“Punting the Pundits” is an Open Thread. It is a selection of editorials and opinions from around the news medium and the internet blogs. The intent is to provide a forum for your reactions and opinions, not just to the opinions presented, but to what ever you find important.

Thanks to ek hornbeck, click on the link and you can access all the past “Punting the Pundits”.

Follow us on Twitter @StarsHollowGzt

Paul Krugman: Phosphorus and Freedom

The Libertarian Fantasy

In the latest Times Magazine, Robert Draper profiled youngish libertarians – roughly speaking, people who combine free-market economics with permissive social views – and asked whether we might be heading for a “libertarian moment.” Well, probably not. Polling suggests that young Americans tend, if anything, to be more supportive of the case for a bigger government than their elders. But I’d like to ask a different question: Is libertarian economics at all realistic?

The answer is no. And the reason can be summed up in one word: phosphorus.

As you’ve probably heard, the City of Toledo recently warned its residents not to drink the water. Why? Contamination from toxic algae blooms in Lake Erie, largely caused by the runoff of phosphorus from farms. [..]

The point is that before you rage against unwarranted government interference in your life, you might want to ask why the government is interfering. Often – not always, of course, but far more often than the free-market faithful would have you believe – there is, in fact, a good reason for the government to get involved. Pollution controls are the simplest example, but not unique.

Dean Baker: Inflation Hawks: The Job Killers at the Fed

Discussions of inflation and Federal Reserve Board policy take place primarily in the business media. That’s unfortunate, because these discussions can have more impact on the jobs and wages of most workers than almost any other policy imaginable.

The context of these discussions is that many economists, including some in policy making positions at the Fed, claim that the labor market is getting too tight. They argue this is leading to more rapid wage growth, which will cause more inflation and that this would be really bad news for the economy. Therefore they want the Fed to raise interest rates.

The part of this story that few people seem to grasp is that point of raising interest is to kill jobs. If that sounds like a bizarre accusation to make against responsible people in public life then you need to pick up an introductory economics text.

Preliminary reports say that a $16 to $17 billion settlement will soon be announced between the Justice Department and Bank of America. That would break the record for the largest bank settlement in history, set less than a year ago by a $13 billion agreement between Justice and JPMorgan Chase.

The numbers that accompany these deal announcements always seem impressive. But how large are they, really? That depends on your point of view.

Bankers fraudulently inflated a housing bubble. They became extremely wealthy as a result, but the U.S. housing market lost $6.3 trillion in value when the bubble burst. It had only recovered 44 percent of that lost value by of the end of 2013, according to Zillow’s data.

That’s more than $3 trillion still missing from American households.

As of the first quarter of this year, 9.1 million residences – 17 percent of mortgaged homes – were still “seriously underwater,” which means that homeowners owed at least 25 percent more on the home than it was worth.

And homeowners weren’t the only ones hurt by banker misdeeds. When the bubble burst, it took the economy with it. Unemployment and underemployment remain at record levels, even as the stock market surges and corporations enjoy record profits. Compared to the wealth that bank fraud has taken from American households, these settlements are a drop in the ocean.

Robert Reich: The Rebirth of Stakeholder Capitalism?

In recent weeks, the managers, employees, and customers of a New England chain of supermarkets called “Market Basket” have joined together to oppose the board of director’s decision earlier in the year to oust the chain’s popular chief executive, Arthur T. Demoulas.

Their demonstrations and boycotts have emptied most of the chain’s seventy stores.

What was so special about Arthur T., as he’s known? Mainly, his business model. He kept prices lower than his competitors, paid his employees more, and gave them and his managers more authority.

Late last year he offered customers an additional 4 percent discount, arguing they could use the money more than the shareholders.

In other words, Arthur T. viewed the company as a joint enterprise from which everyone should benefit, not just shareholders. Which is why the board fired him

Gary Younge: Tales of the cities: the progressive vision of urban America

A union leader is being hailed as a possible mayor in Chicago while elsewhere mayors are pursuing policies Obama has been unable to enact on the national stage

After Bill Clinton was elected president in 1992 one of his key aides, Rahm Emanuel, sat in the campaign’s favourite restaurant in Little Rock, Arkansas, venting his frustration at those who had tried to stand in their way. He would call out a name, ram his steak knife into the table and, like Bluto in Animal House, shout “Dead!” Then he would pull the knife out and call another name and stab the table again.

Heaven only knows what damage he does to the furniture when he mentions Karen Lewis’s name. Emanuel, who was Barack Obama’s chief of staff, is now mayor of Chicago. Lewis is the head of the Chicago Teachers Union who got the better of him after leading the teachers in a strike two years ago. The two genuinely despise each other. When Lewis took on Emanuel over lengthening the school day, he told her: “Fuck you, Lewis!”; during the strike Lewis branded him a “liar and a bully”.

Now Lewis is seriously considering running against Emanuel for the mayoralty next year. People are wearing buttons urging her candidacy and setting up Facebook pages to support her. When she showed up at a civil rights conference two months ago the crowd cheered “Run, Karen, run!”

Dave Johnson: Perhaps We Need Corporate ‘Loyalty Oaths’

Several American corporations are using a tax loophole scheme called “inversion” to get out of being American corporations obligated to pay American corporate tax rates. They buy or merge with a non-U.S. corporation (usually located in a tax haven), pretend they are a subsidiary to that corporation and renounce their U.S. “citizenship.”

That’s almost the only thing that changes. Their U.S. executives, employees, facilities and customers remain where they are, along with the benefits and protections they get from our courts, education system, military, infrastructure and all the other things we pay for through taxes. They just stop paying various taxes to help pay for those things.

Walgreens announced Tuesday that they will not “invert” and become a non-U.S. corporation. (And their stock tumbled as the bailed-out “patriots” on Wall Street heard the news.) Walgreens’ decision follows the collection of more than 160,000 signatures on a “Tell Walgreens to stay in the USA!” petition organized by a coalition of progressive organizations demanding that Walgreens remain a U.S. corporation.

But that announcement is just one victory in what has to be a continuing campaign to make sure corporations honor their obligations to America and pay their share of the cost for the things that enable them to prosper in America.

Alcatraz was an uninhabited seabird haven when it was explored by Spanish Lieutenant Juan Manuel de Ayala in 1775. He named it Isla de los Alcatraces, or “Island of the Pelicans.” Fortified by the Spanish, Alcatraz was sold to the United States in 1849. In 1854, it had the distinction of housing the first lighthouse on the coast of California. Beginning in 1859, a U.S. Army detachment was garrisoned there, and from 1868 Alcatraz was used to house military criminals. In addition to recalcitrant U.S. soldiers, prisoners included rebellious Indian scouts, American soldiers fighting in the Philippines who had deserted to the Filipino cause, and Chinese civilians who resisted the U.S. Army during the Boxer Rebellion. In 1907, Alcatraz was designated the Pacific Branch of the United States Military Prison.

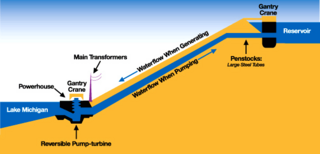

Alcatraz was an uninhabited seabird haven when it was explored by Spanish Lieutenant Juan Manuel de Ayala in 1775. He named it Isla de los Alcatraces, or “Island of the Pelicans.” Fortified by the Spanish, Alcatraz was sold to the United States in 1849. In 1854, it had the distinction of housing the first lighthouse on the coast of California. Beginning in 1859, a U.S. Army detachment was garrisoned there, and from 1868 Alcatraz was used to house military criminals. In addition to recalcitrant U.S. soldiers, prisoners included rebellious Indian scouts, American soldiers fighting in the Philippines who had deserted to the Filipino cause, and Chinese civilians who resisted the U.S. Army during the Boxer Rebellion. In 1907, Alcatraz was designated the Pacific Branch of the United States Military Prison. In a sense, Sunday Train has been mentioning reverse pumped hydro before the Sunday Train actually existed. In 2007 at Daily Kos, in “Driving Ohio on Lake Erie” (

In a sense, Sunday Train has been mentioning reverse pumped hydro before the Sunday Train actually existed. In 2007 at Daily Kos, in “Driving Ohio on Lake Erie” (

Recent Comments