On Tuesday, the Congressional Budget Office released it’s latest report on the Affordable Care Act’s impact on the economy. In the report it estimated that the work force would be reduced by 2.3 million workers by 2021 (pdf). Needless to say, the right wing media and Republicans seized on this as proof positive that Obamacare was a “job killer.”

Well not so fast, this is what the report said:

CBO estimates that the ACA will reduce the total number of hours worked, on net, by about 1.5 percent to 2.0 percent during the period from 2017 to 2024, almost entirely because workers will choose to supply less labor-given the new taxes and other incentives they will face and the financial benefits some will receive. Because the largest declines in labor supply will probably occur among lower-wage workers, the reduction in aggregate compensation (wages, salaries, and fringe benefits) and the impact on the overall economy will be proportionally smaller than the reduction in hours worked. [..]

The estimated reduction stems almost entirely from a net decline in the amount of labor that workers choose to supply, rather than from a net drop in businesses’ demand for labor.

In other words, this isn’t about jobs, it’s about whether or not workers will choose to work less in order to hold on to their eligibility for subsidized health care or Medicaid.

The Washington Post‘s fact checker, Glenn Kessler clarified:

First, this is not about jobs offered by employers. It’s about workers – and the choices they make.

The CBO’s estimate is mostly the result of an analysis of the impact of the law on the supply of labor. That means how many people choose to participate in the work force. In other words, the nonpartisan agency is examining whether the law increases or decreases incentives for people to work. [..]

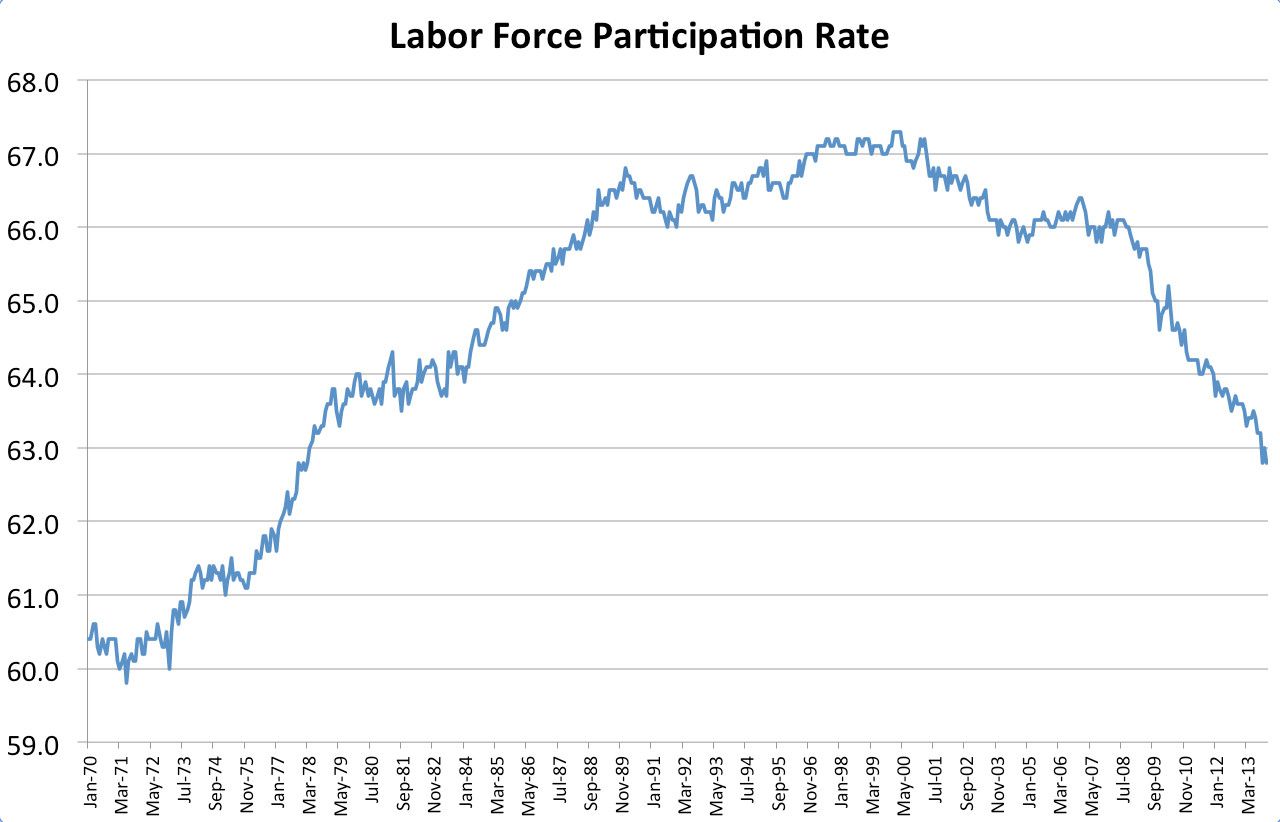

Some might believe that the overall impact of the health law on employment is bad because it would be encouraging people – some 2.3 million – not to work. Indeed, the decline in the workforce participation rate has been of concern to economists, as the baby boom generation leaves the work force, and the health care law appears to exacerbate that trend.

Moreover, the argument could go, this would hurt the nation’s budget because 2.3 million fewer people will pay taxes on their earnings. That’s certainly an intellectually solid argument – though others might counter that universal health care is worth a reduction in overall employment – but it’s not at all the same as saying these jobs would be lost.

On the brighter side, before a House hearing on Wednesday the Director of the CBO Doug Elmendorf made this argument:

“The reason we don’t use the term ‘lost jobs’ is there is a critical difference between people who like to work and can’t find a job – or have a job that’s lost for reasons beyond their control – and people who choose not to work,” he explained. “If someone comes up to you and says, ‘The boss says I’m being laid off because we don’t have enough business to pay,’ any other person feels bad about that and we sympathize for them having lost their job. If someone says, ‘I decided to retire or stay home and spend more time with my family and spend more time doing my hobby,’ they don’t feel bad about it – they feel good about it. And we don’t sympathize. We say congratulations.”

Matt Iglesias at Mother Jones makes a very salient point about the impact on the job force:

Obamacare will reduce employment primarily because it’s a means-tested welfare program, and means-tested programs always reduce employment among the poor.

If, for example, earning $100 in additional income means a $25 reduction in Obamacare subsidies, you’re only getting $75 for your extra work. At the margins, some people will decide that’s not worth it, so they’ll forego working extra hours. That’s the substitution effect. In addition, low-income workers covered by Obamacare will have lower medical bills. This makes them less desperate for additional money, and might also cause them to forego working extra hours. That’s the income effect.

This is not something specific to Obamacare. It’s a shortcoming in all means-tested welfare programs. It’s basically Welfare 101, and in over half a century, no one has really figured out how to get around it. It’s something you just have to accept if you support safety net programs for the poor.

It’s worth noting, however, that health care is an exception to this rule. It doesn’t have to be means tested. If we simply had a rational national health care system, available to everyone regardless of income, then none of this would be an issue. There might still be a small income effect, but it would probably be barely noticeable. Since everyone would be fully covered no matter what, there would no high effective marginal tax rate on the poor and no reason not to work more hours. Someday we’ll get there.

Optimistically, people leaving jobs or working less may be an opportunity for someone else to take their place. On the other side it could increase costs for employers who would then reduce the number of people they hire. This is an educated guessing game that we would not be engaged in if there were single payer or a public option that leveled the playing field.

Bureau of Labor Statistics

Bureau of Labor Statistics

Recent Comments