The government may be facing a shutdown by the Senate Democrats and with good reason. It seems the House Republicans, in passing a continuing resolution (CR) to keep the government operational through April 2017, removed two provisions that could result in a filibuster in the Senate. Those provisions would protect the health coverage of retired …

Tag: Budget

Feb 26 2014

The Truth About the Pentagon’s New Budget

The Secretary of Defense Chuck Hagel announced that the upcoming Pentagon budget would focus on the 21st century realities of warfare with more emphasis on targeted assassinations and cyberwarfare. It also cuts the strength of the Army to pre-World War Two levels relying more heavily on the National Guard.

Defense Secretary Chuck Hagel plans to shrink the United States Army to its smallest force since before the World War II buildup and eliminate an entire class of Air Force attack jets in a new spending proposal that officials describe as the first Pentagon budget to aggressively push the military off the war footing adopted after the terror attacks of 2001 [..]

The new American way of war will be underscored in Mr. Hagel’s budget, which protects money for Special Operations forces and cyberwarfare. And in an indication of the priority given to overseas military presence that does not require a land force, the proposal will – at least for one year – maintain the current number of aircraft carriers at 11.

The Guard and Reserves, which proved capable in their wartime deployments although costly to train to meet the standards of their full-time counterparts, would face smaller reductions. But the Guard would see its arsenal reshaped.

The Guard’s Apache attack helicopters would be transferred to the active-duty Army, which would transfer its Black Hawk helicopters to the Guard. The rationale is that Guard units have less peacetime need for the bristling array of weapons on the Apache and would put the Black Hawk – a workhorse transport helicopter – to use in domestic disaster relief.

The proposed budget would also eliminate the old U-2 spy plane in favor of unmanned drones and eliminate the entire fleet of Air Force A-10 attack aircraft. However, it does keep the allocations for the controversial F-35 warplane, which has been extremely expensive and has run into costly delays, that the Air Force says it doesn’t want.

There will be pain for the troops, too.

The fiscal 2015 budget also calls for slowing the growth of tax-free housing allowances for military personnel and would reduce the $1.4 billion direct subsidy provided to military commissaries, which would most likely make goods purchased at those commissaries more expensive for soldiers.

The budget also proposes an increase in health insurance deductibles and some co-pays for some military retirees and for some family members of active servicemen.

The savings on groceries will reduced, costing a military family as much as $3000 per year, and pay raises will be capped:

Besides paring back grocery savings, the Pentagon would also cap military pay raises at 1% in 2015 and trim housing subsidies for families who don’t live on bases. They will also no longer be reimbursed for rental insurance.

Families are likely to feel the sharpest pain every week when they shop for their grocery. By the end of the third year, the savings will be slashed by about two-thirds, a senior defense official acknowledged on Monday.

Currently, a family of four can save $4,500 a year at commissaries on average, according to the Defense Commissary Agency, which puts savings around 30% compared to retail grocery stores. Under the new proposal, the savings for a similar family would be closer to $1,500 a year or 10% of a grocery bill at other stores.

Despite these cuts and the claims, this hardly an austerity budget still exceeding the budgets of next ten military budgets in the world combined.

A better idea, as suggested by DSWright at FDL News Desk would be “to rethink 800 military bases and a $700 billion annual budget to defend against an enemy that no longer exists.” But the fear mongers will persist regardless:

Despite ‘historic’ cuts, the US will still have 450,000 active-duty soldiers

By Michael Cohen, The Guardian

The Pentagon is able to maintain a bloated and extravagant military force even when the US faces no actual security threats

Rather than a reflection of a changing global security environment, the growing and continued obsolescence of inter-state war and the country’s lack of interest in future military adventures, the cuts announced yesterday by Hagel are an indication of something else altogether: how tenaciously the Pentagon is able to maintain a bloated and extravagant military force even when the US faces no actual security threats.

Indeed, what was missing from yesterday’s headlines was some much needed context. For example, “smallest size since 1940” sounds, on the surface, like quite a step back. Did Neville Chamberlain rise from his grave and become president of the United States? Let’s put aside for a second that the size of the army in 1940 was about 270,000 and the Marine Corps stood at about 30,000 – a far cry from the proposed 180,000 today.

The truth is the military budget is still bloated with wasted tax dollars that could got to rebuilding the US infrastructure that would create jobs increasing economic growth and reducing income disparity.

Dec 18 2013

The Rich Get Richer: Embrace the Suck

The Senate will pass the budget bill that was approved by the House last week. It passes the hurdle of cloture with a “bipartisan” vote of 67 – 33. The bill leaves a lump of coal in the stockings of 1.5 million Americans whose unemployment benefits expire the end of December and future career servicemen and women whose cost of living increases to their pensions will be cut. But the Pentagon will get their due and so will the 1%.

Ryan-Murray Budget Deal Passes Senate Hurdle

By DSWright, FDL News Desk

The truly horrendous Ryan-Murray budget has passed the Senate clearing the way to fully pass Congress this week. The deal restores war spending to astronomical levels while cutting federal pensions and raising airline fees. In other words, cash for defense contractors and groin kicks for the middle class. [..]

Why any Democrat would vote for such an awful reactionary budget is beyond comprehension. According to Nancy Pelosi Democrats had to “embrace the suck.” Otherwise things might not suck? [..]

We truly have the best government money can buy. The naked corruption on display in dumping oceans of cash into the Pentagon patronage den while attacking worker pensions and leaving the unemployed to rot is proof positive that we live in a deranged oligarchy where money is everything and the people are nothing.

A bipartisan budget deal to avert another government shutdown comes before the Senate this week. The vast majority of House members from both parties approved the two-year budget agreement last week in a 332-to-94 vote. It is being hailed as a breakthrough compromise for Democrats and Republicans. The bill eases across-the-board spending cuts, replacing them with new airline fees and cuts to federal pensions. In a concession by Democrats, it does not extend unemployment benefits for 1.3 million people, which are set to expire this month. To discuss the deal, we are joined by David Cay Johnston, an investigative reporter who won a Pulitzer Prize while at The New York Times. He is currently a columnist for Tax Analysts and Al Jazeera, as well as a contributing editor at Newsweek.

Full transcript can be read here

Once again the vast majority are Scrooged.

Apr 15 2013

Can Working People Be Saved From Mr. Obama’s Brilliant Plans?

President Obama has done a brilliant job for the 1%.

Under Mr. Obama’s leadership, after a tremendous, near utter collapse of the economy brought about by a corrupt finance sector, trillions of public dollars have been poured into the coffers of bankers. One recent study showed that the big banks got an annual government subsidy of $83 billion dollars a year – equal to the amount of their alleged profits. Hold onto your hats, another recent study, by Chris Whalen and endorsed by noted economist Nouriel Roubini demonstrates that the subsidy is much larger, at least $780 billion dollars a year:

$360 billion in Federal Reserve subsidies, by creating an artificial “spread” in interest rates

$120 billion in federal deposit insurance (through the FDIC, backed by the Treasury)

At least $100 billion in government-guaranteed loans, especially mortgages

At least $100 billion in monopolistic advantages in the secondary market for home mortgages

More than $100 billion in fees in the over-the-counter (OTC) derivative market. (The lack of capital required in these transactions and other special dispensations from the Fed provide the zombie banks with unlimited leverage and almost no public scrutiny.)

The first study indicates that the too big to fail banks are barely breaking even and they are getting fat and demanding on our largesse; the second study indicates that they are indeed not profitable at all. They are nothing but corporate welfare queens with a large budget to purchase politicians.

Apr 11 2013

Say No to Cuts to Social Security

President Obama formerly released his budget for 2014. As, expected it contained the cuts to Social Security and Medicare that have are an anathema to the left. As has been pointed out before on this site, these proposals for the sake a few dollars in revenue increases and a paltry $50 billion investment for infrastructure improvement. That is bad policy and even worse politics. If you don’t believe that, well here is a sample of the criticism from the right:

Americans for Tax Reform, the advocacy group that asks lawmakers to sign a formal “Taxpayer Protection Pledge,” said Tuesday that chained CPI violates the pledge.

“Chained CPI as a stand-alone measure (that is, not paired with tax relief of equal or greater size) is a tax increase and a Taxpayer Protection Pledge violation,” the group said in a blog post.

Anti-tax crusader Grover Norquist, leader of the organization, criticized the policy via Twitter on Wednesday. “Chained CPI is a very large tax hike over time,” Norquist wrote. “Hence Democrat interest in same.”

The Congressional Budget Office estimates (pdf) that chained CPI would reduce Social Security spending by $127 billion and increase tax revenue by $123 billion over 10 years.

When asked Friday if chained CPI represents a tax hike on the middle class, White House spokesman Jay Carney said, “I’m not disputing that.“

Can you hear the political ads attacking Democrats with this? So much for electoral victory in 2014, Obama just sold that prospect for what? Trying to make the point that Republicans are intransigent? American already know that. A few dollars of revenue from tax reforms that will be changed the first chance the Republicans get, like the debt ceiling hostage situation? We seen this scene played out how many times with Obama caving to Republican demands because some vague fear about the economy.

Predictably the left is outraged and there are threats from left wing organizations to primary any Democrat who votes for chained CPI.

Warren joins lawmakers in criticizing Obama budget

A coalition of prominent Democrats, including many from New England, slammed President Obama’s $3.8 trillion budget blueprint Wednesday for its proposed changes to the Social Security payment formula and Medicare, opening a widening rift between the president and members of his own party.

Senator Elizabeth Warren of Massachusetts said she was shocked by Obama’s proposal to recalculate the cost of living adjustment for Social Security beneficiaries by linking it to a different version of the Consumer Price Index, known as the “chained CPI.” [..]

“In short, ‘chained CPI’ is just a fancy way to say ‘cut benefits for seniors, the permanently disabled, and orphans,'” Warren fired off in an e-mail to supporters. She related the experience of her brother, David Herring, a military veteran and former small business owner who lives on monthly Social Security checks of $1,100. “Our Social Security system is critical to protecting middle-class families,” she wrote, “and we cannot allow it to be dismantled inch by inch.” [..]

Representative Edward Markey of Massachusetts called “chained CPI” an abbreviation for “Cutting People’s Income, a wrong-headed change that would go back on the promise we make to our senior citizens.”

“Tea Party Republicans may have pushed the president into many of these difficult decisions, but it still does not make this budget right nor fair, especially for those Americans who need help the most,” Markey said.

MSNBC’s All In host Chris Hayes discussed the chained CPI with Sen. Jeff Merkley (D-OR), Jonathan Alter, Heather McGhee, and Mattie Duppler, Americans for Tax Reform.

Transcript for this video can be read here

This a direct attack by a Democratic president on our earned benefits. Time to start calling and don’t stop until this deal is dead and buried.

The White House switchboard is 202-456-1414.

The comments line is 202-456-1111.

h/t Susie Madrak at Crooks and Liars

Apr 08 2013

What ‘s Being Said About Social Security Cuts

Before we even start to talk about the Social Security cuts in President Obama’s budget in his quest for a “grand bargain” with Republicans, bit the president and House Speaker John Boehner have admitted there is no deficit crisis. As a matter of fact, the deficit has fallen faster in the last three years than it has since World War II

In fact, outside of that post-WWII era, the only time the deficit has fallen faster was when the economy relapsed in 1937, turning the Great Depression into a decade-long affair.

If U.S. history offers any guide, we are already testing the speed limits of a fiscal consolidation that doesn’t risk backfiring. That’s why the best way to address the fiscal cliff likely is to postpone it. [..]

While long-term deficit reduction is important and deficits remain very large by historical standards, the reality is that the government already has its foot on the brakes.

In this sense, the “fiscal cliff” metaphor is especially poor. The government doesn’t need to apply the brakes with more force to avoid disaster. Rather the “cliff” is an artificial one that has sprung up because the two parties are able to agree on so little.

That’s right, the “fiscal cliff”, ‘the deficit” crisis are MYTHS.

Now here is what digby said:

Greg Sargent has frequently made the case that liberals are going to have to choose between the sequester cuts and the Grand Bargain and therefore will need to make the affirmative case for why they are choosing the sequester. [..]

And Greg is probably right that if the Republicans are smart enough to take yes for an answer, the liberals in the House will face the wrath of their Party apparatus and the president (and the liberal establishment) if they end up voting against a Grand Bargain. [..]

This, on the other hand, is a choice between two negatives. Essentially, as before, the White House and the Democratic centrists are holding hostages but this time they’re basically telling the progressives that a hostage is going to get shot no matter what: Head Start and food inspections today or the elderly, the sick and the veterans tomorrow and they have to choose which one. Why should progressives bear that responsibility? They didn’t get us into this mess.

I say they should just say no. Republicans do it all the time and everybody just throws up their hands and says, “well, I guess we’d better figure out something else.” They should hold fast and say “the sequester sucks and so does the Grand Bargain and we don’t support either one.” Most of the progressives didn’t vote for the sequester in the first place and bear no responsibility for it. (And even those who did have no obligation to defend the monster that everyone assured them had no chance of ever becoming law.) This is a failure of the leadership of both parties and progressives are not required to betray their most fundamental values and defend any of these ridiculous cuts to anyone.

Just say no. The “sequester vs Grand Bargain” is a phony construct made by man, not God, and there’s no reason on earth why any progressive should be forced to own either one. Find another way.

Now matter how you view the cut to Social Security by linking it to the Chained CPI, it is bad policy and even worse politics that will be forever linked to A democratic president, Barack Obama. He owns it. It’s too late to put that back in the can, even if the Republicans reject it out of hand. But worse than that, every Democrat now owns it, too.

Apr 05 2013

Obama Budget: From Bad to Worse

Pres. Barack Obama has released his proposed budget that include cuts Medicare and linking Social Security payments to Chained CPI in hopes (there is that ugly word again) of gaining “bipartisan” (another bad word) from Congressional Republicans. Never mind that the fact that the majority of voters do not want cuts to the top three social safety programs, the president is willing to sacrifice the disable, veterans and the elderly for a few tax changes that even if passed, would most likely be reversed in the next six months. This is not “compromise,” it is a sell out of the majority of Americans.

Huffington Post‘s Sam Stein has the breakdown of the proposal that will be releases in all its full gory details next Wednesday:

- The budget would reduce the deficit by $1.8 trillion over ten years — $600 billion of this reduction would come from revenue raisers, and $1.2 trillion would come from spending reductions and entitlement reforms;

- It would change the benefit structure of Social Security (chained-CPI);

- It would means test additional programs in Medicare;

- All told, it would include $400 billion in health care savings (or cuts);

- It would cut $200 billion from other areas, identified by The New York Times as “farm subsidies, federal employee retirement programs, the Postal Services and the unemployment compensation system;”

- It would pay for expanded access to pre-K (an Obama priority) by increasing the tobacco tax;

- It would set limits on tax-preferred retirement accounts for the wealthy, prohibiting individuals from putting more than $3 million in IRAs and other tax-preferred retirement accounts;

- And it would stop people from collecting full disability benefits and unemployment benefits that cover the same period of time.

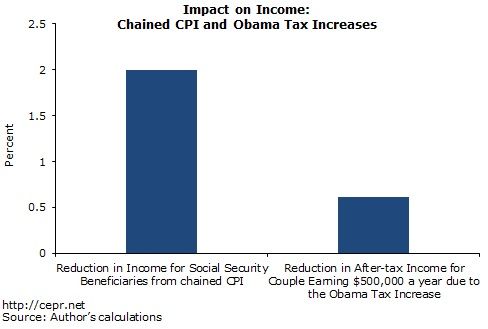

Dean Baker shows that these cuts over time are worse for seniors than for the rich:

By comparison, Social Security is about 70 percent of the income of a typical retiree. Since President Obama’s proposal would lead to a 3 percent cut in Social Security benefits, it would reduce the income of the typical retiree by more than 2.0 percent, more than three times the size of the hit from the tax increase to the wealthy.

The congressional Democratic apologists insist that “certain lines won’t be crossed” which translates that if Republicans realize they can get the cuts to “entitlements’ that they want by temporarily sacrificing the tax and revenue increases this is a done deal.

The president is willing to agree to the entitlement cuts only in exchange for tax hikes in other areas.

“The president has made clear that he is willing to compromise and do tough things to reduce the deficit, but only in the context of a package like this one that has balance and includes revenues from the wealthiest Americans and that is designed to promote economic growth,” the administration official said. “That means that the things like CPI that Republican Leaders have pushed hard for will only be accepted if Congressional Republicans are willing to do more on revenues.”

This is political suicide for Democrats up for election. The Republicans will forever blame Democrats for destroying these programs.

As Paul Krugman points out, this makes no sense other than just Pres. Obama’s need to seek approval of the “Serious People:”

So what’s this about? The answer, I fear, is that Obama is still trying to win over the Serious People, by showing that he’s willing to do what they consider Serious – which just about always means sticking it to the poor and the middle class. The idea is that they will finally drop the false equivalence, and admit that he’s reasonable while the GOP is mean-spirited and crazy.

But it won’t happen.

No, that won’t happen because underneath it all this is what Obama has wanted all along and has continuously said so since 2006. It’s not the GOP that is “mean-spirited and crazy” it’s Obama.

Mar 18 2013

The Three Budgets

Like the tale of the three bears, the congressional budget battle has three budget proposals one from the House Republicans penned by Rep. Paul Ryan (R-WI), chair of the House Budget Committee; another from the Senate Democrats that was worked out by Sen. Patty Murray (D-WA), chair of the Senate Budget Committee; and a third called the “Back to Work” budget presented by the Congressional Progressive Caucus. Each one has is proponents and opponents and, like that bear tale, it has one that’s too hard, one that’s too soft and one that’s just right.

Paul Ryan’s budget, which is getting the most press, the most negative reaction and is “dead on arrival” so to speak, is a rehash of his last two budgets only worse. The proposal would slash Medicare, Medicaid and repeals Obamacare, which even Fox News host Chris Wallace acknowledges, isn’t happening. It proposes balancing the federal budget with the usual draconian cuts to all non-defense spending and reduction of the already smaller federal work force by another 10%. The Ryan proposal would slash $4.6 trillion over 10 years. The budget plan includes no cuts in Social Security. Pres. Obama has suggested changing an inflation measurement to cut more than $100 billion from the program, which makes no sense since Social Security does not contribute to the debt or the deficit.

The there is the Senate Budget proposal which the Republican leadership insisted the Democrats produce even though, constitutionally, all budget and spending bills must originate in the House. That budget would seek $975 billion in spending reductions over the next 10 years as well as $975 billion in new tax revenue, which Sen. Murray said would be raised by “closing loopholes and cutting unfair spending in the tax code for those who need it the least.” It includes a $100 billion in spending on infrastructure repair and educational improvements and the creation of a public-private infrastructure bank.

Then there is that third budget proposal from the House Progressive Caucus that is just right balance of spending, revenue increases and spending cuts. The basic plan is the put Americans back to work, by as Ezra Klein explains fixing the jobs crisis:

It begins with a stimulus program that makes the American Recovery and Reinvestment Act look tepid: $2.1 trillion in stimulus and investment from 2013-2015, including a $425 billion infrastructure program, a $340 billion middle-class tax cut, a $450 billion public-works initiative, and $179 billion in state and local aid. [..]

Investment on this scale will add trillions to the deficit. But the House Progressives have an answer for that: Higher taxes. About $4.2 trillion in higher taxes over the next decade, to be exact. The revenues come from raising marginal tax rates on high-income individuals and corporations, but also from closing a raft of deductions as well as adding a financial transactions tax and a carbon tax. They also set up a slew of super-high tax rates for the very rich, including a top rate of 49 percent on incomes over $1 billion.

But to the House Progressives, these taxes aren’t just about reducing the deficit – though they do set debt-to-GDP on a declining path. They’re also about reducing inequality and cutting carbon emissions and slowing down the financial sector. They’re not just raising revenues, but trying to solve other problems. But they might create other problems, too. Adding this many taxes to the economy all at once is likely to slow economic growth.

As for the spending side, there’s more than $900 billion in defense cuts, as well as a public option that can bargain down prices alongside Medicare. But this budget isn’t about cutting spending. Indeed, the House Progressives add far more spending than they cut.

On Sunday’s Up w/ Chris Hayes, host Chris Hayes discussed the various budget proposals released by Republicans and Democrats in Congress this week with his guests Representative Kyrsten Sinema (D-AZ); Representative Jerrold Nadler (D-NY); Sam Seder, host of The Majority Report, co-host of Ring of Fire; and Heidi Moore, economics and finance editor for The Guardian newspaper.

Mar 09 2013

The Sequester: Lies, Damned Lies, and Libel Against Critics on the Left

Lately there have been some rumors about me that I feel need to addressed. Because I have more class than some people spreading nonsense about me and others, I am not going to name names or link to them, but some of you will know what I am talking about. First off, in the comments of my last diary it was rightly brought up that the President did issue a veto threats against anyone who wants to get rid of any part of the sequester.

This veto threat applied to anyone in both parties which also included the plan from Republicans that wanted to give federal agencies more leeway in how the sequester was implemented so as to spare the defense cuts instead of equal foreign and domestic cuts across the board. It’s not surprising that no one else put anything forward with that veto threat.

Obama Threatens Veto on Bid to Avoid Automatic Cuts as Supercommittee Fails

President Obama said today he will veto any efforts to get rid of the automatic spending cuts that will be triggered by the supercommittee’s failure to reach a bipartisan solution to deficit reduction.

“There will be no easy off-ramps on this one. We need to keep the pressure up to compromise, not turn off the pressure,” the president said this evening. “The only way these spending cuts will not take place is if Congress gets back to work and agrees on a balanced plan to reduce the deficit by at least $1.2 trillion.”

Only those that enable the real life terror federal employees and their families will soon feel deny that this is a debacle created by the Executive and the Legislative working together for austerity. The direct quotes up above can only be ignored by those with an agenda and not one for working people. Get real.

Dec 05 2012

No, This Fiscal Scam Won’t Be Different Than 2011. Stop Deluding Yourselves

Of course that can be easy to do with corporate media hacks parading around as “journalists” basically working to preserve the corrupt machine they feed off of. They’re feeding people revisionist nonsense about the so called fiscal cliff; nonsense like how because of the President was reelected he has more leverage this time. As if Democrats ever use leverage after they win elections like how they kept funding the Iraq war in 2006 after their opposition to the war gave them those mid term victories. Nancy Pelosi also took impeachment of the war criminal GWB off the table so future war crimes could be committed.

And then in 2008 after winning an unprecedented majority in both Houses of Congress, higher than at anytime leading up to that point on the GOP’s end, we were told we didn’t have a mandate for progressive polices despite the fact that the right’s neoconservative Laissez-faire ideology had been fully discredited.

The Mandate Manipulation Machine Enters Stage Right

As I predicted a while back, the Partisan-Industrial Complex in Washington, D.C. has deployed its quadrennial Mandate Manipulation Machine to make sure that the 65 million Americans who voted for Barack Obama remember that America giving more than 340 electoral votes to an African American billed as a Islamic Marxist terrorist means there is no mandate for real change in this, a country obviously more conservative than ever.

A cursory glance at the newspapers today shows the media teeming with stories quoting incoming Obama administration officials, Democratic Party leaders and spokespeople for corporate front groups insisting that actually, no real change can be made, and what small-bore changes can happen, will have to happen in the very distant future, not soon. My favorite was the one-two punch from Senate Majority Leader Harry Reid (D-NV) and Democratic National Committee chair Howard Dean. Upon hearing of his bigger senate majority, Reid said on Tuesday, “This is not a mandate for a political party or an ideology.

And of course we now know that was Democrats’ way of telling us they would waste the crisis that elected them, keep TBTF, not prosecute anyone who caused the crash, dump the EFCA, enact Dolecare instead of a public option or Medicare Buy In, and go half ass on all qualitative legislation. This is what actually led up to the mid term losses in 2010. And keep in mind this 2012 election victory doesn’t even compare to the victory in 2008.

And yet they tell us we will see a new reinvigorated President and Congress. They tell us they are confident this time. They tell us that this time Democrats know they have a mandate for progress so things will be different than when the debt ceiling debacle made fools of them all. No, this is actually what the White House is telling us; the same thing as after the 2008 election victory now in 2012.

Axelrod: Talk of mandate ‘foolish, generally untrue’

Obama senior campaign adviser David Axelrod downplayed talk of an election mandate on the “fiscal cliff” on Thursday.

Axelrod said presidents always talk after an election about a mandate, but he called such talk “foolish.” President Obama and congressional Republicans are bracing for talks on tax hikes and spending cuts that are now set to be implemented in January.

“Everyone’s going to have to come to the table in the spirit of getting things done, but on this issue of particularly the fiscal cliff – presidents always say, ‘I have a mandate’; that’s a foolish word and generally untrue,” Axelrod told MSNBC’s “Morning Joe” on Thursday.

- 1

- 2

Recent Comments