Suit Revives Goldman Conflict Issue

By SUSANNE CRAIG and JESSICA SILVER-GREENBERG, The New York Times

October 10, 2013, 2:43 pm

At a March 2012 meeting, a group of examiners at the Federal Reserve Bank of New York agreed that Goldman Sachs had inadequate procedures to guard against conflicts of interest – guidelines aimed at stopping firms from putting their pursuit of profit ahead of their clients’ best interests.

The examiners voted to downgrade a confidential rating assigned by the New York Fed that could have spurred costly enforcement actions and other regulatory penalties. It is not known whether the vote in fact led to a rating change. The former examiner who pushed for a downgrade, Carmen M. Segarra, now contends in a lawsuit filed on Thursday that just weeks after the vote, her superiors asked her to change her findings on Goldman and fired her after she refused.

…

After Ms. Segarra joined the New York Fed, she said she examined several potentially controversial Goldman deals. For instance, in 2012 Goldman advised El Paso, an energy company, on its decision to sell itself to Kinder Morgan. Goldman owned a big stake in Kinder Morgan, which angered a number of El Paso shareholders, who argued this gave Goldman an incentive to undervalue El Paso. Goldman maintained that it had properly managed the conflicts but was later admonished by a judge, who noted the “disturbing behavior” that led to the deal.As the deal was coming together, the lawsuit said, Ms. Segarra urged Goldman to provide her with its firmwide conflict-of-interest policy. But Goldman, the lawsuit said, told her that it had no such policy.

…

Such concerns, the lawsuit said, prompted Ms. Segarra to raise the issue with Mr. Silva, her boss, in a meeting in early December 2011. He seemed to agree. Mr. Silva “expressed concern that Goldman would suffer significant financial harm if consumers and clients learned the extent of Goldman’s noncompliance with the rules on conflict of interest,” according to the lawsuit.Soon, though, Ms. Segarra was looking at another deal, involving Banco Santander, the largest bank in Spain, and Qatar Holding. As part of her review, Ms. Segarra asked Goldman to provide documentation that it had performed an anti-money-laundering analysis.

According to the lawsuit, Goldman executives told Ms. Segarra that it had done the analysis, but the bank later backpedaled, admitting that no such work had been performed.

Ms. Segarra took her concerns about the transaction to her bosses, who confronted Goldman. She contends that Michael S. Koh, another senior staff member at the New York Fed and a defendant in the lawsuit, told her that Goldman admitted to the misconduct but then he dismissed her concerns. Further efforts to raise the issue were also stymied and her bosses prohibited her from asking Goldman more questions about the deal – a decision that prevented her from finishing her report.

…

In March 2012, Ms. Segarra got her chance to voice her concerns to the New York Fed’s legal and compliance risk team. At the meeting, the group, roughly 20 people, agreed that the issues with Goldman’s conflict-of-interest procedures warranted a warning, known-as a “matter requiring attention,” or M.R.A., according to the lawsuit. As a result, the team approved a downgrade of Goldman’s annual rating from a 2, indicating satisfactory to a 3, indicating fair, according to a confidential document reviewed by The Times. The rating involving policies and procedures is one of several measurements that make up Goldman’s overall score, which is confidential.

Chris Hedges:

Chris Hedges:

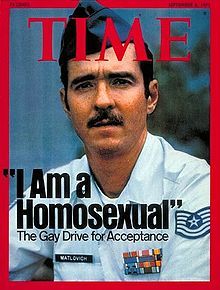

On June 22, 1988, less than a month before his 45th birthday, Matlovich died of complications from HIV/AIDS beneath a large photo of Martin Luther King, Jr. His tombstone, meant to be a memorial to all gay veterans, does not bear his name. It reads, “When I was in the military, they gave me a medal for killing two men and a discharge for loving one.” Matlovich’s tombstone at Congressional Cemetery is on the same row as that of FBI Director

On June 22, 1988, less than a month before his 45th birthday, Matlovich died of complications from HIV/AIDS beneath a large photo of Martin Luther King, Jr. His tombstone, meant to be a memorial to all gay veterans, does not bear his name. It reads, “When I was in the military, they gave me a medal for killing two men and a discharge for loving one.” Matlovich’s tombstone at Congressional Cemetery is on the same row as that of FBI Director

Recent Comments