I’m not even sure I’ll watch it because I’m sure I won’t understand most of it. While fluent in C and Basic I don’t understand Fedese (if there is indeed any understanding of it and it’s not just insincere shamen babbling nonsense in tongues to confuse and impress the ignorant).

Clearly Samuelson economics works and in the words of Krugman (who only has a Nobel Prize in Economics)-

(R)ight now, we’re living in a world in which basic economics points to conclusions utterly at odds with what Very Serious People are supposed to believe, in which radical outsiders base their views on standard economics while orthodox types turn to heterodox, highly dubious speculations.

Econ 101, buttressed if you like by fancier New Keynesian models, says that contractionary fiscal policy is, well, contractionary. Yet much of the world of movers and shakers bought into the exotic notion that expectational effects – the confidence fairy – would make contractionary policy expansionary. And they clung to this belief even as the supposed historical evidence in favor of expansionary austerity was thoroughly debunked.

The blogosphere is full of intellegent questions that will never be asked but my favorite so far was propounded by Sen. Bernie Sanders (via dday).

Sanders’ report found-

(N)umerous instances during the financial crisis of 2008 and 2009 when banks took near zero-interest funds from the Federal Reserve and then loaned money back to the federal government on sweetheart terms for the banks. The banks pocketed interest on government securities that paid rates up to 12 times greater than the Fed’s rock bottom interest charges.

…

“This report confirms that ultra-low interest loans provided by the Federal Reserve during the financial crisis turned out to be direct corporate welfare to big banks,” Sanders said. “Instead of using the Fed loans to reinvest in the economy, some of the largest financial institutions in this country appear to have lent this money back to the federal government at a higher rate of interest by purchasing U.S. government securities.”Chairman Bernanke, in light of this report, do you consider it good policy for the US to hand over money to the nation’s largest banks directly through this kind of scheme? Would it make just as much sense, if you find it good for the economy, to make the same investment strategy available to small businesses, states or the US government itself to deal with their budget problems? After all, it would take a true idiot not to make fantastic amounts of money if they can borrow at zero and loan money back at high rates. Why should individuals be deprived of this money-conjuring strategy?

Furthermore, shouldn’t those profits, rather than boosting the balance sheets of the large banks, have been put back into the economy? Shouldn’t that have been a condition of the direct subsidy?

I dare someone to ask that.

Anyway, your questions and reactions below and hopefully by tomorrow we’ll have some idea of what Bernanke actually said.

Katrina vanden Heuvel:

Katrina vanden Heuvel:  While everyone was focusing on the bogus issue of President Obama’s citizenship and busily examining the authenticity of the newly released long form, there was a national security shake up going on that finally got it’s 5 minutes of attention by the media. Defense Secretary Robert Gates had announced that he would be leaving the Pentagon this year. There was some speculation about his replacement that included Secretary of State Hillary Clinton. She has since made it clear that she was not interested and would remain in the critical job steering Obama’s rudderless foreign policy. By law, the Defense Secretary must be a civilian and disqualified if having served in the military in the last 10 years, thus eliminating any of the current or recently retired generals.

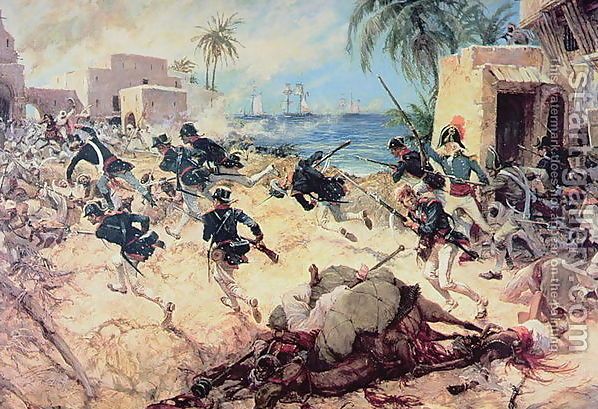

While everyone was focusing on the bogus issue of President Obama’s citizenship and busily examining the authenticity of the newly released long form, there was a national security shake up going on that finally got it’s 5 minutes of attention by the media. Defense Secretary Robert Gates had announced that he would be leaving the Pentagon this year. There was some speculation about his replacement that included Secretary of State Hillary Clinton. She has since made it clear that she was not interested and would remain in the critical job steering Obama’s rudderless foreign policy. By law, the Defense Secretary must be a civilian and disqualified if having served in the military in the last 10 years, thus eliminating any of the current or recently retired generals.  On this day in 1805, Naval Agent to the Barbary States, William Eaton, the former consul to Tunis, led an small expeditionary force of Marines, commanded by First Lieutenant Presley O’Bannon, and Berber mercenaries from Alexandria, across 500 miles to the port of Derna in Tripoli. Supported by US Naval gunfire, the port was captured by the end of the day, overthrowing Yusuf Karamanli, the ruling pasha of Tripoli, who had seized power from his brother, Hamet Karamanli, a pasha who was sympathetic to the United States.

On this day in 1805, Naval Agent to the Barbary States, William Eaton, the former consul to Tunis, led an small expeditionary force of Marines, commanded by First Lieutenant Presley O’Bannon, and Berber mercenaries from Alexandria, across 500 miles to the port of Derna in Tripoli. Supported by US Naval gunfire, the port was captured by the end of the day, overthrowing Yusuf Karamanli, the ruling pasha of Tripoli, who had seized power from his brother, Hamet Karamanli, a pasha who was sympathetic to the United States.

Recent Comments