was slightly more diplomatic. “We have been through more tests and thorough exams than any college student over the past four years, including many conducted by the CFPB. The results of the Hamilton Partners Financial Index and the testimony of OCC Comptroller [Thomas] Curry were very clear: the United States banking system is safe and sound, supported by historic and permanent capital ratios. We are working every day to fulfill the financial needs of the American consumer and small business and will continue to work with any and all lawmakers who seek to assist in this extremely important process.”

Awww, she hurt their feelings.

Sen. Warren has a Mt. Everest size hill to climb. We wish her luck.

Recent Comments