The alleged recovery from the recession that began in 2008 has done wonders for the wealthiest of the world.

The Rich Get Richer Through the Recovery

By Annie Lowry, The New York Times

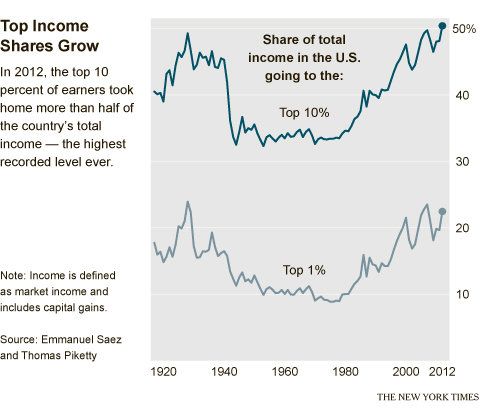

The top 10 percent of earners took more than half of the country’s total income in 2012, the highest level recorded since the government began collecting the relevant data a century ago, according to an updated study by the prominent economists Emmanuel Saez and Thomas Piketty.

The top 10 percent of earners took more than half of the country’s total income in 2012, the highest level recorded since the government began collecting the relevant data a century ago, according to an updated study by the prominent economists Emmanuel Saez and Thomas Piketty.

The top 1 percent took more than one-fifth of the income earned by Americans, one of the highest levels on record since 1913, when the government instituted an income tax.

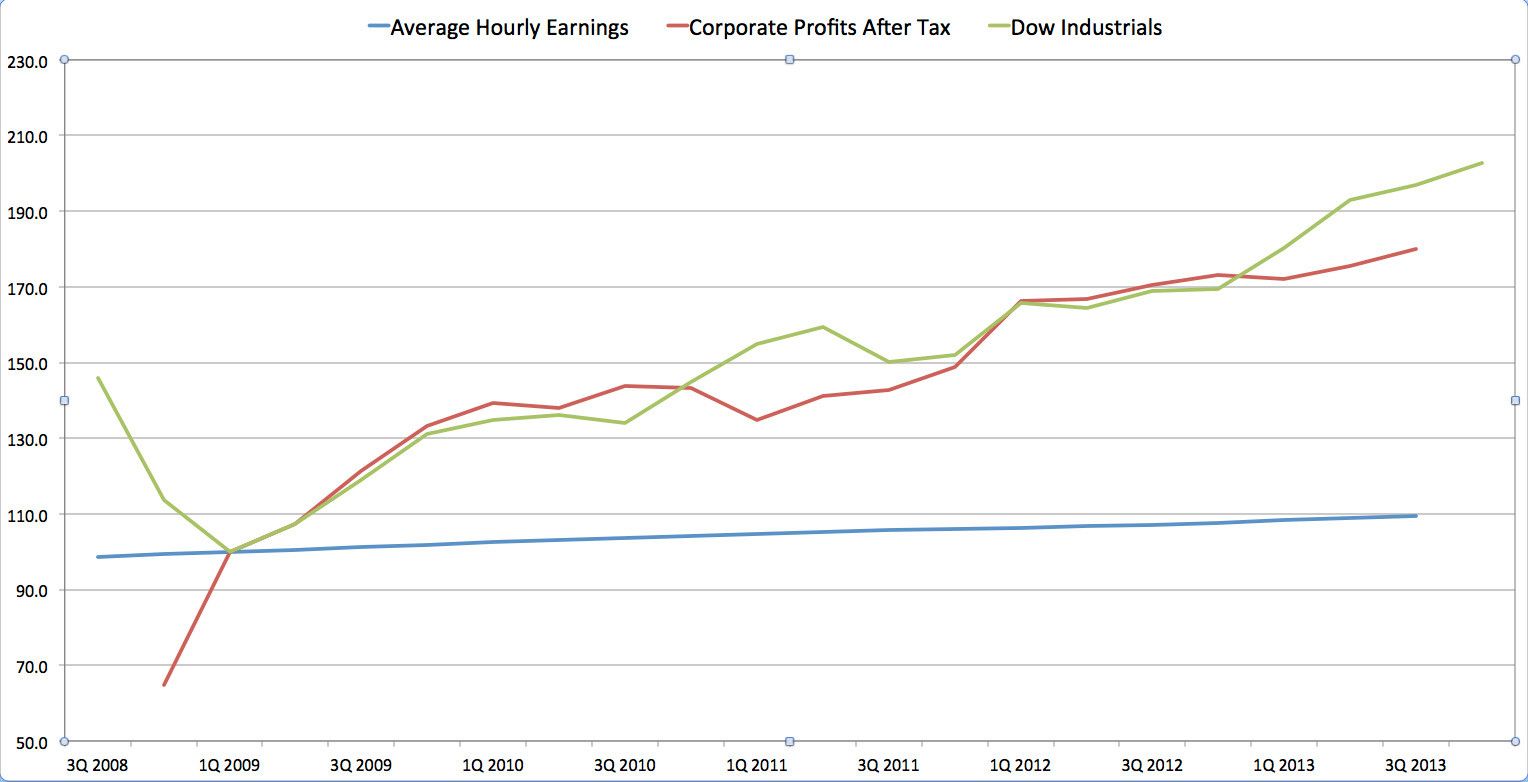

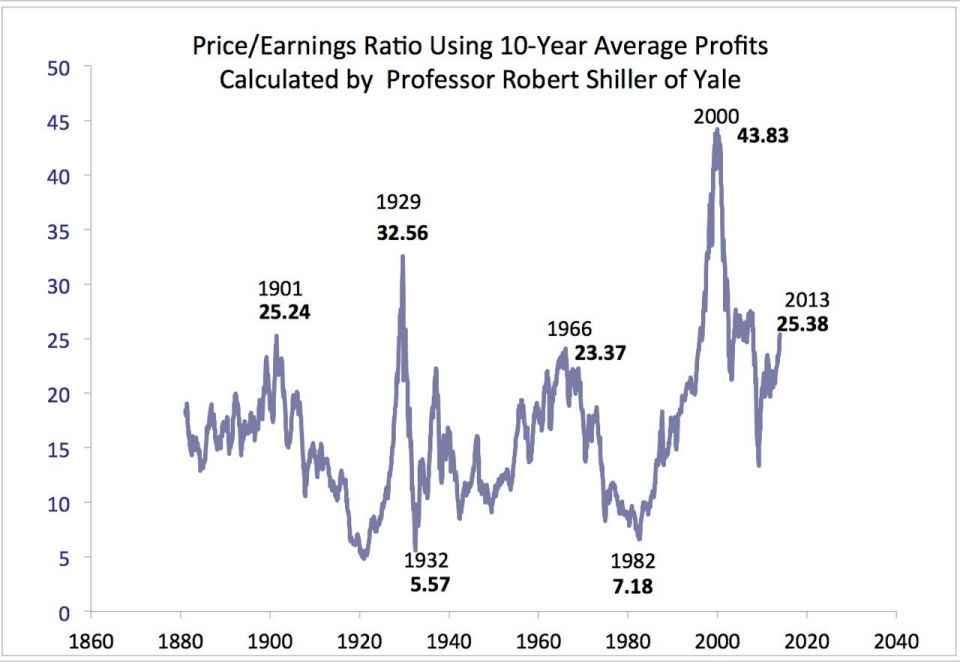

The figures underscore that even after the recession the country remains in a new Gilded Age, with income as concentrated as it was in the years that preceded the Depression of the 1930s, if not more so.

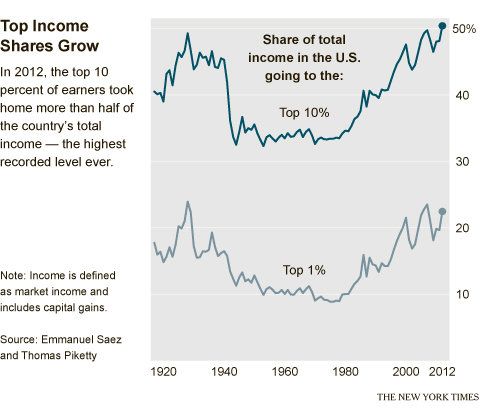

High stock prices, rising home values and surging corporate profits have buoyed the recovery-era incomes of the most affluent Americans, with the incomes of the rest still weighed down by high unemployment and stagnant wages for many blue- and white-collar workers. [..]

More generally, richer households have disproportionately benefited from the boom in the stock market during the recovery, with the Dow Jones industrial average more than doubling in value since it bottomed out early in 2009. About half of households hold stock, directly or through vehicles like pension accounts. But the richest 10 percent of households own about 90 percent of the stock, expanding both their net worth and their incomes when they cash out or receive dividends.

The economy remains depressed for most wage-earning families. With sustained, relatively high rates of unemployment, businesses are under no pressure to raise their employees’ incomes because both workers and employers know that many people without jobs would be willing to work for less. The share of Americans working or looking for work is at its lowest in 35 years.

Three years ago during the height of the Occupy Wall Street movement, the Congressional Budget Office issued a report based on information from the IRS and US Census Bureau that over the last forty years the top 1% has nearly quadrupled:

– The top 1 percent made $165,000 or more in 1979; that jumped to $347,000 or more in 2007, the study said. [..]

– The top 20 percent of the population earned 53 percent of after-tax income in 2007, as opposed to 43 percent in 1979.

– The top 1 percent reaped a 17 percent share of all income, up from 8 percent in 1979.

– The bottom 20 percent reaped just 5 percent of after-tax income, versus 7 percent in 1979.

This is exacerbated by the fact that hourly wages have stagnated while the biggest banks are even bigger than they were before the collapse thanks to policies of the government and the Federal Reserve.

The wealth gap is not an isolated problem, according to a report by the NGO, Oxfam, it’s global with just 85 people possessing owning half the world’s wealth

Almost half of the world’s wealth is now owned by just one percent of the population, and seven out of ten people live in countries where economic inequality has increased in the last 30 years. The World Economic Forum has identified economic inequality as a major risk to human progress, impacting social stability within countries and threatening security on a global scale.

This massive concentration of economic resources in the hands of fewer people presents a real threat to inclusive political and economic systems, and compounds other inequalities – such as those between women and men. Left unchecked, political institutions are undermined and governments overwhelmingly serve the interests of economic elites – to the detriment of ordinary people.

Eighty of the those billionaires are meeting this week in Davos, Switzerland for the World Economic Forum, where the wealth disparity has finally become a concern:

As billionaires bet on accelerating growth and rising asset prices, income inequality is emerging as a key theme for this week’s annual meeting. A study released last week by the forum identified the income gap as the most probable menace to the global economy during the next decade. Wealth disparity — driven by globalization and the recent financial crisis — threatens to breed poverty and social disorder, it said.

Next Tuesday, President Barack Obama will give his State of the Union Address where he will outline the ideas he has for closing this gap that has gotten bigger since he was elected. Perhaps, as Huffungton Post’s Howard Fineman suggests, that the president find governing role models other than Ronald Reagan whose policies have brought the US economy into its New Gilded Age.

Recent Comments