“Punting the Pundits” is an Open Thread. It is a selection of editorials and opinions from around the news medium and the internet blogs. The intent is to provide a forum for your reactions and opinions, not just to the opinions presented, but to what ever you find important.

Thanks to ek hornbeck, click on the link and you can access all the past “Punting the Pundits”.

Follow us on Twitter @StarsHollowGzt

Robert Reich: Why Obama Should Be Attacking Casino Capitalism

I wish President Obama would draw the obvious connection between Bain Capital and JPMorgan Chase.

That way his so-called “attack” on private equity is neither a personal attack on Mitt Romney nor a generalized attack on American business.

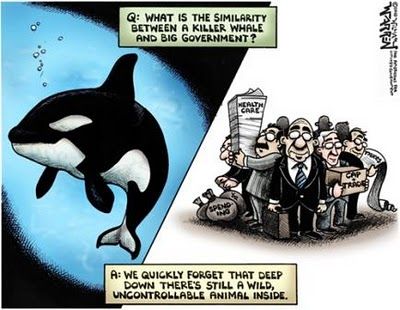

It’s an attack on a particular kind of capitalism that Romney and JPMorgan both practice: Using other peoples’ money to make big bets which, if they go wrong, can wreak havoc on the economy.

It’s the substitution of casino capitalism for real capitalism, the dominance of the betting parlor over the real business of America, financial innovation rather than product innovation.

Paul Krugman: Europe’s Leaders Double Down on a Failed Strategy

I guess we knew this was coming, but in the face of the French and Greek election results and the broader evidence that Europe’s economic strategy is an utter failure, the usual suspects are, you guessed it, doubling down.

Simon Wren-Lewis, an economics professor at Oxford, has looked on in horror as the Dutch have agreed on completely unnecessary austerity measures, as a way of showing their commitment to Europe’s totally misguided fiscal pact. “Towards the end of April the Dutch conservative coalition government collapsed when the far-right party refused to discuss further budget cuts,” Mr. Wren-Lewis wrote on his blog on May 7. “The prime minister resigned. And yet a few days later other parties rallied round to give their support to a similar package of austerity measures, which now have majority support in parliament.”

British Prime Minister David Cameron vowed “no going back” on his failed austerity strategy in a speech after the elections.

Poised to elect a new director general, the International Labor Organization needs to challenge the pro-austerity consensus

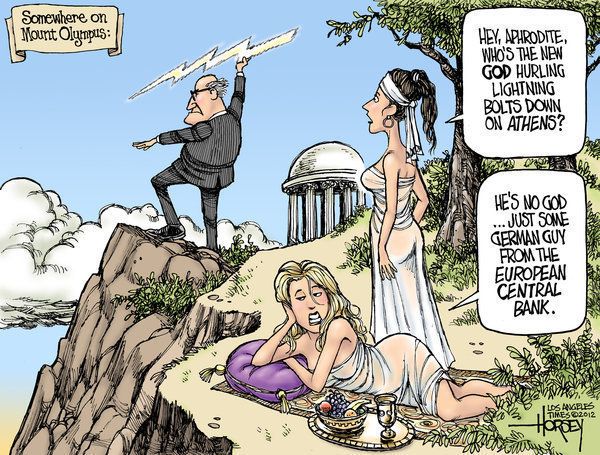

The Troika – the European Central Bank (ECB), the European Commission, and the IMF – is dragging Europe into its second recession in three years. The ECB by itself has the ability to end this crisis, by guaranteeing low interest rates on the sovereign bonds of countries such as Spain and Italy. Member governments would then be able to restore normal economic growth and employment.

But the ECB refuses to do this – partly because the Troika is using the crisis as an opportunity to force changes, especially in the weaker eurozone economies, changes that the people residing there would never vote for. These reforms include shrinking government, privatization, “labor flexibility”, and reduced public pensions.

Since, however, Europe has by far the largest banking system in the world, the eurozone crisis is also a significant drag on growth and employment throughout most of the world. This could easily do more damage if it is not resolved.

Henry A. Giroux: The Occupy Movement and the Politics of Educated Hope

American society has lost its claim on democracy. One indication of such a loss is that the crises produced on a daily basis by crony capitalism operate within a discourse of denial. Rather than address the ever proliferating crises produced by market fundamentalism as an opportunity to understand how the United States has arrived at such a point in order to change direction, the dominating classes now use such crises as an excuse for normalizing a growing punishing and warfare state, while consolidating the power of finance capital and the mega-rich. Uncritically situated in an appeal to common sense, the merging of corporate and political power is now constructed on a discourse of refusal-a denial of historical conditions, existing inequalities and massive human suffering-used to bury alive the conditions of its own making. The notion that neoliberal capitalism has less interest in free markets than an enormous stake in the dominance of public life by corporations no longer warrants recognition and debate in mainstream apparatuses of power. Hence, the issue of what happens to democracy and politics when corporations dominate almost all aspects of American society is no longer viewed as a central question to be addressed in public life.

Chris Hellman and Mattea Kramer: The Nearly $1 Trillion National Security Budget

Recent months have seen a flurry of headlines about cuts (often called “threats”) to the U.S. defense budget. Last week, lawmakers in the House of Representatives even passed a bill that was meant to spare national security spending from future cuts by reducing school-lunch funding and other social programs.

Here, then, is a simple question that, for some curious reason, no one bothers to ask, no less answer: How much are we spending on national security these days? With major wars winding down, has Washington already cut such spending so close to the bone that further reductions would be perilous to our safety?

In fact, with projected cuts added in, the national security budget in fiscal 2013 will be nearly $1 trillion-a staggering enough sum that it’s worth taking a walk through the maze of the national security budget to see just where that money’s lodged.

David Cole: Can Obama Say He’s Sorry for US Role in Torture of Innocent Man?

Can the President say he’s sorry to an innocent man whom the United States delivered to Syria to be tortured? Sixty thousand Americans have done so, signing a petition that begins, “I apologize to Maher Arar for the torture he suffered because of the actions of US officials and I urge you to do the same.” Today, the petition’s organizers-Amnesty International, the Center for Constitutional Rights and the National Religious Coalition Against Torture-delivered the petition to the White House. An apology is the least President Obama can-and should-do.

Maher Arar is the Canadian citizen US officials intercepted in 2002 when he was changing planes at JFK airport on his way home to Canada from a trip to Europe. He was held incommunicado, interrogated by FBI officials and ultimately ordered deported-not to Canada, his home and destination, but to Syria, where he was handed off to Syrian security officials long condemned by the State Department for their use of torture in interrogations. The Syrians did in fact torture Arar, while posing the same questions that the FBI had asked him in New York. After a year in detention-ten months of it spent in an underground cell the size of a grave-the Syrians released Arar, concluding that there was no basis for concern about him.

Meet the new “Death Sentence Czar” appointed by President Barack Obama to choose who will be

Meet the new “Death Sentence Czar” appointed by President Barack Obama to choose who will be  That $2 billion

That $2 billion  The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting.

The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting.

Recent Comments