Under the first U.S. income tax law that was passed in 1913, only 1 percent of Americans were required to file income tax returns, and to be liable to file you would have had to be earning an annual income of about $120,000 in todays dollars. It was passed during a period called the Progressive Era: “a period of social activism and reform that flourished from the 1890s to the 1920s” during which there were widespread “efforts to reform local government, education, medicine, finance, insurance, industry, railroads, churches, and many other areas” of American life.

It was a period of steady economic growth in the U.S. and produced a since unparalleled level of prosperity that lasted for decades. The politics of the era included the concept of an economy of high wages and the idea that American labor could undersell foreign labor by being highly paid, well clothed, well educated, healthier labor with high productivity. The concept of “free market” during the period was an entirely different concept than it is today.

Michael Hudson is President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City and is the author of “Super-Imperialism: The Economic Strategy of American Empire” (1968 & 2003), “Trade, Development and Foreign Debt” (1992 & 2009) and of “The Myth of Aid” (1971).

ISLET engages in research regarding domestic and international finance, national income and balance-sheet accounting with regard to real estate, and the economic history of the ancient Near East. Hudson acts as an economic advisor to governments worldwide, including Iceland, Latvia and China, on finance and tax law.

As an advisor to the White House, the State Department and the Department of Defense at the Hudson Institute, and subsequently to the United Nations Institute for Training and Research (UNITAR), Hudson has been one of the best known specialists in international finance. He also has consulted for the governments of Canada, Mexico and Russia, most recently for the Duma opposition to the Yeltsin regime.

Yesterday we heard Assistant Research Professor at the Political Economy Research Institute (PERI) Jeannette Wicks-Lim explain how currently most minimum wage earners in the U.S. can no longer the afford the basic necessities of life, and outline a proposal to combine minimum wage and earned income tax credit policies to guarantee a decent living wage for all.

Hudson here today talks with The Real News Networks’ Paul Jay and concludes that the the U.S economy can again outperform foreign economies with high wages, increased living standards, and with high top tier tax rates producing higher productivity – a progressive concept, like Wicks-Lim’s ideas, that is nearly the exact opposite of the free lunch economic ‘theories’ so widespread today that are behind wall street’s pillaging of the U.S. economy with the support of both major political parties.

Real News Network – January 1, 2011

Higher Taxes on Top 1% Equals Higher Productivity

Michael Hudson: The history of US shows that the economy grows

when top tier tax rates and workers wages are high

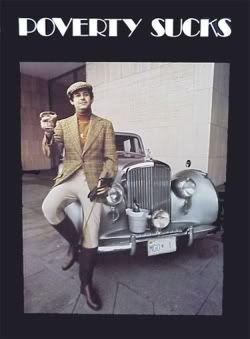

So here’s the deal. Grab your bootstraps and pull as hard as you can. Elbow everybody else out of the way, and climb over any mountains of bodies in your way. Or stomp them if they won’t be reasonable and just die.

So here’s the deal. Grab your bootstraps and pull as hard as you can. Elbow everybody else out of the way, and climb over any mountains of bodies in your way. Or stomp them if they won’t be reasonable and just die. Give up your whining socialist fantasies and screw the suckers. Be a real self made man or woman. The brass ring is there just waiting for you to grab. You can do this!

Give up your whining socialist fantasies and screw the suckers. Be a real self made man or woman. The brass ring is there just waiting for you to grab. You can do this!

Recent Comments