“Punting the Pundits” is an Open Thread. It is a selection of editorials and opinions from around the news medium and the internet blogs. The intent is to provide a forum for your reactions and opinions, not just to the opinions presented, but to what ever you find important.

Thanks to ek hornbeck, click on the link and you can access all the past “Punting the Pundits”.

Follow us on Twitter @StarsHollowGzt

Joe Conason: Iran Deal: Why Should We Heed the Same Voices That Are Always Wrong?

Nobody was surprised by Benjamin Netanyahu’s immediate denunciation of the Iran nuclear agreement as “a historic mistake for the world.” Echoing the Israeli prime minister’s opposition throughout the negotiations were all the usual suspects in this country-a panoply of pundits and politicians from Weekly Standard editor William Kristol and Fox News Channel analyst Charles Krauthammer to MSNBC host Joe Scarborough. Now this same crew will urge its rejection by the United States Senate.

Focusing on the alleged pitfalls of the deal between Iran and the world powers, these critics downplay provisions that would allow economic sanctions to “snap back” quickly if Iran violates its promises, and greatly increase the Islamic Republic’s difficulty in building an undetected bomb. They don’t explain that if the United States had walked away, the result would have been the disintegration of international sanctions, the rapid buildup of Iran’s nuclear capability, and the likelihood of war-not just bombs, but “boots on the ground.”

What everyone should remember about the agreement’s most prominent foes is something they will never mention: their own shameful record in promoting our very worst foreign policy mistake since Vietnam.

Robert Reich: How Goldman Sachs Profited From the Greek Debt Crisis

The investment bank made millions by helping to hide the true extent of the debt, and in the process almost doubled it.

The Greek debt crisis offers another illustration of Wall Street’s powers of persuasion and predation, although the Street is missing from most accounts.

The crisis was exacerbated years ago by a deal with Goldman Sachs, engineered by Goldman’s current CEO, Lloyd Blankfein. Blankfein and his Goldman team helped Greece hide the true extent of its debt, and in the process almost doubled it. And just as with the American subprime crisis, and the current plight of many American cities, Wall Street’s predatory lending played an important although little-recognized role.

In 2001, Greece was looking for ways to disguise its mounting financial troubles. The Maastricht Treaty required all eurozone member states to show improvement in their public finances, but Greece was heading in the wrong direction. Then Goldman Sachs came to the rescue, arranging a secret loan of 2.8 billion euros for Greece, disguised as an off-the-books “cross-currency swap”-a complicated transaction in which Greece’s foreign-currency debt was converted into a domestic-currency obligation using a fictitious market exchange rate.

Warren urges the candidates (read: Hillary Clinton) to push for legislation that would curb Wall Street’s influence in politics.

When Senator Elizabeth Warren took the stage at Netroots Nation in Phoenix on Friday, many of the assembled activists hoped she would be coming to them as a presidential candidate-in fact, more than a few of them operated campaigns to convince her to run.

It didn’t work, but the various Draft Warren campaigns, in concert with the Massachusetts senator’s rapid rise in the party, leave her in a unique position to influence the direction of the presidential primary debate. Warren cashed in some of those chips during her speech Friday, issuing a direct challenge to presidential candidates (read: Hillary Clinton) to support specific legislation that would curb some of the financial sector’s influence at federal regulatory agencies.

Amy Goodman: Torture, Impunity and the American Psychological Association

It has been almost a year since President Barack Obama admitted, “in the immediate aftermath of 9/11, we did some things that were wrong. … we tortured some folks.” The administration of Obama’s predecessor, President George W. Bush, carefully crafted a legal rationale enabling what it called “enhanced interrogation techniques,” which is no more than a euphemism for torture. From the U.S. prison camp in Guantanamo Bay to the dungeons of Abu Ghraib in Iraq and Bagram air base in Afghanistan, countless hundreds, if not thousands, of people were subjected to torture, all in the name of the “Global War on Terror.” With the exception of a few low-level soldiers at Abu Ghraib, not one person has been held accountable. The only high-level person sent to prison over torture was John Kiriakou-not for conducting torture, but for exposing it, as a whistleblower.

The legal facade behind which these heinous acts were conducted relied heavily on the cooperation of professional psychologists, who trained and advised the interrogators and supervised the progress of the “breaking” of prisoners. This cooperation, in turn, was dependent on an official seal of approval from the American Psychological Association, the largest professional organization of psychologists in the world. In 2006, the American Psychiatric Association and the American Medical Association both barred their members from taking part in military interrogations.

Eugene Robinson: The Iran Deal May Not Be Perfect, but It’s Better Than the Alternative

To understand why the Iran nuclear deal is such a triumph, consider the most likely alternative: war.

Imagine a U.S.-led military strike-not a pinprick but an extended bombing campaign robust enough to eliminate 98 percent of Iran’s enriched uranium, put two-thirds of the Islamic republic’s centrifuges out of action and erase any capability of producing plutonium. Imagine that the attack did so much damage that for the next 10 or 15 years it would be utterly impossible for Iran to build a nuclear bomb. Such an outcome would be hailed as a great success-achieved, however, at a terrible cost. [..]

The historic agreement announced Tuesday in Vienna accomplishes what an attack might, but without the toll in blood and treasure that war inevitably exacts. After the agreement expires, critics note, Iran could decide to race for a bomb. But the military option would still be available-and, after years of intrusive inspections, allied war planners would have a much better idea of where the nuclear facilities are and how best to destroy them.

Laura Flanders: Anti-Social Giving to Harvard and Yale

Not so long ago, Yale University received a $150 million gift. That looked like a lot until Harvard scooped up $400 million a few weeks later. Both gifts came from Wall Street speculators – Blackstone Group Founder and CEO Stephen Schwarzman and hedge fund executive John S Paulson. Paulson’s donation alone was more money than 98 percent of US colleges have in their endowments, critics pointed out. It shows just how far-reaching inequality has become they said. It also reveals a thing or two about what’s become of our democracy.

As economist Richard Wolff’s pointed out, with their charitable contributions Paulson and Schwarzman gave – in the first case to endow an engineering school and in the second to build an arts center (Yale’s third.) But the multi billionaires also took – from us – the general public, because under the law the two can use their gifts to their alma maters to pay less to Uncle Sam.

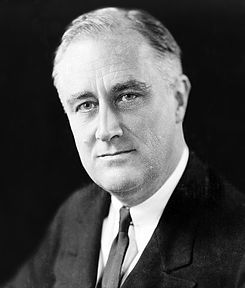

Roosevelt was born January 30, 1882, in Hyde Park, New York, and went on to serve as a New York state senator from 1911 to 1913, assistant secretary of the Navy from 1913 to 1920 and governor of New York from 1929 to 1932. In 1932, he defeated incumbent Herbert Hoover to be elected president for the first time. During his first term, Roosevelt enacted his New Deal social programs, which were aimed at lifting America out of the Great Depression. In 1936, he won his second term in office by defeating Kansas governor Alf Landon in a landslide.

Roosevelt was born January 30, 1882, in Hyde Park, New York, and went on to serve as a New York state senator from 1911 to 1913, assistant secretary of the Navy from 1913 to 1920 and governor of New York from 1929 to 1932. In 1932, he defeated incumbent Herbert Hoover to be elected president for the first time. During his first term, Roosevelt enacted his New Deal social programs, which were aimed at lifting America out of the Great Depression. In 1936, he won his second term in office by defeating Kansas governor Alf Landon in a landslide.

Recent Comments