Last summer it was revealed that one of the world’s largest banks based, HSBC, base in Britain, had been laundering billions of dollars for Mexican drug cartels and skirting US government bans against financial transactions with Iran and other countries that aid Al Qaeda and other terrorist groups. In a stunning move during a hearing before the Senate Permanent Subcommittee on Investigations chief compliance officer, David Bagley, took the blame and resigned.

Last week the federal government and New York State announced a settlement with HSBC:

In a filing in Federal District Court in Brooklyn, federal prosecutors said the bank had agreed to enter into a deferred prosecution agreement and to forfeit $1.25 billion. The four-count criminal information filed in the court charged HSBC with failure to maintain an effective anti-money laundering program, to conduct due diligence on its foreign correspondent affiliates, and for violating sanctions and the Trading With the Enemy Act.

“HSBC is being held accountable for stunning failures of oversight – and worse – that led the bank to permit narcotics traffickers and others to launder hundreds of millions of dollars through HSBC subsidiaries, and to facilitate hundreds of millions more in transactions with sanctioned countries,” Lanny A. Breuer, the head of the Justice Department’s criminal division, said in a statement. [..]

HSBC, based in Britain, has also agreed to pay the Office of the Comptroller of the Currency, one of the bank’s central regulators, an additional $500 million as part of a civil penalty. The Federal Reserve will be paid a $165 million civil penalty. [..]

HSBC also entered into a deferred prosecution agreement with the Manhattan district attorney’s office. As part of that agreement, HSBC admitted that it violated New York State law.

Just like the mortgage and banking fraud that was uncovered during the financial crisis, there will be no criminal charges. The fines that were levied are tantamount to about five weeks of income for the bank. Contributing editor for the Rolling Stone, Matt Taibbi points out the outrageous incongruity of this settlement:

If you’ve ever been arrested on a drug charge, if you’ve ever spent even a day in jail for having a stem of marijuana in your pocket or “drug paraphernalia” in your gym bag, Assistant Attorney General and longtime Bill Clinton pal Lanny Breuer has a message for you: Bite me. [..]

The banks’ laundering transactions were so brazen that the NSA probably could have spotted them from space. Breuer admitted that drug dealers would sometimes come to HSBC’s Mexican branches and “deposit hundreds of thousands of dollars in cash, in a single day, into a single account, using boxes designed to fit the precise dimensions of the teller windows.”

This bears repeating: in order to more efficiently move as much illegal money as possible into the “legitimate” banking institution HSBC, drug dealers specifically designed boxes to fit through the bank’s teller windows. [..]

Though this was not stated explicitly, the government’s rationale in not pursuing criminal prosecutions against the bank was apparently rooted in concerns that putting executives from a “systemically important institution” in jail for drug laundering would threaten the stability of the financial system. The New York Times put it this way:

Federal and state authorities have chosen not to indict HSBC, the London-based bank, on charges of vast and prolonged money laundering, for fear that criminal prosecution would topple the bank and, in the process, endanger the financial system. [..]

So there is absolutely no reason they couldn’t all face criminal penalties. That they are not being prosecuted is cowardice and pure corruption, nothing else. And by approving this settlement, Breuer removed the government’s moral authority to prosecute anyone for any other drug offense. Not that most people didn’t already know that the drug war is a joke, but this makes it official.

Apparently this settlement has garnered some bipartisan concerns from Senators Jeff Merkley (D-OR) and Charles Grassley. In separate statements released from their offices, they criticized the Justice Department for not sending a stronger message to the banking industry. Sen. Grassley said it best:

The Department has not prosecuted a single employee of HSBC-no executives, no directors, no AML compliance staff members, no one. By allowing these individuals to walk away without any real punishment, the Department is declaring that crime actually does pay. Functionally, HSBC has quite literally purchased a get-out-of-jail-free card for its employees for the price of $1.92 billion dollars.

There is no doubt that the Department has “missed a rare chance to send an unmistakable signal about the threat posed by financial institutions willing to assist drug lords and terror groups in moving their money.” One international banking expert went as far as to argue that, despite the “astonishing amount of criminal behavior” from HSBC employees, the DPA is no more than a “parking ticket.”

But, as David Dayen at FDL News notes there are crickets from certain key senators:

Matt Stoller makes a very good point here: where is Patrick Leahy on this? He has made no public statement on the HSBC case, despite being the co-author of the Fraud Enforcement and Recovery Act, which was supposed to deliver funds toward prosecuting fraudulent big bank activity (it never actually did). Grassley, a co-author, has spoken out. Why not Leahy?

Matt Taibbi sat down with Amy Goodman and Juan Gonzalez at Democracy Now to discuss the settlement:

Transcript can be read here

Now, not only are the banks “too big to fail“, they are “too big to jail.”

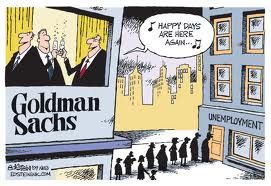

After receiving a $10 billion of tax payer money in the financial crisis bailout and making a record $2.7 billion profit in the first quarter of 2011, Goldman Sachs will lay off 1,000 American workers and

After receiving a $10 billion of tax payer money in the financial crisis bailout and making a record $2.7 billion profit in the first quarter of 2011, Goldman Sachs will lay off 1,000 American workers and

Recent Comments