Up Date: 7:00 PM EDT The California High Speed Rail Bill has passed 21 – 16.

Today is the crucial vote for High Speed Rail project in the California State Senate. As, BruceMcF pointed out in this week’s Sunday Train, it all hinges on the Democrats.

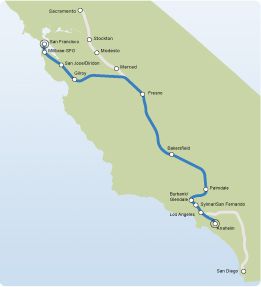

In response to complaints, including from Senators (Joe) Simitian and (Alan) Lowenthal, that too much was being spent in the less heavily populated central valley, and not enough money was being spent in the more populous LA Basin and Bay Area, the revised Business Plan includes “early investment” in the bookends, to help prepare them for blended operation of HSR alongside more local rail services.

That early investment includes an agreement that will allow for the funding of the electrification of the Caltrain Corridor, serving Simitian’s own district, and key to the long term survival of the Caltrain service so that it is available for use when the next petroleum crisis hits.

But, going by the description of a Simitian staffer of his position, these changes may not have been enough to convince Simitian to switch to a position of support for actually building HSR.

The bill passed the Assembly and Gov. Jerry Brown has said that he will sign it but there are at least 6 Democratic hold outs. Since there all the Republicans are opposed and to pass the bill needs 21 of the 25 Democratic Senators, the funding totally hinges on these Senators.

The California state Assembly on Thursday approved an $8 billion high-speed rail financing plan that likely will face a tougher vote in the Senate over the system’s projected $68 billion cost and concerns about its management.

The project, expected to take decades to complete, has the backing of Democratic Governor Jerry Brown, who says a bullet train network will boost job creation and provide an alternative to car and plane travel in the country’s most populous state. [..]

If it is approved, California could begin selling bonds for the project and lock in federal funds for a line in the state’s Central Valley.

Senator Leland Yee, a Democrat from San Francisco, said the plan’s supporters have their work cut out winning him over, a sentiment other Democratic senators have shared with Reuters in recent days.

As David Dayen at FDL News notes, if the bill is not passed, California will lose the billions in promised funding for the project from the Federal government:

This is crucial, because the federal Department of Transportation has made clear that they will revoke their $4.3 billion in federal funds for California’s HSR project, most of which came out of the stimulus package, if the state doesn’t approve funding today. This would undoubtedly stall the project, perhaps permanently. And California is probably the furthest along of any state on a high speed rail system.

Building this leg of the system is crucial to transportation in the region, energy and fuel economy and it will create jobs in hard hit California. All of that should offset any negatives of bond funding, by increasing revenue brought in from more people workong and spending in California. Let’s hope a couple of these Democrats wake up and see the advantage to being at the forefront of a new transportation age.

On this day in 1917, Arabian troops led by

On this day in 1917, Arabian troops led by

Recent Comments