(2 pm. – promoted by ek hornbeck)

A perfect storm is brewing in the elite backrooms where policy is made and it is beginning to bubble up from the factory floor into the media where their policies are sold. Prepare the vital organs of your body for a “December Surpise” as some are calling it. The debt ceiling will be reached before the elections, sequestration from the Budget Control Act of 2011 will be going into effect (and huge military contractors are already threatening massive layoffs). The elite rhetoric about the need for austerity will likely be at a fever pitch on the campaign trail and in the media.

It’s going to be a mighty (if completely contrived) crisis.

Fortunately the elites have already got the answer to all of the problems that are being prepared to come to a head. Never fear, they’ve been working on it for decades.

A “Grand Bargain” will solve everything.

In the last round of this mounting (contrived) crisis, after the failure of the President’s “Catfood Commission” to create a solution, the Congress passed the Budget Control Act of 2011. The BCA was passed after a contentious process to raise the debt ceiling and mandate budget cuts, some immediate and some to be deferred to the discretion of a “super committee,” which ultimately failed to come to an agreement on what to cut out of the budget. The cuts that will now be triggered by the act are unpleasant and will likely cause further economic decline. This is how our political leaders have constructed the cage that we are in now. There is little talk of alternatives to austerity, despite the fact that it has failed spectacularly where the elites have imposed it, as Paul Krugman writes:

Last week the National Institute of Economic and Social Research, a British think tank, released a startling chart comparing the current slump with past recessions and recoveries. It turns out that by one important measure – changes in real G.D.P. since the recession began – Britain is doing worse this time than it did during the Great Depression. Four years into the Depression, British G.D.P. had regained its previous peak; four years after the Great Recession began, Britain is nowhere close to regaining its lost ground.

Nor is Britain unique. Italy is also doing worse than it did in the 1930s – and with Spain clearly headed for a double-dip recession, that makes three of Europe’s big five economies members of the worse-than club. Yes, there are some caveats and complications. But this nonetheless represents a stunning failure of policy.

And it’s a failure, in particular, of the austerity doctrine that has dominated elite policy discussion both in Europe and, to a large extent, in the United States for the past two years.

Now however, we are about to have another artificial crisis, we will be exceeding the debt limit that congress voted to raise a while ago, at the same time that budget cuts, timed and mandated by congress are about to go into effect. This time the elites are better prepared to exploit this contrived crisis, though.

As RJ Eskow explains in a recent article, the stars (and the Washington politicians) are aligning for a bargain on austerity:

On a recent Meet the Press face-off between Democrats and Republicans, a politician claimed we urgently need to cut government spending. He embraced a plan to slash vital government programs and gut retirement security, while actually cutting taxes for the rich. The only tax hikes in his plan were targeted toward the already-devastated middle class.

Then it was time for the Republican to speak.

Who’d have thought it? Progressive stalwarts like Minority Leader Nancy Pelosi and Sen. Dick Durbin are pushing the same radical austerity plan as Jamie Dimon, CEO of troubled megabank JPMorgan Chase, and Robert Rubin, the Clinton Treasury Secretary who represents everything that’s broken about the Wall Street/Washington axis.

The elites are making an all out push, Simpson and Bowles themselves are now working with 47 senators to promote austerity:

Simpson and Bowles are currently working with 47 senators of both parties and members of the House to reach an agreement on a new plan to improve the U.S. economy, Bowles said. An agreement is possible during the lame duck session following the November elections, he said.

As Trudy Lieberman from the Columbia Journalism Review explains, the mainstream media are catapulting the propaganda and creating a sense of inevitability:

On The NewsHour, at the end of that defining week in late March when Pelosi hinted that she might have changed her mind, David Brooks, notified the program’s upscale and politically astute viewers that a deal might be in the offing. Said Brooks:

“One of the saddest things that has happened this week is Jim Cooper, a Democrat from Tennessee, and others put together a Simpson-Bowles bill, sort of an outline, and had them vote on that. I think it got like 38 votes in the House. And so we’re going to end up there eventually. We’ll end up with something like Simpson-Bowles.”

CNBC.com joined the smoke-signal gang early last week, passing along remarks from another Democrat, Sen. Mark Udall of Colorado. “I would want to put Bowles-Simpson in place immediately,” he said, contending that it would cut spending, simplify the tax code, and fix Medicare and Social Security. Neither Udall nor CNBC told us how it would do all that.

On NBC’s Meet the Press in early May, former Nightly News anchor Tom Brokaw signaled acceptance of Simpson-Bowles even more. “There’s something to keep your eye on, Brokaw announced. “There’s a kind of nascent movement at the moment to dust off Simpson-Bowles. To get it back on the table again.”

So the elites are busy working their plans and the media is pumping up the public for the inevitable elite solution. It will fall to the 99% of us who are not particularly interested in a shrinking economy and increasing levels of inequality and social stratification to promote an alternative solution.

The budget cuts that were mandated by the Budget Control Act total 2.1 trillion dollars which will have a significant negative effect on the economy. Slashing government spending in a depression (or a “great recession’) is generally agreed across the economics profession to reduce aggregate demand and cause job losses. The solution which has been proposed by the Obama administration and the Catfood Commission in their “Grand Bargain” nearly doubles the cutting of federal spending to 4 trillion dollars. Not surprisingly, given its significantly larger bite out of federal spending, the Obama/Peterson Catfood plan turns out to be not-so-good for the economy that working people rely upon, in fact it’s worse than what congress has come up with so far.

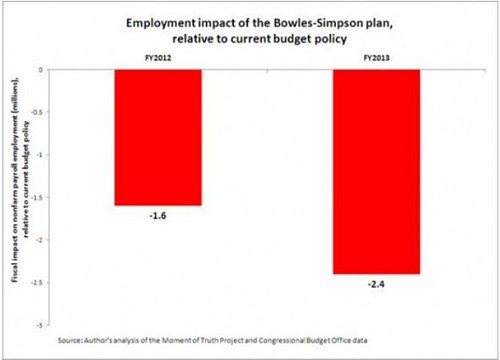

Andrew Fieldhouse of the Economics Policy Institute compares the effects of Simpson-Bowles versus the current policy on unemployment:

Relative to the course Congress has taken, the adverse economic impact proposed by the Bowles-Simpson report is stark. The Moment of Truth Project rescored the Bowles-Simpson report based on the Congressional Budget Office’s March 2011 baseline. For an apples-to-apples comparison, I’ve adjusted non-interest outlays and revenue for economic and technical-but not legislative-changes to the CBO’s budget projections since that March 2011 baseline. Relative to current budget policy, the Bowles-Simpson plan would have reduced non-interest spending by $53 billion in FY12 and $79 billion in FY13 and increased revenue by $107 billion in FY12 and $167 billion in FY13 (largely reflecting the payroll tax cut). As a result, economic output would be 1.3 percent lower in FY12 and 2.0 percent lower in fiscal 2013. This shock to aggregate demand would reduce nonfarm payroll employment by 1.6 million jobs in FY12 and 2.4 million jobs in FY13, again relative to current budget policies.

Get ready to hear a lot more talk from the chattering classes about the need for austerity, there is going to be a tidal wave of it. Like last year, the solution proposed by Congressional Progressive Caucus, the Budget for All will predictably be ignored by the media and the “people who matter.” Don’t forget to ask them about it! While you’re at it you can mention how well it compares to the Ryan Budget.

As long as we’re thinking though, we should be looking for more long-term solutions than the CPC is offering at the moment. In a must-read article, Renee Parsons concludes with this:

As might be expected, the 2012 campaign will avoid reference to the US continuing to borrow its way out of debt (47% of which is owned by foreign entities and 53% owned by domestic entities) or mention of a $533 billion annual interest debt payment by 2015 or to provide clear, concise data on exactly how much interest the debt is costing taxpayers annually and what institutions are profiting from US indebtedness.

Also lacking will be any examination of the very real benefits of a public banking alternative which would allow the government to finance its own infrastructure needs and public services as the Bank of North Dakota does without usury interest payments to a rapacious Wall Street financial services industry that cares nothing for the lost, forgotten Americans on Main Street.

As a final thought, the kid in this video gives me hope that a rising generation may be well on its way to figuring this stuff out:

2 comments

Author

thanks for reading!

… as well as over at the more poisonous Agent Orange.

This is one reason why we have to get Warren into the Senate in MA, and keep Sherrod Brown in the Senate in Ohio. There is likely to be too large a Corporation Party majority in the Senate to be able to kill a Grand Bargain in one stroke, but even individual Senators can slow things down and give us time to mobilize opposition from those who won’t listen to this warning until the Grand Bargain is already underway.