Arguing need for longer-term fiscal consolidation is irresponsible

The insistence that fiscal consolidation is necessary in the longer term is like the doctor who, faced with a patient who has just been admitted to the intensive care ward, repeatedly questions the patient about his ability to afford the treatment. This is both lacking in decency and irresponsible.If the patient loses heart after learning the cost of the treatment, he may end up spending even longer in the hospital, leading to a larger final bill. Completely ignoring the policy duration effect of fiscal policy and constantly insisting on longer-term fiscal consolidation was what prolonged Japan’s recession.

For instance, it was because Japan’s policymakers refused to give up the medium-term fiscal consolidation target of achieving a primary fiscal balance by 2011 that the government stumbled from fiscal stimulus to fiscal retrenchment and back again and, ultimately, was unable to meet its fiscal targets even once in the last 20 years.That is why Japan’s recession lasted as long as it did and why the nation’s debt has risen to some 200% of GDP.

What digby said:

With some notable exceptions, most people still believe that that there will be a hangover of debt which will have to be dealt with at some point. But the confidence fairy died some time back and the only other reason for worrying about it at this point is to get some Shock Doctrine benefits out of the current situation. But as Koo points out, this actually hurts the economy even more.

Paul Krugman eulogizes the “confidence fairy’s” death:

In the first half of last year a strange delusion swept much of the policy elite on both sides of the Atlantic – the belief that cutting spending in the face of high unemployment would actually create jobs.

Herr Professor points out that past analysis of austerity measures by the IMF is contradictory and even worse in the current economic climate:

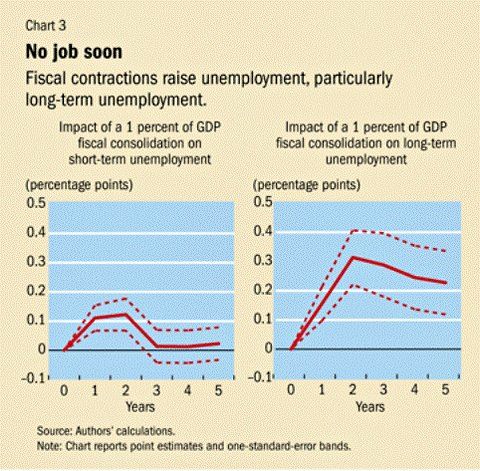

The reduction in incomes from fiscal consolidations is even larger if central banks do not or cannot blunt some of the pain through a monetary policy stimulus. The fall in interest rates associated with monetary stimulus supports investment and consumption, and the concomitant depreciation of the currency boosts net exports. Ireland in 1987 and Finland and Italy in 1992 are examples of countries that undertook fiscal consolidations, but where large depreciations of the currency helped provide a boost to net exports.

Unfortunately, these pain relievers are not easy to come by in today’s environment. In many economies, central banks can provide only a limited monetary stimulus because policy interest rates are already near zero (see “Unconventional Behavior” in this issue of F&D). Moreover, if many countries carry out fiscal austerity at the same time, the reduction in incomes in each country is likely to be greater, since not all countries can reduce the value of their currency and increase net exports at the same time.

Simulations of the IMF’s large-scale models suggest that the reduction in incomes may be more than twice as large as that shown in Chart 2 when central banks cannot cut interest rates and when many countries are carrying out consolidations at the same time. These simulations thus suggest that fiscal consolidation is now likely to be more contractionary (that is, to reduce short-run income more) than was the case in past episodes.

Like Dr. Krugman and digby said, we’re doing it wrong.

Recent Comments