How Goldman Sachs Profited from the Greek Debt Crisis

Robert Reich

Friday, July 17, 2015

Blankfein and his Goldman team helped Greece hide the true extent of its debt, and in the process almost doubled it. And just as with the American subprime crisis, and the current plight of many American cities, Wall Street’s predatory lending played an important although little-recognized role.

…

Goldman Sachs came to the rescue, arranging a secret loan of 2.8 billion euros for Greece, disguised as an off-the-books “cross-currency swap”-a complicated transaction in which Greece’s foreign-currency debt was converted into a domestic-currency obligation using a fictitious market exchange rate.As a result, about 2 percent of Greece’s debt magically disappeared from its national accounts. Christoforos Sardelis, then head of Greece’s Public Debt Management Agency, later described the deal to Bloomberg Business as “a very sexy story between two sinners.”

For its services, Goldman received a whopping 600 million euros ($793 million), according to Spyros Papanicolaou, who took over from Sardelis in 2005. That came to about 12 percent of Goldman’s revenue from its giant trading and principal-investments unit in 2001-which posted record sales that year. The unit was run by Blankfein.

Then the deal turned sour. After the 9/11 attacks, bond yields plunged, resulting in a big loss for Greece because of the formula Goldman had used to compute the country’s debt repayments under the swap. By 2005, Greece owed almost double what it had put into the deal, pushing its off-the-books debt from 2.8 billion euros to 5.1 billion.

In 2005, the deal was restructured and that 5.1 billion euros in debt locked in. Perhaps not incidentally, Mario Draghi, now head of the European Central Bank and a major player in the current Greek drama, was then managing director of Goldman’s international division.

…

Greece was in the worst shape, and Goldman was the biggest enabler. Undoubtedly, Greece suffers from years of corruption and tax avoidance by its wealthy. But Goldman wasn’t an innocent bystander: It padded its profits by leveraging Greece to the hilt-along with much of the rest of the global economy.

…

Even with the global economy reeling from Wall Street’s excesses, Goldman offered Greece another gimmick. In early November 2009, three months before the country’s debt crisis became global news, a Goldman team proposed a financial instrument that would push the debt from Greece’s healthcare system far into the future. This time, though, Greece didn’t bite.As we know, Wall Street got bailed out by American taxpayers. And in subsequent years, the banks became profitable again and repaid their bailout loans. Bank shares have gone through the roof. Goldman’s were trading at $53 a share in November 2008; they’re now worth over $200. Executives at Goldman and other Wall Street banks have enjoyed huge pay packages and promotions. Blankfein, now Goldman’s CEO, raked in $24 million last year alone.

Meanwhile, the people of Greece struggle to buy medicine and food.

Goldman’s Blankfein joins the 3-comma club

By Bill McColl, Yahoo

July 17, 2015 10:28 AM

Bloomberg Billionaire’s Index finds Blankfein’s net worth is at $1.1 billion, thanks to a surge in the company’s stock price, which is up about 9% so far this year. Bloomberg notes Blankfein is the largest individual owner of Goldman shares, with a value of half a billion dollars. The rest of his wealth comes from real estate and an investment portfolio boosted by cash bonuses and payouts from the firm’s private-equity funds.

…

“Lloyd Blankfein has gotten a lot of criticism in the last couple of years for doing ‘God’s work,’ and Goldman is the ‘vampire squid’ and all that bad stuff,” he notes. “But he’s the son of a postal worker. He did not grow up with a silver spoon in his mouth and he made it to the pinnacle of Wall Street society at Goldman Sachs through will, determination, skill and intelligence. That is a great American story for him as an individual.”

…

Monica Mehta, Managing Principal at Seventh Capital, tells Yahoo Finance she finds it interesting the Blankfein news comes as we approach the fifth anniversary of the signing of the Dodd-Frank law, which was enacted after the financial crisis specifically to rein in the big banks.“Aspects of Dodd-Frank in the name of consumer protection are actually making it difficult for people like small-business owners to get mortgages because it’s become tough for banks to lend off of W-2 income,” she adds. “But at the same time banks keep rolling along producing billionaires.”

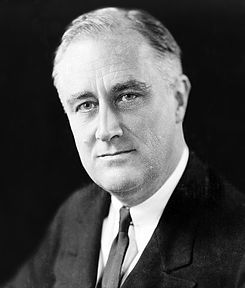

Roosevelt was born January 30, 1882, in Hyde Park, New York, and went on to serve as a New York state senator from 1911 to 1913, assistant secretary of the Navy from 1913 to 1920 and governor of New York from 1929 to 1932. In 1932, he defeated incumbent Herbert Hoover to be elected president for the first time. During his first term, Roosevelt enacted his New Deal social programs, which were aimed at lifting America out of the Great Depression. In 1936, he won his second term in office by defeating Kansas governor Alf Landon in a landslide.

Roosevelt was born January 30, 1882, in Hyde Park, New York, and went on to serve as a New York state senator from 1911 to 1913, assistant secretary of the Navy from 1913 to 1920 and governor of New York from 1929 to 1932. In 1932, he defeated incumbent Herbert Hoover to be elected president for the first time. During his first term, Roosevelt enacted his New Deal social programs, which were aimed at lifting America out of the Great Depression. In 1936, he won his second term in office by defeating Kansas governor Alf Landon in a landslide.

Welcome to the Stars Hollow Gazette‘s

Welcome to the Stars Hollow Gazette‘s

Recent Comments