“Punting the Pundits” is an Open Thread. It is a selection of editorials and opinions from around the news medium and the internet blogs. The intent is to provide a forum for your reactions and opinions, not just to the opinions presented, but to what ever you find important.

Paul Krugman: British Fashion Victims

In the spring of 2010, fiscal austerity became fashionable. I use the term advisedly: the sudden consensus among Very Serious People that everyone must balance budgets now now now wasn’t based on any kind of careful analysis. It was more like a fad, something everyone professed to believe because that was what the in-crowd was saying.

And it’s a fad that has been fading lately, as evidence has accumulated that the lessons of the past remain relevant, that trying to balance budgets in the face of high unemployment and falling inflation is still a really bad idea. Most notably, the confidence fairy has been exposed as a myth. There have been widespread claims that deficit-cutting actually reduces unemployment because it reassures consumers and businesses; but multiple studies of historical record, including one by the International Monetary Fund, have shown that this claim has no basis in reality.

No widespread fad ever passes, however, without leaving some fashion victims in its wake. In this case, the victims are the people of Britain, who have the misfortune to be ruled by a government that took office at the height of the austerity fad and won’t admit that it was wrong.

Eugene Robinson: Lawyers got it right on the foreclosure mess

Don’t blame the lawyers. The crisis over faulty or fraudulent paperwork in mortgage foreclosures — which is either a big deal or a humongous deal, depending on which experts you believe — is the fault of arrogant, greedy lenders who played fast and loose with the basic property rights of homeowners.

Banks and other lenders, it seems, made statements in courts of law that turned out not to be true. Because judges have such an underdeveloped sense of humor when it comes to prevarication, this mess may be with us for a while.

The mortgage industry would love to blame the whole thing on predatory, opportunistic lawyers who are seizing on mere technicalities to forestall untold numbers of foreclosures that should legitimately proceed. The bankers are right when they complain that the delays are gumming up the housing market, as potential buyers for soon-to-be-foreclosed properties are forced to bide their time until all the questions about documentation and proper title are answered.

Linda Greenhouse: Calling John Roberts

As 1997 wound down, Bill Clinton was in the White House, the Republicans controlled the Senate, and the Clinton administration’s judicial nominees were going nowhere. Nearly one in 10 federal judgeships was vacant, a total of 82 vacancies, 26 of which had gone unfilled for more than 18 months. In Democratic hands back in 1994, the Senate had confirmed 101 nominees. In 1997, under the Republicans, the number dropped to 36.

On New Year’s Eve, a major public figure stepped into this gridlock. He was a well-known Republican, and although he had set aside overt partisanship, his conservative credentials remained impeccable. He had given no one a reason to think he was favorably disposed toward the incumbent administration or its judicial nominees. Yet there he was, availing himself of a year-end platform to criticize the Senate and to warn that “vacancies cannot remain at such high levels indefinitely without eroding the quality of justice.”

His name was William H. Rehnquist, chief justice of the United States, using his annual year-end report on the state of the federal judiciary to declare that with “too few judges and too much work,” the judicial system was imperiled by the Senate’s inaction. “The Senate is surely under no obligation to confirm any particular nominee,” he said, “but after the necessary time for inquiry, it should vote him up or vote him down to give the president another chance at filling the vacancy.”

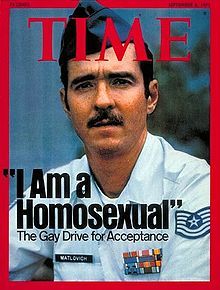

On June 22, 1988, less than a month before his 45th birthday, Matlovich died of complications from HIV/AIDS beneath a large photo of Martin Luther King, Jr. His tombstone, meant to be a memorial to all gay veterans, does not bear his name. It reads, “When I was in the military, they gave me a medal for killing two men and a discharge for loving one.” Matlovich’s tombstone at Congressional Cemetery is on the same row as that of FBI Director

On June 22, 1988, less than a month before his 45th birthday, Matlovich died of complications from HIV/AIDS beneath a large photo of Martin Luther King, Jr. His tombstone, meant to be a memorial to all gay veterans, does not bear his name. It reads, “When I was in the military, they gave me a medal for killing two men and a discharge for loving one.” Matlovich’s tombstone at Congressional Cemetery is on the same row as that of FBI Director

Recent Comments