As we move closer to the debt ceiling limit and defaulting on the debt, two proposals have been put forward by opposing sides. The Republicans have put a bill together that will come up for a vote on Wednesday that calls for a two-step plan that would allow the debt limit to be raised by $1 trillion and create “a “Super Congress,” composed of members of both chambers and both parties, isn’t mentioned anywhere in the Constitution, but would be granted extraordinary new powers.”

From the Democrats, House Majority Leader Harry Reid has proposed $2.7 trillion in spending cuts and raising the debt ceiling through 2012 with no revenue increases but would not touch any of the big three social safety nets. It does include the proposed “super congress”:

“made up of 12 members, to present options for future deficit reduction. The committee’s recommendations will be guaranteed an up-or-down Senate vote, without amendments, by the end of 2011.”

There are a few problems though. The first problem is the neither bill will pass both houses. The other obstacle two-fold. Reid’s bill will need 60 votes for cloture. It is unlikely that Reid can convince four Republicans to vote for it. He may get able to convince Sen, Olympia Snowe (R-VT) and Sen. Collins (R-ME) but he also must get the blue dogs to fall in-line. The only way I can see Reid getting this bill to the floor for a vote is to use the “Cheney nuclear option” and call bull shit on the filibuster. They don’t have the guts for that.

House Speaker John Boehner has similar problems. He needs 217 votes to pass. With 89 tea party Republicans who signed a letter refusing to raise the debt ceiling no matter what the deal, Boehner would need to convince 63 Democrats. That won’t happen either. Some of the tea party crew may break tier “oath” since they are taking heat from their constituents at home. The House bill stands a better chance of suvival.

If both bills by some miracle pass, then it goes to reconciliation and both bills have to be voted on again. This isn’t going to happen in less than a week. If only the House bill makes it, the Senate probably reject it. That is the most probable scenario.

That leaves one option and it falls back to the White House to use the 14th Amendment, Article 4. Obama has already rejected this option but as it gets closer to August 2 and default, given the choice of a constitutional crisis versus a global economic melt down, let hope Obama put his “big boy pants on” and starts acting like a responsible adult who has to make a decision not everyone is going to like.

While CEO’s are rolling in more money than any average workers could imagine in a lifetime, raising their taxes and closing the tax loop holes that allow then to pay even less or, in some instances, nothing at all. According to a

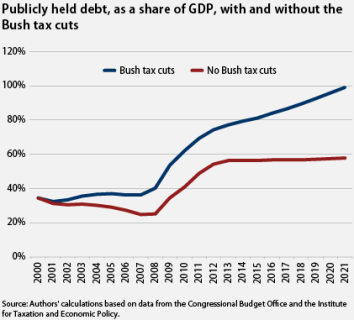

While CEO’s are rolling in more money than any average workers could imagine in a lifetime, raising their taxes and closing the tax loop holes that allow then to pay even less or, in some instances, nothing at all. According to a  Continuing economic policies the have failed is flat out stupid. Proposing to not only continue with those policies but to reinforce them by making them worse is economic and political suicide. It is the path that the Obama administration and Congress have taken us down by renewing the Bush Tax Cuts until December 2012. Some of the GOP candidates would like to cut taxes even further, so much so that it would cripple the government and widen the socio-economic gap of the haves and have-nots.

Continuing economic policies the have failed is flat out stupid. Proposing to not only continue with those policies but to reinforce them by making them worse is economic and political suicide. It is the path that the Obama administration and Congress have taken us down by renewing the Bush Tax Cuts until December 2012. Some of the GOP candidates would like to cut taxes even further, so much so that it would cripple the government and widen the socio-economic gap of the haves and have-nots.

Recent Comments